Just like the tigers waiting in the tall grass to strike, investors have been steadfastly waiting for an indication from the cryptocurrency market to be given the green light for another move. Now may be that time. Over the last few weeks the price of bitcoin has recovered steadily after falling to lows of nearly $7,000. Since that time, the cryptocurrency has managed to rebound by over 25% and that’s just within the last 45 days.

The importance of this has a lot to do with the original boom that many companies involved with cryptocurrency evidently saw at the end of 2017 and early 2018. Companies like MGT Capital (MGTI), DPW Holdings (DPW), Marathon Patent Group Inc. (MARA), and even Eastman Kodak Company (KODK) have seen price breakouts that were in the thousands of percentage points during the later part of 2017, into earlier part of 2018. Clearly, investor demand is dictating the growing desire to see the next cryptocurrency company to make a move.

Despite the fact that this may seem like the wild west, futures contracts coming into play have started to further legitimize the industry and could even help boost the value of cryptocurrencies in general and for such a young industry to have its own futures contracts when other speculative markets like cannabis don’t should speak volumes to the ever-growing interest.

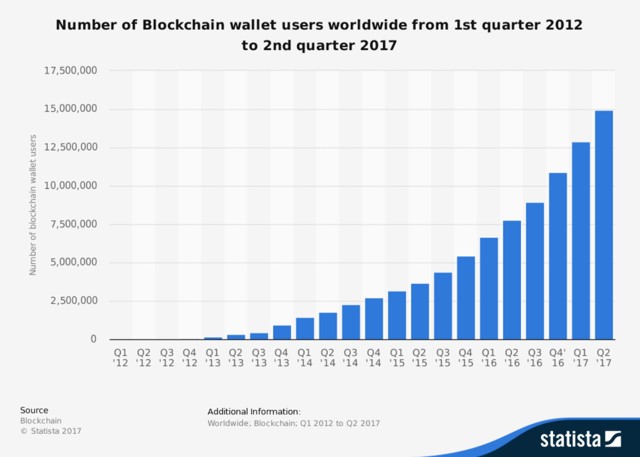

The main goal of digital currency like bitcoin was originally to build a decentralized ecosystem for handling transactions. Not only could this be the next step for investors to take cryptocurrency seriously but it could also be a key step for the industry to take this into account as well. New cryptocurrency wallet accounts have seen a significant increase over the last 3 years. But even with this being the case, one of the biggest barriers to entry has been the method to get set up in order to buy cryptocurrencies.

Companies that have gasped and fully understand the potential of this technology are creating new business platforms and winning first mover advantage. The complexity has deterred traditional investors from blockchain’s potential but now some public companies are changing that & offering investors direct exposure to the crypto economy as well as its huge growth opportunities.

Atlas Cloud Enterprises Inc. (ATLEF)(CSE: AKE) (XFRA: A49) is one of these companies and is working to join the ranks of the cryptocurrency leaders that had success during the early days of this initial boom. The company operates scalable high efficiency blockchain mining operations and unlike some of its competitors, Atlas owns its own property and facilities.

3 Reasons Atlas Cloud Enterprises Inc. (ATLEF)(CSE: AKE) (XFRA: A49) Could Be Set To Change The Landscape For Cryptocurrency Mining

1. Atlas Cloud Enterprises (ATLEF) (CSE: AKE) (XFRA: A49) Successful Acquired MKH Electric City Holdings

With the recent acquisition of MKH Electric City Holdings, Atlas Cloud Enterprises (CSE: AKE) (XFRA: A49) has now secured a 6,600-sq./ft. facility in Washington State. Roughly 1,700 ASIC servers can be used for data mining.

2. Energy Is Cheap For Atlas Cloud Enterprises

Unlike other mining-based companies, Atlas Cloud Enterprises was able to secure some of the cheapest electricity prices with its location being in the state of Washington. Their average cost comes in at just under 3 cents per KW/h and just to put this into perspective, the average price people in the U.S. pay for electricity is about 12 cents per kilowatt-hour; that’s FOUR TIMES the price of what Atlas will pay for large scale mining operations!

3. Diversification Of Mining

Much of the competition that Atlas Cloud Enterprises (ATLEF) (CSE: AKE) (XFRA: A49) has will focus on mining single tokens, which has mainly been bitcoin. The Atlas approach will be 70% dedicated to Bitcoin with 30% available for switching to mine most profitable alternative coins.

Cutting Through The Noise To See Industry Potential

People like Janet Yellen and JPMorgan CEO Jamie Dimon have said that Bitcoin is not a stable store of value and have even gone as far as calling it a “fraud”. But the central bank for central banks has gone as far as saying that cryptocurrencies can’t be ignored any longer especially at the rate of growth that they’re seeing this year.

They’ve even gone as far to say that they will have to think about making a decision whether or not it would make sense for them to issue their own cryptocurrencies at some point.

“Bitcoin has gone from being an obscure curiosity to a household name,” the Bank of International Settlements said.

Aside from this, companies like Square Inc. and even figureheads like PayPal co-founder Max Levchin are openly beginning to support further progress with digital currency ecosystems.

IBM CEO Ginni Rometty went as far as saying, “What the internet did for communications, blockchain will do for trusted transactions.”

New Opportunities Could Present Themselves As Bitcoin Begins To Rebound

The cryptocurrency market is one of the hottest markets in history. Companies like Atlas Cloud have already factored in several key assets to their business model that other companies simply ignored. Its proximity to the Grand Coulee Dam for instance, the largest power station in the United States, gives the company immediate accesses to electricity at approximately $0.03/kWh; some of the world’s cheapest power.

Electricity costs are one the key profitability differentiators and Atlas, for example is positioned to potentially become one of the lowest cost mining operations in North America. Furthermore, the company isn’t just purchasing rigs; they are buying the locations that they will be mining out of.

Additionally Atlas Cloud Enterprises (ATLEF) (CSE: AKE) (XFRA: A49) aims to execute a proposed 1,700 Application Specific Integrated Circuit machine expansion in 2018 and a further increase to 2,550 in the near term. At its existing facility, Atlas has the ability to scale up from 3.0MW to 5.0MW.

Previous and less developed companies have already shown to benefit greatly from the crypotcurrency boom and now that the market is in its next phase, another round of contends could be presenting themselves. The question left to ask right now is what will the next opportunity be that the cryptocurrency industry presents?

Contact: [email protected]

Disclaimer:

JSG Communications which is an affiliate of Midam Ventures, LLC owner of CoinStocks.com has been compensated $100,000.00 by a non affiliate third party Full Service Media LLC for a period beginning December 27, 2017 and ending November 20, 2017, which has been extended through March 31, 2018 FOR NO ADDITIONAL COMPENSATION, to publicly disseminate information about (ATLEF). We may buy or sell additional shares of (ATLEF) in the open market at any time, including before, during or after the Website and Information, provide public dissemination of favorable Information. We own zero shares. Full Disclaimer Here