Forget everything you thought you knew about the oil and gas industry.

Blockchain technology could be about to unleash a major change throughout the whole energy market and this tech is a perfect match for oil and gas.

A little-known company called Petroteq Energy, Inc. (TSX:PQE.V; OTCQX: PQEFF), recently cited by Deloitte, is aiming to get in front of the industry in a big way with PetroBLOQ, which could become the world’s most innovative blockchain solution for the oil and gas industry.

In fact, PEMEX, the largest energy company in Mexico has just announced a contract with them, and many more are in the works.

Deloitte calls blockchain technology the “single source of truth” for the oil and gas industry. It also sees Petroteq as an emerging player in the creation of a global consortium that will advance blockchain across the entire industry.

Small-cap Petroteq is harnessing it in a large-cap way by working on developing a novel blockchain-based oil and gas supply chain management platform that could transform the industry for every single player at every single level.

So, with so many companies slapping the word “blockchain” on their name, why should investors be excited about Petroteq? Petroteq is an energy technology company that jumps in front of industry trends... and licenses their technology to the industry.

For example, it’s also got another high-potential game-changer: The ability to extract clean oil sands from massive deposits at around $23/barrel, without water.

Here are 5 reasons to keep a very close eye on Petroteq (TSX:PQE.V; OTCQX: PQEFF) right now:

#1 Ask Deloitte: Blockchain is Beyond Big, and Petroteq is a Contender

Blockchain might seem complicated to investors who are playing catch-up here, but that doesn’t change the fact that it is one of the biggest opportunities investors have seen in a long time.

Again, that’s why Deloitte calls it the ‘single source of truth’. It’s a reference to the power of blockchain to render every transaction in the world direct (no more middlemen), transparent, and faster than the speed of light.

For example, it could immediately be put to use to shore up $150 BILLION in transaction disputes per year in the energy sector. What the internet did for communications, blockchain could do for almost every industry known to man.

When Deloitte speaks, the market listens. Deloitte director Geoffrey Cann, who specializes in the oil and gas industry, cited Petroteq as a contender for blockchain technologies in the energy sector, noting that the small-cap company is seeking to add “additional oil and gas ‘Majors’ to become members of a global consortium of energy companies that will focus on advancing blockchain and other technological innovations industrywide.”

It is almost unprecedented for Deloitte to mention a small-cap company in reference to a revolutionary market development.

We listened, and other investors are likely doing the same. Why? Because Petroteq is developing a global supply chain network for the oil and gas industry. The business plan is that oil and gas companies will pay Petroteq (TSX:PQE.V; OTCQX: PQEFF) to be involved in this blockchain consortium because it is one source for the entire industry. The platform will be designed as a "one-stop shop" that will provide both small and large oil and gas producers and operators with the ability to customize their own distributed ledger modules that will permit each company, in a secure "closed" environment, to document, track, and account for the supply of equipment, materials and services in project, field, and lease development.

#2 The Most Lucrative Moment in Blockchain Could Be Now

Never have the terms ‘first-mover’ or ‘early-in’ been more appropriate.

Right now, we’re in the early throes of the blockchain revolution, and its core feature is the decentralized ledger—once again, Deloitte’s ‘single source of truth’.

It’s truth at its purest because it has the power to:

- Transform fundamental methods of transaction processing

- Increase speed of execution and confirmation

- Save corporations and individuals significant time and money

- Secure payment and data transfers

- Increase transparency and record keeping for all parties to a transaction

- Mitigate counterparty risk for all sides

- Facilitate complex and international transactions

It’s almost impossible to put a number on the opportunities here because blockchain could change the way every single industry does business.

For energy, it’s a mind-blowing transformation.

And Petroteq’s PetroBLOQ gives new meaning to ‘first-mover’. PetroBLOQ is developing the first blockchain-based platform exclusively for the oil and gas sector’s supply chain needs—GLOBALLY.

That means its blockchain platform could end up being used at every single transaction of the oil and gas supply chain—upstream, midstream and downstream.

If it succeeds, it’s a massive claim to fame for a small-cap company. And the timing is brilliant. Expect announcements over the coming months as established energy companies are expected to come to Petrotech (TSX:PQE.V; OTCQX: PQEFF) and implement PetroBLOQ solution.

Oil and gas transactions are wildly complicated. Even the smallest producers have to coordinate transactions with multiple processors, shippers and contractors along the supply chain. And for large-cap and global companies, the complexity multiplies exponentially.

PetroBLOQ technology is being built to remove all the counterparties across the board and make transactions direct, instant, verifiable and totally transparent. For oil and gas companies, it means countless savings in both transactions costs and time. And PetroBLOQ’s business model is to get paid on every transaction that uses the platform.

#3 IBM, SOCAR, PEMEX … The Big Inside

Industry insiders want the competitive advantage. Blockchain could be how they get it.

BP started experimenting last year with a blockchain trading platform. Then it joined a blockchain consortium with heavyweights Shell and Statoil and major commodity trading houses - Gunvor, Koch Supply & Trading, and Mercuria. Major financial backers like Dutch ABN Amro, ING, and French Societe Generale were quick to jump in.

They’re all after one thing: Higher profitability.

Now the blockchain consortium idea is about to get immensely bigger…

PetroBLOQ (TSX:PQE.V; OTCQX: PQEFF) is harnessing the same power of the blockchain as IBM, and re-licensing to disrupt the energy sector.

They’re also partnering with state-run oil giants PEMEX and SOCAR, and Deloitte is onboard, too.

PEMEX is the biggest energy company in Latin America. It was also the first to allow cryptocurrency payments at gas stations—and the first to join the PetroBLOQ consortium.

The Mexican energy giant wants to use the blockchain to as it de-nationalizes the Mexican oil industry to sell properties and production to global customers. PetroBLOQ’s supply chain platform being developed could take PEMEX’s processes from production to sale to a brilliant new level of efficiency and profitability.

From drilling, to a finished petroleum-based product and everywhere in between, PetroBLOQ aims to track, monitor, and account for every drop of petroleum on a transparent, immutable, and secure blockchain.

This is where it gets lucrative and seamless. The middle man is out of a job and deals can be cut at breakneck speed. That all translates into more time and more money for the industry.

#4 The Second Revolution: Cheap, Clean Oil Sands--Finally

Petroteq (TSX:PQE.V; OTCQX: PQEFF) already has a significant claim to fame: Its patented oil extraction technology is the first ever to generate sales from Utah’s massive heavy oil resource.

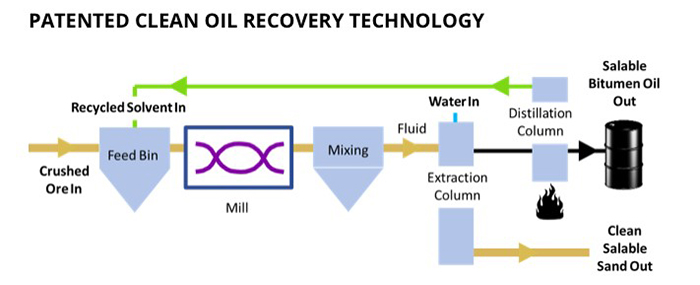

Existing oil sands extraction technologies use tons of water and leaves behind toxic trailing ponds. Petroteq’s system produces oil and leaves behind nothing but clean, dry sand that can be resold as fracking sand or construction sand or simply returned to Mother Nature.

In tests to date, it extracts over 99 percent of all hydrocarbons in the sand, generates zero greenhouse gases and doesn’t require high temperatures or pressures.

For Utah’s 32 billion barrels buried in oil sands, this tech could be the Holy Grail.

This is how it works:

The end result? The extracted crude oil is free of sand and solvents and then pumped out of the system into a storage tank.

The only other place that has oil sands tech is Canada, and it doesn’t compete. It’s designed for wet oil sands and Petroteq is after the dry oil sands bonanza.

The Utah plant is set to produce 1,000 bpd at the end of March when it is scheduled to go live, with a cost of roughly $25 per barrel. The aim then will be to ramp production up to 5,000 bpd.

But the upside here just keeps coming: As soon as production is ramped up in Utah, Petroteq can start licensing the proprietary technology to other countries that are sitting on lots of dry oil sands.

So, Petroteq is sitting on an oil sands property and expects that it can produce oil at around $25 per barrel and sold at $60/barrel. That’s some hefty math. In fact, the oil sands are a $5.2-billion opportunity in the U.S. alone. That doesn’t include the licensing opportunities (think giant oil sands potential in Trinidad, for instance).

#5 Getting in Front of Fast-Moving Opportunity

A blockchain consortium in an industry that badly needs supply chain improvement

(Including an immediate $1.5 billion opportunity eliminating disputes.)

Plus, a huge clean oil sands opportunity that will change the way we view this once-dirty resource…

A global licensing opportunity that makes that math pale by comparison …

Major heavy hitters already interested in this small-cap’s blockchain supply chain consortium, including Mexico’s largest energy company.

The first-ever clean oil sands production is then set to go live, this company is poised for something far bigger than what it is now. And it’s all proprietary and patented.

Smart money is moving to blockchain, and PetroBLOQ is packed with industry insiders who have already earned the respect of major players like PEMEX, SOCAR, IBM and Deloitte.

Can these be right around the corner?

- Petroteq’s unleashing of the FIRST EVER comprehensive oil and gas blockchain platform hoped for in less than 6 months

- Announcements of new blockchain consortium partners

- Licensing deals for its proprietary oil sands extraction tech after it proves out in Utah

- Ramp-up of oil sands production in Utah

Deloitte is focused on the ‘single truth’ for the oil and gas industry, and Petroteq (TSX:PQE.V; OTCQX: PQEFF) is emerging as a top contender in the sector.

Other companies to watch:

TransCanada (TSX:TRP): is a major oil and energy company based in Calgary, Canada. The company owns and operates energy infrastructure throughout North America. TransCanada is one of the continent’s largest providers of gas storage and owns and has interests in approximately 11,800 megawatts of power generations.

With TransCanada’s massive influence throughout North America, it is no wonder that the company is among one of Canada’s highest valued energy companies. Investors can feel comfortable with the company due to its huge and diverse portfolio, and continuing eye for success.

Pembina Pipeline Corp. (TSX:PPL): The North American pipeline industry has had a tough year, but the recent approval of the Keystone XL pipeline route and the growing need for transportation capacity should act as a boon for the sector.

Pembina Pipeline Corp. has ridden the oil price crash in an impressive manner, maintaining a good stock price and increasing its dividend. This is a stock that pays you to wait, and as the sector continues to improve it is likely investors will see good gains here.

Pengrowth Energy Corp. (TSX:PGF): Another company that looks to have halted its falling stock price and is now preparing to ride the bullish sentiment in oil markets. Having shed a lot of excess weight this year in massive asset selloffs, investors can expect a much leaner and meaner Pengrowth in 2018.

For those investors who like to follow the smart money, billionaire investor Seymour Schulich bought millions of extra shares in Pengrowth in early October, boosting his position from 19 percent of the stock to 24 percent. He claims that he is confident that oil and gas is going up.

Cenovus Energy (TSX:CVE): This is one of the most actively traded stocks on the TSX, and it’s been trending up for the second half of this year. The recent sell off represents a great opportunity for investors looking to buy the dip in a stock that climbed over $6 earlier in the year.

The potential is certainly here for this oil company, so for investors who are bullish on the return of the oil markets, this is a perfect pick in the Canadian market.

Gibson Energy (TSX:GEI): has a long history in Canada’s oil and gas game. Established in 1953, Gibson knows the industry inside and out. The company has a diverse portfolio which includes transportation, storage, processing, marketing and distribution of oil, condensates, oilfield waste, refined products and natural gas.

With Gibson’s huge array of assets and its multi-platform sales strategies, investors look to Gibson with a confidence. And with a recent dip in the stock’s price, the company is open for business, with a modest entry point for those interested in dipping their toes into the Canadian oil market.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This news release contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include that PETROTEQ will be able to produce oil as currently scheduled, at the rates of production announced and at the targeted low prices from its Utah property; that PETROTEQ will successfully develop a blockchain supply chain solution for the oil industry; that it will have customers and contracts for its supply chain technology; that oil will be as much in demand in future as currently expected; that PETROTEQ’s technology is protected by patents and that it doesn’t infringe on intellectual property rights of others; that PETROTEQ will find licensees for its technology and that it can patent its technology in many countries; that PETROTEQ’s technology will work as well as expected; that blockchain technology will help PETROTEQ achieve its goals; and that PETROTEQ will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the Company’s patents and other technology protection are not valid, patents may not be granted in countries where PETROTEQ wants to license its technology; production of oil may not be cost effective as expected, technology development costs may be much higher than expected, there may be construction delays and cost overruns at the production plants, PETROTEQ may not raise sufficient funds to carry out its plans, changing costs for extraction and processing; technological results based on current data that may change with more detailed information or testing; blockchain technology may not be developed to be as useful as expected and PETROTEQ may not achieve its business plans; competitors may offer better technology; and despite the current expected viability of its projects, that the oil cannot be economically produced with its technology. Currently, PETROTEQ has no revenues.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company to disseminate this communication. In this case the Company has been paid by PETROTEQ seventy thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. We have been compensated by PETROTEQ to conduct investor awareness advertising and marketing for TSXV:PQE and OTCQX:PQEFF. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases.

The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits similar to those discussed.