The future of mobility is a $7-trillion opportunity—but not for the auto industry.

Instead, it is likely to be the micro-mobility market minting billionaires.

And driving the market? Massive marketing, proliferation of internet-based technologies, soaring urban populations, unbearable congestion, climate change, fuel costs, and wasted time, money and effort.

The segment is already turning brand new start-ups into unicorns practically overnight, and investors are starting to take notice.

From, ride sharing giants like Uber, to scooter kingpins like Bird and Ojo Electric Corp’s (TSX.V:OJO, OTC:AZNVF) sleek new two-wheeled answer to the Tesla, mobility is a stunning market that’s becoming increasingly unconventional.

Scooters in particular have been attracting cash and customers like no other segment. That’s because two wheels have the potential to almost entirely replace cars and completely upend ride-hailing as we know it. It also could be the answer to ailing public transportation.

And you don’t have to take our word for it, investors are pouring huge sums of money into it.

They’ve pumped more than $5.7 billion into two-wheeled startups since 2015, with multiple companies getting to the coveted $1 billion valuation status. Scooter startup Bird is only two years old, but it’s already worth $2.75 billion. Just this month, it raised $275 million in fresh funding. Lime, its main competitor, is now worth $2.4 billion.

It’s a crowded space, but that doesn’t seem to bother venture capitalists who keep throwing down cash for what they are sure is the next revolution in urban transport.

Here are 5 companies to cash in on the mobility craze:

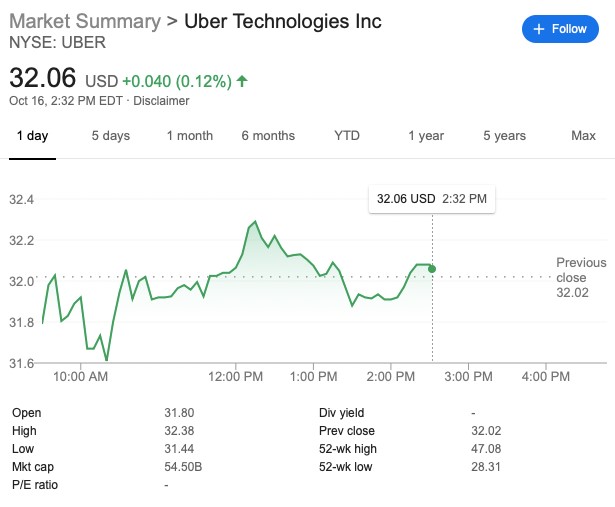

#1 Uber Technologies Inc (NYSE:UBER)

We’ll start with the obvious. Now a $54-billion market cap company, Uber has defined tradition in a million ways. It hasn’t been easy.

And despite all, this stock still looks cheap, thanks to a number of struggles and challenges it still has to get through.

Uber went public in May, and since then it’s taken a bit of a beating.

We’re still waiting for Uber to be profitable, but let’s look at the numbers: According to Needham analyst Brad Erickson, as reported by Business Insider, Uber’s ride-sharing business (not counting Uber Eats or Uber Works) generated approximately $0.33 in EBITDA per trip in Q2. Needham uses a 20x multiple and stretches that margin across a year to come with an implied valuation for Uber of $40 billion, against its current market cap of ~$54 billion.

What Needham is trying to say is that Uber Rides alone justifies its valuation, and all the other Uber businesses are icing on the cake.

Uber still has some major threats to its stock, from a string of layoffs, to being grilled on safety issues, and a showdown in California over whether its drivers should be contractors or benefit-blessed employees, but it’s overcome before and most expect it to overcome again.

What could dull the shine, however, is this next company, because regular four-wheeled ride-sharing is already starting to become “conventional”, and the new trend in mobility is ‘micro’…

#2 OjO Electric (TSX.V:OJO, OTC:AZNVF)

This very well may be the next Uber, but with 2 wheels.

No segment is mining unicorns faster than the e-scooter segment, and OjO doesn’t just tick all the boxes—it lets you sit down. It’s where Tesla meets Vespa.

While investors have been throwing tons of cash into this segment, the first beneficiaries were plain old scooters. OjO is the next generation in this revolution. And it’s promising to turn all that chaos into order.

OJO (TSX.V:OJO) is transforming this market.

These scooters aren’t just sustainable, fully electric and with zero emissions: They’re a safe alternative that regulators are actually comfortable with. That’s because they are patented and custom-engineered with robust geofencing capabilities that automatically controls speed and announces audible safety alerts about changes in speed to its riders.

And their potential to disrupt the multi-billion-dollar ride-share market cornered by Uber and Lyft is clear: These scooters have two swappable 48-volt lithium-ion batteries that can go up to 50 miles on a full charge.

When you add a seat for the first time, and Bluetooth capabilities, this is the ride of the century.

OJO (TSX.V:OJO, OTC:AZNVF) is the next entrant in this massive market, and its path to the unicorn club isn’t paved with all the fuss.

If the first scooter startups filled a general need for easier urban mobility, OjO ticks boxes that go beyond the basic wish-list:

- It’s got design patents

- It’s solving one of consumers’ biggest needs

- It’s safe and legal

- It’s backed by a team of industry veterans

- And it’s part of a trillion-dollar mobility market that investors simply can’t ignore.

They’ve already launched in Austin, Dallas and Memphis. By the end of the year, they’ll have 2,500 scooters deployed. The company is currently in discussions with San Antonio, Portland, Washington, DC, Seattle and many more.

There’s isn’t that much upside to the big scooter companies any more. They’re already at massive valuations.

OJO is a better beast all around, and when you have startups in this space turning into unicorns in a matter of months, the upside for a scooter company ticking all the right boxes is incredible.

#3 Lyft (NASDAQ:LYFT)

Lyft may be a bit overvalued, but it’s still sustainable.

Lyft went public in March for $87.24 and hit $88.60 on the first day of trading.

It’s shed over half that and has been treading water ever since. Lyft’s next earnings report is due on October 30th.

But $40 makes this a cheap stock for a ride-sharing market that’s killing taxi cabs and cutting in on car sales, too.

Q2 was pretty decent for Lyft, all things considered. Sales and marketing expenses dropped from 35% of revenue to 19% of revenue to improve profitability.

Right now, Lyft is valued at 4x its sales, and it’s still losing money—like Uber. But it does have over $3 billion in cash, and it is investing in micro-mobility, too, through bike-sharing startups.

There’s a path to profitability here, even if it’s not yet crystal clear.

#4 Alibaba (NYSE:BABA)

If you want to get in through the back door to China’s micro-mobility craze, hit up Alibaba, which in March led an $866-million funding round for Ofo, China’s biggest bike-sharing platform.

BABA is a $460-billion market cap behemoth that won’t be left out of the Chinese push for easy transportation solutions.

China is the pioneer in this industry, and that’s thanks to BABA-backed Ofo.

China was the first country to implement a dockless bike-sharing platform in 2015 and the authorities have ensured quick implementation across cities in Asia. Part of the reason for this is the push to reduce urban pollution levels.

Several Chinese micro-mobility startups have already made unicorn status of valuations over $1 billion. Again, Ofo was the first and remains China’s largest bike-sharing operator. The best way to get exposure to Ofo right now is through BABA.

#5 Alphabet (NASDAQ:GOOGL)

It might not sound terribly intuitive, but it is. This is the back door into Lime, a startup that gained unicorn status is less than two years and is now valued at $2.5 billion. In July 2018, Alphabet led a $335-million funding round for the scooter unicorn.

Lime is in maximum expansion mode. In July, it busted into Montreal, Sacramento, Milwaukee and a couple of other new markets. It also rolled out integration with Google Maps.

Lime has had to jump through quite a few hurdles, but this week came with some good news: San Francisco has approved their permits after an appeal and a hearing and now they’re on their way back to the streets, with some additional regulatory oversight.

Alphabet definitely isn’t standing on the sidelines as scooters take over the mobility market.

#6 Aptiv (NYSE:APTV)

Aptiv is a company that takes the new mobility revolution seriously. As a global auto-parts manufacturer with a focus on technology and sustainability, Aptiv is harnessing its innovations to help power the driverless push across the world.

Aptiv played a key role in the first coast-to-coast drive in a fully autonomous vehicle, traveling 3,400 miles from San Francisco to New York with 99 percent of the ride being completed in 99% full autonomous mode.

And its innovative solutions are even being used in ride-sharing programs.

In fact, Aptiv recently announced the launch of 30 vehicles in Las Vegas on the Lyft network, allowing would-be passengers to hail fully autonomous cars directly from their smartphones. While the self-driving taxis are still in their early stages, and as such, require a ‘driver’ to be in the car, the new project has been wildly successful, and it highlights the amazing potential that lays ahead of us.

Other companies to watch for exposure to the new transportation revolution:

Glance Technologies (CSE:GET) is a FinTech firm from a Vancouver entrepreneur who is gunning for a repeat of his earlier success, PayByPhone, a mobile parking payment system that took the market by storm before this was even a trend.

Glance’s biggest product, GlancePay, is a streamlined multi-platform mobile payment application which allows users to pay bills and earn rewards.

BCE Inc. (TSX:BCE) is a Canadian giant. Founded in 1980, the company, formally The Bell Telephone Company of Canada is composed of three primary subsidiaries. Bell Wireless, Bell Wireline and Bell Media, however throughout its push into the position of one of Canada’s top telco groups, it has bought and sold a number of different firms.

BCE is also at the forefront of the Internet of Things movement in Canada. Its Machine to Machine solutions are being used by numerous businesses throughout North America and its new LTE-M network is sure to rapidly increase the potential for new innovations that are reliant on a solid network, like self-driving cars or dockless transportation solutions.

Redline Communications Group Inc. (TSX:RDL ): Redline is not a giant, but it does operate in more of a niche environment—in hard-to-access places, providing wireless for critical industries, including oil and gas, and anywhere from the rainforests of South America to the slopes of Alaska and the deserts of the Middle East.

Like BCE, Redline provides an absolutely necessary solutions for many different innovative new companies looking to transform the transportation industry.

Shaw Communications Inc (TSX:SJR.B) owns a ton of infrastructure throughout Canada and its cloud services and open-source projects look to address some of the biggest issues that its customers might face before the customers even face them.

Not only is Shaw a major player in Canada’s telecom infrastructure scene, it is setting records with its industrial Internet of Things solutions. While it might not seem like it’s a major player in the burgeoning new-mobility sector, it would be ill-advised to dismiss its role as the industry continues to grow.

Intrinsyc Technologies (TSX:ITC) is a product development company that provides hardware, software, and service solutions for embedded and wireless products. This Canadian company saw a few hiccups last year, but their impressive Internet of Things division is poised to take the world by storm.

Since the world now runs on technology, Intrinsync is a company that is worth noting. It’s approach to the Internet of Things has continued to surprise even the most knowledgeable and experienced engineers.

By. Joao Peixe

IMPORTANT NOTICE AND DISCLAIMER

PAID COMMUNICATION. This communication was paid for by OJO. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by OJO Electric to conduct public awareness communication and marketing. OJO Electric paid the Publisher fifty thousand US dollars to produce and disseminate this and other similar articles and certain banner ads. This compensation should be viewed as a major conflict with our ability to be unbiased. Readers should be aware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume during the course of public awareness marketing, which subsides as the investor awareness marketing subsides. This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on an interview conducted with the company’s CEO, and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares and/or stock options of the featured companies and therefore has an additional incentive to see the featured companies’ stock perform well. The owner of Oilprice.com has no present intention to sell any of the issuer’s securities in the near future but does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The owner of Oilprice.com will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies concerning, among other things, ride-sharing and scooter-sharing companies, the size and growth of the market for the companies’ products and services, the companies’ ability to fund its capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://oilprice.com/terms-and-conditions If you do not agree to the Terms of Use http://oilprice.com/terms-and-conditions, please contact Oilprice.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. Oilprice.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.