They’re calling it “the streaming wars.”

A bitter fight over market share between media giants.

First, there was Netflix.

But now, there’s Disney, AT&T, Comcast, Apple…the list goes on.

Companies are laying down big bucks to buy up chunks of the streaming market.

Competition has become fierce…

And that’s where Torque Esports Corp. (TSX:GAME.V, OTCMKTS:MLLLD) comes in.

Torque is a little company with a corner of the hottest new market on the streaming scene—esports.

Esports are video game sports tournaments that are attracting big audiences, with investors, advertisers, and the streaming giants paying attention.

Video games dwarf other entertainment sectors- $135 billion in revenue in 2019, and projections of $300 billion by 2025.

And according to Goldman Sachs, revenues from esports is expected to triple to $869 million by 2022. Another study has that figure at $1.8 billion.

The four biggest esports events of 2018 generated 190.1 million viewing hours. The potential audience for esports in 2019 could be as high as 438 million people.

It’s a sector that has only just begun to attract real attention - and Torque Esports Corp. has taken advantage of esports’ rise in a way that no other company has mastered yet…the ability to collect data from across the industry for advertisers and sponsors.

Here’s four reasons to take a look at Torque:

#1 Esports: The New Kid on The Bloc

Ever heard of Fortnite?

It’s that game that your son, or nephew, or the kid next door plays for hours every day.

And it’s probably the biggest cultural sensation to sweep the globe since Pokemon.

And people don’t just love to play Fortnite: they love to watch it.

The streaming service Twitch broadcasts Fortnite matches, and in October more than 7 million people tuned in to watch its “Black Hole” match.

In the Fortnite 2018 World Cup, the biggest event in esports, 40 million players competed to enter into the final competition, where prizes ranged from $50,000 to $3 million.

The total prize pool was $30 million.

Fortnite is just one piece of the esports puzzle. This new and rising sports industry has the potential to top $1 billion in revenue by 2022.

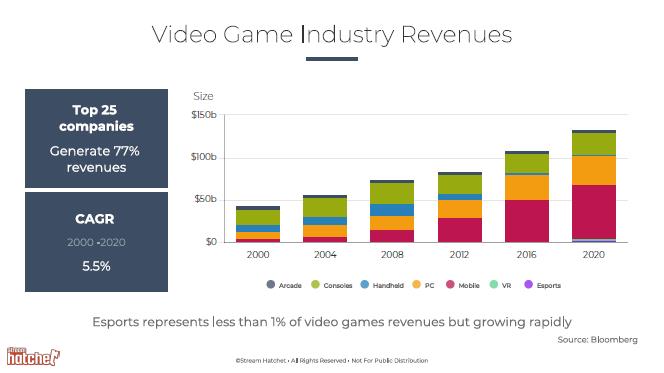

As an industry, video games have surpassed nearly every other form of entertainment. Revenue has tripled since 2000—rising from less than $50 billion to more than $120 billion per year.

Estimates have the industry doubling again, to $300 billion by 2025.

It’s literally bigger than Hollywood.

And millions are tuning in to watch professional gamers duke it out for big prizes.

Comcast has invested $50 million into a new esports arena, while Twitch signed a $90 million deal to broadcast the Overwatch World Cup, another international esports event.

Across the board, traditional sports are down.

And esports is still in its infancy.

But that just makes the timing better: companies like Torque (TSXV:GAME, OTCMKTS:MLLLD) are positioning themselves strategically.

And here’s how they’ll do it.

#2 How Torque is Winning

Torque Esports Corp. (TSXV:GAME, OTCMKTS:MLLLD) is a tiny company, with a number of different assets.

They’ve got a video game developer, Eden Games, which specializes in racing simulators.

Then there’s AllInSports, which Torque is set to acquire, which is partnered with Formula 1 and Ferrari and which makes state of the art racing simulators.

But the secret to Torque’s success isn’t games, or even racing…it’s data.

Right now, the Achilles’ Heel for companies entering the esports market is a lack of good data.

Specifically, user data—information tied to a specific individual’s online habits, from shopping patterns to viewing habits to personal information.

Advertisers and brands want to sign on to esports events, but don’t have good information to use in catering advertisements.

Advertising and brand investment will make up the biggest chunk of revenue from esports. This year, esports will bring in $906 million in revenue, and advertising for esports events was the centerpiece of Advertising Week, a gathering of thousands of advertising professionals.

Companies are very, very interested in the esports demographics.

According to one market research firm, esports fans tend to be well-off, professionals with purchasing power and high levels of enthusiasm.

They’re drawn to the video game events out of strong interest, which means they’re likely to not click away out of boredom—it also means they won’t skip the ads, for fear of losing a moment of the esport excitement.

The user data for esports attendees is priceless for advertisers.

But ad buyers are in a pickle. They can’t get access to accurate data—the industry is in its infancy, and advertisers are having trouble finding the right metrics.

Companies that are joining the esports circuit haven’t figured out how to satisfy advertisers’ concerns. They’ve stalled at the starting line.

But Torque Esports has a secret: it’s figured out the data problem and developed a service that could make it the “Nielsen of Gaming.”

#3 Torque’s Secret

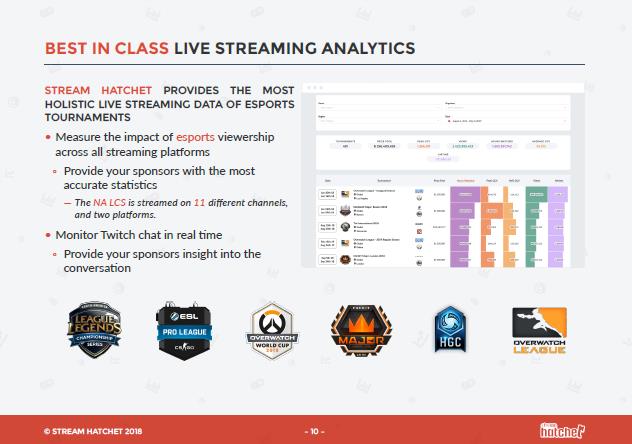

It’s called StreamHatchet, and it’s Torque’s (TSXV:GAME, OTCMKTS:MLLLD) little secret.

Here’s how it works:

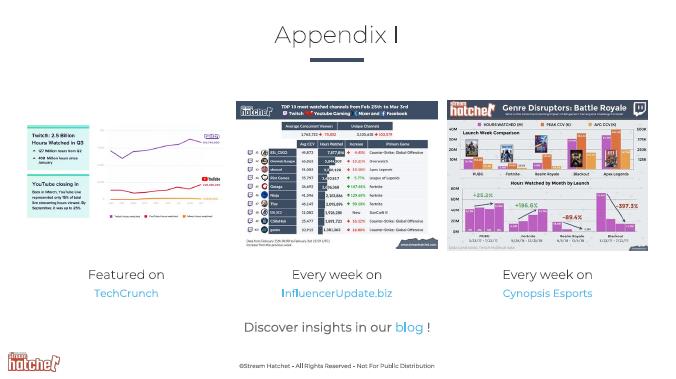

StreamHatchet is a data analytics service that focuses on gathering data sets on esports events, users, and economics, which it can then package in reports for clients.

These reports highlight trends, point out opportunities…basically, they give interested companies a peak under the hood.

All of the biggest names in tech—Twitch, Youtube, Facebook, the gaming platform Steam—desperately need data from within the esports market.

But StreamHatchet is the leading service like this that exists for the esports industry.

Big companies are desperate for this data, which offers the secret to unlocking revenue streams attached to the entire esports market.

#4 Scale Up

From StreamHatchet, Torque has the opportunity to ride the wave of esports and scale up quickly.

Torque Esports (TSXV:GAME, OTCMKTS:MLLLD) is pretty small—a tiny $5 million company, with a few assets, including Stream Hatchet, an esports competition, and a video game development company.

But it’s attracting big attention.

So far, professional racers have come forward with endorsements, the company has expanded its YouTube channel, and made major presentations of its software and services at esports conferences.

Right now, esports is a tiny piece of the video game landscape…but it’s growing.

The four biggest esports events of 2018 generated 190.1 million viewing hours. The potential audience for esports in 2019 could be as high as 438 million people.

And all those users generate huge amounts of precious data advertisers need to maximize customer potential.

One of the only services out there catering to this need is StreamHatchet, owned by Torque Esports Corp.

The company lies at the intersection: between the streaming wars, the rise of video games as an entertainment super-sector, the slow ascent of esports.

“This space is at the intersection of a $140 billion gaming industry and a $640 billion sports industry,” according to CEO Darren Cox.

And Cox is confident Torque (TSXV:GAME, OTCMKTS:MLLLD) will be able to scale up quickly, as demand grows and more companies sign on to esports events.

Other companies looking to win big in the streaming war:

Enthusiast Gaming (TSXV:EGLX) is one of the most impressive video game communities on the web. Thanks to it’s aggressive acquisition strategy, it has a web of over 80 websites reaching more than 150 million people every month. It is also making significant moves in the esports arena, hosting wildly attended events in Canada, including the country’s largest gaming expo EGLX. Enthusiast also leverages its reach to provide advertisers with unique solutions across a wide array of publishers.

EXFO Inc (TSX:EXF) isn’t new to the Canadian tech sector. The company was founded in 1985 in Quebec City, and its original products were portable testing products for optical networks. Since then, the company has acquired and build 3G, LTE, protocol, copper/xDSL, IMS, and VoIP test and service assurance products, all vital pieces of the gaming revolution.

Recent developments from EXFO are promising for long term growth potential. The new baseband unit emulation technology which is sure to be adopted on a large scale, as the tech offers operators a reduction of costs and a faster revenue stream.

Evergreen Gaming (TSX.V:TNA) has succeeded in bringing back its total debt from $7 million to $5.4 million at the end of December 2018. Its cash flow in the meantime has been relatively steady at $5.8 million, giving lenders reason enough to issue new debt to the company in case it needs it for expansion activities.

Compared to its larger competitors in Nevada and the Great Canadian Gaming Corporation, the company is just a small player, but its focus and returns YTD have been strong, giving investors enough reason to keep an eye on this small but sound player.

Contagious Gaming Inc. (TSXV:CNS) is a software developer that has developed many systems for the e-gaming markets. The company has created a remote sports betting system that allows for live in-play betting during sporting and esporting events. The company’s content and technology can be delivered as a fully integrated service across a single, modern customer platform or can be offered as standalone verticals.

Absolute Software Corporation (TSX:ABT): This Vancouver-based company offers endpoint security and data risk-management solutions. And it looks like it’s on a path of securing strong new customers. The pipeline looks great, and forecasts have been increased.

With strong management and an innovative team, Absolute Software is drawing investor attention. Absolute is positioned perfectly for the coming fintech revolution, and its security offerings are sure to save its clients time and money moving forward.

Absolute is another company that stands out a bit due to its backdoor potential. Some of the world’s leading industries trust Absolute with their most important security challenges, and nowhere is that task more essential than in the gaming industry, where so much rides on digital platforms.

By. Charles Kennedy

IMPORTANT NOTICE AND DISCLAIMER

PAID ADVERTISEMENT. This communication is a paid advertisement. Safehaven.com, Leacap Ltd, and their owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Torque Esports Corp. to raise public awareness about the company. Torque Esports Corp. paid the Publisher fifty thousand US dollars to produce and disseminate this and other similar articles and certain banner ads. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, insiders, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of public awareness marketing, which often ends as soon as the public awareness marketing ceases. The public awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on an interview conducted with the company’s CEO, and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The owner of Safehaven.com owns shares and/or stock options of the featured companies and therefore has an additional incentive to see the featured companies’ stock perform well. The owner of Safehaven.com has no present intention to sell any of the issuer’s securities in the near future but does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The owner of Safehaven.com will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies impacting the company’s business, the size and growth of the market for the companies’ products and services, the companies’ ability to fund its capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http:// Safehaven.com/terms-and-conditions If you do not agree to the Terms of Use http:// Safehaven.com/terms-and-conditions, please contact Safehaven.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. Safehaven.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.