By: Zoocasa

Overall property prices were positive in the Greater Toronto Area this April, rising 2 per cent year over year to $820,150, but only thanks to condo units, says the Toronto Real Estate Board.

Condo prices rose 5 per cent to $588,150 year over year, while detached house prices declined 1 per cent to $1,018,150.

“Price growth continues to be driven by the condominium apartment segment and higher-density low-rise segments, “ says TREB in its monthly report. “The average price for detached houses dipped year over year, specifically in regions surrounding the City of Toronto. The detached market segment, with the highest price point on average, has arguably been hardest hit by measures such as the OSFI stress test.”

TREB has continually blamed the new mortgage lending rules for a slowing housing market, saying that it reduces buyer affordability and drives them into less expensive housing types.

“Many potential home buyers arguably remain on the sidelines as they reassess their options in light of the OSFI-mandated two percentage point stress test on mortgages,” says Jason Mercer, chief market analyst at TREB.

“Longer term borrowing costs have trended lower this year and the outlook for short-term rates, for which the Bank of Canada holds the lever, is flat to down this year. Unfortunately, against this backdrop, we have seen no movement toward flexibility in the OSFI stress test.”

Indeed, condos for sale in Toronto now make up 26 per cent of all purchases, although detached homes still make up a healthy 46 per cent. The rest is shared by other housing types, like semi-detached (9 per cent), freehold townhouses (9.5 per cent) condo townhouses (7.5 per cent) and link (1 per cent).

That’s partly because the condo lifestyle has become more accepted, and buyers increasingly desire to live close to work and have amenities nearby, but also because there is so little choice. Developers in Toronto almost only build large detached houses or small condo units, with very little supply of anything in between. TREB refers to this market as “the missing middle” and it’s an issue that they hope to tackle through participating in the new provincial government’s Housing Supply Action Plan. The Plan hopes to reduce red tape and improve the diversity of housing types.

For now, condos will remain the only option for many prospective buyers desperate to get a foot on the property ladder. These buyers should know that Toronto centre remains the most expensive place to purchase a condo across TREB’s region at $705,800. Buyers looking for a bargain should head west to Etobicoke condos, where they are around $570,000, or east to Scarborough condos, where they are even less expensive at $467,000. The most popular area to buy a condo in the 905 is in Mississauga. This suburb is by far the most dense area outside the City of Toronto, with 290 condos selling this April for an average price of $472,900.

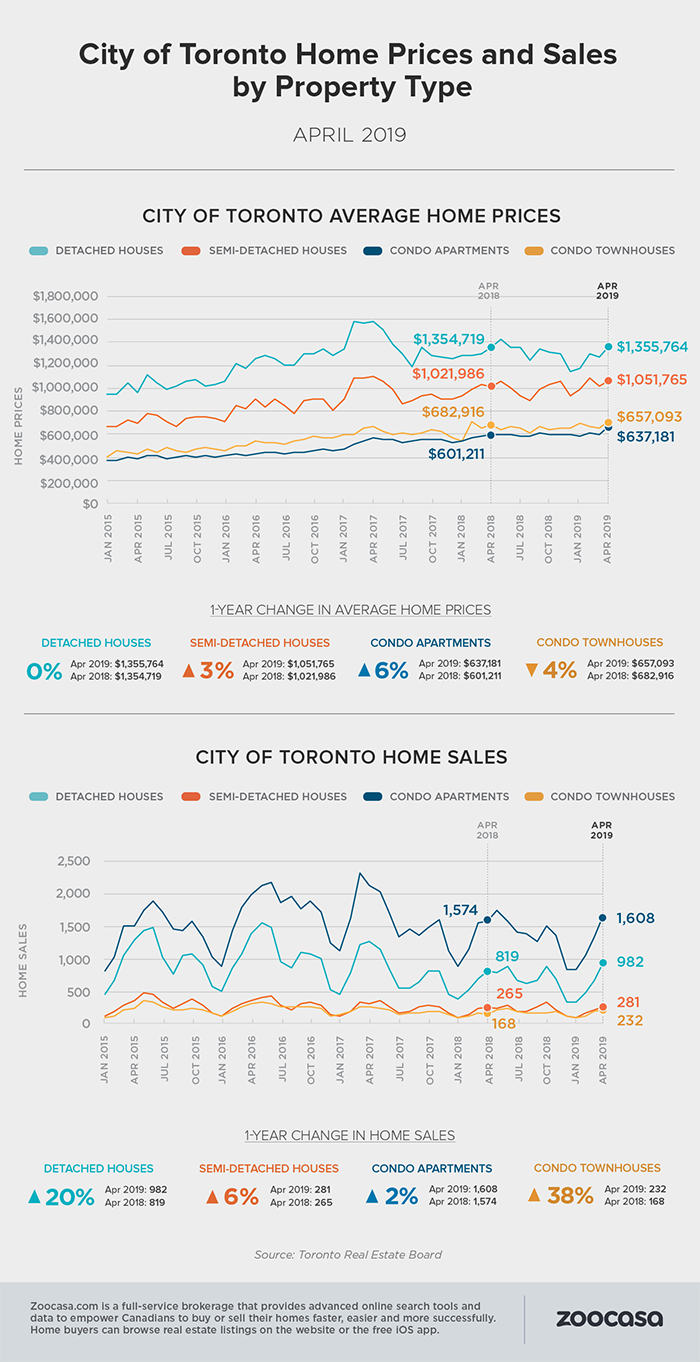

For more data on April’s Toronto housing market, check out the infographic below:

Zoocasa.com is a leading real estate company that combines online search tools and a full-service brokerage to empower Canadians to buy or sell their homes faster, easier and more successfully. Home buyers can browse real estate listings on the website or the free iOS app.