ATNM is starting new trials and will have results from ongoing phase 3 trial in 2018

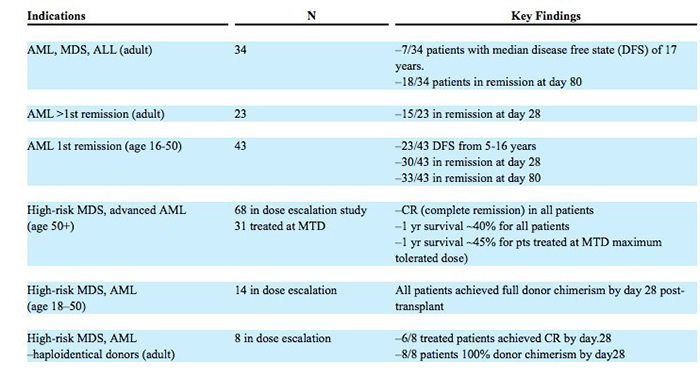

Actinium Pharmaceuticals Inc. (NYSE MKT:ATNM) concluded 2016 with several achievements. The company had started its phase 3 SIERRA trial for Iomab-B during the first half of the year. Iomab-B, an orphan designated drug in Europe and the US, is a coupling of a monoclonal antibody and a radioisotope. The drug is intended to be an induction and conditioning agent used to prepare patients with relapsed or refractory acute myeloid leukemia who are over the age of 55 for a hematopoietic stem cell transplant. The market is large and there’s an unmet need here. There have been numerous trials leading up to the phase 3 trials, with successful outcomes as follows:

Source - 10K

The company, which also received the preferential Small and Medium-Sized Enterprise (SME) status which gives enhanced support from regulators, plans to build upon these developments as it recently provided an outline for its strategies in the current year. Actinium Pharmaceuticals announced the initiation of clinical trial of Actimab-M for treating multiple myeloma. The company plans to conduct Phase 1 trial for evaluating Actimab-M in treating patients with multiple myeloma who are unresponsive to currently available therapies.

The successful trial of this drug candidate may unlock significant revenue stream for the company as relapsed and refractory multiple myeloma is an area of high unmet medical need. Multiple myeloma does not have a cure. However, there are a number of drugs approved for managing the ailment.

Actimab-M is the same construct as Actinium’s Actimab-A, which is currently being studied in a Phase 2 clinical trial in patients newly diagnosed with acute myeloid leukemia (AML) who are over the age of 60.

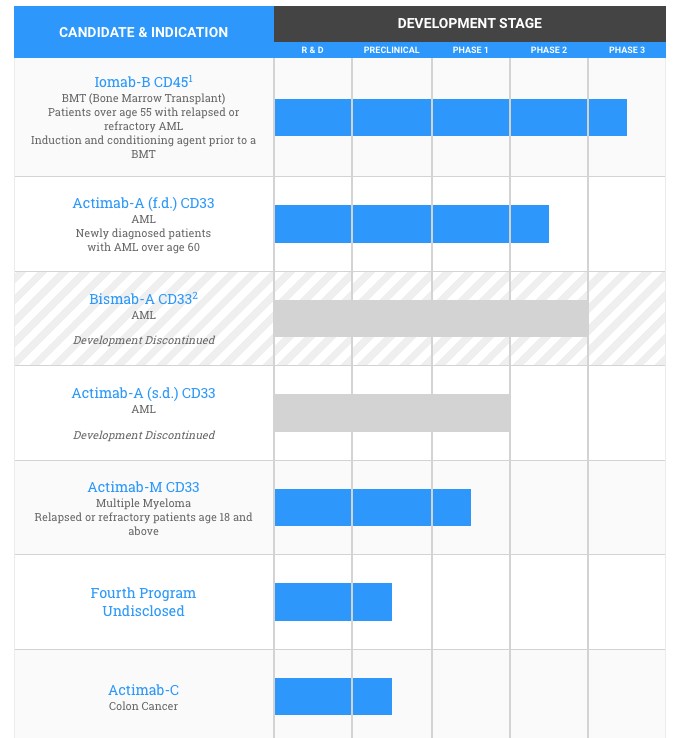

Actinium Pharmaceuticals has a solid pipeline of drug candidates. Currently, it is carrying out Iomab-B pivotal Phase 3 trial, Actimab-A Phase 2 trial and Actimab-M Phase 1 trial. The company focuses on developing oncology therapies using its alpha particle immunotherapy platform and other related technologies. This focused approach enhances the likelihood of success of its trials.

Source - Actinium Pharmaceuticals Company Website

The company’s Alpha Particle Immunotherapy technology gives it an edge over its peers. Actinium Pharmaceuticals has developed the technology in-house and is using it for developing new treatments. The so-called APIT platform does two things; first, it takes a highly cancer cell specific mAb, and then couples that with a short range, powerful radioisotope. The mAb binds to the cancer cell with great specificity, and the isotope then kills it. This sort of targeted radiotherapy is much more potent and causes much less collateral damage than standard radiation.

In the current year, the company expects significant development of its Phase 3 trial for Iomab-B. The drug candidate was given orphan drug designation By European Medical Association in 2016. It already had the similar designation from the FDA. The top line data is expected to be out in 2018, thus making for a long term positive catalyst for the company.

Actinium Pharmaceuticals is also expected to benefit from the synergistic relation between Iomab-B and Actimab. Iomab-B is used for bone marrow transplant by cleaning cancerous cells from the bone marrow. This process is synergistic to the use of Actimab treatment.

The company is also focusing on its organizational set up for augmenting its operational efficiencies. The company recently announced the appointment of a new Director of analytical development. This was followed by the appointment of Dr. Mark Berger as its new Chief Medical Officer. According to the company website, Dr Mark Berger is a hemo-oncology specialist who has worked and led trials of successful drugs at Wyeth (now owned by Pfizer) and

, and held senior positions at various junior biotech’s.

The company stock is keeping in line with its solid progress. The stock appreciated more than 44 percent this year so far. The most prominent uptick occurred earlier this month. The price appreciation helped the stock in recouping some of the losses it sustained in 2016.

The stock price is likely to appreciate further as the company progresses through its trials. As Actinium Pharmaceuticals is developing therapies for ailments which do not have any viable treatments currently, the company is expected to wield considerable pricing latitude. It is believed that there are over 20,000 new cases of Acute Myeloid Leukemia or AML every year in the United States alone.

Since it is expected that top line results from the company’s current trial will start pouring in by late 2017 and early 2018, the stock has strong long term potential. Despite current surge, the stock is still trading more than 50 percent lower than its 52 weeks high of $2.36. This offers a massive upside potential for investors with mid to long term horizon.

Apart from working on developing new therapies, the company is also working on the commercial front. It is expected to strengthen its efforts to forge new collaboration and licensing deals in 2017. Such arrangements will help the company in maintaining its liquidity position as well.

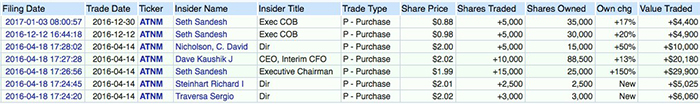

The prospects of solid stock price performance are underscored by insider trading as well. According to the filings made to the SEC by the company, several top-level executives including its Executive chairman and director purchased significant amount of stock in January.

Source - OpenInsider.com

Overall, the company is also likely to benefit from the developments in AML segment. One of its peers, Seattle Genetics suffered a setback as its AML drug was put on hold by the FDA on the fears of potential risk of liver toxicity.

In the current year, ATNM may see strong movements as and when the company offers updates about its trials. Potential collaborations may be another catalyst to the stock price. Given the company’s previous track record and solid performance of its drug candidates, long term investors may find lower prices enticing.

Disclaimer:

Except for the historical information presented herein, matters discussed in this release contain forward-looking statements that are subject to certain risks and uncertainties that could cause actual results to differ materially from any future results, performance, or achievements expressed or implied by such statements. WFM, Inc. is not registered with any financial or securities regulatory authority, and does not provide nor claims to provide investment advice or recommendations to readers of this release. For making specific investment decisions, readers should seek their own advice. WFM, Inc. has not been compensated for this ATNM article. For full disclosure please visit:

http://wwfinancial.com/legal-disclaimer/.