By: Zoocasa

Housing inventory is up in the Greater Toronto Area this March, leading to a corresponding drop in sales and prices from the market’s peak last year.

Inventory levels are now between two and three months, reports the Toronto Real Estate Board (TREB), whereas in 2017 there was less than a month’s available.

Increased inventory levels are likely to due to market uncertainty resulting from a series of measures introduced in spring 2017 meant to cool a market that had climbed almost 35 per cent in price year-over-year.

The introduction of the Ontario Fair Housing Plan and OSFI’s - the bank regulator - decision to tighten mortgage lending rules, seemed to lead to sellers previously sitting on their homes to finally decide to list, out of fear that they’d missed the peak.

Although demand for GTA properties is still extremely strong, the pressure on prospective buyers has eased with so many more properties the market. Prospective buyers are taking their time and properties are taking twice as long sell -- the average days on market this March was 20 days to just 10 last March.

Sales have slowed down compared to last year, where sellers had to do very little to attract attention to their property.

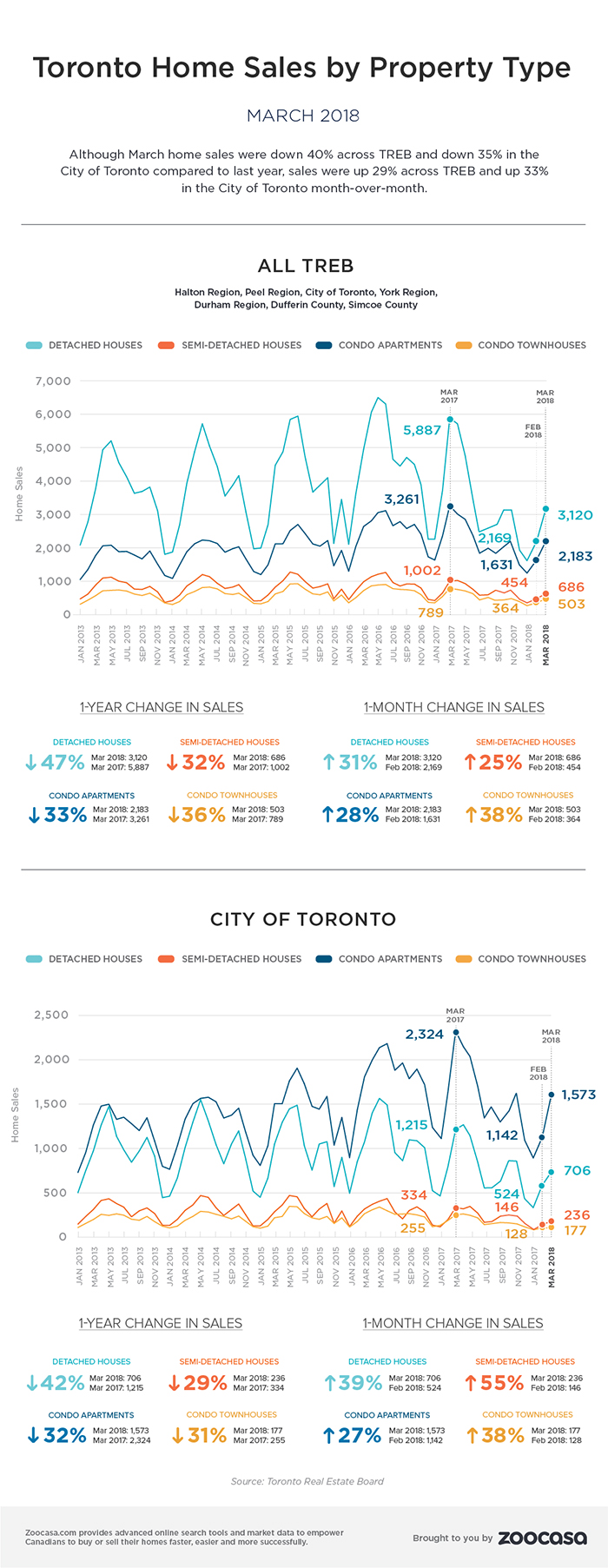

The most dramatic difference is seen in detached housing, where sales have plummeted 46.3 per cent. Only 3,120 detached houses were sold in the GTA this March, while last year saw frenzied buyers snap up 5,887 houses.

Its unclear if buyers, because of OSFI, are experiencing a lending shortfall, unable to borrow enough to buy detached houses, which still average just over $1 million, or if they are waiting for the busier spring and summer to see what new listings appear.

Prices, despite media headlines, have not dropped to the same extent as sales have.

Condos, in fact, are increasing in price year-over-year, even in the GTA. Mississauga condos, for example, are currently $435,036 where as in March 2017 they were $402,344, an increase of 8 per cent.

Prices in other market segments have stabilized. Yes, they are down from their peak in 2017, but are still up overall from the year before, in 2016.

King City is still the most expensive TREB area in which to buy this March, with an average property selling price of $1,698,815 . Houses for sale in Mississauga are going for just about the overall TREB average $ 716,690. The most affordable place to buy in the GTA is in Essa, up in cottage country, where the average property goes for $507, 756.

Check out the infographic below to examine the data in closer detail:

Zoocasa.com is a leading real estate resource that combines online search tools and a full-service brokerage to empower Canadians to buy or sell their homes faster, easier and more successfully. Home buyers can browse real estate listings on the website or the free iOS app.