A potential high upside opportunity in the oil and gas sector is unfolding that offers one of the most attractive risk/reward profiles this industry has seen in quite a while.

This opportunity is with a small oil explorer sitting on a supermajor-sized oil and gas basin...and yet the company is still currently flying very much under Wall Street ’s radar.

Reconnaissance Energy Africa (TSX:RECO.V; OTCMKTS:RECAF) is a small – for the time being, anyway - $300+ million company that has secured petroleum licenses for an entire sedimentary basin in Namibia and Botswana...two extremely resource-friendly countries with very low royalties fees.

This basin – as deep as the Permian – could prove to be one of the world ’s last-ever giant onshore oil discoveries. And as a new basin, the potential is likely for Conventional Oil and Gas. No Fracking, normal production profiles, low water requirements which means low cost per barrel.

And Recon Africa has secured the petroleum licensing rights to the entire basin.

With one of the world ’s largest onshore, undeveloped hydrocarbon basins – whose potential has been analyzed and acknowledged by some of the industry ’s most sought-after experts – the oil that is hoped to be discovered by Recon Africa could ultimately prove to be worth tens of billions.

This isn ’t an investment with simply ordinary profit potential. We ’re talking about a true “lottery ticket” – potentially the largest oil discovery in the last 20 to 30 years. They just have to make that big discovery.

And, again, one small-cap company has secured the rights to all of it.

Should the pieces all fall into place, Recon Africa could be sitting on oil reserves that rival the majors. This could be the kind of story you tell your friends and relatives about for years.

Drilling Has Begun and Results Are Expected Soon; This is a Fast-Moving Scenario.

In our experience, in the history of oil exploration, never has one company this small been on top of a basin this big. This basin, like all major oil and gas provinces, is actually a set of 5 sub-basins separated by structural highs, where the best conventional traps can often be found.

With drilling now underway, it ’s unlikely that this company remains under-the-radar for much longer – and the world will be very interested to learn about any major discovery made here.

Here are 5 Reasons why you should look at Recon Africa (TSX:RECO.V; OTCMKTS:RECAF).

1. Recon Africa owns the rights to a massive sedimentary basin loaded with potentially hundreds of billions of dollars ’ worth of oil and gas.

Under several long-term petroleum licenses, they have acquired all rights to an entire sedimentary basin in Namibia and Botswana.

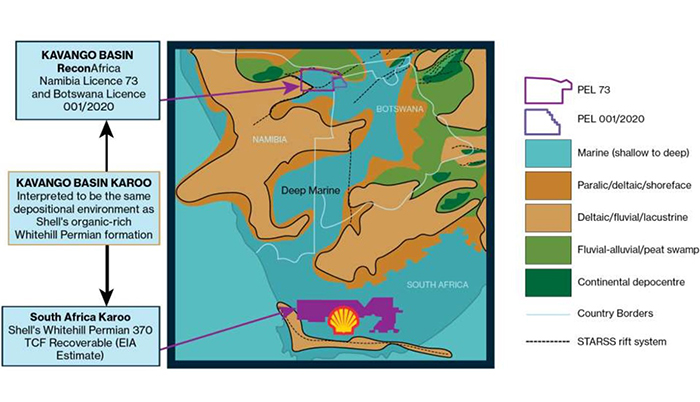

This basin – known as the Kavango Basin – is comprised of 8.5 million acres and is said to be similar in depth to the Permian. New data on the basin shows that not only is it large – it ’s also as much as 30,000 feet deep. The Kavango is a rift-basin, which refers to geologically how the basin formed. All of the major onshore oil and gas fields in sub-Saharan Africa are contained in rift basins.

The source rocks in the Kavango basin are believed to be the same age and quality South Africa ’s 600,000-square-kilometer Karoo sedimentary basin, home to Shell ’s massive Whitehill Permian gas play. The difference is that the thermal history in South Africa led to much higher heat flow and subsequent over-cooking that lead to only dry gas remaining.

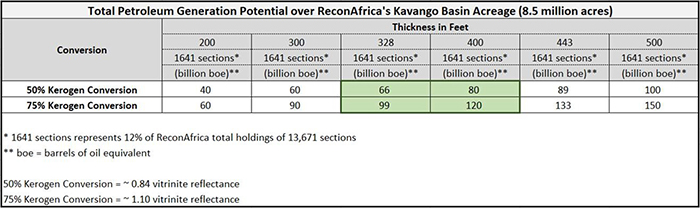

How much oil and gas is potentially in the ground at Recon Africa ’s Kavango Basin?

This year, armed with new data, noted source rock expert Dan Jarvie has estimated that the basin could be capable of generating 100 billion-plus barrels of oil.

In November 2020, the highly respected global energy consultants at Wood Mackenzie issued a report proclaiming that the Kavango Basin “represents one of the largest onshore undeveloped hydrocarbon basins in the world.”

In this report, the experts at Wood Mackenzie identified three basins that provide a useful benchmark as to what the potential for the Kavango Basin might look like...one of which was the US – Midland Basin (Permian) in Texas that has an estimated overall development value of $540 billion.

And, again, we ’re talking about a small-cap exploration company that currently owns the rights to this entire massive basin...a small-cap exploration company with a market cap of around $300 million potentially sitting on billions of dollars in value of oil and gas in the ground.

2. The experts have already weighed in on Recon Africa ’s potential.

Bill Cathey, President and Chief Geoscientist of Earthfield Technology is known as the “geological interpreter to the supergiants,” as he has consulted for every oil and gas major and large independent in the business.

Here ’s what Bill Cathey had to say about the Kavango Basin:

Not only was the data on the basin some of the best he had ever seen... nowhere in the world is there a sedimentary basin of this depth that has ever failed to produce commercial quantities of hydrocarbons.

Let me be clear: What Bill Cathey had to say about Recon Africa ’s Kavango Basin is not a guarantee of success...after all, there is no such thing in this business.

But what he said, is that basins of this depth always produce hydrocarbons.

But Bill Cathey is not the only expert to have weighed in on the potential for Recon Africa (TSX:RECO.V; OTCMKTS:RECAF).

Sproule – a tier 1 resource assessment company – in early 2018 estimated that the Kavango Basin has a potential 18 billion barrels of oil.

Noted source rock expert Dan Jarvie went even further with his projection. Jarvie, of course, was a key member of the Mitchell Energy team – the company that cracked the code on the major Barnett gas play.

Jarvie has estimated Recon Africa ’s Kavango Basin is capable of generating over 100 billion barrels of oil.

In addition to the expert geologists that spoken to Recon Africa ’s explosive potential, Haywood Securities recently issued a positive report on the company and upped its target price from $2.50 to $4.00 per share.

Haywood is recommending “accumulating a position ahead of drilling/evaluation news flow in H1/21 aimed at proving up the presence of a working hydrocarbons system, which if confirmed, should provide abundant opportunities for further exploration and appraisal drilling”.

The Haywood report proclaimed that, “With such a large potential, coupled with the early stage nature of the Company, any success from the current program could be a significant catalyst for the stock. The resulting net impact of this update is favorable to our near-term outlook of the shares. As such, we are increasing our target price from $2.50 to $4.00 and reflects a higher risked NAV given the de-risking of rig mobilization to country and onto drill site location.” (Full Report Here)

It is truly rare in the small cap oil and gas space to see such overwhelming consensus about the potential for exploration success.

Haywood Securities went so far as to include examples in its report of plays in which an initial oil discovery during the exploration phase delivered upside between 380% and 1,000%.

While this apparent consensus is, of course, no guarantee of future success...it is as strong a forecast for high upside as has been seen in this space in many years.

3. An ideal location in Africa: The final frontier for oil investors.

Here ’s the thing to keep in mind about massive, onshore Permian-sized basins: They ’re not discovered very often.

And if they are discovered these days, it ’s likely in Africa – the final onshore frontier for oil explorers.

After all, Africa is the only huge, underexplored venue in the world left where it ’s possible to have a large discovery made by a small cap exploration company.

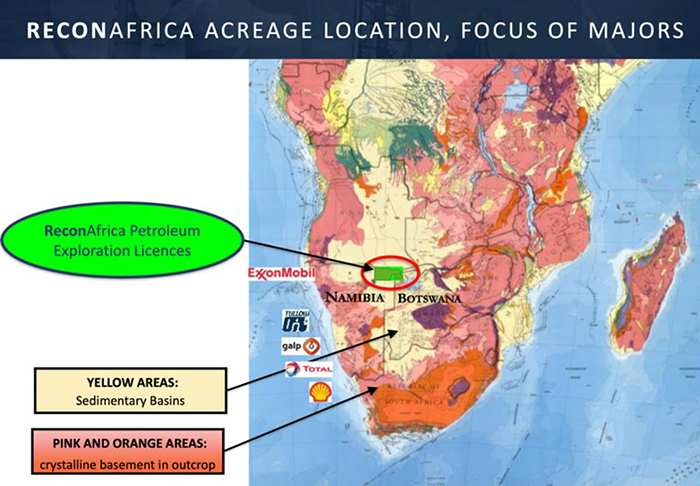

Namibia is one of the most exciting up-and-coming African oil venues and that ’s precisely why companies like Shell and Exxon have been scooping up assets in the region.

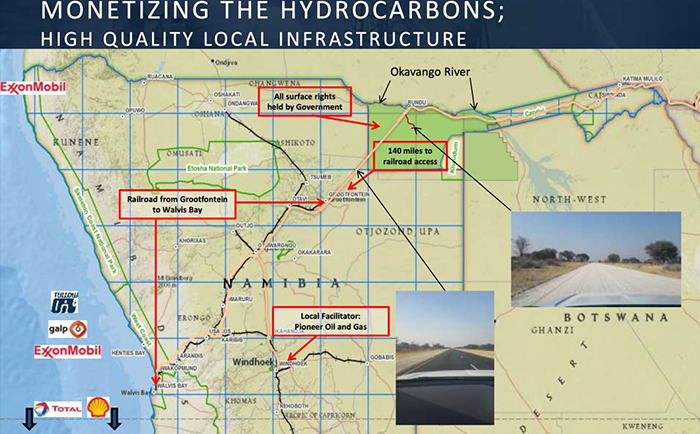

The location of Recon Africa ’s Kavango Basin is virtually ideal – with easy accessibility and significant exploration underway nearby involving major producers.

ExxonMobil (NYSE:XOM) has a massive exploration presence offshore of Namibia – and increased it by 7 million net acres recently. In fact, ExxonMobil, Total (NYSE:TOT) and Shell each have active exploration programs offshore Namibia as of 2021.

The Kavango Basin is part of the Karoo Group, and it ’s also been shown to have the same depositional environment as Shell ’s Whitehill Permian resource play in the main Karoo Basin in South Africa.

Namibia offers outstanding geology and unlike other African states, Namibia has a rule of law, an internationally recognized petroleum regime, and provides one of the most attractive fiscal environments in the world. That includes a 5% royalty and a 35% corporate income tax on oil profits.

4. This opportunity is moving quickly; drilling has already begun.

As you might expect with such a potentially lucrative opportunity, the dominoes have already begun to fall.

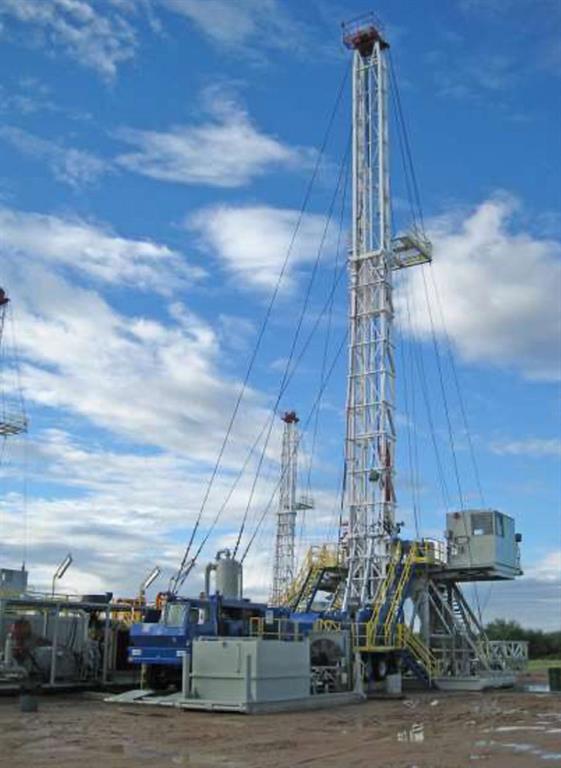

Recon Africa (TSX:RECO.V; OTCMKTS:RECAF) has acquired its own drilling rig to minimize costs and to facilitate on-time drilling schedules.

The company ’s ownership of the Crown 750 drilling rig is expected to reduce overall drilling costs by as much as 60% for its initial holes.

Recon Africa in August completed a $C23 million capital raise, which was upsized twice in response to demand.

Drilling to confirm an active petroleum system has begun on the property, with the first of three wells spuds in January 2021.

The company ’s three hole drilling program is fully funded – and news of discovery success could present a number of opportunities for strategic joint ventures...and potential acquisition.

The size of the potential upside for Recon Africa, combined with the speed the company is executing its exploration program, means that this is not likely a scenario where investors are forced to wait for a potential payoff five years or more into the future.

Positive drilling results could trigger an increase in share value – or potential partnership and acquisition news – at some point in 2021, probably making this a rare short-term opportunity with significant upside potential.

The company is also initiating the first seismic data acquisition in the basin, 400k of 2D. This data, tied to the first well, will help Recon Africa understand the potential of the entire basin.

5. Recon Africa has assembled a world-class technical team.

One of the most attractive components to the Recon Africa (TSX:RECO.V, OTC:RECAF) story is that the company has assembled a Tier 1 team of geologic and market professionals with a proven history of building and selling international junior exploration companies.

That team includes...

* Nick Steinsberger, SVP, Drilling & Completions

Nick brings 32 years' experience in petroleum engineering, drilling and completions, production, and surface facilities to Recon Africa. Mr. Steinsberger began his career as Completions Manager for Mitchell Energy in 1988 and was responsible for completing the first 25 horizontal wells ever drilled and completed in the Barnett gas play in Texas, transforming the Barnett into ultimately one of the largest gas fields in the USA reaching peak production of 5.75 Billion Cubic Feet per day in 2012. Based on its success in the Barnett, Mitchell Energy was sold to Devon Energy for $3.1 Billion in 2002.

* Daniel Jarvie, Geochemist

Daniel Jarvie is globally recognized as a leading analytical and interpretive organic geochemist, having evaluated petroleum systems around the World. Most notably, he completed the geochemical analysis for Mitchell Energy, in their development of the Barnett formation of the Fort Worth Basin, in Texas. In 2010, he was awarded “Hart Energy ’s Most Influential People for the Petroleum Industry in the Next Decade.”

* Scott Evans, CEO, Geologist

Scot Evans is an energy industry leader with a combined 35 years of experience with Exxon and Halliburton. In his last position, Mr. Evans served as Vice President of Halliburton ’s Integrated Asset Management and Technical Consulting organizations where he grew production from 20K to over 100K barrels of oil equivalent per day, creating the equivalent of a Mid-Cap upstream oil company. He is an expert in new resource development.

* Bill Cathey, Geophysicist

Mr. Cathey, President and Chief Geoscientist of Earthfield Technology, has over 25 years of potential fields interpretation experience. Mr. Cathey is world-renowned in the field of aero-magnetics with clients including Chevron, ExxonMobil, ConocoPhillips and many other major and large independent oil and gas companies. Mr. Cathey performed the entire aero-magnetic survey interpretation of the Kavango Basin for Recon Africa.

* Jay Park, Chairman

Jay Park is an energy lawyer with over 35 years of experience advising on oil and gas projects. Mr. Park has advised oil companies, governments, state oil companies and investors on upstream oil and gas transactions, contracts, laws and regulations in over 50 countries and has served as a director or officer or both of a number of oil and gas companies with operations in Africa, including as chairman and director of Voyageur Oil and Gas Corporation, which explored the Borj El Khadra Sud block in Tunisia, farmed out to Anadarko, and as a director of Caracal Energy Inc., which was sold for $1.35 billion to Glencore International.

Bottom Line

- Recon Africa is a small oil explorer sitting on a supermajor-sized basin in Namibia and Botswana...and the company owns the oil and gas rights to the entire basin.

- This basin – known as the Kavango Basin – is comprised of 8.5 million acres - almost the size of Switzerland. It’s as deep (30,000’) as the world renowned Permian basin in Texas.

- Bill Cathey, one of the world’s leading geophysicists, has interpreted the basin to be over 30,000’ deep. Not only was the data on the basin some of the best he had ever seen... nowhere in the world is there a sedimentary basin of this depth that has ever failed to produce commercial quantities of hydrocarbons.

- Noted source rock expert Dan Jarvie went even further with his projection, estimating Recon Africa’s Kavango Basin could be capable of generating over 100 billion barrels of oil.

- Haywood Securities recently upped its target price for Recon Africa from $2.50 to $4.00 and issued a positive report about the company’s potential based on spudding of the first high impact well on Recon Africa’s property.

- The company is led by a highly respected team of geologists and market professionals with a proven track record of success.

- And this under-the-radar company is about to begin drilling – and it could be sitting on potentially billions of dollars’ worth of oil.

You can find more information on Recon Africa here: (TSX:RECO.V; OTCMKTS:RECAF).

Other companies that stand to benefit from the rebound in oil:

Marathon Petroleum Corporation (NYSE:MPC) is an Ohio-based downstream company with a huge reach across North America. And following its 2018 acquisition of Andeavor, it became the country’s largest refinery operator. Across its 16 U.S.-based refineries, the company processes as much as 2.9 million barrels of oil per calendar day.

Marathon has had a particularly tough time since the oil price downturn last spring. From mass layoffs to halting several refinery locations, the company has been one of the most impacted in the U.S. market. But the tough choices its made have also helped it stay afloat.

In August, Marathon released its Q2 earnings report, showing net loss of $750 million or $0.95 per diluted share and an adjusted net loss of $477 million, or $0.60 per diluted share. Net operating cash flow was $9 million ($86 million prior to changes in working capital), and that’s coming up rather short considering that the company spent nearly $140 million on capital projects.

Since then, however, has staged somewhat of a recovery, with its share price increasing from $35 in Mid-August to $44.25 today. Though the company’s rebound hasn’t been particularly exciting, it’s important to note that it is heavily-dependent on demand, and with lockdowns continuing across the globe, it may not get back on its feet for another few months. But when demand for refined fuel does finally rebound, Marathon will be well positioned to take advantage.

Valero Energy Corporation (NYSE:VLO) is another U.S. oil company that was hit particularly hard in 2020. The company saw its share price plummet from its January price of $96 to a yearly low of $38 in March. Despite this drastic drop, however, Valero managed to keep its dividends in tact while many other industry majors cut back. Still sitting at 6.69%, Valero provides investors an opportunity to keep earning as the oil industry bounces back.

In addition to its strong dividend payouts, Valero has also seen a lot of love from analysts. In fact, Morgan Stanley even upgraded its price target for the company from $50 to $74, representing a potential 48% increase.

One of the biggest things Valero has going for it is its remarkably low cash operating expenses. This alone has helped Valero manage what some of its peers have failed to do: keep its refineries open.

Another reason to keep an eye on Valero is its fast-growing renewable diesel operations. With the world racing towards greener pastures, Valero is adapting. And with Biden preparing to take the wheel, there could be a lot more cash flowing into renewables soon, which will be great news for Valero and its shareholders.

While Canada’s oil sector was one of the hardest hit by the oil price crisis, Canadian Natural Resources (NYSE:CNQ; TSX:CNQ) kept its dividend intact after swinging to a loss for the first half of the year, while Canada's producers are scaling back production by around 1 million bpd amid low oil prices and demand. Though Canadian Natural Resources kept its dividend, it withdrew its production guidance for 2020, however. It also said it would curtail some production at high-cost conventional projects in North America and oil sands operations and carry out planned turnaround activities at oil sands projects in the second half of 2020.

Despite the negative stigma surrounding the the oil sands, the sector is starting to clean up its act a bit. And Canadian Natural Resources is leading the charge. And if analysts are right about Canada’s comeback, Canadian Natural Resources could be in for a big year.

Though the Canadian energy giant has seen its stock price slump this year, it could provide a potentially opportunity for investors as oil prices rebound. It is already up over 170% from its March lows, and it could still have some more room to run.

TC Energy Corporation (NYSE:TRP, TSX:TRP) is a major oil and energy company based in Calgary, Canada. The company owns and operates energy infrastructure throughout North America. TC Energy is one of the continent’s largest providers of gas storage and owns and has interests in approximately 11,800 megawatts of power generations. It’s also one of the continent’s most important pipeline operators. With TC Energy’s massive influence throughout North America, it is no wonder that the company is among one of Canada’s highest valued energy companies.

One of TC Energy’s biggest struggles in recent years was grappling with the particularly difficult approval process for its Keystone Pipeline. But that’s all history now, and with the bounce back in oil and gas demand, TC Energy could stand to benefit.

While TC Energy’s stock price has yet to recover from pre-pandemic levels, it is one of the few industry giants which has managed to keep high dividends rolling in. With quarterly payouts exceeding 6%, TC has kept investors on board and its share price from falling too far. In fact, while many oil-focused energy companies saw their market caps shed as much as 50% of their value, TC Energy only dropped by 36% in from February to March 2020.

Whitecap Resources, (TSX:WCP) is a diversified player with toe in all forms of oil and gas E&P in Western Alberta province and Saskatchewan. Their production is skewed slightly toward oil. With proved reserves of ~500 mm BOE the company's 2-P reserves value would give it a gross valuation of $12.5 bn US. On an EV/2-P multiple of 6, Whitecap looks cheap at its current price. Analysts are high on the company as well.

Magna International (TSX:MG) is a fantastic way to get in on the explosive EV market without betting big on one of the new hot stocks tearing up among the millennials right now, and though the EV market isn’t necessarily set to boom because of a rebound in oil, Magna will still be able to ride the wave as car demand, in general rebounds.. The 63-year-old Canadian manufacturing giant provides mobility technology for automakers of all types. From GM and Ford to luxury brands like BMW and Tesla, Magna is a master at striking deals. And it’s clear to see why. The company has the experience and reputation that automakers are looking for.

Like Magna, Westport Fuel Systems (TSX:WPRT) is another hardware and tech provider in the auto-industry. It builds products to help the transportation industry reduce their carbon footprint. In particular, it provides systems for less impactful fuels, such as natural gas. In North America alone, there are over 225,000 natural gas vehicles. But that shies in comparison to the global 22.5 million natural gas vehicles globally, which means the company still has a ton of room to grow.

By. Timothy Mole

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements. Statements contained in this document that are not historical facts are forward-looking statements that involve various risks and uncertainty affecting the business of Recon. All estimates and statements with respect to Recon’s operations, its plans and projections, size of potential oil reserves, comparisons to other oil producing fields, oil prices, recoverable oil, production targets, production and other operating costs and likelihood of oil recoverability are forward-looking statements under applicable securities laws and necessarily involve risks and uncertainties including, without limitation: risks associated with oil and gas exploration, timing of reports, development, exploitation and production, geological risks, marketing and transportation, availability of adequate funding, volatility of commodity prices, imprecision of reserve and resource estimates, environmental risks, competition from other producers, government regulation, dates of commencement of production and changes in the regulatory and taxation environment. Actual results may vary materially from the information provided in this document, and there is no representation that the actual results realized in the future will be the same in whole or in part as those presented herein. Other factors that could cause actual results to differ from those contained in the forward-looking statements are also set forth in filings that Recon and its technical analysts have made, We undertake no obligation, except as otherwise required by law, to update these forward-looking statements except as required by law.

Exploration for hydrocarbons is a speculative venture necessarily involving substantial risk. Recon's future success will depend on its ability to develop its current properties and on its ability to discover resources that are capable of commercial production. However, there is no assurance that Recon's future exploration and development efforts will result in the discovery or development of commercial accumulations of oil and natural gas. In addition, even if hydrocarbons are discovered, the costs of extracting and delivering the hydrocarbons to market and variations in the market price may render uneconomic any discovered deposit. Geological conditions are variable and unpredictable. Even if production is commenced from a well, the quantity of hydrocarbons produced inevitably will decline over time, and production may be adversely affected or may have to be terminated altogether if Recon encounters unforeseen geological conditions. Adverse climatic conditions at such properties may also hinder Recon's ability to carry on exploration or production activities continuously throughout any given year.

DISCLAIMERS

ADVERTISEMENT. This communication is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) have been paid by Recon seventy thousand U.S. dollars to write and disseminate this article. As the Company has been paid for this article, there is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated but may in the future be compensated to conduct investor awareness advertising and marketing for TSXV:RECO. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.