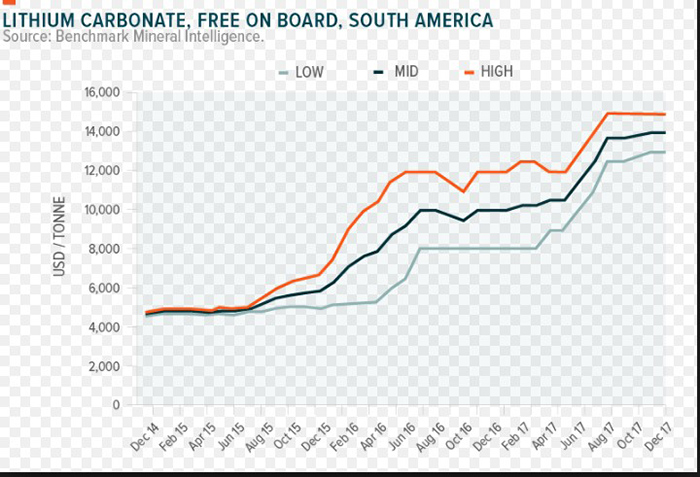

Lithium prices have taken off. In just a few years, a ton of lithium has increased by 300%.

And while prices fell in early 2018, there's no question lithium demand will continue to grow.

The answer to the huge increase in demand is simple: electric vehicles (EV) are growing in popularity, and battery-based tech, particularly in renewable energy sectors, has pushed demand for lithium up and up.

The real question now is: how are lithium suppliers going to feed all this new demand

Thank Tesla, of course. The EV pioneer has risen the profile of EV tech and opened up its first "gigafactory" in January 2017. But Tesla isn't alone: it only provides 30% of EVs, and in a few decades demand for the vehicles is going to skyrocket in the US, Europe and Asia where sales of gas-powered cars could become illegal.

By 2025, the battery market alone will be twice as big as today's entire lithium market—and the growth will only continue.

In early 2018, fears of an oversupply sent some lithium stocks tumbling. But their wrong; Asia and Europe have already started talking about banning gas-powered vehicles, and a lot of lithium will be needed to meet that new demand.

The EV industry alone uses up almost 40 percent of the world's lithium supply for batteries, and when you add massive energy storage solutions, unbridled consumer electronics growth and the emergence of more battery gigafactories—lithium supply will indeed be fantastically tight.

Today we're looking at 5 stocks that will bring the most lithium at the lowest prices.

#1 Albemarle (NYSE:ALB)

This major producer of chemicals is the world's largest supplier of lithium, and has been since early 2015 when it acquired Rockwood Holdings. Right now, ALB has about 35 percent of the global lithium market share.

And if you think the lithium stock extravaganza is over, guess again. This huge company, with a $14 billion market cap, still has plenty of room to expand.

Albermarle enjoyed a boom last year, reaching as high as $140 before tumbling down to less than $100 when it failed to fully deliver on investor expectations.

But 2017 was still a banner year, with 31 percent year-on-year revenue growth in its segment for lithium and advanced-materials in Q1 2017.

Major catalysts include an up-coming doubling of lithium carbonate production capacity thanks to a recent regulatory approval to expand Greenbushes in Australia, which will begin in the Q2 2019. And there will be more growth before then, with capital expenditures of up to $400 million. Lithium is the key focus right now for Albemarle.

The company has beaten analyst estimates for four quarters running, with a price-to-earnings (P/E) ratio of 25.42—way above the industry average.

#2 International Battery Metals (CSE:IBAT; OTC: RHHNF)

With the global battery market set to hit $120 billion in less than two years, lithium is now more of a tech play than a mining play. That means that tech expertise will be needed to meet the new demands of a changing sector.

Enter International Battery Metals (BAT.CN), a little company with big ambitions. It's signed a definitive agreement with North American Lithium (NAL) to buy the new, advanced technology to get lithium out of brine in 24 hours instead of 24 months.

Lithium is currently produced from brine sources and spodumene mines. Production from spodumene is typically significantly more expensive to produce due to high chemical consumption and waste disposal. Solar evaporation processes from brine in Chile and Argentina are large producers of lithium. But these processes are cumbersome because they entail pumping the salt-rich waters into a series of evaporation ponds to extract all other elements, leaving a number of salt fields that must be harvested. Some is sold and the rest is stacked in the desert.

Where traditional solar evaporation technology takes up to 24 months to extract lithium from the brine, IBAT's incoming CEO says the tech that he has invented can do it in 24 hours.

IBAT's technology is different because it picks out the lithium ions individually from the solution. This means that the process removes lithium chloride and leaves the other salts in the solution to be pumped back into the ground. No toxic ponds or salt piles are left over from production.

As inventor-CEO John Burba puts it: "Our tech has such a high specificity for lithium that it can directly take the lithium out."

And Burba knows what he's talking about: IBAT's new technology is actually based on a tech that he co-invented and sold to FMC in the 1990s. Now he's made major advancements, and the new method is set to come on-line just in time for lithium demand to skyrocket.

The lithium game isn't about exploration, it's about innovation—and IBAT's proprietary technology was invented by the same game-changing inventor that came up with a similar tech for FMC Corp. (NYSE:FMC), one of the world's four top lithium producers.

#3 Sociedad Quimica y Minera S.A. (NYSE:SQM)

This Chilean giant has five business segments—one of which is lithium, and it's expanding production.

SQM's lithium segment is an emerging market pick, but so far its performance has been stellar.

This company has access to vast reserves, right in the heart of the South American 'Lithium Triangle', which spans Chile, Bolivia and Argentina.

It's one of the biggest lithium producers in the world—and it knows that lithium is the future.

SQM is ramping up its JV project with Lithium Americas in Argentina. Now it's planning to increase its Chilean lithium capacity to 63,000 tonnes per year—up from 48,000 tonnes per year currently.

Rumors that the miner was being taken over by a Chinese firm were squashed recently, with news that Chile is moving to block the sale. SQM's price along with that of Albermarle took a hit in February, as analysts started worrying about a short-term lithium oversupply.

But make no mistake: this company is dominant in the lithium field, and will continue its success as lithium demand increases.

#4 FMC Corp. (NYSE:FMC)

The primary driver for FMC has been agricultural products, but the company is also a major lithium producer, one of the top-four big miners out there. It's lithium segment was its fastest-growing segment in 2017.

FMC was a big winner from the 2016-2017 lithium boom, as it watched its share price increase 155%.

The lithium segment could also end up being spun-off into its own publicly owned company. That would be a first: the first pure-play lithium stock (of any standing).

Last spring, the company said it would triple its production of lithium hydroxide by 2019, and production growth this year has been promising.

FMC took a tumble with the other miners early in 2018 due to fears of an oversupply. But that hasn't stopped the company from announcing a $500 million IPO on the NYSE for its lithium business next fall. The 15% IPO would give the whole business a market cap of $3 billion.

FMC expects a lithium deficit by 2025, with a supply of 700,000 tons failing to meet demand exceeding 1 million tons.

That should provide some major opportunities for miners, and FMC hopes to be at the head of the pack.

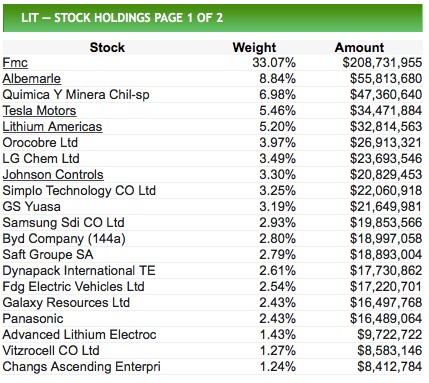

#5 Global X Lithium & Battery Tech ETF (NYSEARCA:LIT)

For investors who want broad exposure, LIT is it.

The ETF has 28 stocks in its basket, and the strongest focus is on FMC and Albemarle, which together make up nearly 42 percent of the ETF's assets.

In 2017, LIT rounded up over $263 million in capital, and it was one of the best performing ETFs of the year

This ETF with a lithium and battery theme—the full lithium cycle--is being accepted by the market with a fair amount of enthusiasm, and is gaining momentum as we speak.

It's an attractive basket right now, and gives investors direct exposure to lithium prices, but also adds nice diversification along the entire chain.

This makes it a winner for any investor who wants to profit when lithium demands shoots back up.

Honorable Mentions in the lithium/EV space:

Royal Nickel Corporation (TSX:RNX): While investor attention is about to refocus on zinc, it's possible that nickel is being overlooked, and while this stock has been a recent top decliner, if nickel demand growth is overlooked, RNC could be a good stock to hold.

RNC's principal assets are the producing Beta Hunt gold and nickel mine in Western Australia, the Dumont Nickel Project located in the established Abitibi mining camp in Quebec and a 30% stake in the producing Reed copper-gold mine in the Flin Flon-Snow Lake region of Manitoba, Canada.

RNC's stock price has lagged since July, but a recent uptick in nickel prices could revive this stock once again.

Centerra Gold (TSX:CG): This big mid-tier gold Canadian miner realized a very competitive cost per ounce in 2016 and expects to cut costs even further in 2017. Its Kyrgyzstan operation yielded a very strong result in 2016. Next to gold, Centerra's copper production is worth noting as prices for this metal just leapt to two-year highs, providing a nice extra income for Centerra this year.

With new deals in the making, Centerra Gold stands to continue to be a force in the Canadian stock market, and a fair bet for investors.

eCobalt Solutions (TSX:ECS) is an established mineral exploration and development company based in Canada. It is a leader in the cobalt industry which is just as important as the lithium space in this energy revolution. Moreover, eCobalt prides itself on providing ethically sourced commodities. Its primary asset is in prime territory in Idaho.

Backed by strong leadership and a forward-thinking attitude, eCobalt is expecting feasibility study results in Q2. This is shaping up to be one of the most exciting belts in the US, and investors are definitely taking notice.

Fortune Minerals (TSX:FT) is another player in the cobalt space. Operating in Canada's Northwest Territories, Fortune is eyeing status as a major Canadian producer of battery-grade cobalt chemicals--but it's also got copper and gold bismuth upside. And it's getting a boost from the government in terms of mining infrastructure.

Fortune's modest market cap and low buy in make it a great stock for investors looking to get a piece of the electric vehicle revolution. The company's value has increased significantly over the past year but it hasn't yet reached its peak.

Nemaska Lithium Inc. (TSX:NMX) is a smart company which realizes that lithium will be used in nearly every major tech-leap in electric vehicles and consumer products using batteries the coming years. With a looming lithium supply squeeze coming, Nemaska has a unique technology and great government support. Nemaska explores and develops hard rock lithium mining properties and related processing in Quebec.

It's small, and its shares are trading right now under $1, but it's the government support you should look out for. Smart investors know a good thing when they see it and will be sure to follow Nemaska in the coming years.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This news release contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include that IBAT will complete its announced transaction with North American Lithium and acquire NAL's technology and IP; the Lithium extraction process will be cost effective and can work much more quickly that other extraction technologies; that the process can be commercialized for large scale production; that the NAL team which knows the NAL technology will join IBAT; that the NAL technology can be licensed worldwide; that IBAT plans to set up a pilot extraction facility in early 2018, and then secure additional licenses for other high-grade lithium brines by this summer; that by 2020, IBAT anticipates becoming a supplier of various battery metals; that IBAT plans to secure 3 tin properties in 2018; and that it plans to acquire high value tin and tantilum properties. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the Company and NAL may not agree on the final agreement terms, aspects or all of the process development may not be successful, the process may not be cost effective, the Company may not raise sufficient funds to carry out its plans, changing costs for mining and processing; increased capital costs; the timing and content of upcoming work programs; geological interpretations and technological results based on current data that may change with more detailed information or testing; potential process methods and mineral recoveries assumption based on limited test work and by comparison to what are considered analogous deposits that with further test work may not be comparable; high value mineral properties may not be available for IBAT to acquire, or IBAT may not be able to afford them; competitors may offer better technology than NAL's lithium extraction technology; the availability of labour, equipment and markets for the products produced; IBAT may not be able to finance its business plans; and despite the current expected viability of the project, that the minerals cannot be economically extracted with the NAL technology, or that the required permits to build and operate the envisaged mines cannot be obtained. The forward-looking information contained herein is given as of the date hereof and the Company assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively "the Company") has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by International Battery Metals. In this case the Company has been paid by International Battery Metals one hundred and ninety thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. If we own any shares we will list the information relevant to the stock and number of shares here. We have been compensated by International Battery Metals to conduct investor awareness advertising and marketing for [CSE:IBAT and OTC:RHHNF]. Oilprice.com receives financial compensation to promote public companies. This compensation is a major conflict of interest in our ability to be unbiased. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. You should verify the information, and again are encouraged to never invest based on the information contained in our written communications.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.