How much do you know about the $3.6 trillion U.S. infrastructure crisis?

Experts predict a major rise in accidents and disasters if no action is taken within the next few years.

U.S. dams are failing from coast to coast, with 15,500 of our 90,500 dams now a high-hazard potential for public safety and the economy that will take $45 billion to fix …

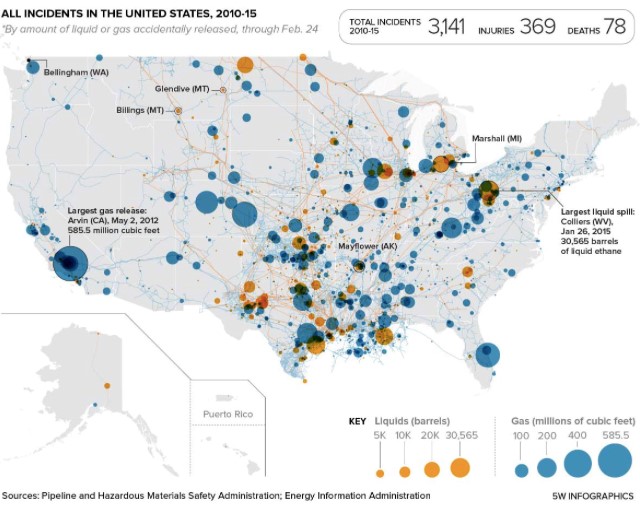

Pipelines have caused almost 9,000 significant accidents in only 30 years, hitting us with $8.5 billion in damages, killing 548 people and injuring over 2,500 more …

The over 140 oil refineries in the U.S. are potential disasters waiting to happen, with more than 500 accidents since 1994, and explosions killing and threatening millions with fatal toxins.

The Trump administration has vowed to take action and boost infrastructure spending by a whopping $1 trillion, but the American Society of Civil Engineers (ASCE) says the price tag to fix to this aging infrastructure is closer to $3.6 trillion. In the meantime, a game changing technology may be the best way to avoid more economic disasters and human tragedies.

The tech is designed to save infrastructure from everything from oil spills and dam failures, to toxic explosions and mine collapses, taking advantage of and using information from a massive remote data system that will be worth over $27 billion by 2023.

Meet Carl Data Solutions (CSE:CRL; OTC:CDTAF), the company that’s taking the remote sensing of data to the next level with a major evolutionary bang that promises to help solve the multi-trillion dollar infrastructure crisis.

Here are 5 reasons to keep a close eye on Carl Data Solutions (CSE:CRL; OTC:CDTAF):

#1 The Application of Artificial Intelligence

From Toronto to LA and Dallas; and from municipalities, engineering firms and massive infrastructure operators at every vertical, Carl Data has a data industry application and solution.

Literally.

While everyone’s been focusing on the billions of sensors that collect data remotely, Carl Data has been focusing on the data itself in a disruptive way.

All of these industry verticals are overloaded with data. That data is going into log files and then disappearing into a black hole. Carl Data has the tools to intercept the data and makes it actionable—and money saving.

Carl Data’s application takes the chaos of massive amounts of data and turns it into something actionable. For major cities with aging infrastructure, it’s not enough to have a bunch of sensors collecting data. You have to know what the data is telling you, and in order to do that, you have to have super modern analytics capabilities.

That’s exactly what Carl Data has, and there are few systems out there that can handle the sheer volume of data created, and manage any data type in their cloud.

Carl Data’s SaaS-based solutions can help identify problems in near real-time, saving customers time and money. That’s huge when a disastrous dam failure can cost on average over $700 million in damages and close to $2 billion for clean-up.

Carl Data has the capability not only to collect, store and analyze critical big data for all major industries, but it takes things one step further and does what no one else yet does: predictive analytics, machine learning and web-based applications—all rolled into one. That’s how it’s planning on becoming the overlord of overload.

This system is designed so that it can service absolutely any and every industry vertical with a massive data platform.

Carl Data’s AI system can predict events that may lead to critical infrastructure failures up to seven days into the future.

It can use AI to compare past storm events to current weather predictions to forecast whether a future storm might cause a major incident at one of America’s many aging and high-hazard potential dams—before they fail.

For oil and gas stream crossings, and major pipeline operators like Kinder Morgan, Enbridge, Husky and Trans Canada, Carl Data use flow and stability sensors to monitor where the pipeline crosses the stream in real-time, alerting engineers via cell phone immediately if thresholds are threatening breach. For Kinder Morgan’s 1,300 LNG stream crossings in British Columbia alone, monitoring is critical.

For companies like Teck, Gold Corp., Imperial Metals and BC Hydro and thousands of hydro-electric dams and toxic trailing ponds around the world, Carl Data could be the difference between a small patch-up and a billion-dollar clean-up.

#2 American Critical Infrastructure is Dangerously Failing

So why is this Why is Carl’s (CSE:CRL; OTC:CDTAF) predictive data solution so valuable?

America’s infrastructure gets a woeful D+ on its report card. The country’s more than 90,000 dams represent a major threat to public safety and the economy, with nearly 15,500 already considered high-hazard potential in 2016. On average, these dams are 56 years old, and the hazards are mounting.

In October 2015, 18 dams were breached in South Carolina flooding, closing down 300 roads and 166 bridges, and killing 19 people. Just a year later, Hurricane Matthew ripped through the same state, causing 25 dams to fail—again.

In February this year, 200,000 people were urgently evacuated in northern California over fear that the Oroville Dam—America’s tallest--would collapse.

In the past two years alone, there have been 21 dam failures.

And that’s just one part of our massive critical infrastructure.

From the Deepwater Horizon immolation that killed 11 workers and released 5 million barrels of crude oil into the Gulf of Mexico to the Anacortes Tesoro oil refinery explosion and the collapse of West Virginia coal mine that killed 29 miners, public safety has been comprised.

And that was only in 2010—and all in a single month, April.

Just a few weeks ago, the Keystone Pipeline in South Dakota leaked over 200,000 gallons of oil, forcing a shutdown.

(Source: Politico)

Bigger and better monitoring measures are critical, and Carl Data Solutions not only uses the latest in artificial intelligence (AI) to alert critical infrastructure operators to impending disasters, but it’s predictive—enabling customers to respond before situations become life-threatening.

For America’s bursting dams, having a 7-day lead time on a pending disaster is likely the difference between life and death, and could save operators tens of millions in catastrophic clean-up fees, lawsuits and damage control.

#3 Multiple Billion-Dollar Markets Need to Manage Remote Sensing

Remote monitoring is a massive market across industries—from power generation, oil and gas and chemicals, to water, wastewater, pipelines and railroads. It’s a market that is anticipated to hit $27.11 billion by 2023, for a CAGR of 4.47 percent.

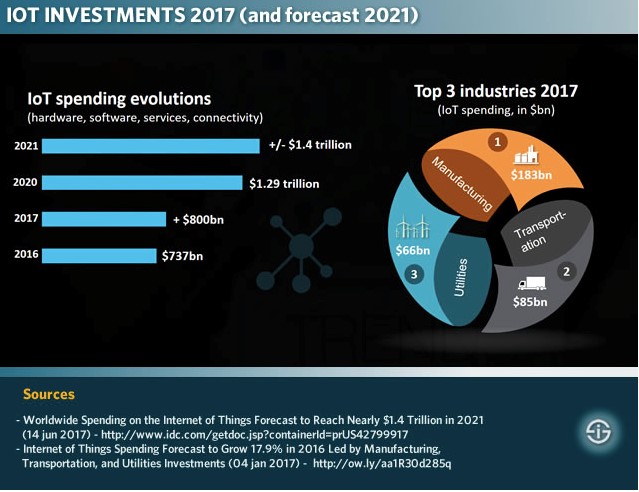

Globally, investment in the Internet of Things (IoT) is expected to go from over $800 billion this year to nearly $1.4 trillion in 2021, with the manufacturing, transportation and utilities industries the biggest spenders. In other words … remote monitoring connectivity and critical infrastructure.

Manufacturing is expected to spend $183 billion this year on IoT, while the transportation industry is expected to spend $85 billion and utilities are looking at a $66-billion IoT shopping spree.

According to IDC, worldwide revenues for big data and business analytics will reach $150.8 billion this year—a 12.4 percent increase over last year. By 2020, revenues are expected to be more than $210 billion.

Big data is now irreversibly mainstream, and it’s the key to keeping our critical infrastructure from causing critical damage.

#4 A Revenue-Earning Company Has the Potential to Get Much Bigger

What investors should be aware of is Carl Data (CSE:CRL; OTC:CDTAF) is working its way into multiple verticals because the applications of its SaaS-based technology are not limited to any specific industry. So the revenue potential can come from a great many different industries.

Clients pay a fee based on the number of data sources coming into their account, along with set-up fees and customization services, which include new algorithms and unique reporting.

And the entire system just got a lot easier and even more cost-effective with Carl Data’s acquisition of ab Embedded Systems Ltd assets. This is where low-power wireless mesh networks are scooping up huge amounts of data from remote locations automatically.

With the potential to tap into every industry that collects big data, Carl Data already has a strong pipeline for this year, and has a base of revenue generation that it is now ready to build on.

And the potential for near-term revenue growth is already visible through proprietary applications and strategic acquisitions.

- Through its acquisition of Flowworks real-time reporting and analytics in 2015, Carl Data has solidified its relationship with major sensor manufacturer Hach, with a new project for the City of Dallas, which has since been expanded, with several more projects expected in the near future.

- Carl Data’s Polish subsidiary, where its core team of data scientists are, was approved for a substantial EU research grant to help the company maintain its lead in tech that monitors aging water infrastructure.

- Carl Data is also working closing with big-cap miner Teck Resources and has developed and deployed an application for monitoring tailing ponds. The tech system will help Teck manage risk and is expected to result in significant operational savings.

- The same technology is also being adapted for Dam Safety and other Asset Monitoring.

From Toronto and Dallas to LA, major cities could benefit from Carl Data solutions to protect budgets and populations from the devastating disasters caused by aging infrastructure. The mining vertical is already being successfully tapped, and Carl Data anticipates other major verticals to follow suit.

#5 Big Data Visionaries, Big Business Brains

While everyone was blindsided by the remote sensing bonanza, Carl Data (CSE:CRL; OTC:CDTAF) CEO Greg Johnston was looking into the future. What to actually do with all that data to make it work for its owners. He had a big idea that he’s since turned into a small-cap company with a large-cap potential.

The real gold mine is the data, not the sensors. And in Johnston’s words: “We’re turning the industry on its head”.

Johnston’s idea was hard-hitting and unique. He set out to create a system that can work with any hardware vendor, giving Carl Data a rare advantage. Once it’s set up, it spoon-feeds critical data to clients—filtered and relevant and in time to fix problems and divert disaster.

Carl Data is about Greg Johnston’s vision, and the high-tech team he put together to disrupt the future.

- Johnston is the former director of ecommerce marketing for Global Hyatt Corporation, where he increased online revenue by 34 percent. He’s also a principal at BDIRECT Online Communications, Director of Database & Loyalty Marketing for Choice Hotels Canada, VP of Antarctica Digital Marketing, and partner at Revenue Automation Incorporated.

- CTO Piotr Stepinski is a high-level software engineer with a major track record in Kainos, Atena and Telzas and he is the tech architect for Carl Data.

- Director Chris Johnston, a professional engineer, is the also the co-founder of Flowworks

- VP of Business Development Kevin Marsh led the industry’s first successful efforts to commercialize an IoT-based Data-as-a-Service solution, overseeing its rapid market adoption.

- Director Craig Tennock is a veteran civil and structural engineer who was awarded the Order of Merit by Industry Canada for designing and implementing a new way to measure open channel flow with greater accuracy.

The expert management team and board has major successes behind it in launching award-winning data solutions, start-up ventures and Fortune 500 consumer programs. And they are heavily invested in Carl Data, with over 80 percent insider ownership.

Remote monitoring is already a multi-billion-dollar business, that’s heading to over $27 billion in the next few years. Harnessing the real power of all that data floating around in the cloud is where the big money might be made.

A serious flood resulting from a dam breaking can hit us on average with $700 million in damage and clean-up can cost up to $1 million per day. And our dams are failing in record numbers. Oil equipment failure can cost more: BP’s Deepwater Horizon spill cost $62 billion. Countless billions of dollars are at stake if we can’t reign in our aging infrastructure. Countless populations, too.

Carl Data’s (CSE:CRL; OTC:CDTAF) big vision for big data may be the biggest thing to happen to North American infrastructure cost savings, by tackling a multi-billion dollar crisis before disaster strikes.

Honorable Mentions:

BCE Inc. (TSX: BCE) is a Canadian giant. Founded in 1980, the company, formally The Bell Telephone Company of Canada is composed of three primary subsidiaries. Bell Wireless, Bell Wireline and Bell Media, however throughout its push into the position of one of Canada’s top telco groups, it has bought and sold a number of different firms.

BCE is also at the forefront of the Internet of Things movement in Canada. Its Machine to Machine solutions are being used by numerous businesses throughout North America and its new LTE-M network is sure to rapidly increase the adoption of these solutions.

It’s paying a quarterly dividend of $0.72 per share right now. It’s had some great results, even if net income has declined a bit in the most recent quarter. It’s still blowing other telcos out of the water.

Pivot Technology Solutions Inc. (TSX:PTG): Pivot focuses on the strategy to acquire and integrate technology solution providers, primarily in North America. It sells and supports integrated computer hardware, software and networking products for business database, network and network security systems.

Pivot has seen explosive growth so far this year and we expect the current cyber threats to add to the already strong sentiment in cyber security stocks, making the company one sure to draw investor interest.

Imperial Oil (TSX:IMO): Imperial oil could be one of the best contrarian bets in the oil markets for 2018, having missed its third quarter profit estimates and currently dealing with the resultant stock decline. It still has some of the lowest cost producing oil sands in Canada and that is going to pay off as oil prices continue to rise and new tech breakthroughs bring breakeven prices even lower.

As infrastructure becomes a target for hackers, oil companies are scrambling to secure their networks and find solutions to prevent losses in their supply line, and Imperial is certainly aware of this.

The management is well known for being conservative, but that certainly shouldn’t put investors off in a time when recovery is the buzzword of the day and consistency is sure to be rewarded.

Mogo Finance Technology Inc. (TSX:MOGO): This is a new spin on unsecured credit, which is a burgeoning sub-segment of FinTech. Providing loan management, the ability to track spending, stress-free mortgages, and even credit score tracking, Mogo is at the forefront of an online movement to assist users with their financial needs using new technology and Big Data solutions.

Mogo’s software analyzes borrowers instantly and greatly reduces the traditionally cumbersome underwriting process for loans. It’s online only, so there’s very low overhead and a ton of cash to spend on marketing. Labeled as “ the Uber of finance” by CNBC, Mogo is definitely turning heads.

With increasing membership growth and revenue lines continuing to improve, and a platform which many banks have failed to offer, Mogo could well become an acquisition target in the near future.

Pretium Resources (TSX:PVG): This impressive Canadian company is engaged in the acquisition, exploration and development of precious metal resource properties in the Americas.. Additionally, construction and engineering activities at its top location continue to advance, and commercial production is targeted for this year.

Like many other companies in the resource space, Pretium is looking for high-tech solutions for some of its biggest problems. Managing inventory, contracts, and its assets is becoming increasingly difficult, and Pretium will be looking toward new technology to solve some of these issues.

The company’s modest market cap and stock price make it an appealing buy for investors. Pretium has an impressive portfolio and if you can catch the stock while the price is right, there could be huge opportunity for upside.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Disclaimer for Forward-Looking Information

Certain statements in this press release are forward-looking statements and are prospective in nature. Forward-looking statements are not based on historical facts, but rather on current expectations and projections about future events, and are therefore subject to risks and uncertainties which could cause actual results to differ materially from the future results expressed or implied by the forward-looking statements. Forward-looking statements in this news release include statements that Carl Data’s custom closed control system can predict events that may lead to critical infrastructure failures up to seven days into the future, that Carl Data can precisely monitor and analyze the vibration of pipelines and predict maintenance of infrastructure which can save millions and prevent possible disasters; that new projects in Dallas and elsewhere will materialize; that revenues could grow substantially, that Carl Data’s technology may be able to prevent disasters resulting from infrastructure failure, that Carl Data’s revenues are expected to rise rapidly, and that the Company’s technology can be adopted for almost any industry.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Such forward-looking statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in the statements including, without limitation, risks with respect to: that Carl Data’s data scientists may not be able to continue developing breakthrough machine learning abilities into their software, that machine learning and Carl Data’s technology in general may not achieve the expected results and its accomplishments may be limited, that the use of past data may not enable accurate predictions as expected, Carl Data may not establish a market for its services as expected; general economic conditions in the US, Canada and globally; the inability to secure additional financing; contracts that are expected may not materialize or may be cancelled; competition for, among other things, capital and skilled personnel; potential delays or changes in plans with respect to deployment of services or capital expenditures; possibility that government policies or laws may change; technological change; risks related to Carl Data’s competition who may offer better or cheaper alternatives; Carl Data may not adequately protecting its intellectual property; interruption or failure of information technology systems; and regulatory risks relating to Carl Data’s business, financings and strategic acquisitions. The Company disclaims any intent or obligation to update publicly any forward-looking information other than as required by applicable securities laws.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Safehaven.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by Carl Data one hundred and twelve thousand five hundred US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. We have been compensated by Carl Data to conduct investor awareness advertising and marketing for (CSE:CRL; OTC:CDTAF). Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc., discussed in this message and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect those of the publisher.