A massive $250 billion has poured into ESG index funds since August, making ESG an investing megatrend that’s soared over 733% in just two years and has had over $30 trillion invested globally.

This is Big Capital’s new safe haven and some of the largest names in finance and tech from Goldman Sachs, to Elon Musk and Jeff Bezos are investing heavily.

ESG is considered a less risky and increasingly lucrative corner of Wall Street.

The multi-trillion-dollar reality is that tech and ESG are now inextricably linked.

And they are massively outperforming the market.

The holy grail of this new trend, therefore, should be a solid ESG platform combined with an impressive tech ecosystem.

And now, there’s a company that’s managed to do just that. Facedrive (TSXV:FD; OTC:FDVRF)—the Canadian tech darling that’s been stealing headlines across multiple sectors.

It’s a company that’s grasped the enormity of this megatrend.

It knows what Big Capital—like the $7 trillion finance giant BlackRock —wants.

It understands that big money is looking for more places to park on the in-demand ESG playing field.

And it doesn’t want a limited, one-off opportunity.

It wants an entire ecosystem of ESG tech offerings with limitless verticals.

That’s why Facedrive, one of the most impressively ambitious innovators to have come out of Canada’s Waterloo ‘Technology Triangle’ (aka the new ‘Silicon Valley’) - has created, launched, and exceptionally branded 6 entire ESG divisions in just one year.

It’s been hot on the acquisition trail for months, and its latest grab was a game-changer:

Two Huge Disruptors in Two Months

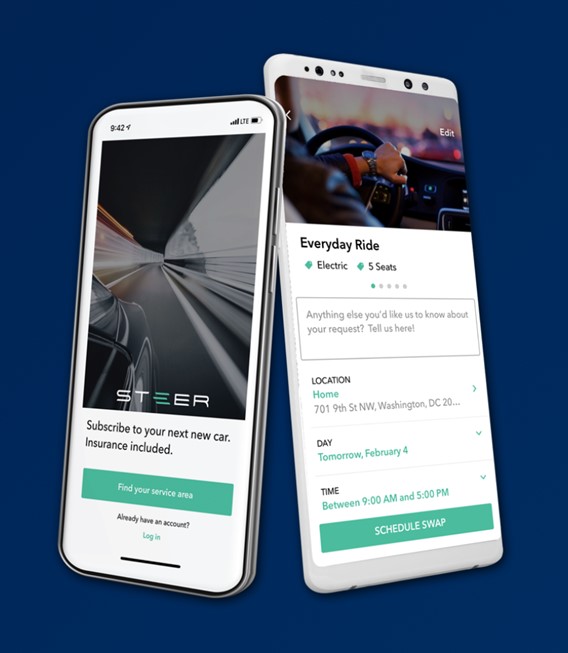

In September, Facedrive scooped up Chicago-based Steer, an EV subscription service that aims to upend the $5 trillion global transportation industry, in a deal that includes a $2-million strategic investment by energy giant Exelon’s wholly-owned subsidiary, Exelorate Enterprises, LLC.

The pioneer of carbon-offset ride-sharing in Canada, Facedrive—behind the wheel of Steer—plans to completely change the way people view car ownership.

Anyone who wanted but couldn’t afford an EV before, can now afford an EV ride, with Steer. That means Steer and its heavy-weight owners and backers will be disrupting industry segments on multiple levels.

Exelon’s (NASDAQ:EXC) market cap is ~$41 billion … and it’s not the only huge market-cap company whose radar Facedrive is pinging: There’s also a tie-in to ecommerce king Amazon (NASDAQ:AMZN) ….

Steer is at the crossroads where $25 trillion meets:

- The $5 trillion IT industry

- The $12 trillion digital economy

- The $8 trillion auto industry

And it’s all boosted by the fastest-growing megatrend of the year—ESG investing.

But Steer is just the most recent move by Facedrive, the tech giant’s previous deal was arguably even bigger.

In August, Facedrive acquired Tally Technologies, the high-tech major league sports predicting startup founded by NFL superstar Russel Wilson.

Tally came out of TraceMe, a celebrity content app founded by Wilson with early-in investors from the biggest tech companies in the world and acquired by Nike last year.

And that acquisition turned some of the biggest names in the tech industry into Facedrive shareholders … because the transaction was a share exchange that saw Facedrive inject $1M in cash in Tally and $2M in Facedrive shares.

Now, Tally plans to revolutionize major league sports with “gamification” and online fan engagement.

Gamified for ultimate fan engagement, this major league sports platform will now be free-to-play and predictive.

That means new revenue potential for major leagues sports, which is exactly why Tally has already been chosen by the NFL, NHL, NBA and MLB as the premier tech solution.

All-Inclusive Tech on the Front Lines of COVID-19

There’s hardly a better “impact” investing element to add to your ESG portfolio than a contact tracing app designed to counter the COVID-19 pandemic with its very own line of wearables …

The company’s TraceSCAN contact-tracing technology is positioned to help save the tourism industry, which is facing $1 trillion in losses due to the pandemic and is expected to shed 100 million jobs before the year is out worldwide.

Aviation giant Air Canada is already on board.

On October 7th, Air Canada signed a deal with Facedrive Inc. (TSXV:FD,OTC:FDVRF) to launch a pilot project for its employees using proprietary TraceSCAN technology.

TraceSCAN Wearables could help the tourism industry deal with COVID. Facedrive combines complex algorithms in an AI-enabled mobile application with wearable devices built on the industry standard nRF52 Bluetooth chipset.

That means it can reach those millions of workers around the world, from construction and medical to education and security, who can’t operate with a phone in hand 24/7, as well as the at-risk elderly.

It’s fully mobile COVID-19 detection on a wristband, in a tag worn around the neck or in a pocket pod. And it intends to get us back to work, and back to fun--safely.

Air Canada isn’t the only major airline taking the TraceSCAN plunge...

The Government of Ontario lent its support to TraceSCAN back in July because it’s the only feasible technology that will help get masses of government employees back to work without spreading COVID-19.

And now, talks with other airlines are in motion because the industry is facing more than $84 billion in losses … so, the news flow is expected to be fast and momentous.

The Tech Company That Has It All

Even before it acquired Steer with the aim to change the way we view car ownership …

And before it jumped into Tally, the innovative tech that creates major sports revenue verticals for our interactive, engaged future …

Facedrive already had 5 ESG divisions, making it a one-stop-shop for multi-industry tech-driven ESG.

From its pioneering carbon-neutral ride-sharing and long-distance carpooling platform, food and pharmacy deliveries and COVID contact-trading to its own celebrity-branded merch marketplace (think: Will Smith’s Bel Air Athletics) and a blockbuster social distancing trivia and social engagement app, Facedrive has the kind of verticals the new big money is looking for.

Until now, Facedrive’s ESG platform has been stealing headlines across industries in Canada…

But the Steer deal plants it firmly in the United States, where the next big push is about to take place.

Big names have already tied into this wide-ranging tech play … from a Bezos fund and energy giant Exelon to Air Canada …

There’s been no faster news flow coming out of the Toronto Stock Exchange than this …

And the next big name to sign on to any one of these tech deals is likely to have serious impact.

Some other Canadian companies looking to capitalize on the sustainability push:

Stars Group Inc. is a world leader in the online and mobile gaming industry. With a focus on maintaining high regulatory standards while simultaneously offering a wide range of products across multiple platforms, Stars has solidified its place among the gaming hierarchy.

In December, Stars Group secured a major partnership with the National Basketball Association in order to use data and league marks across their digital sports betting offerings.

Scott Kaufman-Ross, Head of Fantasy & Gaming, NBA explained, "This dynamic partnership will be another way to create authentic fan engagement with league logos and official NBA betting data, while leveraging Stars' global expertise to further optimize the fan experience.

ePlay Digital Inc. (CSE:EPY) creates technology that helps TV networks, esports teams and leagues and even venues cut through the noise to reach their target audience. The company brings together multiple platforms to create engagement across social media, traditional media, streaming, and more. With a team built from sports, esports, and gaming experts, ePlay knows the video game industry inside and out. That’s why they’ve secured partnerships with companies including Time Warner Cable, ESPN, Sony Pictures, AXS TV, Intel, AXN, Fiat, CBS, Cineplex, and others.

Shaw Communications Inc. (TSX:SJR.B ) is major player in the Canadian telecoms sector. It owns a ton of infrastructure throughout Canada and its cloud services and open-source projects look to address some of the biggest issues that its customers might face before the customers even face them.

As online gaming depends on solid internet connections, Shaw will likely become a backdoor benefactor in increased online activity.

Telus Corporation (TSX:T) is Canada’s second largest internet provider, serving over 8 million Canadians from coast to coast. Though it’s not producing its own content, it is carving out its own path in the industry thanks to its innovative approach to technology and investments across multiple sectors.

Like Shaw, Telus will be another company to watch as gamers, and the general population, turn to their phones and computers for entertainment.

Pollard Banknote Ltd. (TSX:PBL) Pollard Banknote is one of the world’s largest instant scratch-off lottery suppliers for over 30 years, distributing tickets to over 60 lottery and charitable gaming organizations across the globe. With top-tier marketing, new design developments and other innovative measures, Pollard has solidified its position as one of the greats.

One way that Pollard sets itself apart from the competition is its social media presence. Pollard has worked hard to leverage new media outlets including Facebook and Twitter to really up its marketing game…and its efforts show.

By. Nick Freeman

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements /

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that the demand for ride sharing services will grow; that Steer plans to completely change the way people view car ownership, that Steer can disrupt industry segments; that the Tally app will become popular and start generating substantial revenues; that the Tally sports predictive app will lead to online sports betting; that Tracescan could help the tourism industry deal with COVID; that new tech deals will be signed by Facedrive; that Facedrive will be able to fund its capital requirements in the near term and long term; and that Facedrive will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that riders are not as attracted to EV rides as expected; that the Tally app may not become popular, may not lead to revenues from gaming and that competitors may offer better or cheaper alternatives; TraceScan may not work as expected in commercial settings; changing governmental laws and policies; the company’s ability to obtain and retain necessary licensing in each geographical area in which it operates; the success of the company’s expansion activities and whether markets justify additional expansion; the ability of the company to attract a sufficient number of drivers to meet the demands of customer riders; the ability of the company to attract drivers who have electric vehicles and hybrid cars; and the ability of Facedrive to attract providers of good and services for partnerships on terms acceptable to both parties, and on profitable terms for Facedrive; and that the products co-branded by Facedrive may not be as merchantable as expected. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) owns a considerable number of shares of FaceDrive (TSX:FD.V) for investment, however the views reflected herein do not represent Facedrive nor has Facedrive authored or sponsored this article. This share position in FD.V is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the featured company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns a substantial number of shares of this featured company and therefore has a substantial incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.