Get ready to go green.

In the coming months, Canada will make history by becoming the very first major industrialized nation to legalize marijuana for recreational use nationwide.

If everything goes the way experts are expecting, this September, Canadian lawmakers will be fully decriminalizing the sticky stuff for millions of happy customers in one of the biggest cannabis-consuming nations in the world.

While California remains the biggest single market for cannabis worldwide, the United States is showing no signs of legalization or even decriminalization on a federal level, making the inner workings of the industry logistically fraught with complications and legislative snares.

But now, Canada’s move towards legal weed will change everything for the country’s economy, with a projected cannabis market of as much as $8 billion.

If consumption patterns in U.S. states where marijuana has been legalized teach us anything, it’s that demand is sure to grow beyond current estimation thanks to the availability of edible cannabis products, which account for nearly 30 percent of sales in California, Colorado, Oregon, and Washington.

Meanwhile, the most conservative estimates are projecting that the U.S. market could reach $25 billion by 2020, but if recreational use continues to skyrocket thanks to legalized markets like California and Colorado, high demand could send the market soaring as high as $50 billion by 2026.

These numbers, while impressive, are only telling half the story. The demand is high and getting higher (no pun intended) - but what about supply?

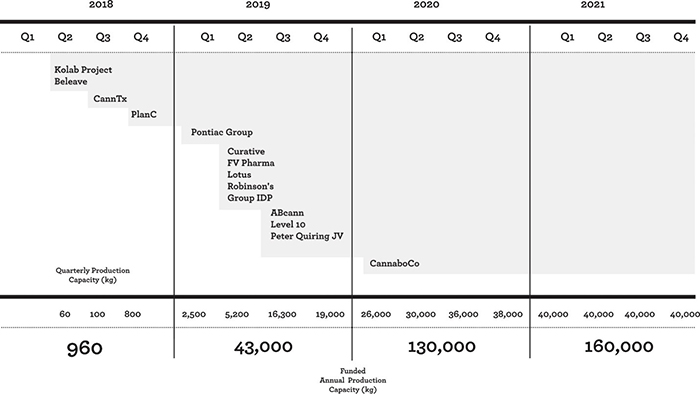

In Canada, current production can meet only a fraction of overall domestic demand for a medical marijuana community of just 300,000 people. What’s more, demand is expected to outpace supply until 2021.

This summer, when the market opens up to recreational consumers for the first time, the market could be in desperate need of new investment to keep up with the booming demand. Here lies the golden opportunity for companies ready to get in on the ground floor in what is guaranteed to be a hefty return on investment.

In such a young and popular industry, there are endless opportunities for growth and innovation. Here are 5 companies that we are expecting to play a major role in the rush to meet demand in the coming cannabis revolution:

#1 Scotts Miracle-Gro (NYSE:SMG)

Scotts Miracle-Gro offers everything that up-and-coming growers are going to need in large quantity: seeds, pest deterrents, in-demand hydroponic equipment, and other grow-op essentials.

A huge segment of cannabis growers utilize hydroponics, the artful science of growing plants without soil. Scotts Miracle-Gro’s subsidiary Hawthorne Gardening Company has an entire division devoted to hydroponics which currently accounts for 10 percent of their overall sales, a number that they are expecting to explode come July.

The company has been quite busy making $1 billion worth of acquisitions for their hydroponics sector through Hawthorne Gardening Company, and their largest acquisition yet, $450 million for Vancouver’s Sunlight Supply Inc. is slated to close on June 1st. Now, the company is focusing on slashing overhead and duplicate jobs for a savings of $35 million per year after 2019.

Thanks to ever-improving technologies and steadily growing demand, hydroponics has been reliably growing by 20 percent each year, and that rate is poised to rise significantly. Scotts Miracle-Gro, thanks to their proactive approach and aggressive acquisition strategy, is in the perfect position to supply the needed equipment for the cannabis growers that are going to find themselves rushing to keep up with demand in the coming years.

#2 Cannabis Wheaton (TSX-V:CBW; OTC: CBWTF)

Cannabis Wheaton has a lot of competition amongst the hordes of Canadian marijuana opportunists, but the small Canadian company is on track to be one of the dominant financiers of the marijuana industry with one distinct advantage - for their investors, they can promise diversified, reduced-risk exposure in a market with skyrocketing demand.

Cannabis Wheaton aims to connect distributors and producers through its standout “streaming cannabis” platform, which allows firms access to capital and markets in this exploding industry, while Cannabis Wheaton collects royalties.

The “streaming” model largely removes investor risk. Instead of putting all your eggs in one basket, Cannabis Wheaton invests in varied producers and distributors, protecting investors against risks like a failed firm or an unsuccessful crop.

Cannabis Wheaton already has 15 partners with 17 production facilities totaling a potential 2.0 million effective square feet of growing space, as well as strong political support and a coast-to-coast network. They have also already established strategic alliances with a national chain of convenience stores, a national chain of independent pharmacies, and other promising distribution partnerships.

The company already has its foot in the door with the medical marijuana industry (they are partnered with 39 clinics with access to 30,000 registered patients), leaving them perfectly positioned to take on the market boom from the coming legalization of recreational cannabis.

#3 Pfizer (NYSE:PFE)

A huge pharmaceutical power offering huge dividends, Pfizer is gearing up for a big year. With a net income of $7.2 billion and operating cash flow of nearly $16 billion, it goes without saying that Pfizer has some serious buying power.

However, after a series of less-than-impressive quarters, Pfizer is looking to corner new markets. The company has recently acquired Anacor Pharmaceuticals, Hospira and Medivation, and is seeing promising growth from innovative cancer and autoimmune drugs.

Meanwhile, the company’s current best-sellers are continuing to trend up, with steadily climbing demand for fast-growing drugs like Ibrance, Eliquis, and Xeljanz. Xeljanz could take off in a big way this year if the FDA takes the advice of its advisory committee and approves the autoimmune disease drug for treatment of moderate to severe ulcerative colitis, a $5 billion market worldwide.

Stay tuned for this summer’s FDA decision on Xeljanz in addition to other Pfizer trial drugs including lung cancer drugs, lorlatinib, and dacomitinib, poised to target a largely untapped market. Also slated for July, the FDA will be making a decision on whether to expand the application of prostate cancer drug Xtandi (which already gained $159 million in the first quarter) to include patients with non-metastatic castration-resistant prostate cancer, pushing sales even higher.

Also, if Pfizer’s recent attempted merger with Allergan was any indication, it can be assumed that they have some very big plans down the line.

#4 Canopy Growth Corp. (TSE:WEED) (OTCMKTS:TWMJF)

Canopy Growth Corp. is a diversified cannabis firm, with multiple brands, curated strains, half a million square feet of production space, and a $4.35 billion valuation. The bullish company also boasts partnerships with leading names in the cannabis industry, including Tweed, Spectrum Cannabis and Bedrocan.

Canopy has been preparing for recreation legalization for the past few years. Shares in the firm jumped in March 2017 when the Canadian government indicated its push toward this year’s full legalization in 2018. That was nothing, however, compared to the last years’ astonishing 386 percent growth in stock, gaining the company a reputation as a “cannabis unicorn”.

The company continues to boast growing stock prices as stock market speculators sing its praises. As we all know, size does matter, and Canopy blows the competition out of the water in terms of peak annual production potential with what is soon to be 5.7 million square feet of space for cultivation, making it a no-brainer for investors.

Speaking of which, Constellation Brands, the investment powerhouse behind Corona, recently investing a whopping $245-million into Canopy Growth Corp. in what amounts to a 99 percent stake, indicating big growth for the small company in the years to come.

#5 Sanofi (NYSE:NYS)

French pharma titan Sanofi is playing the long game. With a market cap of $123.99 billion, the company is sitting back while smaller firms do the risky work of early short-term investing and will swoop in for acquisitions once some of the little guys begin to strike gold. With the coming legalization and cannabis boom in Canada, there is sure to be a lot of gold to go around.

Since its IPO, Sanofi has performed at 8.41 percent. Its biggest growth has been thanks to the drug Dupixent, an anti-eczema drug which is expected to reach sales of $4.3 billion by 2022 in the U.S. alone since its FDA approval in March 2017.

Sanofi has also just made a major advancement in the race to enter the fast-growing PD-1/PD-L1 inhibitor market. The company won an FDA deadline of October 28th for a review of its cemiplimab, designed to target cutaneous squamous cell carcinoma, the second most common form of skin cancer. This drop is just one of many that the pharmaceutical company hopes to begin rolling out to stimulate growth.

Like many other pharmaceutical companies with massive cash flow, cannabis will be hard for Sanofi to ignore when looking for new (massive) markets to target.

Other companies to watch in the space:

Aurora Cannabis Inc (TSX:ACB) which is a producer and distributer of medical marijuana across Canada. The company, formally Prescient Mining Corp, is a Vancouver-based business founded a little over one decade ago. Aurora’s main objective is to bring medicine to the people reliably and economically, which sets it aside from many of its major competitors. In the marijuana industry, patients will often have to jump through hoops to procure their medication, but with Aurora’s caring and knowledgeable staff, patients no longer have to worry.

One of the most appealing things for patients ordering medications from Aurora is the company’s delivery method. This marijuana major sells marijuana by phone and over the internet and then it is delivered straight to the patient’s door.

Aurora is a major player in Canada’s cannabis scene. With a $1-billion market cap and solid growth, savvy investors are watching this stock like hawks.

Emerald Health Therapeutics Inc (TSXV:EMH) is another producer and distributer of medical marijuana. Based in British Columbia, Emerald Health is fully licensed by Access to Cannabis for Medical Purposes Regulations (ACMPR) and provides high quality medicine of different varieties. The company’s approach to research is what really sets the company apart from the competition. With the incredible emphasis placed on isolating the most important qualities in each strain and creating new products for patients, it is no wonder their medicine is so popular.

Additionally, Emerald Health has an incredibly talented administration. With over 30 years in the life sciences field, CEO Dr. Bin Huang is leading the company to greatness.

Because the company focuses on quality, both in their leadership positions and in their products, investors can feel comfortable taking the leap into this budding enterprise.

Cronos Group Inc (TSXV:CRON) is another Toronto-based cannabis company with a lot of ambition. The company has prioritized its production acquisitions in order to provide geographically diverse products. Loaded with values, this company is comprised of passionate and focused employees.

One of the primary objectives of Cronos Group is to destigmatize the medical use of marijuana and bring medicine to those who need it. Cronos Group has made it their priority to lead as an example for the industry, and provide the best care possible to the community.

For investors, Cronos Group is especially appealing due to their core and strategic assets. Their portfolio is sure to impress, and will assuredly continue to grow in time.

Hydropothecary Corp (TSXV:THCX) is a another heavy hitter in Canada’s cannabis scene. With former BC Health Minister Dr. Terry Lake as the VP of Corporate Social Responsibility, and the well-versed Ed Chaplin, who has raised millions for his previous ventures, as the Chief Financial Officer, the company is sure to have a bright future ahead.

With 4 primary products, including Canada’s only peppermint flavored medical cannabis oil sublingual mist, Hydropothecary has chosen quality over quantity. Offering patients the ability to administer their medication in a smoke-free format provides users with an option that is not available just anywhere.

Keep an eye on this stock moving forward as it may just have what it takes to take the industry by storm come June 2018.

OrganiGram Holdings. (TSXV:OGI): Organigram Inc. is a licensed medical marijuana producer in Canada, while it managed to maintain its production license this year, the company saw its stock price fall somewhat Year-To-Date, but we see strong upside for this stock as the changing Canadian cannabis legislation could give a massive boost to the market.

OrganiGram Holdings is a customer-first organization with a wide variety of products from which patients can choose. The company specializes in both organic and minerally grown cannabis, and is sure to satisfy the customers’ needs.

Moving forward, OrganiGram’s trajectory is sure to send the company far within the marijuana world. Poised to take a noticeable chunk of the pot market, OrganiGram is equipped with solid leadership and an ambitious drive that investors are sure to follow closely.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

FORWARD-LOOKING STATEMENTS. Statements in this communication which are not purely historical are forward-looking statements and include statements regarding beliefs, plans, intent, predictions or other statements of future tense. Forward looking statements in this article include that: new cannabis legalizing legislation will create an $8-billion-dollar industry; that there will likely be a supply shortage; that this industry could have an economic impact of $22.6 billion annually; that by 2021, marijuana demand is expected to grow by 420,000 kg; that Cannabis Wheaton Income Corp.’s (“Cannabis Wheaton”) business model reduces risk for investors; that Cannabis Wheaton will be able to close streaming deals with its current 15 partners, along with 1.4 million effective square feet of acreage by 2019; that producers will need to obtain additional financing from companies like Cannabis Wheaton; that timeliness of government approvals for granting of permits and licenses, including licenses to cultivate cannabis, and completion of grow facilities will occur as expected; that actual operating performance of the facilities meets expectations, that regulatory change occurs as announced; that competition does not quickly develop; and that Cannabis Wheaton can retain key employees and contacts. Forward-looking information is based on certain factors and assumptions believed to be reasonable at the time such statements are made, including but not limited to: facts and assumptions relating to expected changes to cannabis legislation and the effects thereof; the potential demand for recreational and medical cannabis; that Cannabis Wheaton’s business model will position it well to capitalize on upcoming cannabis legislation changes; that Cannabis Wheaton will be able to close expected transactions, compete and retain employees and contacts; and such other assumptions and factors as set out herein. Forward-looking information is based on the opinions and estimates of Cannabis Wheaton at the date the information is made, and is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Forward looking statements involve known and unknown risks and uncertainties which may not prove to be accurate. Actual results and outcomes may differ materially from what is expressed or forecasted in these forward-looking statements. Matters that may affect the outcome of these forward looking statements include that: markets may not materialize as expected; marijuana may not turn out to have as large a market as thought or be as lucrative as thought as a result of competition or other factors; Cannabis Wheaton may not be able to diversify or scale up as thought because of potential lack of capital, lack of facilities, regulatory compliance requirements in Canada or outside of Canada or lack of suitable employees or contacts; partners of Cannabis Wheaton may not be granted licenses or additional capacity under existing licenses for them to grow for the cannabis market; foreign governments may not allow Cannabis Wheaton to operate in their countries; and other risks affecting the Company in particular and the cannabis industry generally. The forward-looking statements in this document are made as of the date hereof and the Company disclaims any intent or obligation to update such forward-looking statements except as required by applicable securities laws.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by Cannabis Wheaton ninety thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. If we own any shares we will list the information relevant to the stock and number of shares here. We have been compensated by Cannabis Wheaton to conduct investor awareness advertising and marketing for [TSX:CBW.V and OTC:KWFLF]. Oilprice.com receives financial compensation to promote public companies. This compensation is a major conflict of interest in our ability to be unbiased. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non- compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor awareness efforts. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur. Our emails may contain forward looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, The Company often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications.

DISCLOSURE. The Company does not make any guarantee or warranty about what is advertised above. The Company is not affiliated with, any specific security. While the Company will not engage in front-running or trading against its own recommendations, The Company and its managers and employees reserve the right to hold possession in certain securities featured in its communications. Such positions will be disclosed AND we will not purchase or sell the security for at least two (2) market days after publication.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LEGAL ADVISORY. Investing in companies associated with the cannabis industry may be illegal in the jurisdiction where a reader resides. Before investing in any public company involved in the cannabis industry, potential investors should check with their legal advisor as to whether an investment will breach local law.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR- OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

All trades, patterns, charts, systems, etc., discussed in this message and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect those of the publisher. No system or methodology has ever been developed that can guarantee profits or ensure freedom from losses. No representation or implication is being made that using the methodology or system will generate profits or ensure freedom from losses. The testimonials and examples used herein are exceptional results, which do not apply to the average member, and are not intended to represent or guarantee that anyone will achieve the same or similar results.

AFFILIATES. Some or all of the content provided in this communication may be provided by an affiliate of The Company. Content provided by an affiliate may not be reviewed by the editorial staff member. Our affiliates may have their own disclosure policies that may differ from The Company’s policy.