Get a cup of coffee. There are lots here you'll be glad that you read.

Enterprise Group, Inc. (TSX:E) is a consolidator of services to the energy sector, focused primarily on specialized equipment rental.

The Company has successfully weathered several significant downturns in the Oil and Gas sector for almost 20 years, producing positive cash flow, growing revenues, and purchasing and retiring shares to the benefit of shareholders. With all that continuing, Enterprise is set up to participate and lead in the current Capex spending boon being facilitated by its clients.

Enterprise Group benefits as it is a ‘picks and shovel’ play highly correlated to rising CAPEX spending; When its clients boost spending, Enterprise sees a commensurate rise in business.

Take a moment to get up to speed on Enterprise. Des O'Kell, a founder, gives a great history and positions the Company. An excellent 5-minute synopsis from a company intimately involved in the O&G sector for over 1.5 decades.

Two years later, the global economy is roaring back, and analysts have forecast the reappearance of record-high oil and gas prices not seen for years.

Recent articles note Tier ones (A large part of Enterprises’ client base) are aggressively raising spending. Imperial Oil (TSX:IMO), Cenovus (TSX:CVE), Suncor (TSX:SU), ConocoPhillips (NYSE:COP) sharply raises Capex to $7.2 billion, and Chevron boosts spending 20 percent to US$15 billion.

2020 and the Pandemic saw Oil Demand drop by a staggering amount. Oil Giants responded by slashing CAPEX spending and keeping only "maintenance CAPEX" to keep production flat.

For years, Wall Street has pressured oil and gas companies to cut CAPEX and shift their cash to financial goals like boosting dividends and buybacks, paying down debt, and decarbonization after the fracking revolution left the U.S. shale patch bleeding money and deeply indebted.

Ready, Steady…

What is unique to this O&G up-leg is the amount of money and technology spent markedly reducing carbon emissions and greenhouse gases. Enterprise is ready for this development as it transitions from diesel power, both expensive and 'dirty,' to Natural Gas. Besides an initial drop in emissions, clients transitioning to Natural gas-powered generators and equipment will see the ugly diesel fueling costs they ate each year turn into a fraction of that number: And allow O&G companies to get to Government mandates with manageable pain.

All parties realize the benefit of this integral approach.

Leonard Jaroszuk, Enterprise President & CEO, states, "Our customers are doing the right thing, and we need to offer every advantage we can to support their socially-responsible goals. “

- Enterprise has recently invested in electrification grid technology fueled by natural gas power generation, with systems deployed for top-tier Canadian Producers.

- The emissions and cost reductions are significant for our customers' transitioning from diesel fuel sources to cleaner alternatives, with support and strong interest to expand upon that technology.

- Investment in technology, research, and development, combined with a widespread commitment to environmental sustainability that will allow Canadian producers to maintain their international leadership role in the energy transition

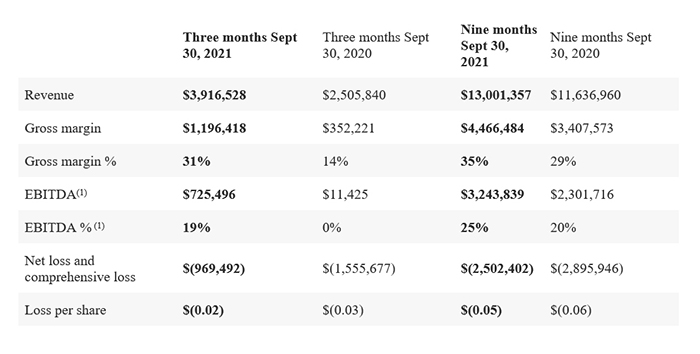

And if that's not enough to put Enterprise on your buy or at least watch-list, here are the latest numbers.

As

current production development Capex levels in the Canadian O&G sector

significantly increase and look to continue, Enterprise is prepared and

well-positioned to benefit from that growth.

Disclaimer: Nothing in this article should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this article is not provided to any individual with a view toward their individual circumstances. Baystreet.ca has been paid a fee of one thousand eight hundred dollars for Enterprise Group advertising. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this article as the basis for any investment decision. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in this article is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.