In a matter of weeks, Canada will most likely legalize marijuana for recreational use. Expectations for a pot boom sent stocks soaring in 2017, and while enthusiasm ebbed early this year the index for cannabis stocks is up 71 percent from November last year.

Production of marijuana is expected to surge this year and companies are looking abroad for more investment.

“Cannabusiness” is one of the hottest market trends this year, but finding the right company can be challenging.

The industry is full of risky plays: growers who lack a market outlet, or distributors without access to sufficient product.

Analysts have become wary, even warning investors away from the riskiest plays.

But that doesn’t mean there isn’t plenty of opportunity for investors who do their research to make smart choices.

Here are five companies that span the cannabis space, who could profit from this year’s biggest trends in the pot market:

#1 GW Pharmaceuticals (NASDAQ:GWPH)

This major pharma company is getting into the cannabis game through a major industry milestone: in 2018, GW Pharma received approval for its cannabis-based drug Epidiolex from the Federal Drug Administration.

For the first time, the FDA approved a drug based on cannabis for the American market…and GW Pharma’s stock enjoyed a huge boost at the news.

The drug itself is expected to be a big seller, one of the 10 biggest new drugs of 2018 according to Evaluate Pharma.

Epidiolex reduces seizures in patients and could mark the beginning of a new age of federally-approved cannabis-based drugs used for a wide variety of treatments.

Industry leaders are already arguing for cannabis as an alternative to opioids, which have ravaged the United States in recent years.

With the U.S. government ready to step in to reduce opioid abuse, cannabis drugs may provide an alternative. GW Pharma is the first to profit from an approved cannabis-based drug, and it could be the pioneer that brings cannabis drugs into the mainstream.

#2 BLOCKStrain Technology Corp. (TSX-V: DNAX)

Marijuana is an industry that comes with a lot of risk, and even more uncertainty—products are developed and sold on the black market, producers are unsure if their plants are adequately protected from intellectual theft, and consumers have little protection or quality control.

But now, a company has emerged to solve those problems by deploying the power of the blockchain.

BLOCKStrain (TSX-V:DNAX) is the first company dedicated to verifying marijuana products as they enter the market.

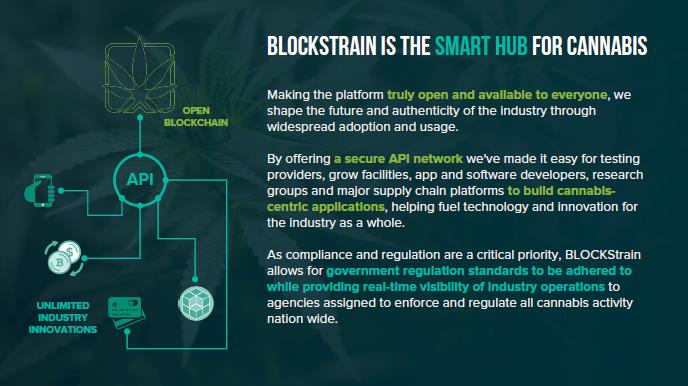

The company has developed a “smart hub” for cannabis, a repository that can act as a “single source of truth for cannabis strains and their ownership.”

The company uses the blockchain technology that allows transactions to be processed at lightning speeds without the need for a sluggish middleman.

BLOCKStrain’s network will act as a “clean, immutable, legal and transparent distribution network of product between producers and consumers.” It’s the first time a company has dedicated itself to bringing this level of security and transparency to the pot market.

BLOCKStrain verifies every marijuana product that clients add to its blockchain database, tracking products and ensuring validity.

Their service is a crucial one. As Canada undergoes wide-spread legalization of marijuana, ensuring greater transparency for producers and consumers will be crucial to the industry’s growth, which could be as large as a $77-billion market.

BLOCKStrain has already signed on its first client: WeedMD Inc., a fully licensed producer (LP) under Canada’s Access to Cannabis for Medical Purposes Regulations (ACMPR).

According to Derek Pedro, design, cultivation and production partner at WeedMD, “BLOCKStrain is best positioned to protect our intellectual property by further validating and securing our best-in-class genetics.”

In March, BLOCKStrain, as part of a strategic investment, received a $500,000 infusion from WeedMD, which ‘’will be amongst the first federally-licensed producers to initiate the integration of blockchain technology into its ecosystem’’.

And this deal could be the first of many and BLOCKStrain has its sights set on every LP in Canada…and now, there are more than 100 that could benefit from the services of the blockchain to verify and protect their products.

BLOCKStrain’s CTO is a veteran of applying cutting-edge tech to the cannabis industry. As CTO of Weedmaps, he oversaw the company’s multiple technology systems during an exciting growth phase in 2015.

And why stop at pot? BLOCKStrain’s CEO, Robert Galarza, has already indicated interest in broadening the scope of the company’s services beyond cannabis to the grocery industry, which is valued at $2.3 trillion.

Blockchain could transform entire industries, and BLOCKStrain is poised to bring it to the weed business. This is a company to watch.

#3 Canopy Growth (TSE: WEED)

Judging by market cap, Canopy Growth is the biggest pot player around. The grower bucked the trend in early 2018. As most cannabis stocks slumped, it enjoyed a 10 percent boost, stemming from investor confidence in the company’s vertical integration.

Canopy has seen impressive growth, rising by 20.4 percent in the last three months and 292 percent in the last year on the Toronto exchange.

Canopy is set for a large expansion, in anticipation of increased demand if Canada’s legalization indeed goes through this summer. The company has seven facilities totaling 665,000 square feet and is developing greenhouses on 3.7 million square feet in British Columbia.

While the company seems to be keeping expectations of growing potential conservative, with this much land, it could emerge by 2019 as Canada’s top grower.

As a sign of its potential graduation from scrappy start-up to established pot player, Canopy Growth has applied to list on the NYSE.

If successful, that could place it above the rest: a cannabis company listed amongst Fortune 500s and Blue Chip firms.

#4 Scotts Miracle-Gro Co. (NYSE: SMG)

A company with strong name-recognition in garden materials, Scotts Miracle Gro. has emerged as a significant stock in the cannabis industry and presents a way to invest in the marijuana boom without exposure to riskier ventures.

Scotts has a 75 percent stake in Gravita International, a company that manufactures hydroponics equipment, a crucial component in marijuana cultivation.

The company claims more than $250 million in revenue from their hydroponics holdings.

Scotts acquired another hydroponics firm last month, scooping up Sunlight Supply for $450 million.

The aggressive move into hydroponics is part of a strategy concocted by Scotts CEO Jim Hagedorn, who hopes to pivot Scotts into a major player in the cannabis industry after the company hit a rough patch in the aftermath of the Great Recession.

The move seems to have paid off: Scotts saw solid growth during 2017, as did much of the cannabis market. Still, the price has doubled since the doldrums of 2014, and with growers increasing acreage to meet future demand, Scotts should expect demand for hydroponics products to grow at a steady rate moving forward.

#5 Aurora Cannabis (NASDAQ:ACBFF)

This cannabis firm just pulled off the first big acquisition in industry history: in May, it announced the takeover of MedReleaf (NASDAQOTH:MEDFF) for $2.5 billion.

This comes after another big acquisition earlier in the year, when Aurora bought out CanniMed for $852 million.

With so much money to throw around, Aurora is on the verge of pulling an “Amazon” -type move: dominating every aspect of the supply chain, from production to distribution.

The company has a huge, 800,000 square foot growing facility that is expected to become fully automated: once complete, it could produce 100,000 kilograms of dried cannabis each year. Another facility, 1.2 million square feet in size, is planned for next year.

CEO Terry Booth wants Aurora to be the top grower in the industry, and has his sights set on spreading Aurora to distribution after legalization goes through in Canada.

Like a lot of pot stocks, Aurora shot up in the early part of 2018, only to tumble in February and March. Investors are greeting the news of the MedReleaf acquisition with caution, out of concerns that the company is spreading itself too thin.

But there’s no question that Aurora has the potential to be the biggest grower in North America by the end of the year, in a superb position to dominate upstream and seize a huge chunk of the market.

Other companies looking to capitalize on the cannabis boom:

Hydropothecary Corp (TSXV:THCX) is a another heavy hitter in Canada’s cannabis scene. With former BC Health Minister Dr. Terry Lake as the VP of Corporate Social Responsibility, and the well-versed Ed Chaplin, who has raised millions for his previous ventures, as the Chief Financial Officer, the company is sure to have a bright future ahead.

With 4 primary products, including Canada’s only peppermint flavored medical cannabis oil sublingual mist, Hydropothecary has chosen quality over quantity. Offering patients the ability to administer their medication in a smoke-free format provides users with an option that is not available just anywhere.

Keep an eye on this stock moving forward as it may just have what it takes to take the industry by storm come June 2018.

Emerald Health Therapeutics Inc (TSXV:EMH) is another producer and distributer of medical marijuana. Based in British Columbia, Emerald Health is fully licensed by Access to Cannabis for Medical Purposes Regulations (ACMPR) and provides high quality medicine of different varieties. The company’s approach to research is what really sets the company apart from the competition. With the incredible emphasis placed on isolating the most important qualities in each strain and creating new products for patients, it is no wonder their medicine is so popular.

Aurora Cannabis Inc (TSX:ACB) which is a producer and distributer of medical marijuana across Canada. The company, formally Prescient Mining Corp, is a Vancouver-based business founded a little over one decade ago. Aurora’s main objective is to bring medicine to the people reliably and economically, which sets it aside from many of its major competitors. In the marijuana industry, patients will often have to jump through hoops to procure their medication, but with Aurora’s caring and knowledgeable staff, patients no longer have to worry.

Aphria (TSX:APH) is a Canada-based cannabis company which focuses on the production, sales, and distribution of legal marijuana. The company’s business model focuses primarily on online sales, which is perfect for its patients. A simple point and click and the medication will arrive at the patient’s in no time.

Aphria’s products are developed to treat to a variety of different patients and symptoms. The company offers several smoke free medications for those who are unable to consume the products in that manner. Aphria also produces low-THC products for patients who are more sensitive to marijuana’s psychoactive properties.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Disclaimer for Forward-Looking Information

Certain statements in this press release are forward-looking statements and are prospective in nature. Forward-looking statements are not based on historical facts, but rather on current expectations and projections about future events, and are therefore subject to risks and uncertainties which could cause actual results to differ materially from the future results expressed or implied by the forward-looking statements. Forward-looking statements in this news release include that Blockstrain’s technology will work as well as expected; that the cannabis industry in Canada and worldwide will continue to grow and meet sales expectations; that Blockstrain’s technology will successfully validate and verify products, providing security for LPs and transparency for users; that Blockstrain can dominate the Canadian cannabis verification market; that Blockstrain could bring its tech to cannabis markets all over the world; that using the blockchain cuts down on verification costs; that the WeedMD deal could lead to other and bigger such deals; that six more clients are scheduled to come on line, and more partnerships are soon expected to be announced; and that Blockstrain could adapt its technology to service other industries.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, such forward-looking statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in the statements including, without limitation, risks with respect to: that Blockstrain’s technology may not achieve the expected results and its accomplishments may be limited; that Blockstrain may not establish a market for its services as expected; competitors may quickly enter the industry; general economic conditions in the US, Canada and globally; the inability to secure financing necessary to carry out its business plans; competition for, among other things, capital and skilled personnel; the possibility that government policies or laws may change; technological change may result in Blockstrain’s solutions not be the best or cheapest available; Blockstrain not adequately protecting its intellectual property; interruption or failure of information technology systems; the cannabis market may not grow as expected; Blockstrain’s technology may not adapt to other industries; and regulatory risks relating to Blockstrain’s business, financings and strategic acquisitions. The Company disclaims any intent or obligation to update publicly any forward-looking information other than as required by applicable securities laws.

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by Blockstrain ninety thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. We have been compensated by Blockstrain to conduct investor awareness advertising and marketing for Blockstrain. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public and non-public sources but is not researched or verified in any way whatsoever to ensure the information is correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares and/or stock options of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities.