2017 will go down in the history books as the year when a long bull run for metals really took off. Prices for a long list of metals have soared this year, making some investors rich, but leaving many more envious because they missed the boat.

But with the electric vehicle revolution only at its beginning stages, the price for some of these metals will remain sky-high, and will not come back to earth anytime soon. Copper, nickel, cobalt and lithium are just a few of the materials that are essential to an electric vehicle, and they are enjoying a once-in-a-generation hot streak. The producers of these components should be on every investor’s radar.

Here are 5 companies that produce some of the most critical materials that go into an electric vehicle.

#1 FMC Corp. (NYSE:FMC)

Investors looking for profits in the EV boom can’t overlook lithium, which has quickly become a hot commodity for EV manufacturers and battery makers. And because prices are skyrocketing, lithium producers have become the belle of the ball.

Investors in FMC have been massive winners this year – the company’s stock price is up more than 80 percent in 2017. Soaring lithium prices no doubt contributed to the company’s banner year.

FMC took in $94 million from its lithium unit in the third quarter, a 35 percent jump from a year earlier. A jump in earnings came from its operations in China, where FMC is ramping up production of lithium hydroxide. FMC was the only producer to add significant lithium hydroxide capacity this year.

FMC is also debottlenecking its project in Argentina, and it expects to double its output from 2,000 to 4,000 tonnes by the end of next year. The company is also conducting engineering work to add another 20,000 tonnes in Argentina.

Nomura raised its price target for FMC to $106 per share, after its third quarter earnings beat expectations. FMC was trading at about $94/share in the second week of November.

There is something unique about FMC that investors will want to keep an eye on. FMC is expected to spin off its lithium division in the second half of 2018, establishing a standalone pure-play lithium listing. Up until now, investors who wanted some action in lithium likely felt a little unsatisfied with FMC, because its many other businesses diluted the lithium exposure. That is about to change next year.

#2 Quantum Cobalt (CSE:QBOT; OTC:BRVVF)

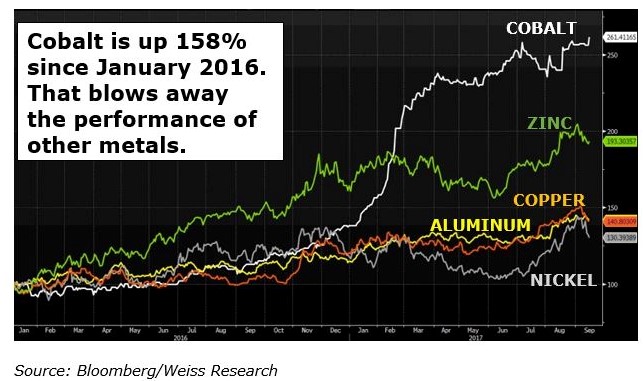

Although EVs are inflating prices for a lot of key metals, cobalt stands head and shoulders above the rest. Cobalt prices are up nearly 160 percent since January 2016. And the thing is, because supply is restricted, cobalt prices are heading in only one direction: Up.

Why is cobalt the stand out performer when demand for all of these metals is soaring? Because it has a unique and massive sourcing problem.

Battery manufacturers and automakers who are scrambling to find a reliable supply of cobalt see two-thirds of the world’s cobalt production coming from the conflict-riddled nation of the Democratic Republic of the Congo (DRC). Sourcing conflict metals from a nation beset with violence, child labor, and slave-like conditions is, needless to say, not a good look for corporations worried about their PR image. Apple said earlier this year that it has stopped buying cobalt from problematic mines in the DRC, and many other tech and auto giants are under similar pressure to straighten out their supply chains.

It’s a tricky situation though, because of there is a shortage of conflict-free cobalt mines. Everyone is abandoning the DRC, and there isn’t really a Plan B.

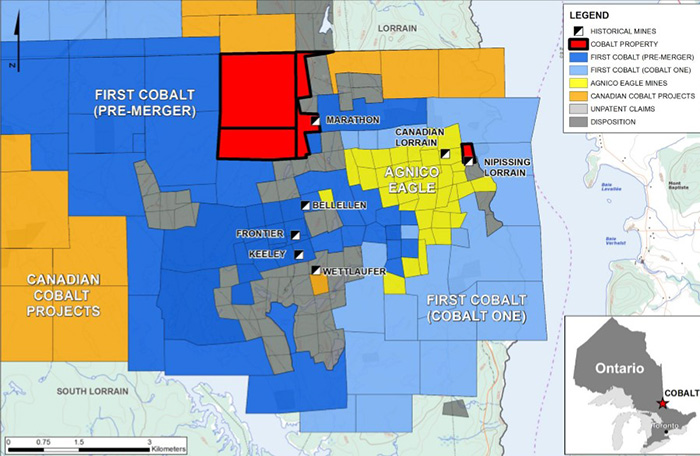

But that is quickly changing with a new cobalt mecca emerging in Ontario, Canada, around a town aptly named Cobalt. “Anybody who has cobalt outside the DRC is in a better situation because carmakers are very worried about their supply chains,” Roger Bell, director of mining research at Hannam & Parters in London, told Bloomberg. The mass adoption of EVs will mean cobalt producers will struggle to keep up with demand. “Even in the most conservative assumptions, you’re looking at maybe a 20 percent gap between supply and demand for cobalt by 2025.”

At the center of it all are just a few companies. Quantum Cobalt (CSE:QBOT; OTC:BRVVF) is one of these, with some of the most exciting prospects at the heart of the cobalt rush. Its Nipissing Lorrain Cobalt Project is the site of a once-producing mine that has cobalt mineralization at 22 percent, an eye-popping figure when you consider that most projects are viewed as highly valuable with mineralization at just 0.05 percent.

Quantum has two other exploration projects underway. The Rabbit project is 55 kilometers to the north with past records showing cobalt mineralization at 8.76 percent. Then there is the Kahuna Cobalt-Silver project, an area covering 1,200 hectares, also has demonstrated cobalt mineralization in the past.

Quantum has some near-term catalysts just over the horizon. It has crews currently carrying out exploration work on the Rabbit and Kahuna sites, and the results could catapult the company to a higher level of investor excitement.

"Very few [mining companies] are at a level where they'd be putting shovels into the ground. But that could happen very quickly," Gino Chitaroni, president of the Northern Prospectors Association and a geologist from the region, told the CBC earlier this year. Exploration is underway in earnest and production could come online towards the end of the decade.

To get an idea of just how hot this area is, you need only look at Quantum Cobalt’s neighbour First Cobalt Corp. (CVE:FCC). The company withdrew from the DRC to scale up operations in Canada and its stock price has surged by 90 percent this year. First Cobalt has a market cap of CAD$39 million, but that is expected to rise to more than CAD$150 million once it complete a key acquisition. The company’s soaring valuation suggests that tiny Quantum Cobalt is a highly undervalued neighbor.

It is still early days, but the cat will soon be let out of the bag. Cobalt will surely mint a lot of new millionaires, and much of that fortune is destined to be made in Cobalt, Ontario, where companies like Quantum Cobalt are quietly building a world-class production base.

#3 Rio Tinto (NYSE: RIO)

Rio Tinto is a household name for mining investors, and there is a lot to like from the mining giant when looking for a way to profit off of the EV revolution. Rio Tinto is one of the top global producers of both aluminum and copper, making it a strong investment case for the next decade or so.

Aluminum is highly important for the structures, or cases, that hold the batteries in EVs. Those cases allow for thermal transfer – something that aluminum is great at – which keeps batteries cool or warm, depending on what is needed. Aluminum is also essential for brake components. Aluminum’s lightweight qualities mean that more and more automakers will be switching over to aluminum, because reducing weight is necessary to extend the range of EVs.

Aluminium will not be an alternative for an EV, it will be mandatory,’ Lionel Chapis, managing director for automotive structures at Constellium, told Aluminum Insider in an interview. Finally, aluminum will be a key ingredient in the build out of EV recharging infrastructure.

Overall, demand for aluminum from the automotive industry in Europe will grow at a 12 percent CAGR between 2016 and 2021, while North America will see a 19 percent CAGR over that same time period. Prices recently hit a 5-year high, and are showing no sign of slowing down.

Rio Tinto has bauxite production – the precursor to aluminum – and smelters all over the world, with a heavy presence in Australia. The miner’s bauxite production was up a healthy 4 percent in the third quarter. Rio Tinto is keen to reward shareholders, announcing a $2.5 billion share buyback program in September, using the proceeds from its divestment from Coal & Allied.

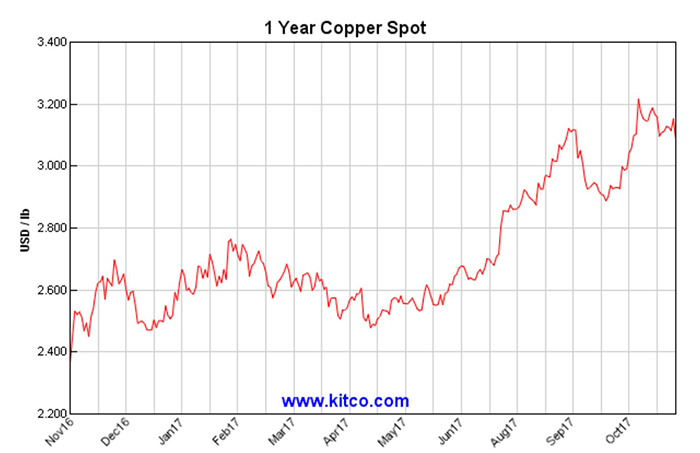

The aluminum proposition is a strong one, but adding to Rio Tinto’s allure is that it is also a significant producer of copper, which, as mentioned above, is critical to the wiring of EVs, as well as for EV recharging infrastructure. Copper prices have surged nearly 20 percent this year. Strong economic growth explains some of that resurgence in prices, but such a dramatic spike suggests there is much more going on. The EV boom is central to the story here.

Goldman Sachs said in a recent investment note that it expects the bull run for metals to continue, particularly because demand from EVs will keep supply tight. And here’s the twist: prices are already up on strong demand, but Goldman says demand really starts to take off in the early 2020s. That means investors who get in now before prices move up too much will have a strong position for the long haul.

#4 Southern Copper Company (NYSE: SCCO)

Copper is integral to the development of wiring in an electric vehicle. EVs use four times as much copper as a traditional gasoline-powered vehicle – 80 kilograms compared to just 20 kg. On top of that, the build out of tens of thousands of EV recharging stations will add 5 percent to global copper demand by 2025, according to BNP Paribas.

Copper prices hit a three-year high in September, riding the EV wave up along with a lot of other metals.

Southern Copper Corp. is one of the largest integrated copper producers in the world, with mining, smelting and refining facilities in Mexico and Peru, along with exploration assets in Chile.

The company’s stock began to take off in late 2016, and has not looked back since. Third quarter profits were up more than 103 percent compared to the same period in 2016, surpassing $400 million. Cash flow in the first nine months of this year jumped to $1.2 billion, also up more than 100 percent from a year earlier. Southern has done a great job keeping costs under control, meaning that surging copper prices translate almost entirely into extra profit.

Southern Copper is sharing its newfound windfall with investors – the company more than doubled its dividend this year to $0.25 per share, ending what had been a decade of consistent reductions in the shareholder payout.

For Southern, things will only get better from here as carmakers scoop up evermore volumes of copper for their vehicles. “We are currently seeing a substantial price improvement caused by an expected copper market deficit in the coming years,” German Larrea, chairman of the board for Southern Copper, said in a statement.

Southern is positioning itself to be a key supplier in the years ahead, with new projects coming online in Mexico and Peru. “After completing our expansion in Mexico, we are now nearing completion of the Peruvian Toquepala expansion project. This investment in Peru will add 100,000 copper tons to our annual production, allowing us to reach one million tons of copper production capacity per year,” Larrea boasted.

#5 Albemarle (NYSE: ALB)

The lithium story is real – Goldman Sachs predicts lithium supply will have to expand fourfold within the next decade just to keep pace with demand. “Such dramatic growth was rare in the history of commodities,” Goldman wrote in a not to investors.

That means prices are high and won’t go down anytime soon. UBS predicts that lithium prices will remain elevated through 2024 at least.

Albemarle is another lithium play, except what makes it stand out is the fact that it is the world’s largest producer. The company controls a whopping 35 percent of global lithium supply. It has three major sources of lithium, including its Salar de Atacama project in Chile, its Silver Peak mine in Nevada (near Tesla’s gigafactory), as well as its Talison Lithium joint venture in Western Australia.

Albemarle is riding the lithium boom better than anybody else – its share price is up 66 percent this year, and the company has steadily increased its dividend over the past several years.

Albemarle is aggressively pursuing expansion in order to satisfy market demand. It aims to boost capacity to 165,000 metric tons by 2021, which will be possible because of expansions at its sites in Western Australia and Chile, while continuing exploration work in other parts of Chile and Argentina.

Albemarle is already the world’s top supplier, but it is rapidly growing production. The company has dubbed its huge expansion through 2021 its “wave 1” expansion, which tells investors all they need to know about Albemarle’s ambitions.

Honorable mentions:

Nemaska Lithium Inc. (TSX:NMX) is a smart company which realizes that lithium will be used in nearly every major tech-leap in electric vehicles and consumer products using batteries the coming years. With a looming lithium supply squeeze coming, Nemaska has a unique technology and great government support. Nemaska explores and develops hard rock lithium mining properties and related processing in Quebec.

It’s small, and its shares are trading right now under $1, but it’s the government support you should look out for. Smart investors know a good thing when they see it and will be sure to follow Nemaska in the coming years.

Lithium Americas Corp. (TSX:LAC) is a resource company with a focus on lithium development. The company’s two large plays, the Cauchari-Olaroz project in Argentina – a joint venture with Sociedad Química y Minera de Chile - and the Lithium Nevada project in Nevada, are promising assets that will be sure to provide the company for many years to come.

The company’s impressive market cap, keen eye for investments, and excellent partners have certainly sparked the interest of investors. The company’s YTD stock value has increased by over 100% and shows no signs of slowing down.

Neo Lithium Corp. (TSXV:NLC) is a new player having entered the scene in 2016, but it is certainly not a company to overlook. In early 2017, Neo Lithium announced a huge discovery of a high grade salar and brine reservoir in Argentina’s lithium triangle.

Taking full advantage of increased lithium demand, Neo Lithium is making moves within the space that investors are paying close attention to. As demand continues to grow, supply will not be able to keep up, making Neo Lithium a hot target in the market.

Ballard Power Systems (TSX:BLDP) Ballard develops and produces hydrogen fuel cell products for markets such as heavy-duty motive, portable power, material handling and transportation.

Ballard’s stock price jumped a whopping 27% in September as the company announced a new way to manufacture fuel cell batteries, reducing the need for platinum in its production process by some 80%. Ballard expects to start producing the new fuel cells at the end of this year.

While Ballard looks at bit expensive compared to its peers, the stock should be on investors’ radars as this is one of the most exciting fuel cell stocks.

Orocobre (TSX:ORL) This company has had some serious problems and its stocks have seen major extremes. Right now it’s really low and has earned the title of one of the most-shorted stocks in this space because of production delays and even a gross spreadsheet error. But the company still must be viewed as the first brine concentrate lithium project in 20 years, and a new catalyst may end up being the ability to self-fund the expansion of its Olaroz lithium hydroxide plant in Japan.

Right now, Orocobre is on a rampage. The TSX traded stock has risen 25% in three months, with no signs of slowing. The company has just announced big news and could be a potential target for takeover.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This communication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include: that cobalt demand will increase in the future, and potentially by 14,900% by 2030; that cobalt supply will not be able to catch up to future increases in demand; that one of the biggest beneficiaries in the EV supply chain will be cobalt miners and, specifically, new entrants that develop new supplies that are safe and ethical; that cobalt prices could go even higher than current levels; that rapid news flow on prospecting, geologic mapping, geochemical mapping, geochemical surveying and sampling to locate and delineate mineralized structures can be expected from Quantum Cobalt Corp. (“Quantum Cobalt”); and that this year will be the year in which cobalt leaves Africa and is relaunched in Canada. Risks that could change or prevent these statements from coming to fruition include: that cobalt demand will not increase, as expected, in the future; that cobalt supply will be able to catch up to future increases in demand; that one of the biggest beneficiaries in the EV supply chain will not be cobalt miners or that new entrants developing new supplies that are safe and ethical will not benefit from the EV supply chain; that cobalt prices will not go higher than current levels; that rapid news flow on prospecting, geologic mapping, geochemical mapping, geochemical surveying and sampling to locate and delineate mineralized structures will not be forthcoming from Quantum Cobalt; and that this year will not be the year in which cobalt leaves Africa and is relaunched in Canada. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. The forward-looking statements contained in this communication reflect the current expectations, assumptions and/or beliefs of the writer based on information currently available to the writer. In connection with the forward-looking statements contained in this communication, the writer has made assumptions about: future increases in cobalt demand; the ability of cobalt supply to catch up to future increases in demand; the biggest beneficiaries in the EV supply chain, going forward; future cobalt prices; Quantum Cobalt’s future news flow; and the fact that this year will be the year in which cobalt leaves Africa and is relaunched in Canada. The writer has also assumed that no significant events will occur outside of Quantum Cobalt’s normal course of business. Although the writer believes that the assumptions inherent in the forward-looking statements are reasonable, the forward-looking statements are not a guarantee of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. The forward-looking information contained herein is given as of the date hereof and the writer assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Safehaven.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively, “we” or the “Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by Quantum Cobalt ninety thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is not a recommendation to buy or sell securities. This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. We have not investigated the background of Quantum Cobalt. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. These non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor awareness efforts. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company, in communications, writing and/or editing.

DISCLOSURE. The Company does not make any guarantee or warranty about what is advertised above. This article and the information herein are provided without warranty or liability.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc., discussed in this message and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect those of the publisher.