Earlier this week the U.S. Federal Reserve raised interest rates by 0.25 points and signaled two more hikes this year. In the past decade this is only the third upward Fed adjustment. Gold had consolidated around the $1,200 / ounce level, but has seen a sudden surge after the telegraphed interest rate hike.

The metal built on those gains Thursday with April futures contracts on the Comex market in New York touching a high of $1,234.00 at the open, up 2.8% from yesterday’s settlement level. Gold has gained more than $80 / ounce this year alone.

Junior companies in the Gold sector will more than likely start seeing some major traction in the near future, especially considering that Fed officials signalled only two more rate hikes this year, below what most economist had been predicting, which sent US government bond yields lower and hurt the dollar. A recent research report points to one company in particular which Gold investors should keep a very close eye on, which can be found here.

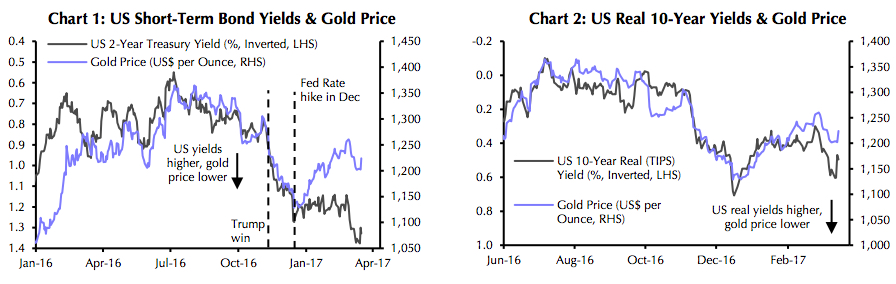

Because gold is not yield-producing and investors have to rely on price appreciation for returns, the metal has a strong inverse correlation to inflation adjusted interest rates.

The rate of price growth has nearly doubled in the twelve months to end January this year to 1.99%, bang on the central bank’s target rate. With the Fed’s key rate at 0.75–1.00% real short-term rates in the world’s biggest economy remains in negative territory.

Janet Yellen, Chairman, also said the Fed was willing to tolerate inflation temporarily overshooting this goal and the bank intended to keep its policy accommodative for “some time.” Gold traditionally is viewed as a hedge against inflation.

Source: Capital Economics

According to a recent research note, analysts at Bank of America Merrill Lynch highlighted its recent dip but said there were reasons for optimism. “While tighter monetary policy is not bullish, inflation and a range of uncertainties, including European elections and protectionism should support the yellow metal. As such, we see prices at $1,400 (per troy ounce) by year-end”.

Read: Outside of physical Gold, where is the best place to invest in Gold?

The worlds number one gold producer, Barrick Gold (NYSE: ABX) was down slightly in late morning trade Friday. The $19 billion Toronto-based company sports 19% gains so far this year making it the best performing major gold mining stock of 2017.

Related: Previously owned by Barrick Gold Corp., investors are starting to notice this small-cap with huge potential

Newmont Mining (NYSE: NEM), the second largest gold producer in terms of output, inched ahead after giving up all its post-Fed gains Thursday. Vancouver’s Goldcorp (NYSE: GG) was trading flat and Johannesburg-based AngloGold Ashanti (NYSE: AU) was also trading flat before noon Friday.