PREFACE

While covered calls are one of the most commonly used option strategies, it turns out we need to be clever in how we treat earnings in order to maximize the strategy in Yelp Inc (NYSE:YELP) . Even further, if we don't do this analysis, we can easily dismiss some worthy covered call opportunities as losers. This is one of those cases.

STORY

There's a lot less 'luck' involved in successful option trading than many people realize and we're going to review that right now for YELP. Let's first examine a two-year back-test of a covered call strategy with some simple rules:

* Trade monthly options (roll the trade every 30-days).

* Avoid earnings

* Test this strategy for two-years

Here's how this quick set up looks in the back-tester:

If we do this test, it turns out the best covered call to sell is out of the money with a delta of 30. Any delta below 50 is usually out of the money and certainly a 30 delta is out of the money.

RESULTS

If we do a covered call in Yelp Inc (NYSE:YELP) over the last two-years but always skip earnings we get these results:

| Buy YELP Stock, Sell 30 Delta Call |

| * Trade Frequency: 30 Days |

| * Always Avoid Earnings |

|

| Gross Gain: |

$6,123 |

| Gross Loss: |

-$5,675 |

| Covered Call Return: |

8.5% |

| Stock Return: |

-27.4% |

|

| Out-performance: |

35.9% |

That tile tells us two critical pieces of information. First, we see a very nice covered call result with a 8.5% return. But, just as important, we also see that the 8.5% return in the covered call considerably out-performs Yelp Inc stock over the last two-years, which hit -27.4%.

In total we're looking at a 35.9% out-performance while taking less risk than owning the stock outright and always avoiding earnings risk.

GOING FURTHER

While out-performing the stock and avoiding the risk of earnings is a powerful implementation of a covered call, we actually did even better. Next we do the same back-test, but this time we only trade earnings. That is, we open our position two-days before earnings, let the event occur, and close the position two-days after earnings.

Here's the set-up -- very easy. Just click the appropriate buttons.:

Now we examine the results for that same 30 delta covered call.

| Buy YELP Stock, Sell 30 Delta Call |

| * Trade Frequency: 30 Days |

| * Only Trade Earnings |

|

| Gross Gain: |

$1,727 |

| Gross Loss: |

-$4,072 |

| Covered Call Return: |

-37.2% |

Now we see why avoiding earnings was so powerful. Holding the covered call in Yelp Inc (NYSE:YELP) through earnings under-performed the stock and certainly under-performed a covered call that avoided this risk. In fact, our strategy to avoid earnings beat the strategy held only during earnings by a whopping 45.7%. It could have been so easy to miss this result without diving just a little deeper than the standard option analysis.

CLARITY

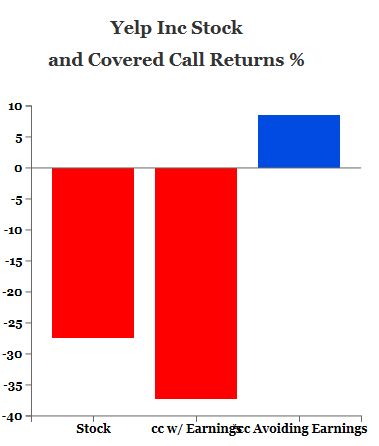

For some clarity we simply chart the returns of the stock, the covered call strategy with earnings and the one that avoids earnings, below.

Note the out-performance we get in Yelp Inc by being methodical in our approach and in this case avoiding the risk of earnings.

TRADING TRUTHS

Going through this practice with Yelp Inc (NYSE:YELP) reveals that the entire concept of 'options expert' has been made made overly complicated. Below, we go the final step (with a video).

WHY THIS MATTERS

When the time for reading analysis articles is over, and it's time to actually trade, it turns out there's a lot less "luck" and a lot more planning in successful trading than many people know. But it’s not about trying to guess which stocks will go up or down. That’s likely a losing bet over the long-term and extremely volatile. The real way to succeed is quite the opposite.

What the CML TradeMachine allows us to do is find calm, low-stress stocks and ETFs (like SPY, QQQ, etc), and find the option strategies that have created a high percentage of winning trades, gaining profitability slowly, while avoiding unnecessary risks — such as earnings events.

In this short video, your entire view of the options world and what it means to be an "expert trader" will be turned upside down — and turned to your advantage:

Tap here to see the CML Pro option back-tester

Thanks for reading, friends.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.