The rise of electric vehicles is one of the biggest trends of the last decade, taking names like Tesla and Nio to the top of the markets.

But 2021 is proving that other types of companies may be ready to make their mark.

Last year, it seemed EV companies could do no wrong, with countless companies in the industry seeing their shares hit new highs.

Nikola, for example, soared for 672% gains at its highs.

Tesla was up 695% on the year.

And Nio took off for incredible 1,210% gains.

But today, we’re finally seeing some chinks in the armor of the companies that seemed invincible just 6 months ago.

And space is finally being made for new, exciting companies with a different spin on how to use this new technology.

For example, while Nikola, Nio, and Tesla, for example, are all slightly down for the year from their highs...

Two companies in other but related industries that we've discovered are looking to have a banner year thanks to key new partnerships and acquisitions.

This rise and transition of EVs could duplicate the same trend we've seen over and over again with major booms.

While some successful EV companies may just be taking a breath to come back to reality...

The market also appears to be trimming the fat and revealing who the truly valuable companies are.

Today, we're seeing a second wave shaping up - one where the EV automakers have already played out their incredible upside.

And others who are taking electric vehicles in creative new directions.

These are the pick and shovel plays we think might prove akin to the big winners of the gold rush.

Here are 2 non-EV companies that could benefit in the second wave of the EV boom.

Facedrive (TSXV:FD; OTC:FDVRF)

Facedrive is a fast-growing Canadian company which has seen shares soar for incredible 526% gains over the last year.

And they've done it by leveraging the power of the first EV boom by taking it in exciting new directions.

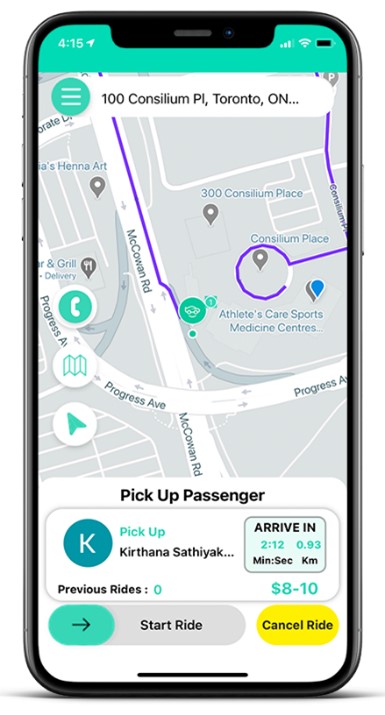

For example, they became well-known first for their signature ridesharing service.

Giving riders the flexibility and eco-conscious options that Uber and Lyft are only planning to provide, Facedrive allows customers to choose whether they'd like to take their ride in an electric vehicle, gas-powered vehicle, or hybrid.

And it even takes it a step further by planting trees to help offset the carbon footprint of each ride using AI technology.

It's this sort of "people and planet first" philosophy that has helped Facedrive multiply their business several times over throughout 2020 and into 2021.

But while they've done well for themselves growing this side of the business, they've also been acquiring major pieces to help them take it to the next level.

That includes the acquisition of Steer, a company with a unique subscription model for EVs.

It used to be that if you wanted an electric vehicle, you'd have to shell out anywhere between $40,000 to $80,000 (or more) to do it.

But Steer's unique subscription model allows for not just lower upfront costs but much more flexibility than the old personal car ownership model we've grown so accustomed to.

That's because many are drawing the line and saying that while going green is important to them, they also aren't willing to pay exorbitant costs for it.

It's the reason why Steer charges a much lower monthly subscription rate in exchange for the choice of a whole line of EVs, including luxury EVs.

And as long as you're a subscriber, you can keep the same car or trade it for another of your choice.

Steer has been building a strong following in the Washington DC area, and given its success, it's now being taken international.

That's because they've recently branched into Canada as it's become available in Toronto as well.

With 2 of the biggest metro areas in North America hopping on board, the momentum appears to be picking up for Steer.

For Facedrive, between their signature EV ridesharing service and Steer's unique subscription service, they also added more pieces to make 2020 a year of incredible growth.

That includes a thriving EV food delivery service, a clothing apparel line partnering with A-list celebrities, and even breakthrough contact tracing technology for COVID-19.

And with their creativity and business savvy, this is making Facedrive (TSXV:FD; OTC:FDVRF) a prime competitor to benefit in the EV Boom 2.0.

Oshkosh Corporation (NYSE: OSK)

Oshkosh Corporation is a manufacturer that's been in business for well over a century now.

But most people hadn't heard about them until just a month ago when they won a major contract over one of the industry darlings, Workhorse.

Oshkosh manufactures specialty trucks along with military vehicles, truck bodies, and access equipment like cranes and lifts.

But lately they've received loads of press for their new EV delivery trucks.

So while folks like Tesla are busy selling one-off cars to individual consumers, Oshkosh has focused on locking down major contracts for tens of thousands of electric vehicles.

And that's exactly what helped them sign a contract with the United States Postal Service last month.

Through this partnership, they'll manufacture EV mail trucks for the USPS, helping flip their fleet to go electric.

They're set to assemble between 50,000 and 165,000 next-generation vehicles in the years ahead.

And the agreement comes with $482 million toward retooling and building out its factory.

This is major news for an under-the-radar company like Oshkosh.

But the truth is, this is just the first part of a multi-billion dollar deal that will help the USPS replace much of their fleet over the next 10 years.

And this has been established as a top priority for Biden, as shown in his American Jobs Plan.

In the fact sheet for his plan, he stated he'll "utilize the vast tools of federal procurement to electrify the federal fleet, including the United States Postal Service."

That has helped Oshkosh's shares jump 40% this year, as they're finally recognized as a key piece of the second wave of the EV boom.

The Next Winners of the Second Wave of the EV Revolution

As major companies like Tesla and Nio have seen their stocks rise to incredible new highs over the last year, more competition is inevitable for these industry giants.

But as the second wave of the EV revolution takes off, it could be the small innovators in other industries like Facedrive and Oshkosh that benefit by finding exciting new applications for electric vehicles everywhere.

Other Potential Winners In The Next Stage Of The EV Boom

General Motors (NYSE:GM) is one of the legacy automakers benefiting from a shift from gas-powered to EV technology. With the news of GM’s new business unit, BrightDrop, they plan to sell electric vans and services to commercial delivery companies, disrupting the market for delivery logistics.

That’s not all its working on, either. In October, auto industry legend, GM announced that it’s majority-owned subsidiary, Cruise, has just received approval from the California DMV to test its autonomous vehicles without a driver. And while they’re not the first to receive such an approval, it’s still huge news for GM.

Cruise CEO Dan Ammann wrote in a Medium post, “Before the end of the year, we’ll be sending cars out onto the streets of SF — without gasoline and without anyone at the wheel. Because safely removing the driver is the true benchmark of a self-driving car, and because burning fossil fuels is no way to build the future of transportation.”

Canada is not likely to be left out of this boom, either. GreenPower Motor (TSX:GPV) is an exciting company that produces larger-scale electric transportation. Right now, it is primarily focused on the North American market, but the sky is the limit as the pressure to go green grows. GreenPower has been on the frontlines of the electric movement, manufacturing affordable battery-electric busses and trucks for over ten years. From school busses to long-distance public transit, GreenPower’s impact on the sector can’t be ignored.

NFI Group (TSX:NFI) is another one of Canada’s most exciting companies in the electric vehicle space. It produces transit busses and motorcycles. NFI had a difficult start to the year, but it since cut its debt and begun to address its cash flow struggles in a meaningful way. Though it remains down from January highs, NFI still offers investors a promising opportunity to capitalize on the electric vehicle boom.

Recently, NFI has seen an uptick in insider stock purchases which is often a sign that the board and management strongly believe in the future of the company. In addition to its increasingly positive financial reports, it is also one of the few in the business that actually pay dividends out to its investors.

Another way to gain exposure to the electric vehicle industry is through AutoCanada (TSX:ACQ), a company that operates auto-dealerships through Canada. The company carries a wide variety of new and used vehicles and has all types of financial options available to fit the needs of any consumer. While sales have slumped this year due to the COVID-19 pandemic, AutoCanada will likely see a rebound as both buying power and the demand for electric vehicles increases. As more new exciting EVs hit the market, AutoCanada will surely be able to ride the wave.

Magna International (TSX:MG) is a great way to gain exposure to the EV market without betting big on one of the new hot automaker stocks tearing up Robinhood right now. The 63 year old Canadian manufacturing giant provides mobility technology for automakers of all types. From GM and Ford to luxury brands like BMW and Tesla, Magna is a master at striking deals. And it’s clear to see why. The company has the experience and reputation that automakers are looking for.

Like Magna, Westport Fuel Systems (TSX:WPRT) is another hardware and tech provider in the auto-industry.It builds products to help the transportation industry reduce their carbon footprint. In particular, it provides systems for less impactful fuels, such as natural gas. In North America alone, there are over 225,000 natural gas vehicles. But that shies in comparison to the global 22.5 million natural gas vehicles globally, which means the company still has a ton of room to grow!

By. Andrew Grewel

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that the demand for ride sharing services will grow; that Steer can help change car ownership in favor of subscription services; that tech deals signed already will increase company revenues; that Facedrive will achieve its plans for manufacturing and selling Tracescan devices; that Facedrive will be able to expand to the US and globally; that Facedrive will be able to fund its capital requirements in the near term and long term; and that Facedrive will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that riders are not as attracted to EV rides as expected; that competitors may offer better or cheaper alternatives to the Facedrive businesses; changing governmental laws and policies; the company’s ability to obtain and retain necessary licensing in each geographical area in which it operates; the success of the company’s expansion activities and whether markets justify additional expansion; the ability of the company to attract drivers who have electric vehicles and hybrid cars; and that the products co-branded by Facedrive may not be as merchantable as expected. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) own a considerable number of shares of FaceDrive (TSX:FD.V) for investment. This share position in FD.V is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the featured company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns a substantial number of shares of this featured company and therefore has a substantial incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.