Over 3,000 investors with over $110 trillion in assets under management can’t be wrong …

That $110 trillion supports “responsible investment”, or ESG investing for a more sustainable future.

Some of that $110 trillion dollars is now squarely focused on the electric vehicle (EV) industry.

And Tesla (NASDAQ:TSLA) is predicted to be the next trillion-dollar company, with stocks soaring more than 300% this year thanks to record demand, record deliveries and even record-breaking revenues and profits.

Investors in EV delivery and utilities darling Workhouse Group (NASDAQ:WKHS) have seen 700% gains.

Chinese EV hot shot Nio (NYSE:NIO) is up nearly 950%.

Plug Power (NASDAQ:PLUG) - an EV tie-in that is producing hydrogen fuel cell systems - has witnessed a gain of over 530% this year alone.

These gains have been remarkable.

But there’s still a way to play the EV boom.

With a savvy startup that’s brought two ESG segments into combination for EVs:

1) the world’s first carbon-offset ride-sharing company…

2) An EV subscription service that plans to entirely change the way the world owns or leases cars.

It’s Facedrive (TSXV:FD; OTC:FDVRF) the company that first upstaged giant Uber and Lyft on the ESG investing scene to bring the world a carbon-offset ride-hailing service with an EV option …

And then decided to challenge the entire conventional auto industry by acquiring Washington, DC-based Steer, backed by energy giant Exelon. Steer is a high-tech vehicle subscription service that isn’t planning to simply disrupt the auto industry and change the way we “own” cars …

It’s a seamless, hassle-free technology that is grabbing onto the ESG megatrend by giving subscribers access to their own virtual garage of low-emissions vehicles and EVs.

EV Evolution, Transportation Revolution

There’s a ton of money floating around this space …

EV startups are lining up to go public, and some are getting billion-dollar plus valuations.

Battery developer QuantumScape, backed by Bill Gates, has been valued at $3.3 billion.

Electrified powertrain manufacturer Hyliion (NYSE:HYLN) racked up a $1.1-billion market cap on its first day of trading on October 2nd.

Facedrive’s been making stealth moves with a series of acquisitions that cover 6 different ESG-focused segments since it launched the world’s first carbon-neutral ride-sharing platform.

Steer is where Facedrive comes out of stealth mode and lays claims to the U.S. market, with the backing of one of America’s biggest energy companies, and with big name tie-ins that included e-commerce giant Amazon, Canadian tier-1 telecoms provider Telus, and a lineup of celebrities from Will Smith to NFL Superbowl superstar Russell Wilson.

Car ownership could be near death if the strong trend continues …

It’s not necessary to own a car anymore. By early 2019, four out of 10 Americans agreed that owning a vehicle was not necessary.

By Q3 2020, a global pandemic has massively fast-forwarded the sense of urgency to get clean energy off the ground and conventional cars off the road.

And the market isn’t just supporting it--it’s got $119 trillion dollars behind it this new ESG-focused megatrend.

And that’s exactly the impetus behind Facedrice’s September 8th acquisition of Steer--which plans to put another nail in the coffin of traditional car ownership and leasing.

Steer is a direct response to the need for a revolution in transportation at a time when big money is scrambling for more places to park its ESG-earmarked trillions.

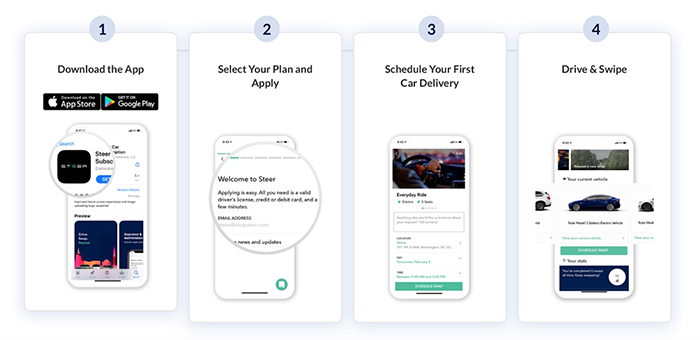

And this transportation revolution is as easy as downloading an app and then choosing your favorite EV from your own virtual car showroom. If you couldn’t afford to ride in a Tesla before, this may be your chance. It’s yet another way for more EVs to go mainstream--even faster.

And with this acquisition, Facedrive brought on another big name after attracting the attention of some of the world’s biggest tech players. The September 8th deal included a $2-million strategic investment in Facedrive-Steer by Chicago-based Exelon’s wholly-owned subsidiary, Exelorate Enterprises, LLC.

An ESG Pipeline of Huge Capacity

While Facedrive (TSXV:FD; OTC:FDVRF) is preparing to disrupt the transportation industry on two different fronts, that’s not the only big move flowing through this ESG pipeline.

This is an entire tech-driven ESG “ecosystem” - the new big capital buzzword.

This fast-track company has 6 ESG divisions, making it a one-stop-shop for many of the hottest sectors in the impact-driven tech space:

- FaceDrive and HiRide--Environmentally-friendly ride-sharing and long-distance carpooling

- Facedrive Health: Carbon-neutral pharma deliveries and government-endorsed COVID contact-tracing with TraceScan

- Facedrive Marketplace, with celebrity co-branded (Think: Will Smith’s Bel Air) exclusive clothing, focused on sustainably sourced materials

- Facedrive Foods carbon-neutral food delivery platforms

- Social distancing trivia platform, HiQ, with over 2,000,000 app downloads

- Steer in the EV subscription space

- Tally Technologies, another potentially transformative tech collaboration with major league sports

In August, Facedrive acquired Tally Technologies, the high-tech major league sports predicting startup founded by NFL superstar Russel Wilson

Their plan? To revolutionize major league sports fan engagement.

The NFL, NHL, and NBA know it. It’s their next big opportunity for revenues, which depend on fan engagement that has been culled during a pandemic.

This is where the “gamification” of online major league sports engagement gets real with a free-to-play, predictive platform that gets fans hooked, and keeps them there.

And all of this evolved out of TraceMe, a celebrity content app founded by Wilson with money from the investment vehicles of the Who’s Who of the supermajor tech world:

Massive companies are taking notice on multiple Facedrive fronts.

Earlier this month, Air Canada jumped in on Facedrive’s COVID-19 contact-tracing technology and wearables, TraceSCAN--a technology developed in collaboration with the University of Waterloo that has put Facedrive at the forefront of this specialized space.

This isn’t a simple mobile phone app. Unless you're a teenager with a hand permanently attached to your phone, that’s not enough. Millions of workers around the world, from construction and medical to education and security, can’t operate with a phone in hand 24/7. Nor can the at-risk elderly.

TraceSCAN Wearables is the solution. Facedrive combines complex algorithms in an AI-enabled mobile application with wearable devices built on the industry-standard nRF52 Bluetooth chipset.

With the tourism industry facing $1 trillion in losses and on track to shed 100 million jobs before the year is out, Air Canada has signed a deal with Facedrive Inc. (TSXV:FD,OTC:FDVRF) to launch a pilot project for its employees using proprietary TraceSCAN technology.

Whether it’s helping to save a devastated tourism industry one airline at a time, or fostering the disruption of the global transportation industry … Facedrive is there, and it’s going for radical efficiency and quantum impact.

It’s generally accepted that some 95% of U.S. car miles will be traveled in self-driving, electric, and shared vehicles by 2030. That’s where all the big money is gathering, and Facedrive right in the middle of it.

Other Canadian companies capitalizing on new market trends:

Shopify Inc (TSX:SHOP)

Shopify is a massive e-commerce company, helping users built their own online stores. It has huge clients – everyone from Tesla to Budweiser are on board. And the company is beloved by millennial investors. In addition to its revolutionary approach on e-commerce, Shopify is also delving into blockchain technology, making it a promising pick for investors in sustainability.

Shaw Communications Inc (TSE:SJR.B)

Shaw’s dominance in Canada’s telecom sector means that if any internet-based services want to operate, they’ll likely be utilizing the company’s infrastructure. After all, without telecoms, these TaaS companies would not be able to operate. In addition to its telecom dominance, it has also branched out into sustainable ventures, holding stake in renewable projects across the country.

BCE Inc. (TSX:BCE)

Like Shaw, BCE is a Canadian telecom giant. Founded in 1980, the company, formally The Bell Telephone Company of Canada is composed of three primary subsidiaries. Bell Wireless, Bell Wireline and Bell Media, however throughout its push into the position of one of Canada’s top telco groups, it has bought and sold a number of different firms. For the past 25 years, BCE has been at the forefront of the environmental movement. Their environmental management system (EMS) has been certified to be ISO 14001-compliant since 2009.

Polaris Infrastructure (TSX:PIF)

We can’t mention sustainability without touching on some of Canada’s most exciting renewable companies. Polaris is a Toronto-based renewable giant with a global influence. The company’s biggest projects are in Latin America. It’s Nicaragua geothermal project, for example, is already producing over 77 MW of renewable electricity. And in Peru, its El Carmen and 8 de Augusto hydropower plants, are set to produce a combined 17MW of electricity in the near future.

Westport Fuel Systems (TSX:WPRT)

Westport is a low-emissions energy provider for the exploding transportation industry. it provides systems for less impactful fuels, such as natural gas. In North America, there are over 225,000 natural gas vehicles. But that shies in comparison to the global 22.5 million natural gas vehicles globally, which means the company still has a ton of room to grow!

By. Sasha Kay

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements /

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that the demand for ride sharing services will grow; that Steer can help completely change the way people view car ownership, that Steer can disrupt industry segments; that the Tally app will become popular and start generating substantial revenues; that the Tally sports predictive app will lead to online sports revenue; that Tracescan could help the tourism industry deal with COVID; that new tech deals will be signed by Facedrive; that Facedrive will be able to fund its capital requirements in the near term and long term; that 95% of US miles will be driven in electric, self-driving and shared vehicles by 2030; and that Facedrive will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that riders are not as attracted to EV rides as expected; that the Tally app may not become popular, may not lead to revenues from the app; that competitors may offer better or cheaper alternatives to the Facedrive businesses; TraceScan may not work as expected in commercial settings; changing governmental laws and policies; the company’s ability to obtain and retain necessary licensing in each geographical area in which it operates; the success of the company’s expansion activities and whether markets justify additional expansion; the ability of the company to attract drivers who have electric vehicles and hybrid cars; the ability of Facedrive to attract providers of good and services for merchandise partnerships on terms acceptable to both parties, and on profitable terms for Facedrive; and that the products co-branded by Facedrive may not be as merchantable as expected. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) owns a considerable number of shares of FaceDrive (TSX:FD.V) for investment, however the views reflected herein do not represent Facedrive nor has Facedrive authored or sponsored this article. This share position in FD.V is a major conflict with our ability to be unbiased, more specifically: This communication is for entertainment purposes only. Never invest purely based on our communication. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the featured company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns a substantial number of shares of this featured company and therefore has a substantial incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.