Toronto properties continue to rise just over the rate of inflation, with prices rising 3.6% this August from August 2018, according to the Toronto Real Estate Board (TREB).

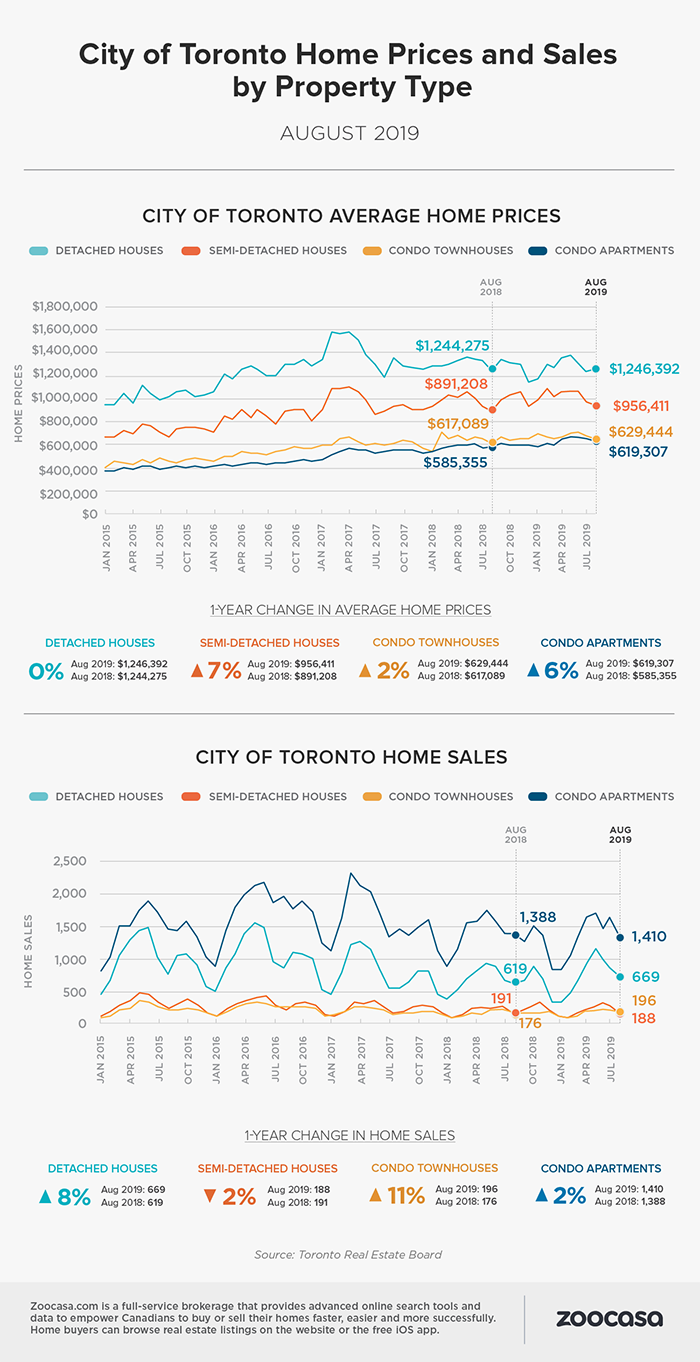

Expensive detached houses continue to be a drag on the market rising just 0.3 per cent year over year to $978,920 across TREB’s region. Prices for single-family homes across the City of Toronto are $1,246,392, a 0.3% rise from last year, but are actually $1,987,737 in the city centre. That means those who want to stay anywhere near the TTC’s Line 1 subway - the heart of the city - are actually looking at closer to $2 million dollars for a property.

If you go outside of the city limits to the 905, single family homes get noticeably cheaper, at an average of $918,242. In the west end, for example, Milton homes for sale are $879,878 and on the east end, houses for sale in Oshawa are just a fraction of the price of living in the city, at $554,891.

“GTA-wide sales were up on a year-over-year basis for all major market segments, with annual rates of sales growth strongest for low-rise home types including detached houses. This reflects the fact that demand for more expensive home types was very low in 2018 and has rebounded to a certain degree in 2019, albeit not back to the record levels experienced in 2016 and the first quarter of 2017,” says TREB.

Meanwhile, condos appear to be driving all the price growth in the Greater Toronto Area, up 6.1% to $574,632. City condos are up 5.7% year over year to $619,307 while condos in the 905 are cheaper, up 8.5% to $478,755. Condos in the core will run closer to $686,118, more than a single family home in many 905 cities. But there’s a reason for that — it’s the highest demand area for high-density living — 894 units sold this August — more than the entire TREB region combined. In the 905 only Mississauga sold over 100 units this August, at an average price of $478,714.

TREB expects a slow and steady price rise in the near future, as new listings drop and constrain the supply of houses. It’s unclear why so few sellers are listing their homes, but new listings are down 3% year over year to 11,789 properties. Active listings are down 11.2% to 15,870 properties. And since properties on the MLS tend to sell in under a month, just 25 days, few new or active listings last long on the market. This puts enormous pressure on buyers to make speedy decisions and makes them more likely to bid higher and increase their offerings.

To see more data on Toronto’s housing market, check out the infographic below:

Zoocasa is a full-service brokerage that offers advanced online search tools to empower Canadians with the data and expertise they need to make more successful real estate decisions. View real estate listings at zoocasa.com or download our free iOS app.