Billionaire John Paulson says now is the best time to buy gold. ““The U.S. dollar’s devaluation, due to inflation and geopolitical tensions, will drive gold up considerably this year,” he said, as quoted by Newsmax.com. “There has been a significant increase in demand from central banks to replace dollars with gold, and we’re just at the beginning of that trend. Gold will go up and the dollar will go down, so you’d be better off keeping your investment reserves in gold at this point. We’re at the beginning of trends that are going to increase the demand for gold, and inflation and geopolitical tensions will determine the rate at which gold increases. This year gold will appreciate versus the dollar, and also over a three, five- and ten-year basis.” That’s all positive news for Calibre Mining Corp. (TSX: CXB) (OTCQX: CXBMF), Barrick Gold Corporation (NYSE: GOLD) (TSX: ABX), Newmont Corporation (NYSE: NEM) (TSX: NGT), Kinross Gold Corporation (NYSE: KGC) (TSX: K), and B2Gold (NYSE: BTG) (TSX: BTO).

Look at Calibre Mining Corp. (TSX: CXB) (OTCQX: CXBMF), For Example

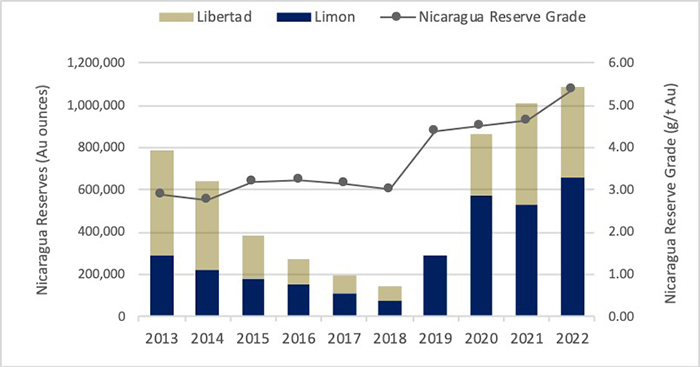

Calibre Mining Corp. announced the results of the Company’s updated Mineral Resources and Mineral Reserves for its Nicaragua and Nevada properties as of December 31, 2022.

Nicaragua 2022 Mineral Resource and Mineral Reserve Highlights

- 16% increase in the Nicaraguan Mineral Reserve grade to 5.37 g/t gold (2021: 4.62 g/t gold);

- 278% increase in the Nicaraguan Mineral Reserves to approximately 1,082,000 ounces gold, net of depletion since acquisition in 2019;

- Largest Nicaraguan Mineral Reserve estimate, at a record grade of 5.37 g/t gold, for the combined assets in 12 years;

- Panteon North Maiden Mineral Reserve estimate, discovered in May 2022, added approximately 244,000 ounces (0.8Mt at 9.45 g/t Au) to the Nicaraguan Mineral Reserves, and;

- The trend towards higher grades is anticipated will lead to lower per ounce costs.

Nevada 2022 Mineral Resource and Mineral Reserve Highlights

- 23% increase in pit-constrained Pan Mine Mineral Reserves to 234,000 ounces gold, net of depletion; and

- 12% increase in Pan Mine Measured and Indicated Mineral Resource to 359,000 ounces gold.

Nicaragua Mineral Reserves (Dec 31, 2022)

Darren Hall, President and Chief Executive Officer of Calibre stated: “Since acquiring our Nicaraguan assets in Q4 2019, the teams’ commitment has created significant value. Year-over-year we have discovered new, high-grade deposits, increasing overall reserve ounces and grades. In 2022, the discovery and delineation of the high-grade ore shoot at Panteon North resulted in 810,000 tonnes at a grade of 9.45 g/t Au for approximately 244,000 ounces of Mineral Reserves, a significant achievement for the team. We have a multi-rig drill program underway following up on the most recent results including 11.61 g/t Au over 9.3m located along the VTEM Gold Corridor approximately 1.5 km northeast of Panteon North indicating an additional high-grade opportunity not included in the 2022 Mineral Resource and Mineral Reserve statement.

Our 2022 Nevada programs yielded a 23% increase in Mineral Reserves, net of depletion. This, in combination with the discovery of new Coyote zone proximal to the operating open pit mine, demonstrates the additional upside that exists.”

Nicaragua 2023 Priority Mineral Resource Expansion Opportunities

- High-grade expansion opportunities at Limon include Panteon VTEM Gold Corridor and Talavera extension, and at Libertad include Veta Azul and Volcan, not included in the Company’s 2022 Mineral Resource statement;

- Additional Mineral Resource expansion and grade increase opportunities at our Eastern Borosi Project including Blag, La Luna and East Dome, as well as Riscos de Oro Southwest and Northeast extensions;

- First pass drilling at the recently permitted Buena Vista and La Fortuna concessions, located near the Limon and Libertad mine complexes, respectively, and;

- 60,000 metre drill program underway.

Nevada 2023 Priority Mineral Resource Expansion Opportunities

- Numerous discovery opportunities along a 5 km trend south of the Pan resource area and centered on the new Coyote discovery to be drilled following up on recent drilling success;

- 40,000 metre drill program underway, and;

- Generative program underway including mineral alteration classification and structural interpretation.

Other related developments from around the markets include:

Barrick Gold Corporation reported preliminary full year and fourth quarter 2022 production results. On the back of stronger Q4 production, 13% higher than the previous quarter, preliminary gold production for the full year of 4.14 million ounces was approximately 1% lower than the 4.2 million ounces1previously guided, while preliminary copper production of 440 million pounds for 2022 was in line with the guidance range of 420 to 470 million pounds. The preliminary Q4 results show sales of 1.11 million ounces of gold and 99 million pounds of copper, as well as preliminary Q4 production of 1.12 million ounces of gold and 96 million pounds of copper. The average market price for gold in Q4 was $1,726 per ounce and the average market price for copper in Q4 was $3.63 per pound.

Newmont Corporation joins the Dow Jones Sustainability™ World Index (DJSI World), representing the top 10% of the largest 2,500 companies in the S&P Global Broad Market Index. DJSI World membership is based on long-term economic factors, as well as leading environmental, social and governance (ESG) performance evaluated through the 2022 S&P Global Corporate Sustainability Assessment (CSA). In addition to being ranked number one in the Metals and Mining Industry, Newmont received the top score for the Governance and Environment dimensions and earned top decile performance in 23 of the 25 CSA performance categories. The ranking is based upon Newmont’s performance in calendar year 2022. As of December 9, 2022, the company achieved the highest score out of 147 metals and mining companies assessed in the CSA.

Kinross Gold Corporation has acquired deemed beneficial ownership of 5,018,017 common shares of Allegiant Gold Ltd. issuable upon exercise of common share purchase warrants previously acquired by Kinross. The warrants were acquired as part of the previously announced investment in Allegiant completed on March 17, 2022. Pursuant to the investment, Kinross purchased 10,036,034 units of Allegiant, representing 9.9% of the issued and outstanding shares of Allegiant. Each unit was comprised of one common share and one-half of one common share purchase warrant. The Units were acquired for a purchase price of $0.40 per Unit, representing an aggregate purchase price of $4,014,414.00. The common shares held represent approximately 9.8% of the currently issued and outstanding Allegiant common shares and the Warrants provide deemed beneficial ownership of common shares representing approximately 4.7% of the currently issued and outstanding Allegiant common shares. Accordingly, as of today Kinross is the deemed beneficial owner of common shares representing approximately 14.0% of the issued and outstanding shares of Allegiant and is therefore required by applicable Canadian securities laws to issue this press release and file a corresponding early warning report.

B2Gold announced its gold production and gold revenue for the fourth quarter and full year 2022, in addition to its production and cost guidance for 2023.Fourth Quarter and Full Year 2022 Highlights: Total gold production quarterly record in Q4 2022: Total gold production in the fourth quarter of 2022 of 367,870 ounces, including 15,101 ounces of attributable production from Calibre Mining Corp., a quarterly production record for B2Gold. Achieved upper half of 2022 annual gold production guidance: Total gold production for 2022 of 1,027,874 ounces (including 54,871 ounces of attributable production from Calibre), above the mid-point of 2022 guidance, the seventh consecutive year of meeting or exceeding annual production guidance.

Legal Disclaimer / Except for the historical information presented herein, matters discussed in this article contains forward-looking statements that are subject to certain risks and uncertainties that could cause actual results to differ materially from any future results, performance or achievements expressed or implied by such statements. Winning Media is not registered with any financial or securities regulatory authority and does not provide nor claims to provide investment advice or recommendations to readers of this release. For making specific investment decisions, readers should seek their own advice. Winning Media is only compensated for its services in the form of cash-based compensation. Pursuant to an agreement Winning Media has been paid three thousand five hundred dollars for advertising and marketing services for Calibre Mining Corp. by Calibre Mining Corp. We own ZERO shares of Calibre Mining Corp. Please click here for full disclaimer.

Contact:

Ty Hoffer

Winning Media

281.804.7972

[email protected]