PREFACE

There's no doubt that the possibility of reduced regulations on the big banks has a special meaning for Goldman Sachs Group Inc (NYSE:GS) -- a faux bank which is really a risk taking machine.

Less regulation, any kind of roll back of Dodd-Frank, or however it could look, would give Goldman Sachs more room to take risk with the assets it holds – and in general, that has meant a larger return on assets – as long as we ignore the total collapse of the U.S. housing market back in 2008.

So the question becomes, if we do want to make a bullish bet with options:

How do we make sure we don't get crushed if we're wrong but still profit a lot if we're right?

BE SMARTER

One approach to benefiting from the Goldman Sachs Groups' stock rising is actually a bet that it simply does not fall very far. That would be selling a put spread, and if that type of trading schematic feels more like your cup of tea, you can read about that here:

There is a win in Goldman Sachs options right now -- and it's growing

But, if you want to get aggressively long to try to bank this next few months if GS really takes off, then buying slightly out of the money calls has been a huge winner. First we'll show that, but then we'll show you how to hedge that, just in case things don't quite work out.

The results above come from owning weekly out of the money calls in Goldman Sachs Group Inc, rolling literally every seven days. While the returns are large, it's a lot of risk to be naked long an option.

But there's a risk maneuver we can make.

Here's what we do:

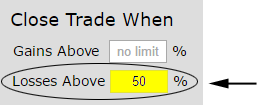

Let's do the same thing but implement a stop loss on the calls at 50%. In English, if a call ever loses 50% of its value in any given week, we simply close it, and then wait until the next week to open a new one:

Now we see returns in the 1800% range, which is 500% percentage points better than the previous strategy in Goldman Sachs Group Inc (NYSE:GS), but all we did was cut the risk in half with a stop loss.

Getting naked long calls in any company is risky -- but if we're clever, we can find the names where dropping risk can actually improve returns. This is not always the case, but when it does happen, it's the crown jewel of trading in any instrument, especially options. It's true in Apple and Facebook. But the real question is, how do we find these opportunities?

THE KEY

The key here is to find edge, optimize it -- in this case by putting in a stop loss -- and then to see if it's been sustained through time. For Goldman Sachs Group Inc it has, and that makes for a powerful result.

We've just seen an explicit demonstration of the fact that there's a lot less 'luck' and a lot more planning in successful option trading than many people realize. Here is a quick 4-minute demonstration video that will change your option trading life forever:

Tap here to see the Trade Machine in action

Thanks for reading, friends.

The author has no position in Goldman Sachs Group Inc (NYSE:GS) at the time of this writing.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.