Imagine waking up to a dire warning from officials to avoid drinking any tap water - even boiled or purified tap water. If you think such a scenario is impossible with today’s technology, you might be surprised to learn that such an event occurred just last year.

Nearly a half million residents of northwestern Ohio woke up on Sunday, August 2, 2014, to Toledo officials telling them to avoid tap water at all costs. In an inspection, both treated and untreated water coming from the City of Toledo Collins Park Water Treatment Plant had been infected with a dangerous toxin called microcystin, which can lead to abnormal liver function, diarrhea, nausea, vomiting, numbness or dizziness. The culprit was a nutrient-fueled toxic algae bloom in the nearby Great Lakes that released the microcystin toxin when it died.

According to the Environmental Protection Agency (“EPA”), livestock agricultural practices are one of the largest sources of nutrient pollution to the nation’s water sources, feeding algae blooms like the one that occurred in Toledo. Livestock produce approximately a billion tons of manure each year, which translates to over eight million pounds per day of nitrogen and three million pounds per day of phosphorus. Under the guise of fertilizing crops, the waste is routinely applied to the ground in amounts that surpass the environment’s ability to absorb, so that it runs off to pollute the water supply. Despite its significant contribution to excess nutrients and other forms of air and water pollution, the livestock industry enjoys a number of exemptions and substantially less regulation under the Clean Air and Clean Water Acts than other industries. That is changing: in January 2015 a U.S. federal court ruled for the first time that manure from livestock facilities can be regulated as solid waste.

To date, our country’s clean water strategy has focused on ‘point sources’ such as municipal wastewater treatment plants, power plants, and factories. However, these efforts have begun to reach their limits, as illustrated by crises like the Toledo water crisis and so-called “dead zones” in the Gulf of Mexico, Chesapeake Bay and Great Lakes. To deal with declining water quality and steeply escalating clean water costs, policies and strategies are being developed to refocus efforts from traditional ‘downstream’ solutions, to ‘upstream’, nearer today’s greatest sources and where the most cost-effective way to address the problem resides.

Bion Environmental Technologies, Inc.’s (OTCQB: BNET) technology platform is designed to bridge the gap between the livestock industry and environmental concerns, while saving taxpayers significant sums of money that are now being lost in the form of high cost and ineffective downstream water treatment.

Push & Pull Catalysts

Strategies at both the state and federal levels are being crafted to “push” voluntary reductions through incentives to address the livestock problem in a more meaningful way. At the same time, consumers are increasingly demanding sustainably produced foods, creating a “pull” in the market for the same technologies. This combination of “push” and “pull” factors should create significant demand for technologies to address the livestock waste problem, such as the technology platform developed by Bion Environmental.

The best example of upcoming “push” policy changes was the introduction of Pennsylvania Senate Bill 994 in 2013, to create a competitive bidding program to stimulate private sector solutions and bring transparency and accountability to the process. A modified version of SB 994 is expected to be introduced in the PA Legislature in the near future. In essence, these policy changes will enable spending from the current high-cost downstream treatment strategy to be reallocated to lower cost upstream opportunities. Technologies that address the upstream side of the equation can be much more effective in reducing pollutants at the source, without a significant increase in taxpayer spending.

The legislation in Pennsylvania could serve as a blueprint for similar programs across the nation on both state and federal levels. With the livestock industry valued in the hundreds of billions of dollars, these programs could effectively create an enormous market overnight for livestock waste treatment, with very few companies operating in the space. The limited number of competitors within the industry means that the companies already operating within them could see significant gains as these strategies are put into place.

On the consumer side, the soaring popularity of sustainably raised animal products can be seen in the success of restaurants like Shake Shack Inc. (NYSE: SHAK) or Chipotle Mexican Grill Inc. (NYSE: CMG). McDonalds, Costco, Walmart and others have joined them by committing publicly to sourcing their meat and dairy products from sustainable suppliers. Consumers (as taxpayers) are also increasingly cognizant of government spending – much of that spending in the clean water space takes place with little transparency or accountability. Livestock waste management technologies are well positioned to capitalize on this “pull” market, too.

A Complete Solution

Bion Environmental has developed a proven and patented technology platform providing comprehensive environmental treatment of livestock waste. As an expert in the space, the company has participated in numerous government panels as the only representative of private sector solutions providers, an indication of the expertise and credibility management has built with critical stakeholders. These dynamics have positioned the company for success as these policies are ultimately implemented over time.

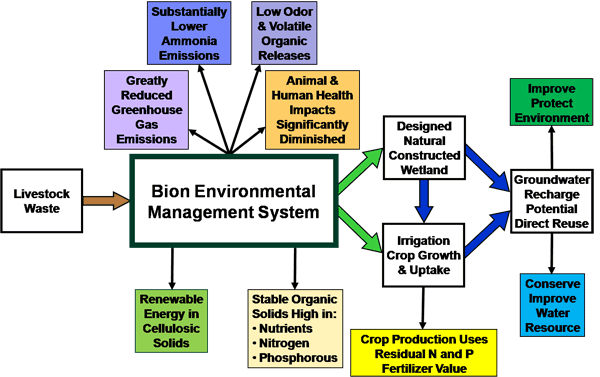

The technology works by removing up to 95% of the nutrients from livestock waste, while substantially reducing air emissions like ammonia and greenhouse gases. At its core, the technology relies on patented biological, mechanical and thermal processes that convert the nutrients into innocuous nitrogen gas and solid and/or particulate forms that can be reclaimed in the form of value-added byproducts. The system also produces a certain amount of renewable energy that is utilized onsite to increase efficiencies.

While other technologies have been developed to handle dry waste from poultry, the company focused its technology development to handle the wet waste produced by dairy, beef and swine. Management believes that it has developed the only comprehensive and cost-effective solution on the market capable of handling wet livestock waste, which provides a significant first-mover and competitive advantage relative to other opportunities in the space. There are currently nine million dairy cows, 92 million beef cattle, and 64 million swine in the United States alone. As the only viable technology for wet waste, the company has a huge opportunity as these upstream strategies come into play.

Unique Opportunity Ahead

Bion Environmental stands at a tipping point in its corporate history. After spending the last twenty-five years developing its technology, alongside industry regulators and commercial partners, the company is well positioned to take advantage of an evolving strategy that is just now coming into force in Pennsylvania and other states across the nation. The company’s long history in the space, coupled with its proven and accepted technology, provides a strong first-mover advantage. Competitors entering the space will experience a lengthy lead-time to prove their technology, creating a significant barrier to entry.

As a comparison, while many pharmaceutical companies are worth hundreds of millions of dollars before FDA approval (since that market is well-understood and funded), Bion Environmental Technologies trades with a market capitalization of less than $50 million, with a technology that is “approved”. The primary reason it that , until now, the clean water space has been dominated by government and NGO entities, with little participation by the private sector and therefore, little institutional knowledge or coverage. The irony is that Bion’s potential end-markets are worth significantly more than most pharmaceutical company markets, they face far less competition in the near term, and the eventual passing of these new policy frameworks is a foregone conclusion.

Investors in downstream water purification plays, such as Calgon Carbon Corporation (NYSE: CCC) or Mueller Water Products Inc. (NYSE: MWA) may want to take a closer look at Bion Environmental Technologies, Inc. (OTCQB: BNET), given its unique focus and near-term policy catalysts in place.

To learn more, visit the company’s website at http://www.biontech.com/.

About Emerging Growth LLC

EGC is a marketing and consulting firm that specializes in creating ongoing communications strategies for public and private companies.

Legal Disclaimer:

Except for the historical information presented herein, matters discussed in this release contain forward-looking statements that are subject to certain risks and uncertainties that could cause actual results to differ materially from any future results, performance or achievements expressed or implied by such statements. Emerging Growth LLC is not registered with any financial or securities regulatory authority, and does not provide nor claims to provide investment advice or recommendations to readers of this release. Emerging Growth LLC may from time to time have a position in the securities mentioned herein and may increase or decrease such positions without notice. For making specific investment decisions, readers should seek their own advice. Emerging Growth LLC may be compensated for its services in the form of cash-based compensation or equity securities in the companies it writes about, or a combination of the two. For full disclosure please visit: http://secfilings.com/Disclaimer.aspx