You thought it was about balloons. Instead, it’s one of the most strategic gases in the world…

And we’re running out of it.

Helium was discovered at the beginning of the last century, and the US government immediately placed production and supply under strict control.

Then, in the 1960s, the Cold War rendered helium even more valuable. It was collected and stored in the US federal helium reserve in Amarillo, Texas.

It was only in the late 1990s that the government allowed helium from the reserve to be sold to private entities. Now, the reserve is nearly depleted and will shut down entirely in September.

Why all the fuss about a gas the general public largely associates with party balloons?

Because it’s a critical gas from a technical, biomedical, and national security standpoint.

“By adding it to the list of strategic minerals, the US government is recognizing that our healthcare and high tech future is intricately tied to helium,” says Chris Bakker, CEO of Avanti Energy Inc. (TSX:AVN.V; US OTC:ARGYF), a junior Canadian explorer that is getting ready for its maiden drill on a prime helium prospect in Alberta.

With so much at stake, and the US taking over 2 billion cubic feet off the market, the next explorer to hit a new helium discovery of commercial viability will reward early-in investors…

Even better if it’s a small-cap whose stock would jump by multiples at every positive announcement in the exploration phase.

Right now, Avanti looks best positioned as our next North American helium play at a time when supply is absolutely critical.

And it’s just made its biggest acquisition move, yet …

There are 4 reasons to put Avanti Energy Inc. (TSX:AVN.V; US OTC:ARGYF) on your radar:

#1 Avanti Is exploring for a gas that isn’t just strategic, it’s make-or-break for trillion-dollar industries

The 21st-Century economy is nothing without helium.

Nothing is possible without it. Not astrophysics. Not space travel. Not big data. Not fiber optics, or even an MRI.

There would be no video streaming …

No Netflix.

No cell phones.

And there is absolutely no substitute for helium in the massively growing $5.7-billion cryogenics market, where temperatures below –429 °F are required.

Running out of helium would be like going back in time. In the case of cryogenics … quite literally.

Helium is formed when radioactive elements (uranium and thorium) decay through fission into smaller particles that are helium atoms stripped of their electrons. That fission replenishes helium that is then dispersed in the atmosphere or trapped in minerals typically found in natural gas reservoirs, where helium is usually “mined” as a by-product.

Helium is a noble gas. It’s non-combustible, very unreactive, highly stable and so light that Earth’s gravity cannot hold it. Once it escapes into the atmosphere, it’s gone forever in the vacuum of space.

Its properties are vital to virtually everything that is the backbone of our modern-day economy. In addition to the fact that it is inert and nonreactive, helium is also non-toxic and boils at -268 degrees Celsius--near absolute zero, which is the lowest temperature in the universe. No other element comes close to this magic of being able to remain a liquid at such temperatures.

In other words, helium is irreplaceable.

And it’s 100x more valuable than natural gas.

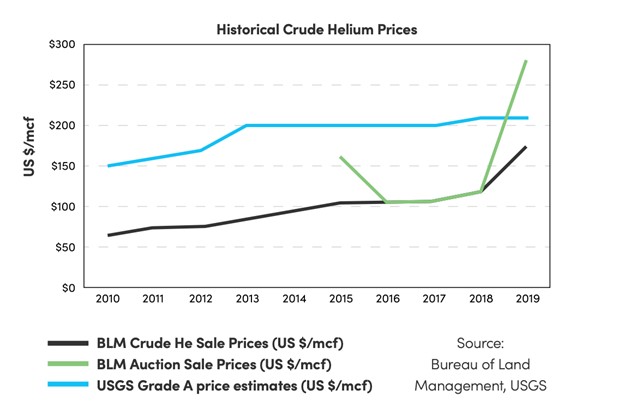

Natural gas goes for around $3 per Mcf. Helium can go for as high as $400 per Mcf. It’s not traded like a commodity, though, so prices are harder to track.

And for the next 20 years, we are facing a situation in which helium supply will not be able to keep up with demand.

That makes Avanti’s prospective helium acreage in Alberta and Montana prime-time territory.

Canada has some of the largest helium reserves in the world, and several explorers are hovering around some of the best territories in Saskatchewan.

With helium prices hitting what the Calgary Herald calls “stratospheric levels”, and supply rapidly diminishing, Alberta is witnessing a land rush that hopes to turn the province into a major supplier of the critical gas.

That makes Avanti’s two newest moves in Montana even more important. They’ve moved on over 60,000 acres in northern Montana, one on territory that is nearby and on-trend with helium prospects in Saskatchewan and the other on-trend with drilled wells in Alberta that have shown helium concentrations over 2%.

#2 4 Prospective Helium License Acquisitions, and Avanti’s Biggest Yet

Avanti Energy Inc. (TSX: AVN.V; US OTC: ARGYF) could be one of the biggest beneficiaries of the helium rush, and its four big license acquisition moves are putting it on analysts’ radar.

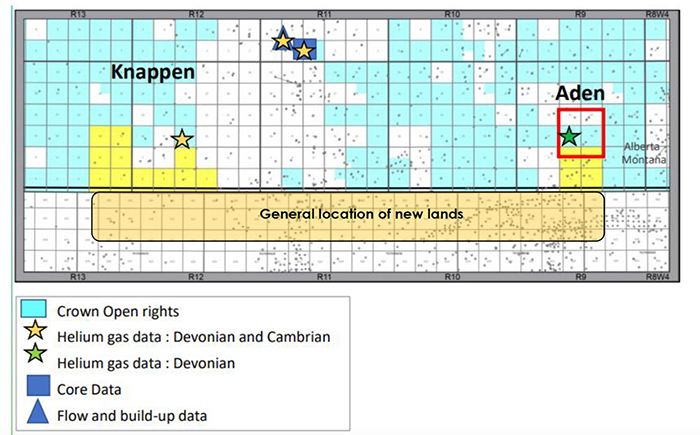

The beginning of Q2 saw Avanti acquire the license for over 6,000 acres from the Government of Alberta in highly prospective helium territory, and then another ~2,500 acres in Alberta. Those projects--Knappen and Aden--show helium up to 2% and helium-trapping structures.

Gas analysis at Knappen shows helium concentrations up to 2.18% and nitrogen up to ~98%, as well as several deep structural features that are ideal for trapping helium.

Aden has an even more promising structural trap and similar high helium concentrations in multiple zones.

Avanti’s Alberta acquisitions garnered some attention due to the fact that this province is prime-time for helium … but it was what happened next that set the radar pinging.

In mid-April, Avanti moved to acquire the helium license rights to a 12,000-acre land package in Montana that is on-trend with an active helium drilling area in Saskatchewan, and anticipated to close in the coming weeks..

Two months later, Avanti made its biggest move yet announcing its intention to purchase the helium license rights a huge land package of ~50,000 more acres in Montana. Although the transaction is not finalized just yet, the highlights look great, and appears to contain multiple formations like Aden where surrounding wells showed helium in multiple Devonian and Cambrian targets. More specifically, they show helium of 1.5% to 2.2% in the Cambrian and 0.7% to 1.7% in the Devonian, along with nitrogen up to 96%.

Those are some impressive numbers to start with considering that in Alberta, 1% helium is considered a very good concentration.

But the biggest news is this fourth acquisition of license rights to the 50,000 acres in Montana that Avanti expects to be finalized by the end of this month, giving Avanti rights to 60,000 acres (75,000 total acres when you include Alberta) of prospective helium land against the backdrop of a critically looming supply squeeze.

Alberta is gunning for status as a major global helium hub … and Avanti Energy Inc. (TSX: AVN.V; US OTC: ARGYF) might just be the one to help the province do just that.

It’s got a track record that makes this look perfectly feasible …

#3 The Avanti team has done this before … with giant Encana

Helium is found by drilling wells, similar to natural gas.

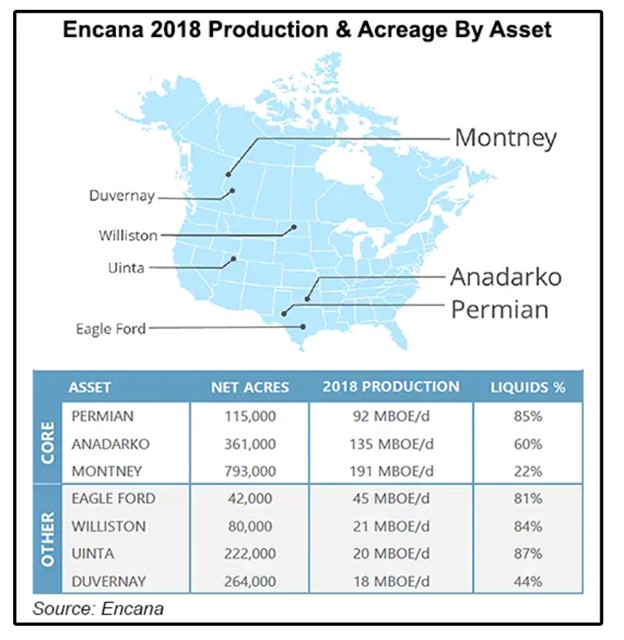

The team at Avanti Energy Inc. ( TSX: AVN.V; US OTC: ARGYF) has already made one discovery in Canada’s prized Montney, for Encana. That’s one of the richest natural gas deposits in the world, and it’s also where you find helium. That Montney discovery ended up producing 300,000 boe/d over 15 years.

Avanti CEO Chris Bakker has over two decades of experience in oil and gas and served as a commercial negotiator with Encana/Ovintiv for major facilities and pipelines in the Montney gas play.

He’s an expert in natural gas exploration, from acquisitions and exploration to drilling and production.

#4 Analysts have initiated coverage and insiders are buying it up…

Insiders have been buying up this stock, and that’s always a good sign …

Beacon Securities Limited, which initiated coverage recently, is maintaining its 12-month $3.80 price target, noting that with its big move on another 50,000 acres in Montana, Avanti “now has a contiguous land block that may support several years of drilling”.

“If successful, numerous development wells would follow with production in H2/22 once facilities are configured and installed,” Beacon notes, adding that “critical mass” has been achieved with Avanti, which now has a “key asset on which its world-class technical team can explore.”

The helium rush is on and demand is set to be as staggering as this gas is critical, while Avanti looks to be positioned to catapult Alberta into a major global helium hub. This is early days speculative exploration play, but if it pays off, it will pay off big--all the better before it starts pinging Wall Street radar.

Other companies to watch in the race for alternative fuels:

Magna International (TSX:MG) is a Canadian-based company that provides engineering, manufacturing and supply chain solutions. The company is one of the world's largest automotive suppliers with over 100 facilities in 29 countries on six continents. Magna has been named one of Canada’s Top Employers for four consecutive years by Mediacorp Canada Inc.

Magna International was founded in 1957 by Frank Stronach and his family in Austria but moved to Toronto in 1959 after receiving an Austrian government contract from Volkswagen Group. Now as one of the world's leading providers of engineering, manufacturing, and supply chain innovation services to customers worldwide, Magna continues its tradition of providing quality products through innovative technologies while managing resources efficiently at every step of the process.

Over 10 years ago, Magna was already making major moves in the battery market, investing over half a billion dollars in battery production while the market was still in its infancy. At the time, electric vehicles as we know them had barely hit the scene, with Tesla launching its premiere car just two years prior.

Magna’s massive investment has paid if in a big way, however. Since its battery bet, the company has seen its valuation soar by tens of billions of dollars, and it has solidified itself as one of the leaders in the business. With the semiconductor industry in chaos, and another looming lithium and helium shortage, it will be interesting to see how Magna deals with these challenges.

Westport Fuel Systems (TSX:WPRT) is a leading manufacturer of aftermarket fuel systems for diesel engines and gasoline engines. Their products are designed to meet or exceed OEM specifications without sacrificing performance, quality, reliability, or durability. Westport's mission is to provide customers with the best solutions available on the market today. They offer an extensive line of products that will fit most engine types in any vehicle application from passenger cars to heavy-duty trucks.

Westport isn’t necessarily a resource play, but it is an important company to watch as new fuels and new forms of energy take the spotlight. Especially as the world races to leave behind traditional gasoline and diesel-powered vehicles. That’s because, while it is a manufacturing play at heart, it offers a particularly unique way to gain exposure to the alternative fuels market. As a key manufacturer of the hardware needed to build natural gas and other alternative-fueled cars, Westport is definitely a company to watch in this scene.

Turquoise Hill Resources Ltd. (TSX:TRQ) is a key player in Canada’s resource and mineral industry. It is a major producer of coal and zinc, two resources with distinctly different futures. While headlines are already touting the end of coal, zinc is a mineral that will play a key role in the future of energy for years and years to come.

In addition to its zinc operations, Turquoise Hill is also a significant producer of Uranium. Uranium is a key material in the production of nuclear energy, which many analysts are suggesting could be a major component in the global transition to cleaner energy. While the mineral has not seen significant price action in recent years, there are a number of new projects set to come online across the globe in the medium term, which could be a boon to Turquoise Hill, especially as alternative energies gain traction in the marketplace.

Teck Resources (TSX:TECK.B) could be one of the best-diversified miners out there, with a broad portfolio of Copper, Zinc, Energy, Gold, Silver and Molybdenum assets. It’s even involved in the oil scene! With its free cash flow and a lower volatility outlook for base metals in combination with a growing push for copper and zinc to create batteries, Teck could emerge as one of the year’s most exciting miners.

Though Teck has not quite returned to its January highs, it has seen a promising rebound since April lows. In addition to its positive trajectory, the company has seen a fair amount of insider buying, which tells shareholders that the management team is serious about continuing to add shareholder value. In addition to insider buying, Teck has been added to a number of hedge fund portfolios as well, suggesting that not only do insiders believe in the company, but also the smart money that’s really driving the markets.

Supply disruptions can impact anyone, even fossil fuel producers. Westshore Terminals (TSX:WTE) is a coal export terminal located at Roberts Bank Superport in Delta British Columbia. It is Canada's largest coal export facility, surpassing the combined coal shipments of all other terminals in Canada. The company exports thermal and metallurgical coals to markets around the world, including Japan, South Korea, China, India and Taiwan. Westshore also offers services to ship various bulk cargoes through its marine facilities. Westshore Terminals has been operating for over 30 years and employs more than 240 employees that work 24/7 shifts to ensure continuous operation.

By: Lucas Friedman

** IMPORTANT NOTICE AND DISCLAIMER -- PLEASE READ CAREFULLY! **

PAID ADVERTISEMENT. This article is a paid advertisement.

GlobalInvestmentDaily.com and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Avanti Energy Inc. (“Avanti” or “AVN”) to conduct investor awareness advertising and marketing. Avanti paid the Publisher to produce and disseminate four similar articles and additional banner ads at a rate of seventy thousand US dollars per article. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by Avanti) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The Publisher owns shares and / or options of the featured company and therefore has an additional incentive to see the featured company’s stock perform well. The Publisher does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The Publisher will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that prices for helium will significantly increase due to global demand and use in a wide array of industries (including key technology sectors) and that helium will retain its value in future due to the demand increases and overall shortage of supply; that Avanti can pursue exploration of the recently acquired licenses of property in Alberta; that Avanti’s licenses in respect of the Alberta property can achieve drilling and mining success for helium; that Avanti will be able to acquire the rights to helium on the 12,000 acres of land in Montana pursuant to its recent letter of intent announced on April 16, 2021, and the helium rights to the ~50,000 acres of land in Montana pursuant to its recent letter of intent announced on June 14, 2021; that the Avanti team will be able to close on the aforementioned Montana helium license acquisitions; that the Avanti team will be able to develop and implement helium exploration models, including their own proprietary models, that may result in successful exploration and development efforts; that historical geological information and estimations will prove to be accurate or at least very indicative of helium; that high helium content targets exist in the Alberta and both Montana projects; and that Avanti will be able to carry out its business plans, including timing for drilling and exploration. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that demand for helium is not as great as expected; that alternative commodities or compounds are used in applications which currently use helium, thus reducing the need for helium in the future; that the Company may not fulfill the requirements under its Alberta licenses for various reasons or otherwise cannot pursue exploration on the project as planned or at all; that the Company may not be able to acquire the helium rights to the Montana lands as contemplated in the letter of intent or at all; that the Avanti team may be unable to develop any helium exploration models, including proprietary models, which allow successful exploration efforts on any of the Company’s current or future projects; that Avanti may not be able to finance its intended drilling programs to explore for helium or may otherwise not raise sufficient funds to carry out its business plans; that geological interpretations and technological results based on current data may change with more detailed information, analysis or testing; and that despite promise, there may be no commercially viable helium or other resources on any of Avanti’s properties. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://GlobalInvestmentDaily.com/Terms-of-Use. If you do not agree to the Terms of Use http://GlobalInvestmentDaily.com/Terms-of-Use, please contact GlobalInvestmentDaily.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. GlobalInvestmentDaily.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.