LEDE

Hello, All. This is Ophir writing. I had a chat with Invitae's CEO, Sean George, and its Chief Commercial Officer Katherine Stueland, two-days ago, just a couple of hours after earnings were released and I'm going to share what we spoke about while wrapping up the Invitae story holistically.

PREFACE

InVitae Corp (NYSE:NVTA) is our smallest Spotlight Top Pick, and also our riskiest. But, it is also the single Top Pick where we see the largest potential upside.

Invitae was added to Top Picks on September 1st, 2016 for $7.42. As of this writing the stock is trading at $9.22, 24% higher.

INVITAE - THE RISK

We're going to start where we usually finish when we discuss this company, which is simply a risk alert:

Invitae has a special kind of risk relative to other Top Picks in that the company could fail - not in the sense that the stock drops and it's a lousy investment, but in the sense that it could go away - as in, zero.

We're starting here because what we're about to cover is a very bullish thesis, so much so it will be easy to get tangled in that web and lose perspective. We are bullish on Invitae -- extremely so -- but that doesn't mean we're right, and that doesn't mean there isn't risk.

INVITAE - THE STORY

Invitae is the opportunity so many investors say they welcome – say they search for. The opportunity to find the "Next Apple," or the "next Google." The genomics realm is growing and will become a part of main stream medicine in the near future. It has the potential to re-shape everything about the way we are treated medically.

This is a world where pre-emptive care saves lives before diseases take shape. A world where risks are identified early and treatments are pinpointed, down to the individual person. Where people no longer suffer through years of agonizingly imperfect diagnoses, where doctors are finally empowered with the information they need to heal and prevent, rather than to react and to guess.

InVitae has a simple goal: to bring genetics into mainstream medicine. So far, it's working.

In the latest earnings call, CEO Sean George touched on the total addressable market (our emphasis is added):

That's a huge opportunity, we suggest in all seriousness an addressable market of more than a billion people in modern medical systems worldwide.

Invitae is building a business for the genomic era in which comprehensive genetic information and services are an essential and integrated part of medical care.

INVITAE- PROGRESS AND EARNINGS CALL

Here is a quick chart storm of Invitae's progress with some discussion and highlights from the earnings call. Then we will get to our meeting with the team.

We start with revenue, and as the company writes, "momentum is accelerating with more than 150% year-over-year growth."

We have hand entered that last bar -- revenue in the trailing twelve months is now just above $40 million, up from less than $15 million a year ago.

Here is commentary from the earnings call:

Starting in 2017 we became convinced that our base business is on-track to become a runaway leader in diagnostic pediatric and adult inherited disorders making it the right time for us to accelerate our strategic plans for growing our business.

Now, as volume has increased, so too cost of each test has declined rapidly:

The average test cost Invitae $500 last year -- today that cost sits at $345. As of two quarters ago the company turned a gross profit, which is a fancy way of saying the average revenue received per test is now greater than the average cost.

From the earnings call we got this: "Revenue collected per report delivered increased to $563."

As revenue has jumped and average cost per sample have decreased, the company has also increased its gene reach:

This is from Invitae's CFO, Shelly Guyer:

We accessioned approximately 30,500 samples in the quarter, this reflects not only year-over-year growth of approximately 140% but also a 17th consecutive quarter of double-digit sequential growth.

Importantly, volume growth was seen across all clinical areas. As a result, we increased our full year volume guidance to 120,000 to 130,000 samples accessioned.

A great gene accession count allows for the testing of more diseases, with greater depth. Our final chart is perhaps the most stunning.

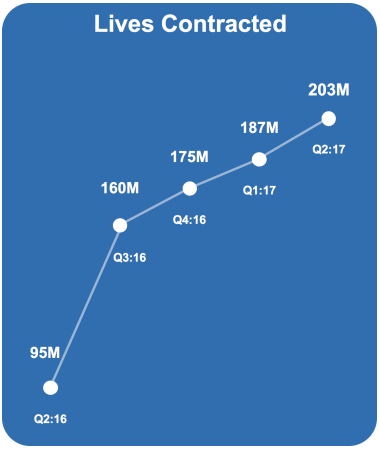

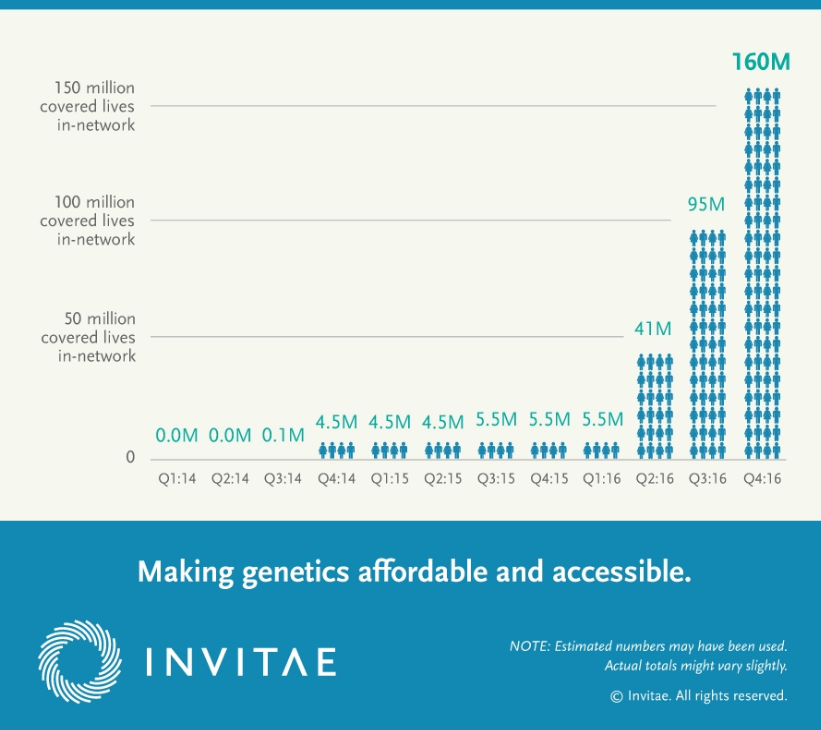

The insurers of 203 million people now cover Invitae tests. But that chart doesn't do the company justice. Here is the chart from three-quarters ago:

That chart stops at 160 million -- as of the latest earnings call, the most recent bar would reach over 200 million.

So, before we move on to our discussion with the company we note triple digit percent growth in revenue, decreasing cost of goods sold (which means increasing gross profits), an outpaced growth in accessioned genes and now a tremendous moat in lives insured.

More from the CFO:

We have signed contract with all but one of the major payers and have been steadily layering in remaining regional private payers.

Now, our conversation.

THE CALL

We can start with insurance and the roll payors play. While there are literally hundreds of new genomics companies popping up, insurance companies are the gatekeepers. As Invitae becomes the gold standard in the industry it is creating a moat.

I discussed this with Sean, and the idea that if payment speeds are increasing for Invitae that they may in fact be decreasing for other genomics providers. We can see evidence of Invitae's growing moat with their commentary not just on the call with me, but openly to Wall Street analysts:

Last quarter management provided detailed insight into the reimbursement trends impacting revenue growth and noted that we expected our efforts to operational these contract signed in the latter part of 2016 would result in significant revenue ramp in the second half of 2017.

As you can see by the more than 150% year-over-year growth and nearly 40% sequential growth in revenue that lift has begun.

Insurers want genetic testing to become the standard -- it finds risks before they become full blown diseases and allows for treatment well before disaster strikes. With all but one of the major insurers left and 203 million lives covered, and payment speeds increasing, we can see this moat in plain sight.

Shelley Guyer went on to say: "the increased reimbursement during the second quarter dramatically improved our gross profit."

Invitae has projected revenue of $55 million - $65 million for full year 2017 and loosely discussed another doubling of revenue in 2018. I re-confirmed this loose guidance, although we are talking about Invitae proper. We now have to discuss Invitae's acquisitions.

Acquisitions

Invitae acquired two companies recently and the final impact was revealed on the earnings call.

First, Invitae has acquired GoodStart Genetics. Good Start had $22.5 million in revenue in 2016 and turned a gross profit of $9.7 million and a net loss of 18.1 million.

For the second quarter of this year, GoodStart recorded an estimated revenue of $5.2 million. Good Start accessions nearly 9,500 samples in this most recent quarter. For the second quarter of 2017 Good Start achieved gross profit of $1.6 million representing a gross margin of 30%.

Invitae expects it will take up to three quarters to improve GoodStart's gross margins and that will result in an overall improvement in gross profit and gross margin for the combined company. Invitae re-iterated their long-term guidance of 50% gross margins across Invitae platform.

Invitae acquired the company for about $40 million in in cash and stock.

The rationale behind the GoodStart acquisition was as follows:

* The company is a first entry point into the broader Perinatal market by way of carrier and preimplantation genetic diagnosis (PGD) capabilities in the In Vitro Fertilization (IVF) sector.

Recall from our prior conversation with CEO Sean George that Invitae's overarching goal. We learned that Invitae is in a pilot program and later this year is going to sequence babies at birth and follow them through life.

This is where the company will turn on the genome management business – with the idea that if parents are going to run a genetic test on their babies, it might as well be comprehensive. With the service business of genome management, Invitae will stay in touch with the baby throughout life to stay on top of health progress.

* GoodStart has strong relationships with clinicians, seamless customer experience, solid customer workflow tools.

* The company will bolster Invitae's sales force with the addition of commercial team members covering ~500 IVF clinics nationally.

* We also learned that GoodStart too has strong reimbursement with over 130 million lives under contract or in credentialing as of Q1 2017.

Sean noted that the acquisition of Good Start (CombiMatrix) "enable(s) [Invitae to] deliver genetic information to inform healthcare decisions at every stage in a patient's life. This is a transformative moment for Invitae, for our industry, and importantly, for the patients we serve."

Invitae also agreed to terms to acquire CombiMatrix -- this is officially a "pending acquisition." Here is the rationale behind that takeover:

* Expand into prenatal, miscarriage and pediatric testing. Here's a helpful slide from the earnings presentation:

More rationale:

* Adding more prenatal sample types and products of conception.

* Accelerates conversion from chromosomal microarray to next generation sequencing (NGS) testing for perinatal and pediatric primary diagnostic testing.

* Trusted provider of miscarriage analysis, historically covered by third-party payers.

* Bolsters sales force with the addition of commercial team experienced in the perinatal space.

In sum, the totality of Invitae with its two small acquisitions accelerates the company's stated goal of creating one platform, delivering diagnostic-quality genetic information to inform healthcare decisions throughout life.

A company slide reads: The combined entities will also simplify multiple call points with a consolidated menu: one company, one platform, one sales force.

LONG-TERM GOALS

OK, that was the quarter that happened, the acquisitions that are upon the company and the goals, re-stated, or re-iterated, including the goal of having a cash flow positive quarter as of Q4 2018, and then onward.

The CFO did explicitly state:

Longer term, we believe that the acquisition of Good Start and the proposed acquisition of CombiMatrix will contribute positively to cash flow allowing us to reach cash flow breakeven by the end of 2018.

THE UPSIDE

While Invitae had guided revenue in the $55-$65 million range by year end, with the combined entities that revenue target is now in the $90 million - $115 million range.

But at CML we are looking well beyond the next year or two. In fact, I told Sean that within 4-years I believed Invitae could hit half a billion dollars in revenue. I can tell you that while Invitae has not put out official guidance beyond 2018 that $500 million didn't receive any push back, and if anything, felt a little conservative.

They see a wide-open market, a growing leadership position, a growing moat, exploding revenue, lowering cost of goods sold, and the soon to be disruption that is their Exome product (you can read details about the Exome on the dossier that covers our first meeting with Sean Speaking with the CEO of Invitae).

We see a company that, as of this writing, has a market cap of $390 million that could well show $500 million in sales in the mid-term with 50% gross margins and an ever-growing moat. And for the record, yes, the company does have a small foot print internationally, and CCO Katherine Stueland does have her eye on the prize there as well.

We could be wrong about Invitae, which is to say, yes, companies that look like they are ready for a huge bolt forward do fail -- competition, poor execution, miscalculated costs -- all these things can overcome even the most bullish opportunity. But for now, we remain very bullish and see tremendous upside to this young genetics company that could in fact change the world, and in the process, see its stock price rise.

We'll leave it with Sean's remarks:

In summary, we believe that we are winning the race to scale and we are uniquely positioned to change this industry for the better having recently taken some bold steps to do so.

We can now apply our business model and industry leading capabilities to serve patients and their families across all stages of life.

SEEING THE FUTURE

It's understanding technology that gets us an edge on finding companies like Invitae early, finding the gems that can turn into the 'next Apple,' or 'next Amazon,' where we must get ahead of the curve. This is what CML Pro does.

Each company in our 'Top Picks' has been selected as a future crown jewel of technology. Market correction or not, recession or not, the growth in these areas is a near certainty. We are Capital Market Laboratories. Our research sits next to Goldman Sachs, JP Morgan, Barclays, Morgan Stanley and every other multi billion dollar institution as a member of the famed Thomson Reuters First Call. But while those people pay upwards of $2,000 a month on their live terminals, we are the anti-institution and are breaking the information asymmetry.

The precious few thematic top picks for 2017, research dossiers, and alerts are available for a limited time at a 80% discount for $19/mo. Join Us: Discover the undiscovered companies that will power technology's future.

Thanks for reading, friends.

The author is long shares of InVitae Corp (NYSE:NVTA).

Legal The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.