Uber and Lyft were the first to disrupt the $8 trillion global transportation industry by making car ownership less necessary and with the ride-hailing industry now worth $60 billion and on track to top $85 billion by 2023, the transportation revolution is well underway.

But Uber and Lyft can’t finish what they started.

Their business models are broken. They’ve failed to grasp the enormity of the parallel revolution in ESG, or “impact” investing.

And this is where the disruptors become the disrupted.

A startup that launched in late 2019 in Canada is pushing aggressively into the United States, and it’s not just challenging Uber and Lyft—it’s challenging the entire auto industry by taking the ride-sharing revolution to the next level.

The company is Facedrive (TSXV:FD,OTC:FDVRF) and it’s not only the first in the world to offer a carbon-offset ride-sharing solution that Big ESG Money loves …

It’s also planning to put another nail in the coffin of traditional car ownership with its recent acquisition of a pioneer in the electric vehicle subscription space.

And that’s only the very beginning.

Here are 5 reasons to keep a close eye one of the hottest and fastest-moving companies to come out of Canada’s “Silicon Valley”:

#1 The Transportation Revolution: Phase 2

Facedrive. Washington-based Steer. Energy giant Exelon.

These three names have now come together to form the next big challenge to the auto industry.

Private car ownership is under threat. Conventional car ownership is under attack.

It took almost a decade for cars sales in the European Union to even begin to recover when Uber and Lyft decimated sales in urban areas.

And now, the pandemic could change private car ownership forever because the general idea of pandemic has been irrevocably tied to other “natural disasters” and the fear of climate change.

Economics plays a big roll, too, and will do so even more under the struggles of COVID-19.

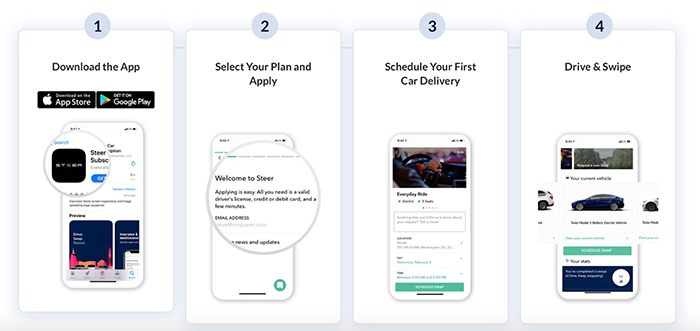

Chicago-based Steer says it’s time for a transportation revolution, and it fully intends to get more people into unconventional cars--without breaking the bank.

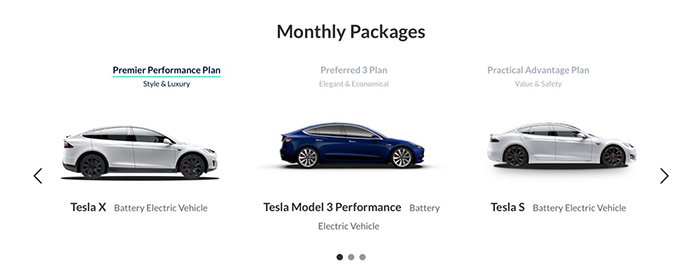

This offers people the chance to drive a Tesla and other new electric vehicles without the huge expenses that come with owning one.

Even better, Facedrive’s acquisition of Steer came with a $2 million strategic investment from energy giant Exelon’s wholly-owned subsidiary, Exelorate Enterprises.

This could well be a game-changer for the auto industry.

The success of subscription based ‘leasing’ models is already well documented, and this simple concept will be at the core of the next major disruption in the auto industry.

We’ve already seen it with electric bikes and scooters…

But this step will change everything.

This seamless, hassle-free technology is grabbing onto the $250-billion ESG megatrend by giving subscribers access to their own virtual garage of low-emissions vehicles and EVs.

So, for anyone who would love to drive a Tesla but finds it prohibitively expensive to own, this is the answer:

Not only is Steer planning to upend the auto industry by offering an alternative to the tradition of owning, leasing or renting vehicles for everyday use …

but it’s also promising to give the EV industry itself another boost. And the electric vehicle market could top $800 billion by 2023.

#2 A Key To Airline Response to Covid-19

As COVID-19 continues to rage and the dreaded third wave takes hold, the $7.6T global tourism industry is facing $1 trillion in losses and is expected to shed 100 million jobs by the end of 2020.

U.S. airlines alone lost $12 billion just in the second quarter.

Air Canada, for one, is taking pre-emptive measures … and again, Facedrive (TSXV:FD,OTC:FDVRF) is a leader on the front line here:

On October 7th, the airline giant signed a deal with Facedrive to launch a pilot project for its employees using proprietary COVID-19 contact tracing technology, TraceSCAN.

TraceSCAN Wearables combine complex algorithms in an AI-enabled mobile application with wearable devices built on the industry standard nRF52 Bluetooth chipset.

That means it can reach those millions of workers around the world, from construction and medical to education and security, who can’t operate with a phone in hand 24/7, as well as the at-risk elderly.

Air Canada isn’t the only major player taking the TraceSCAN plunge...

The Government of Ontario lent its support to TraceSCAN back in July because it’s the only feasible technology that will help masses of government employees who are back to work to trace contacts who have COVID-19.

And now, talks with other airlines are in motion, and the news flow is expected to be fast and momentous.

#3 Verticals Extending into Major League Sports

The pandemic has also shaken the world of major league sports, but even before COVID, sports was struggling to increase revenues and to piggyback on the lucrative eSports world that has become a major part of everyday life.

The fact is … the $600B sports industry has a serious revenue problem and it needs a new way to encourage fan engagement—and monetize it.

Again, Facedrive is there… with another celebrity-studded acquisition.

Major League Baseball (MLB) reportedly lost over $3 billion this year because of the pandemic, and it’s $8.3 billion in debt.

In August, Facedrive acquired Tally Technologies, the high-tech major league sports predicting startup founded by NFL superstar Russel Wilson.

Tally came out of TraceMe, a celebrity content app founded by Wilson with early-in investors from the biggest tech companies in the world and acquired by Nike last year.

Tally plans to add another dimension to major league sports with “gamification” and online fan engagement by making it free-to-play … and predictive.

It’s a big opportunity for major league sports, which is scrambling for new revenue verticals.

And that’s not where it ends: We anticipate rapid news flow on this as new teams line up to take advantage of revenue potential.

#4 Multiple Verticals in an Entire Tech-Driven ESG Ecosystem

Facedrive (TSXV:FD,OTC:FDVRF) isn’t just challenging Uber in the ride-sharing space … it’s got an impressive collection of ESG offerings in a single tech-driven ecosystem:

It’s all about carbon-neutral footprints, sustainability, healthy social distancing and even contributing on the front lines of the pandemic.

- FaceDrive and HiRide--Environmentally-friendly ride-sharing and long-distance carpooling

- Facedrive Health: Carbon-neutral pharma deliveries and government-endorsed COVID contact-tracing with TraceScan

- Facedrive Marketplace, with celebrity co-branded (Think: Will Smith’s Bel Air) exclusive clothing focused on sustainably sourced materials

- Facedrive Foods carbon-neutral food delivery platforms

- Social distancing trivia platform, HiQ, with over 2,000,000 app downloads

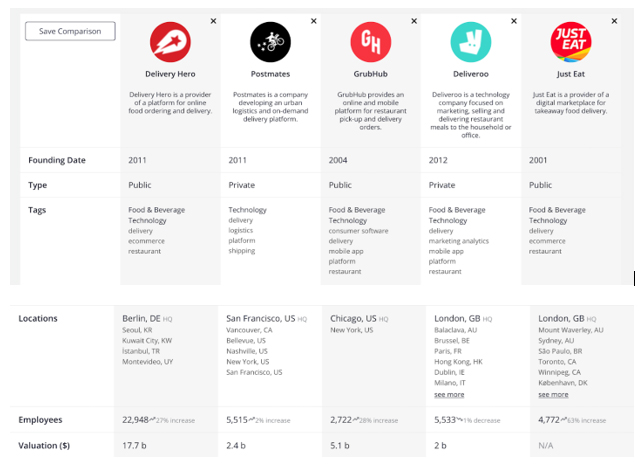

Worth $24 billion already in 2018 and predicted to top $98 billion by 2027, the global food delivery market is now officially at war. And it’s a war even more ferocious than streaming.

The stakes have never been higher for the delivery industry, whose giants are burning cash like crazy and still unsure they will ever turn a profit.

Facedrive’s acquisition earlier this of Foodora Canada was another challenge to Uber, which belatedly realized that its profits would depend on delivery. Foodora isn’t just any food delivery company—it previously was a subsidiary of the $20-billion multinational food delivery service Delivery Hero, which operates in over 40 countries and services more than 500,000 restaurants.

Facedrive’s acquisition of the Foodora Canada food delivery business gave it hundreds of thousands of customer names and over 5,500 new restaurant partners for just a part of the high-tech mobility company’s revenue-generating ecosystem. The chart below tells us about some of the big food delivery players worldwide.

But Facedrive understands what a tech-driven, ESG ecosystem is.

Branding is everything, and that’s where Facedrive is armed to the hilt in this war for positive branding.

Facedrive is associated with the community, with benefits for all stakeholders, with sustainability… with lifestyle.

Its motto is “people and planet first”, and it has attracted some huge names, including Will Smith.

The Facedrive brand is aiming to become a household name. Will Smith’s Bel Air Athletics clothing brand is betting that Facedrive is the ride of the future. That’s why he’s co-branding an entire line of exclusive clothing with Facedrive.

It’s also why WestBrook Inc., the company he shares with his wife Jada Pinkett Smith, is partnering with this ride-share startup that is now expanding to the US with a goal to challenge Uber for the throne.

Even better: Bel-Air Athletics is green and in line with Facedrive principles as the aim is to ensure by next year that all clothing materials are 100% sustainably sourced.

Over 1,000 new products co-branded by Bel Air and Facedrive have launched on the Facedrive marketplace website and the demand is just starting.

#5 ESG At Its Best

Facedrive, is one of the biggest things to emerge from Ontario’s ‘Technology Triangle’, also called “Waterloo”. It’s not only Canada’s answer to Silicon Valley, but it’s also fast growing as a startup tech hub.

Facedrive launched in Q3 2019, and already we’re looking at constant news flow and a string of smart acquisitions--all leading to global expansion plans.

The deal timeline has been so fast-paced that’s it’s hard to keep up …

From Will Smith to Exelon to Air Canada and Superbowl star Russel Wilson, Facedrive is becoming a household name with celebrity-studded acquisitions that all that make for a steady stream of news flow …

And it’s all targeting to fit the needs of $119 trillion in Big Capital that’s scrambling for somewhere to park its sustainability funds.

Canadian companies are diving into this new market trend, as well:

Boralex Inc. (TSX:BLX) is an ambitious Canadian renewable firm. The company’s primary energies are produced through wind, hydroelectric, thermal and solar sources and help power the homes of many people globally. Not only has it has had a great influence in the adoption of renewable electricity domestically, it’s even branching out into the United States, France and the United Kingdom.

Westport Fuel Systems (TSX:WPRT) is an energy technology provider for the vital transportation industry. It creates and distributes systems for less impactful fuels, such as natural gas. That means it has an amazing potential upside, considering there are over 2.5 million natural gas vehicles worldwide.

Shaw Communications Inc (TSX:SJR.B) is taking a leadership role among Canadian telecom providers through its use of renewable energy, In fact, it is one of the biggest customers of Bullfrog Power which sources its electricity from a blend of wind energy and hydropower. It is also building its own portfolio of clean energy investments.

Shopify Inc (TSX:SHOP) is playing a pivotal role in the e-commerce boom. Not only does it help anyone and everyone who wants to have a try at launching their own business, it gives them the tools and resources to do so. And it’s not without its ethical grounding, either. Shopify is pushing towards sustainability in a major way. It has started its own sustainability fund, which it adds $5 million to each year to help tackle the looming climate crisis.

The Descartes Systems Group Inc. (TSX:DSG) is a Canadian multinational technology company specializing in logistics software, supply chain management software, and cloud-based services for logistics businesses. Recently, Descartes announced that it has successfully deployed its advanced capacity matching solution, Descartes MacroPoint Capacity Matching. The solution provides greater visibility and transparency within their network of carriers and brokers. This move could solidify the company as a key player in transportation logistics which is essential-and-often-overlooked in the mitigation of rising carbon emissions.

By. Steve Merrill

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements /

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that the demand for ride sharing services will grow; that Steer can help completely change the way people view car ownership, that Steer can disrupt industry segments; that the Tally app will become popular and start generating substantial revenues; that the Tally sports predictive app will lead to online sports revenue; that Tracescan could help the tourism industry deal with COVID and will sign new agreements for use of its alert wearables; that new tech deals will be signed by Facedrive; that Facedrive will be able to expand to the US and globally; that Facedrive will be able to fund its capital requirements in the near term and long term; and that Facedrive will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that riders are not as attracted to EV rides as expected; that the Tally app may not become popular, may not lead to revenues from the app; that competitors may offer better or cheaper alternatives to the Facedrive businesses; TraceScan may not work as expected in commercial settings; changing governmental laws and policies; the company’s ability to obtain and retain necessary licensing in each geographical area in which it operates; the success of the company’s expansion activities and whether markets justify additional expansion; the ability of the company to attract drivers who have electric vehicles and hybrid cars; the ability of Facedrive to attract providers of good and services for merchandise partnerships on terms acceptable to both parties, and on profitable terms for Facedrive; and that the products co-branded by Facedrive may not be as merchantable as expected. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) owns a considerable number of shares of FaceDrive (TSX:FD.V) for investment, however the views reflected herein do not represent Facedrive nor has Facedrive authored or sponsored this article. This share position in FD.V is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the featured company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns a substantial number of shares of this featured company and therefore has a substantial incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.