2019 is already on track to be a major win for gold investors, and it’s not likely to slow down anytime soon.

The global economy is looking increasingly dangerous…

Just as Goldman Sachs is saying that ‘peak gold’ may be right around the corner.

Stock markets are beginning to look less interesting for savvy investors…

And a ‘perfect storm’ for gold is already forming.

The biggest winners though?

Gold miners.

More specifically: miners who meet a specific but simple criterion…

1) They’ve got a tech edge

2) They’ve got a proven team

3) They’ve got the resources in the ground and the skill to bring them out.

New technology isn’t just unlocking new gold veins… it’s also rediscovering legendary gold hotspots such as the Klondike or Julius Caesar’s gold in Romania. And only a few teams have the experience and know-how to dig it up.

With gold prices on the rise, gold miners are gearing up for what could become an unforgettable 2019.

Here are 5 stocks to keep an eye on as you get into the gold game:

#1 Pretium Resources (NYSE:PVG, TSX:PVG)

Canadian Pretium Resources is one of the most exciting growth stories in the gold space.

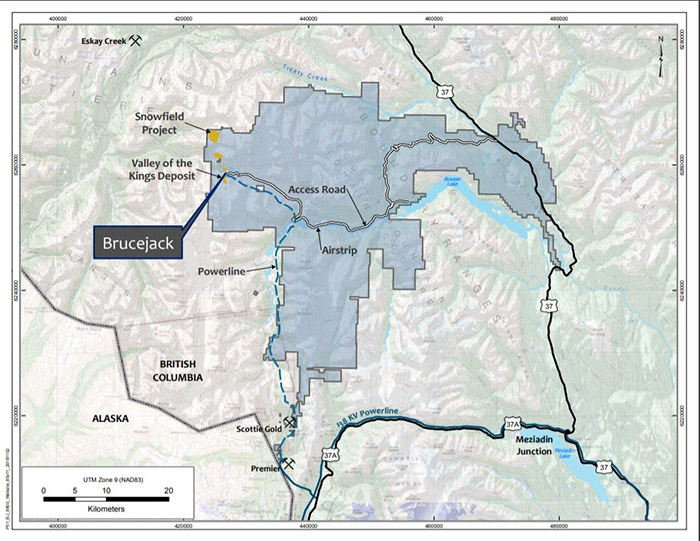

Pretium is sitting on top of a diverse portfolio of precious metal properties throughout the United States, Canada, and Mexico. Its prized mine, however, is Brucejack mine in British Columbia, which is fully owned by the company. A 2016 estimate estimated the total gold reserves of Brucejack at 8.7 million ounces. At today’s gold prices that’s no less than $11.3 billion.

Over 154,484 ounces of gold was unearthed in its first six months at this 2,700 ton-per-day high-grade gold mine. Now, Brucejack is averaging nearly 13 grams of gold per ton of rock mined, a very modest output that is allowing Pretium to keep their all-in sustaining costs well below the global gold mining average.

In terms of exploration, Pretium has administered comprehensive geological sampling in the vicinity (15-30km) of the mine and has unearthed deposits with grades as high as 19.25 grams of gold per ton.

Long term, investors are excited by the 100 percent company-owned snowfield property. In addition to porphyry-style gold and gold-copper deposits, the exciting -and reliable- property also benefits from molybdenum and rhenium mineralization.

#2 Euro Sun (TSX:ESM, OTCMKTS:CPNFF)

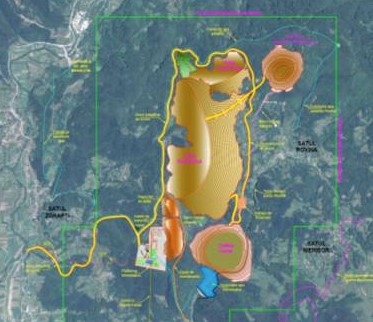

Euro Sun has captured an asset of immense value: a Romanian gold mine that was first proven one hundred years ago.

The Ancient Romans excavated $16.8 billion at today’s prices in gold from this area of Romania, minting coins that were scattered across an empire 11 million square miles in size.

Modern research indicates that Europe still has billions in gold locked away, with hundreds of mines sitting around just waiting for re-activation.

The problem? Acquiring permits can be labor-intensive and sometimes impossible, thanks to EU regulation.

Back when permits were available, Barrick Gold (NYSE:ABX), the world’s most valuable gold miner, got in on the action: the company pumped in $20 million to develop Rovina.

Now Rovina is owned by Euro Sun… and Euro Sun has done the impossible... it just got its hands on a mining permit.

The Rovina mine has been classified as a “highly scalable” asset, with an immense growth potential, according to Cantor Fitzgerald.

Mines like Rovina are hard to come by, even though the area is rich in ore.

And Euro Sun (TSX: ESM, OTCPK:CPNFF) has gotten around its toughest problem – acquiring the licenses it needs to start developing Rovina’s full potential.

Industry experts like GMP and Cantor Fitzgerald agree that Euro Sun is significantly undervalued. Cantor Fitzgerald has deemed Euro Sun’s short-term target to be $2.10 - a huge increase from its current price. If this sounds too good to be true, just wait: GMP estimates Euro Sun’s value could be $2.70, an increase of a whopping 671%.

Right now, in large part thanks to the sorry state of the small mining stock market, Euro Sun is a penny stock. But that could change at any moment.

With such a huge find ready for the taking, this could be the gold story of 2019.

Plus, any small move on the gold market could potentially accelerate the company’s rise… from 5x to 10x to even 30x its current market cap.

#3 Alamos Gold Inc. (NYSE:AGI, TSX:AGI)

Next on the ‘gold stocks to watch’ list is Canada-based Alamos Gold Inc., a mid-tier gold producer that owns four fully functional gold mines in Ontario and Canada.

Apart from their gold mines in Canada and Mexico, Alamos owns additional development projects at home in Manitoba, Canada with its Lynn Lake project, in Mexico with La Yaqui and Cerro Pelon, an extension of the Mulatos Mine, and even as far-flung as Turkey, where it owns the Kirazli, Agi Dagi, and Camyurt development projects.

Its Kirazli project is especially significant as the company recently received a key operating permit from the Turkish Department of Energy and Natural Resources…

This massive development will permit Alamos to scale up construction, with the goal of kicking off initial production at the mine by the end of 2020. This is exciting news because Kirazli’s probable reserves sit at 10,078,000 ounces, or approximately $13 billion in revenue for the company.

Additionally, Alamos Gold also closed a major deal with Metalla Royalty and Streaming, securing $8 million in Metalla shares in a sale of 18 royalties on assets not owned by Alamos. The deal means that Alamos will now own 6.26% of Metalla.

Alamos’ growing portfolio and key partnerships make it an interesting stock to watch for goldbugs and stock market investors alike.

#4 Osisko Gold Royalties Ltd. (NYSE:OR, TSX:OR)

This Canadian company boasts an exceptional portfolio of assets spread across the globe, with plenty more royalties and exploration in development.

Osisko Gold Royalties is now being watched very closely by investors who have zeroed in on a telling deviation amid the vast amounts of data available on all publicly traded companies - you see, the key to successful trading is not having just access to the information, but knowing what exactly to look for and what to make of it.

In this case, the movement that has caught the market’s eye is that the firm’s Mesa Adaptive Moving Average (MAMA) has moved above the Fractional Adaptive Moving Average (FAMA). In layman’s terms: there is potentially some major upward mobility in Osisko’s near future.

With its investors feeling bullish about Osisko’s prospects, the company’s stock has climbed at a healthy clip over the last year. To get into the nitty gritty, “shares have moved 6.53% over the past 4-weeks, 58.50% over the past half year and 25.48% over the past full year.”

Osisko is a smart, low-risk investment thanks to its consistent growth and impressively reduced debt. Investors who were lucky enough to get their hands on Osisko stock in the last quarter of 2018 will be the first to tell you what a rewarding buy it is.

#5 IAMGOLD (NYSE:IAG, TSX:IMG)

The last stock to watch of the group, but absolutely not the least, is Canada-based IAMGOLD. The enthusiastic young company is a budding mid-tier gold miner that looks like it’s on track to become a major in the gold mining industry.

Sure, the company has withstood some recent setbacks, first by postponing its Cote Gold project and now by revealing a plan to lay off 32% of the workers at its Westwood mine. These moves, however, have kept stock prices appetizing and set the company up for a major bounce back.

Many traders are still bullish on IAMGOLD, expecting continued growth from the ambitious company.

The company originally amassed a fair bit of hype when it produced some 214,000 ounces in Q1 2017 thanks to its successful operations in South America and Africa. Now, this past June, IAMGOLD closed a new and a momentous deal with Japanese commodity giant Sumitomo, which will result in the development of a new Ontario gold project.

Right now, is the perfect time for investors to get involved with IAMGOLD as the buzz wears off but the projections are rock solid for this quickly-growing commodity.

Other companies to watch as traders turn bullish on gold…

Kinross Gold Corporation (NYSE:KGC, TSX:K)

Kinross Gold Corporation is relatively new on the scene, founded in the early 90s, but it certainly isn’t lacking drive or experience. In 2015, the company received the highest ranking of any Canadian miner in Maclean's magazine's annual assessment of socially responsible companies.

While Kinross posted a significant loss in the fourth quarter of 2018, the company is making strong moves to turn around its earnings, including the hiring of a new CFO, Andrea S. Freeborough.

“Andrea’s successful track record at Kinross and throughout her career, including accounting, international finance, M&A, and deep management experience, will be an excellent addition to our leadership team,” said Mr. Rollinson. “We have great talent at Kinross and succession planning is a key aspect of retaining that talent for the future success of our Company.”

By. Meredith Taylor

IMPORTANT NOTICE AND DISCLAIMER

PAID ADVERTISEMENT. This communication is a paid advertisement. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Euro Sun Mining, Inc. to conduct investor awareness advertising and marketing. Euro Sun Mining paid the Publisher fifty thousand US dollars to produce and disseminate this and other similar articles and certain banner ads. Euro Sun Mining also paid the Publisher additional sums as compensation for other marketing services earlier this year. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on an interview conducted with the company’s CEO, and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, the success of the company’s exploration operations, the size and growth of the market for the companies’ products and services, the companies’ ability to fund its capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://oilprice.com/terms-and-conditions If you do not agree to the Terms of Use http://oilprice.com/terms-and-conditions, please contact Oilprice.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. Oilprice.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.