There's a new kind of transportation.

It's not electric cars or electric trucks...

It's not public transportation like buses or trains…

And it’s not Uber or Lyft...

In fact, it's busy taking market share away from all of those.

You’ve maybe seen them... but you probably haven't considered how lucrative this $177-billion industry actually is.

The electric scooter industry is booming, and OjO Electric (TSX.V:OJO) is trying to transform it.

Investors are already going all in on this sector. Bird has shot up 12,800%...Lime is now up 5,700%... and Tier Mobility is up 2,000%.

These seemingly small companies are now getting multi-billion-dollar valuations.

Bird is now worth $2.75 billion...while Lime is sitting on a $2.4 billion valuation...

But the proverbial train has well and truly left the station for investors hoping to get in on those industry giants.

Instead, it’s time to focus on "the next Tesla" - a small scooter company worth only $38 million currently - which could soon rise significantly.

OjO (TSX.V:OJO) ticks every box

- It’s got a moat of patents

- It’s solving one of consumers’ biggest needs

- It’s safe and legal

- It’s backed by a team of industry veterans

- And it’s part of a trillion dollar mobility market that investors simply can’t ignore

$38 MILLION COMPANY WITH AN INCREDIBLE PATENT PORTFOLIO

In the startup industry, a strong patent portfolio is the ultimate war chest that can ensure massive returns for investors, and that’s exactly what OjO has going for it.

Inventions that are patented instantly become investible assets.

Because there is a direct relationship between patent value and market demand, patented inventions tend to attract strong investments that help the startup compete with entrenched incumbents.

Startups with powerful patents are at a distinct advantage because they are protected from undue competition, giving them room to grow organically while also making them attractive M&A targets.

That’s why there is a long line of companies that started off with just sweat equity but went on to become multi-billion-dollar unicorns.

Their secret sauce? Strong products backed by strong patent portfolios.

American-Dutch sports and clothing company Head started with $6,000 and a ski built in a garage. Howard Head was savvy enough to get patents to protect his inventions right away and that translated into astounding 6,700,000% growth.

Microsoft Inc. founders Bill Gates and Paul Allen bet that personal computing would one day become huge, despite the prevailing skepticism. The first coup here was when they bought the license for the code for MS-DOS in 1986 for $925,000 and refused to grant IBM an exclusive licensing agreement. It was a huge risk for Microsoft, but one that paid off massively in the end. They spent only $925,000 and grew a staggering 194,000% as soon as the PC revolution caught fire.

Then, of course, there’s Apple Inc. and Steve Jobs, widely considered as one of the greatest inventors of the last century. Job’s name appears as the author of 346 patents in the US registry, including the original Macintosh in 1984 and the iPhone in 2007.

Job’s patent-securing genius has propelled Apple shares 8,700% since the launch of the iPhone and 14,500% since the Mac made its debut.

Now, OjO Electric Corp. (TSX.V:OJO) is seeking to revolutionize the next multi-billion-dollar industry with its own remarkable patent portfolio.

PATENTS AND PERMITS

OjO Electric Corp. has a mission to change the future of micro-mobility for good by providing safe and sustainable first- and last-mile mobility.

The OjO scooter is a patented custom-engineered bike that’s fully-electric and produces zero emissions. It’s powered by two swappable 48-volt Li-ion batteries that allows it to travel an industry-best 50 miles on full charge at a bike-lane-legal top speed of 20mph.

The OjO scooter also features unique integrated GPS technology that allows for geofencing and automated speed throttling whenever the user exceeds the speed limit for a particular jurisdiction or zone.

OjO’s approach to first- and last-mile mobility is different from its competitors because it emphasizes close collaboration with municipal and local authorities. The company is already in the process of rolling out a grand total of 1,250 scooters, which will include 500 in Austin, 500 in Dallas and 250 in Memphis, Tennessee.

All that is left to get the ball truly rolling is to deploy thousands of scooters to these areas.

SAFE AND ROADWORTHY SCOOTERS

The e-scooter trend is a modern-day phenomenon that transcends the age barrier.

Electric scooters have been rapidly gaining popularity as a cost-effective, convenient and safe mode of transportation and proving that getting from A to point B does not have to be a dull, soporific affair.

Everyone from Gen-Zers to Millennials and even Baby Boomers are now getting on board, especially due to its convenience and accessibility.

What makes the OJO scooters really stand out is the fact that they are one of the only brands that uses Bluetooth speakers to announce audible safety alerts. Additionally, the scooter’s speed will automatically adjust to comply with speed limits in different zones while also providing audible safety alerts informing the rider of speed zones and restrictions. They can make their scooters automatically slow down in school zones or campuses.

While the first influx of scooters created chaos for cities, OJO (TSX.V:OJO) is turning that chaos into organized safety. That’s why cities, municipalities and local authorities may be more interested in dealing with OJO.

A $7 TRILLION TREND

Micro-mobility is an unstoppable and powerful secular trend that is just taking off and seeing explosive growth.

The total mobility market is currently valued at $7 trillion…and growing.

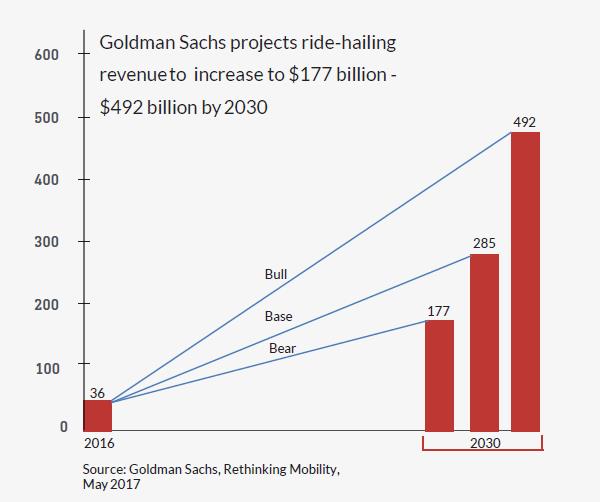

According to projections by industry pundit Goldman Sachs, the ride-hailing sector was valued at $36.4 billion in 2017 and is expected to reach $126.5 billion by 2025 and up to $492 billion by 2030. That represents an impressive 22.1% CAGR over the period.

What’s even more impressive is the fact that the budding e-scooter ride-hailing sector is expected to grow much faster than other forms of ride-hailing such as bikes and cars.

A big reason why this particular service is expected to experience robust growth is due to its sheer versatility. For instance, e-scooters can be readily deployed as a more practical and convenient last-mile delivery tool for companies like Amazon than, say, drones. Good case in point is a leading food delivery company already uses OjO (TSX.V:OJO) scooters for food delivery in a pilot program.

Further, tech-based mobility solutions and city infrastructure improvements such as public transit and added bike lanes are emerging and helping improve commuting times and also lower congestion and GHG emissions.

All these trends are helping open up the e-scooter micro-mobility sector.

Tesla-esque CEO

OjO (TSX.V:OJO) is a design-first company that was founded by a group of successful inventors, designers and consumer goods entrepreneurs.

Just like Musk, the CEO is a rare quintessential combination of wit, intelligence, fortitude, sarcasm and judiciousness. In a nutshell, a brilliant visionary.

While Elon is shooting for the stars with his electric cars and dreams of colonizing Mars... this guy is looking at the smallest travel segment with the same laser-focus on clean-energy and industry-defining premium products.

HOW THEY MAKE MONEY

This company boasts an attractive and profitable business model with superior economics compared to its rivals.

The OjO scooter costs $1,240 vs. $551 average by competitors. While it costs more, the Ojo scooter is expected to last years instead of months and therefore, recoup and generate positive cash returns.

A big reason why OjO’s scooters have much better economics is because they are designed to be used for ride-sharing. These scooters are built with heavy-gauge aluminum under chassis for optimal strength, cushioned seat for comfort and powered by a robust rear hub motor capable of climbing an 18% grade.

They can also do 40-50 miles on a single charge allowing them to go well beyond the usual limits of their less robust brethren. Indeed, while the average kick scooter ride is about 0.6 miles, OjO scooters average close to 2 miles and they even have rides in cities that are 10-15 miles long, comparable to the range by Uber and Lyft cars.

In other words, OjO is already competing in Uber and Lyft’s back yard.

It’s early innings for OjO (TSX.V:OJO), yet all the revenue and profit metrics are already tracking positive.

2019 Trends in Key Rideshare Metrics

You can expect a big revenue ramp by the company as well.

OjO (TSX.V:OJO) has already deployed 250 scooters and expects to hit 2,500 by year-end and 10,000-15,000 by the end of 2020.

Planned scooter deployments and revenue run-rate projections

But that will only be the beginning.

After that, OJO expects the project will get much bigger once they start launching in the lucrative European market.

This company is where Bird and Lime were two years ago (they both launched in 2017). Remember, it took them a matter of months to reach unicorn status (i.e., achieve valuations of a billion dollars or more and little more than a year to double that).

This could be history repeating itself right in front of our eyes.

Rich pickings for early-in investors

Bird, Lime and OjO’s own experience has proved just how quickly the e-scooter business can ramp.

Things happen so fast it’s like a Lamborghini… 0-60mph in less than three seconds.

This is the lowest-hanging fruit in the micro-mobility industry right now, a rare opportunity to get in early.

Yet those off-the-charts number might only be enjoyed by investors who waste little time buying OjO (TSX.V:OJO) shares.

Other companies to watch as this new tech revolution kicks into high gear:

MAXR (NYSE:MAXR, TSX:MAXR) is an end-to-end space solutions business.

This is about Earth intelligence and space infrastructure. The focus right now is on Earth imagery, geospatial data, satellites and robotics, and NASA is one of their biggest customers, along with the European Space Agency and the UK Space Agency.

There’s also been talk of a billion-dollar buyout, with plenty of reason to put Amazon on that wishlist.

And keep in mind that a billion-dollar buyout would be a 67% premium on MAXR current price.

It’s extreme--but we’re talking about space.

It’s not just the US government (think: DARPA and the US Air Force) that MAXR has on its client list--they also have international governments, and major commercial clients like Boeing and Lockheed Martin. They have nearly 6,000 employees and customers in more than 70 countries.

Celestica Inc. (TSX:CLS) is a manufacturer of electrical devices used in IT, telecommunications, healthcare, defense and aerospace industries. The company has seen strong growth YoY which we expect to continue as the sales expectations are almost 3% better than last year’s.

While telecommunications stocks have been volatile recently, defense, IT and aerospace industries have outperformed and while many see limited upside, these industries continue to surprise both investors and analysts.

Pure Technologies Ltd. Pure technologies is all about critical infrastructure including water and wastewater pipelines, oil and gas pipelines, and bridges and structures. One of Pure Tech’s biggest achievements in this space is its SoundPrint acoustic monitoring technology, which is set to revolutionize the industry.

Investors are watching Pure Technologies closely and the company is sure to be a valuable addition to numerous portfolios going forward.

EXFO Inc (TSX:EXF) isn’t new to the Canadian tech sector. The company was founded in 1985 in Quebec City, and its original products were portable testing products for optical networks. Since then, the company has acquired and build 3G, LTE, protocol, copper/xDSL, IMS, and VoIP test and service assurance products.

Recent developments from EXFO are promising for long term growth potential. The new baseband unit emulation technology which is sure to be adopted on a large scale, as the tech offers operators a reduction of costs and a faster revenue stream.

Mogo Finance Technology Inc. (TSX:MOGO): This is a new spin on unsecured credit, which is a burgeoning sub-segment of FinTech. Providing loan management, the ability to track spending, stress-free mortgages, and even credit score tracking, Mogo is at the forefront of an online movement to assist users with their financial needs.

Mogo’s software analyzes borrowers instantly and greatly reduces the traditionally cumbersome underwriting process for loans. It’s online only, so there’s very low overhead and a ton of cash to spend on marketing. Labeled as “the Uber of finance” by CNBC, Mogo is definitely turning heads.

With increasing membership growth and revenue lines continuing to improve, and a platform which many banks have failed to offer, Mogo could well become an acquisition target in the near future.

By. Charles Kennedy

IMPORTANT NOTICE AND DISCLAIMER

PAID COMMUNICATION. This communication was paid for by OJO. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by OJO Electric to conduct public awareness communication and marketing. OJO Electric paid the Publisher fifty thousand US dollars to produce and disseminate this and other similar articles and certain banner ads. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should be aware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume during the course of public awareness marketing, which subsides as the investor awareness marketing subsides. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on an interview conducted with the company’s CEO, and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares and/or stock options of the featured companies and therefore has an additional incentive to see the featured companies’ stock perform well. The owner of Oilprice.com has no present intention to sell any of the issuer’s securities in the near future but does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The owner of Oilprice.com will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies concerning, among other things, ride-sharing and scooter-sharing companies, the size and growth of the market for the companies’ products and services, the companies’ ability to fund its capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://oilprice.com/terms-and-conditions If you do not agree to the Terms of Use http://oilprice.com/terms-and-conditions, please contact Oilprice.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. Oilprice.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.