Green energy. LNG. Battery tech. Rising oil prices…now is a great time to seek out new investments in energy.

The industry is changing daily. New technology has already upset the global energy makeup. The years-long oil and gas bear market has finally come to an end, and the oil and gas majors are raking in the dough. But the opportunities in energy extend far beyond the traditional OG plays.

Innovative firms are changing how energy is stored. Electricity providers are shutting down coal plants and going green. Solar panels and wind turbines continue to be built at an astonishing pace, and this summer passed 1 terawatt in global capacity.

Within such a massive, diverse industry there are opportunities galore for the savvy investor.

With so many to choose from, here’s five of the smartest energy plays currently out there:

#1 Xcel Energy (NASDAQ:XEL)

One of the largest energy providers in the U.S. is taking the Green Revolution to the mountains of Colorado.

In August, Xcel Energy got the clearance from the Colorado Public Utilities Commission to retire two coal-fired power plants and replace them with 2 GWs of wind, solar and energy storage assets.

The project will cost $2.5 billion but could save energy customers in Colorado billions over the years.

Xcel has been steadily going green. In 2017 it boasted that 23 percent of its capacity came from winder and solar, compared to 37 percent from coal. With a capital base of $25.1 billion (estimated to increase to $36.4 billion by 2022), Xcel has a lot of potential assets to put into place. But lately, it’s been concentrating on upping its investments in wind and solar.

In second place behind NextEra Energy, Xcel has been pumping money into wind power to close the gap. The company owns 6.7 GWs of wind capacity and supplies about 9 percent of the total wind power in the U.S.

Big investments into green energy are a sign that Xcel has its eyes trained on the future. Its hoping to shed itself of its expensive coal fleet and embrace the cleaner, cheaper and more profitable energy that wind and solar can provide. That makes it a stock to watch in 2018.

#2 United Battery Metals (CSE:UBM, OTC: UBMCF)

One of the biggest opportunities in energy has nothing to do with oil, gas, wind or solar.

It’s all about storage.

That’s right. Batteries, thousands of them, are the key to unlocking the next stage of the energy revolution. There’s just one problem: existing battery tech, based on lithium ion, is pretty lousy.

But one company is working into a position to change all that. United Battery Metals is sitting on a huge potential supply of vanadium, “Element 23” that might serve as the backbone for the next generation of super batteries.

It works like this: existing batteries use antiquated dry-cell technology, often using lithium components. But lithium batteries can’t be scaled up, have short life spans and tend to generate engineering problems.

That’s why battery manufacturers and energy suppliers are turning to vanadium redox flow batteries (VRFB) that use liquids to generate charge rather than dry-cell.

Vanadium batteries can be built to almost any size: they can be as big as a storage container, and right now China is building the world’s largest battery utilizing VFRB tech.

Vanadium flow batteries could transform the energy infrastructure: it’s what billionaire Robert Friedland has called “the next revolution in energy.”

McKinsey & Co. predict that the energy storage market will grow 100x by 2025, reaching $90 billion.

But you need vanadium to make VFRBs work. And United Battery Metals is one of the few mining companies to have already secured a U.S.-based contingent supply in the ground.

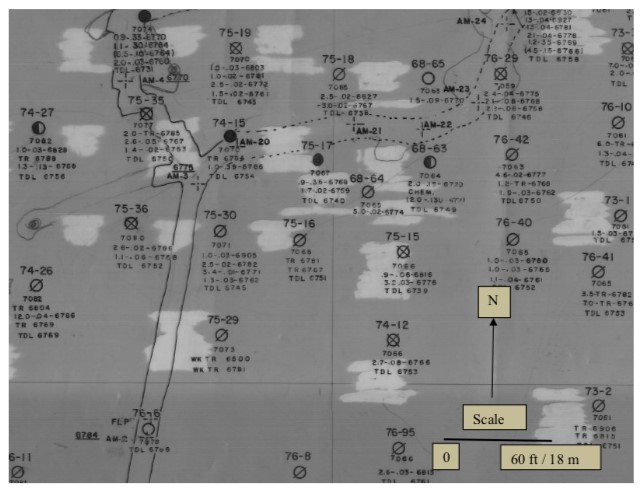

At Wray Mesa, UBM has found uranium, but they’ve also found a ton of vanadium: in some areas, at a ratio of 6:1 or even 14:1.

The total deposit could potentially be huge, as big as 2.7 million pounds of vanadium, with a current total market value of $49.9 million once mined. (Source 43-101 report by Anthony Adkins: 2013)

But that’s just for starters. Based on previous efforts to uncover uranium. The UBM team has new exploration underway that focuses JUST on vanadium.

The vanadium locked away at Wray Mesa could prove vital for the US as demand heats up. China is building a 200-MW battery in Dalian, and hopes to have 100-MW of VFRBs in place by 2020. This project could eat up $500 million. India wants to install 50 solar parks at 10 MW each, and it’s going to need large-scale VFRB batteries to handle the energy loads.

The VFRB revolution is one of the biggest stories in energy, but so far it’s flown completely under the radar. Savvy investors should check out companies like UBM.

#3 Renewable Energy Group (NASDAQ:REGI)

Remember biodiesel? The fossil-fuel alternative was all over the news a decade ago, but now it’s making a comeback, thanks to Renewable Energy Group, the largest supplier of biodiesel fuels in the U.S.

This stock rose 58 percent in August 2018, a spectacular rise that saw it realize a $1 billion market cap. This increase came after subsidies for biofuels expired in 2017, proving that the company could turn a profit (and then some!) without any help from Uncle Sam.

How to explain this success? REG invested in a wider distribution network, and in 2018 it sold 58 million gallons of biodiesel, a 45 percent increase from the year before. At the same time, REG began courting customers with large-fleet sales, in areas with a high interest in clean fuel transport.

Finally, biodiesel has gotten a lot more efficient, and REG has added 77 million gallons to its annual production without adding any new facilities.

These numbers might look like small potatoes compared to the giants of oil and gas, but for REG it means happy days are here again. Expect more from this company in the months ahead.

#4 Cheniere Energy Partners LP (NYSE:CQP)

Cheniere is the name to beat when it comes to U.S. energy exports. This Louisiana-based company has captured the most valuable part of the natural gas supply chain, and it’s harnessed the shale revolution in ways few other companies can match.

Cheniere specializes in the export of liquefied natural gas (LNG), which it exports from its terminal at Sabine Pass, LA. Most of this LNG is sent to markets in East Asia, particularly China, and the U.S.-China trade dispute with a Chinese tariff on imported U.S. LNG has given rise to fears that Cheniere’s margins may take a pounding.

While quarterly earnings beat expectations, Cheniere’s management has announced a slew of future projects to whet investors’ appetites.

First, there’s a $3.2 billion expansion project to add a process train at the company’s facility in Corpus Christi, TX.

Then, there’s the recent deal with a Taiwanese national oil company for 2 million tons of LNG for 25 years, starting in 2021.

Finally, Cheniere wants easier access to natural gas fields in the American interior, and it’s just received permission to build a 200-mile natural gas pipeline in Oklahoma, which will link the SCOOP and STACK fields with the national pipeline grid and feed more gas to Cheniere’s export terminal.

Cheniere’s stock was on the rise all throughout 2017 and the first half of 2018. Tariff scares notwithstanding, the company should expect strong earnings this winter when natural gas demand shoots back up.

#5 ConocoPhillips (NYSE:COP)

This U.S. oil and gas major has been having a great year. Higher prices have fueled strong gains, made even stronger by a stock buy-back program.

Now, ConocoPhillips has emerged as the best-performing oil stock on the market. And its management thinks there’s a considerable upside, and plans more buy-backs to bring the price even higher.

What’s the secret? It lies in ConocoPhillips unique structure. In 2012, the company spun out its downstream operations into a new entity called Phillips 66.

As an upstream pure play, ConocoPhillips took a pounding during the 2014-2016 bear market. But with prices on the rise again, it’s been surging past its competition.

This success has brought the company greater investor attention, raising expectations that it will continue to outperform its competitors for the rest of the year.

Other companies looking to transform energy markets:

Lithium Americas Corp. (TSX:LAC) is a resource company with a focus on lithium development. The company’s two large plays, the Cauchari-Olaroz project in Argentina – a joint venture with Sociedad Química y Minera de Chile - and the Lithium Nevada project in Nevada, are promising assets that will be sure to provide the company for many years to come.

The company’s impressive market cap, keen eye for investments, and excellent partners have certainly sparked the interest of investors. And in August, Lithium Americas announced new financing agreements to expand Argentinian and Nevada-based projects.

eCobalt Solutions (TSX:ECS) is an established mineral exploration and development company based in Canada. It is a leader in the cobalt industry which is just as important as the lithium space in this energy revolution. Moreover, eCobalt prides itself on providing ethically sourced commodities. Its primary asset is in prime territory in Idaho.

Recently, eCobalt released their Idaho project construction update. With the water treatment plant and waste storage facilities near completion, eCobalt is nearing its goals. CEO Paul Farquharson noted, "Our main priority is finalizing all environmental systems at site in preparation for underground mine development in early 2019."

Fortune Minerals (TSX:FT) is another player in the cobalt space. Operating in Canada’s Northwest Territories, Fortune is eyeing status as a major Canadian producer of battery-grade cobalt chemicals--but it’s also got copper and gold bismuth upside. And it’s getting a boost from the government in terms of mining infrastructure.

In mid-September, Fortune announced successful tests to upgrade the value of cobalt from the company’s Canadian-based NICO project. It’s worth noting that the company’s 100% owned NICO project also contains significant gold reserves.

Neo Lithium Corp. (TSX.V:NLC) is a new player having entered the scene in 2016, but it is certainly not a company to overlook. In early 2017, Neo Lithium announced a huge discovery of a high grade salar and brine reservoir in Argentina’s lithium triangle.

Taking full advantage of increased lithium demand, Neo Lithium is making moves within the space that investors are paying close attention to. As demand continues to grow, supply will not be able to keep up, making Neo Lithium a hot target in the market.

Alexco Resource Corp (TSX:AXR) operates on two sides of the mining spectrum. Its mining business operates in the Keno Hill Silver District in Canada’s Yukon Territory, historically one of the highest-grade silver districts in the world, having produced over 214 million ounces of silver. Alexco is a focused and driven company with proven exploration, development, and operational skills.

On the other end, Alexco also operates Alexco Environmental Group, an environmental consultation business offering remediation solutions and project management, assisting businesses with environmental permitting and compliance issues.

Recently, Alexco released an especially noteworthy update on their Bermingham project, with CEO Clynt Nauman noting, "The majority of the tonnage in the Bermingham deposit resides in the Arctic and Bear Zones where approximately 28 million of the 33 million indicated ounces of silver are located at an average grade of approximately 700 g/t silver. Looked at in total, the Bermingham deposit is now emerging as a one of the larger discoveries in the Keno Hill district.”

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This article contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this article include that prices for vanadium will retain value in future as currently expected; that UBM can fulfill all its obligations to maintain its property; that UBM’s property can achieve drilling and mining success for vanadium; that the vanadium extraction process being developed will be cost effective; that the vanadium battery process can be commercialized for large scale production; that high grades found in samples are indicative of a high grade deposit; that high-grade vanadium is in sufficient quantities to make drilling economic; that batteries and EVs will start using large amounts of vanadium; and that UBM will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the Company may not be able to finance its intended drilling programs, aspects or all of the property’s development may not be successful, mining of the vanadium may not be cost effective, UBM may not raise sufficient funds to carry out its plans, changing costs for mining and processing; increased capital costs; the timing and content of upcoming work programs; geological interpretations and technological results based on current data that may change with more detailed information or testing; potential mineral recoveries assumptions based on limited test work with further test work may not be viable; competitors may offer cheaper vanadium; more production of vanadium could reduce its price; alternatives could be found for vanadium in battery technology; the availability of labour, equipment and markets for the products produced; and despite the current expected viability of its projects, that the minerals cannot be economically mined on its properties, or that the required permits to build and operate the envisaged mines cannot be obtained. The forward-looking information contained herein is given as of the date hereof and the Company assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by UBM fifty nine thousand two hundred and eighty six US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. We have been compensated by UBM to conduct investor awareness advertising and marketing for CSE: UBM; OTC:UBMCF. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct.

SHARE OWNERSHIP. The owner of Oilprice.com may be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.