Moko Social Media (NASDAQ: MOKO) is one of the best ways to capture upside in the social media & mobile app space, in our view. It's also one of the only pure-play companies trading at a discount to what an acquirer would potentially pay for the Company and its impressive suite of rapidly-growing mobile apps. Most importantly, MOKO just signed a deal potentially worth $100 Million+, tapping into one of the hottest and most-desired demographics among advertisers - and no one noticed.

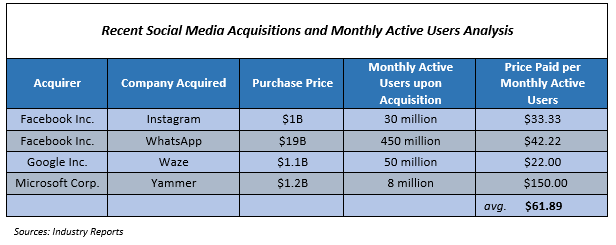

Earlier this month we found that acquirers were paying $20 - $150 per monthly active user to acquire hot, and rapidly-growing social media companies. MOKO has proven to have incredible retention and virality with a suite of mobile apps designed around existing but underserved social communities.

We believe an arbitrage opportunity exists between fair value and what MOKO is currently valued at, as a result of the Company's origins in Australia and limited sponsorship in the U.S markets. Conversely, the Company's NASDAQ listing finally gives U.S. investors an opportunity to own a small, pure-play name in social media apps (eg. non-gaming) and capture the upside in this exciting sector.

THE $100 MILLION NEWS THAT NO ONE IS PAYING ATTENTION TO

Last week, MOKO entered into a Memorandum of Understanding (MOU) for an exclusive partnership with [US-based] BigTeams. This marks entry of MOKO’s REC*IT platform into the high school sports market in a big way – BigTeams has ~15% market share across >4000 high schools. The US National Center for Education Statistics estimates enrollment of 16 Million students in grades 9 – 12 in 2015, which implies MOKO will have the ability to potentially capture 2.4 Million teenagers through this partnership with BigTeams (and onwards from there). Our due diligence shows acquirers have valued each monthly active user (MAU) at $20 - $150 (as shown, below).

The weighted average of the acquisitions illustrated (above) is $41.40 per MAU. This implies that the BigTeams deal could be worth upwards of $100 Million to MOKO (potential MAUs * $41.40).

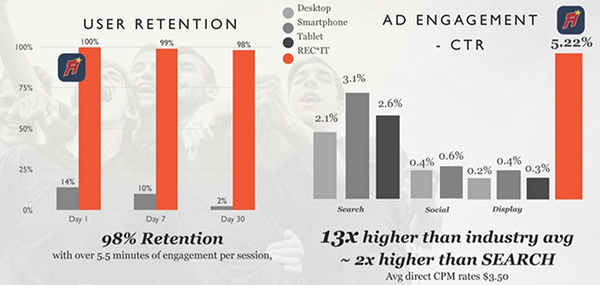

If you recall, Facebook’s (NASDAQ: FB) early virality began with exclusivity - you needed a college email address to join the social network. Exclusivity has worked well for MOKO in a pilot launch of REC*IT among college students interested in intramural and extracurricular sports & activities and is likely to prove popular among their younger counterparts for the same reasons: (i) REC*IT has exclusive feeds of data and content required to power the apps and (ii) the app is exclusive to each college/social group.

REC*IT’s early traction with college students is shown, below.

Source: Company Reports

We believe that MOKO is likely to quickly monetize REC*IT with advertisers targeting the teenager demographic thanks to growth in the ‘Athleisure’ market.

REC*IT COULD POTENTIALLY BECOME AN ‘ATHLEISURE’ ADVERTISING HOT SPOT

Athleisure is one of the hottest trends in the fashion industry that the teenager demographic has amply embraced. It refers to clothing and shoes related to performance gear and sportswear outfits worn for athletic purposes and leisure activities alike. According to Piper Jaffray’s Spring 2015 Taking Stock With Teens - a semi-annual survey that studies the behavior of teenagers in regards to spending, social network activity, preferred brands, household economic data and other variables - teenagers are accountable for $75 billion of discretionary spending. The survey suggests that athletic-leisure, preppy, leggings and jogging pants are the top teen fashion trends. By category, clothing and shoes represent 20% and 8% of total spending, respectively.

Nike (NYSE: NKE) is considerably immersed in the Athleisure movement and was designated as the top preferred clothing and shoe brand by teenagers. Companies like Under Armour, Inc. (NYSE: UA) and lululemon athletica (NASDAQ: LULU) are specifically oriented towards the Athleisure movement and could be considered pure plays in the fashion trend.

Since REC*IT already stands as a social network that is specific to sports and recreation specifically, companies that produce Athleisure-related products can find in REC*IT a vertical in which their main consumer group exclusively exists. REC*IT provides companies like Nike, Under Armour and lululemon, an opportunity to promote their products directly to their intended audience. If traction among high school student users mirrors what we’ve seen so far with the college user base, REC*IT could offer one of the top mobile advertising portals in the U.S. for the demographic.

5 REASONS TO OWN MOKO NOW

In our view there are 5 reasons investors should consider owning MOKO right now.

- Unique & Proven Business Model

i. Subscription-based, premium and freemium business models are the norm. MOKO offers its social networking apps to users at no charge and monetizes the assets through premium advertisers eager to reach a highly-targeted and engaged user base.

ii. MOKO has proven across numerous verticals – politics, college sports, college social network, running enthusiasts – that users are highly engaged on their platform and use it out of necessity, not boredom. This is reflected in impressive retention numbers among new and existing users (eg. REC*IT)

- Barriers to entry for Competitors & Scalability

i. Exclusivity agreement with data providers create near-insurmountable barriers to entry for competitors. Being the only app for access to recreational sports schedules at your school, for example, helps to rapidly penetrate the total addressable user base and, importantly, keep it.

ii. MOKO has entered in exclusivity agreements across several large social groups, for instance progressive politics, which has shown considerable growth. At last count Blue Nation Review had 3.5M MAUs and could be expected to continue growing with the 2016 U.S. elections looming.

- Valued At Discount To Intrinsic Value

i. The best way we can compute what MOKO is intrinsically worth is to ask ourselves what an acquirer would potentially pay to own 100% of the Company.

ii. Research shows acquirers will pay ~$40 per MAU - on the lower end - to own a fast-growing social media company.

iii. At year-end 2014, MOKO had 5 Million MAUs. This would imply, at $40/MAU, an intrinsic value of $200 Million versus MOKO’s enterprise value of just $65 Million, or >200% in potential upside. This does not factor in the expected 10-15 Million MAUs management has targeted for year-end 2015.

- Near-Term Profitability

i. MOKO has built an enviable user-base and erected huge barriers to entry for competitors with rather limited resources.

ii. Cost management and fixed overhead suggest top-line growth will almost immediately accrete to bottom-line results.

iii. Management has indicated profitability is a top priority and we believe this could become reality in the next 12 months.

- Management Team with Track-Record of Value Creation, Now Building MOKO

i. MOKO is led by impeccable management and directors with track-records for value creation

ii. 75+ years of cumulative senior management/executive experience in Fortune 500 firms, creating, running or overseeing marketing/advertising and financial operations

iii. Directors with extensive experience building and overseeing firms with $100M+ in annual revenues and involvement in successful M&A exits

iv. Management has a meaningful equity stake in MOKO and is therefore incentivized to build shareholder value

We believe investors in King Digital (NYSE: KING), Zynga (NASDAQ: ZNGA), Gluu Mobile (NASDAQ: GLUU) et al. would find owning MOKO a good way to diversify in the niche mobile app space by owning a Company with a unique and de-risked business model. We expect that as quarterly earnings come into focus, MOKO will guide on user growth and traction for the first time since reporting year-end 2014 numbers, which were related to soft-launches of key products, for instance REC*IT.

Any traction towards the 10-15 Million MAUs by YE2015 could create a catalyst for shares to breakout. As MOKO gains visibility with U.S. investors, we anticipate the Company will trend towards its intrinsic value.

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds in equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One

Equity Research LLC on behalf of Moko Social Media (the “Company”), as part of

research coverage services. As of the date of this note, One Equity Research

has received ten thousand dollars from the Company and expects to be

compensated up to twenty thousand dollars per month and may receive additional

compensation for ongoing coverage of the Company. This research note is not an

offer or solicitation to buy or sell the securities of the Company. The report

is for information purposes only, and is not intended to (and is provided

explicitly on the condition that it not) be used as the sole basis to make any

investment decision. Investors should make their own determinations whether an

investment in any particular security is consistent with their investment

objectives, risk tolerance, and financial situation. Please read our full

disclaimer at http://www.oneequityresearch.com/terms/