If you were looking for the perfect energy stock...

What would it look like?

First, you'd look for an incredibly rare element... one with limited supply.

Second, you'd want an element now under the radar... but about to break out with huge potential demand.

Third, you'd want a company with a virtual monopoly on the element...

And these three things may well have just aligned.

There's a new metal -- not any of the usual precious or rare earth metals -- that is seeing demand soar..

And one little-known miner has a virtual monopoly on U.S. supply!

The metal? Element 23... Vanadium... it could be the key to the next energy revolution.

A metal that President Trump has added to a list of minerals that are 'critical' for national security.

The stock? United Battery Metals (CSE:UBM, OTC: UBMCF)

Here are 5 reasons people should consider looking further into the United Battery Metals story:

#1: Vanadium Batteries Solve The Scale Problem

The biggest problem in green energy isn’t production: there’s plenty of wind and solar power out there, and building panels or turbines has never been easier, or cheaper.

The problem is scaling up energy storage capacity: in other words, building batteries that are big and durable enough to handle the increasing load.

While great for short-term, small-scale use in cars or cell phones, lithium ion batteries can’t be expected to carry the full weight of a clean energy electrical grid.

Lithium battery costs have fallen substantially, from $1000 per kilowatt hour (kWh) to $200/kWh. But costs would soar if lithium batteries were installed to feed and back-up an entire grid.

Worse, experts believe lithium battery costs will never be less than $100/kWh, which isn’t an economic rate for storing energy on a large scale.

Large lithium batteries need a lot of lithium, which is an expensive mineral to produce on a large-scale… and lithium mining can have a major environmental impact.

Lithium batteries can handle small-scale commitments for now…but the new “liquid electricity” batteries will become the real backbone of clean energy.

It’s what the billionaire founder of Ivanhoe Mine Robert Friedland calls “the next revolution in energy.”

And it’s all thanks to Vanadium, Element 23 on the periodic table and why small cap explorer United Battery Metals (CSE:UBM, OTC: UBMCF) is so excited about the future.

#2 ELEMENT 23: ELECTRIC STORAGE’S BREAKTHROUGH THAT’S BETTER THAN LITHIUM

Consider the dry-cell battery. It’s in a lot of standard appliances, from remote controls to wireless keyboards and portable stereos.

The design is very simple: a metal electrode or graphite rod surrounded by an electrolyte paste is sealed inside a metal cylinder. The paste reacts to zinc inside the battery, producing energy through a chemical process.

Even the brand-new lithium batteries used in electric cars use basically the same methods as any old dry cell battery.

By contrast, “liquid electricity” batteries work quite differently.

Two liquids held in separate containers are used to produce an electrical charge, which can then be discharged without any need for graphite anodes.

Vanadium flow batteries use an electrolyte fluid that flows back and forth between two tanks.

And there’s no limit to the amount of liquid used in a single battery…which can be as large as a shipping container.

Imagine batteries that can be produced in differing sizes to fit differing needs: from powering a car... to charging 50 cars simultaneously... to fueling a house... to producing enough energy to power a factory.

The key to building the new liquid batteries is vanadium, Element 23. Unlike lithium, vanadium doesn’t degrade over time.

And United Battery Metals (CSE:UBM, OTC: UBMCF) seems to be one of the only company’s in the U.S. paying attention.

These vanadium redox flow batteries (VRFB) are superior to the dominant lithium batteries.

With a lifespan that is effectively infinite, vanadium can be relied upon to serve as the foundation of a liquid energy battery longer than any other element.

With no need to replace the vanadium, the batteries are cheaper to manufacture on a large scale over time.

A study completed last year by the Imperial College London found that flow batteries beat out their lithium competitors: they would require an investment of only $4 billion to reach a level lithium could only reach after $94 billion.

That’s an over 20-fold improvement.

Moreover, VRFBs are safer: unlike lithium, they aren’t prone to sudden catastrophic failures, leading to overheating or explosions.

Right now, experimental vanadium batteries can produce energy at $500/kWh, but that is expected to fall to $150/kWh. But the real key is in scaling: building bigger and bigger vanadium batteries is simply a matter of adding more and more fluid.

The facts are in. The evidence speaks for itself. Vanadium batteries beat out lithium in every way. There’s really no competition.

We’re about to witness a revolution in how energy is stored.

And the battle for Vanadium is getting bigger and bigger.

#3: THE GLOBAL BATTLE FOR ELEMENT 23 HAS BEGUN

The power of vanadium is no secret. In fact, vanadium steel has been around for a while. Lighter and stronger than other metal alloys, it’s used in the manufacturing of complex components in airplanes, high performance cars and rocket engines.

Recently, vanadium prices have started to tick upwards. The major reason: tougher regulation of low-quality steel in China, the world’s foremost steel producer.

China wants to end its exports of cheap, poorly-made steel. It’s demanding a stronger rebar requirement from its steel manufacturers, forcing them to incorporate more vanadium.

As a result, vanadium prices went up in 2018.

Today, vanadium is found in 43% of cars. But by 2025, 85% of cars will use vanadium steel components, thanks to their improved durability and lower weight.

Plus, thanks to recent government regulations, a “second boom” in vanadium steel is taking place as U.S. steel producers finally begin to ramp up production again.

Demand for vanadium is strong. But the real reason prices will be soaring soon is in surging demand for VRFBs.

Robert Friedland is right: “there’s a revolution coming in vanadium redox flow batteries.”

Countries around the world want to increase their energy storage capacity, and they’re turning to VRFBs to do it.

China wants to launch multiple VRFB pilot projects, with 100 MW-scale VRFBs in place by 2020. This $500 million installation will triple China’s grid-connected battery storage capacity.

China has already started construction on the biggest battery in the world, a 200-MW 800-megawatt hour storage station in Dalian province. The battery will be charged with wind power and will utilize VRFB technology to store more power for longer, resulting in a stable energy grid without any fossil fuels or lithium.

India plans to install 50 solar parks with 500 MW capacity in the next several years. These parks, equal to 40 modern nuclear power plants, will need VRFB batteries to handle their colossal energy production.

United States energy storage demand is expected to increase 900% by 2023. Only VRFBs will be able to provide efficient energy storage. And United Battery Metals (CSE:UBM, OTC: UBMCF) is one of the few companies looking to build domestic supply.

With this kind of demand forecast, it’s no wonder that MarketWatch picked vanadium as a market to watch in 2018. According to Bushveld Minerals CEO, vanadium was the best performing battery mineral of 2017, growing 72% and achieving 500% growth since 2015.

Vanadium is on everyone’s radar, and it’s attracting some major press attention.

The problem? Vanadium is hard to find.

The United States has no strategic stockpile of this vital mineral. If it doesn’t ramp up domestic production, it might get lost in the dust.

And that’s where United Battery Metal’s Wray Mesa property comes in.

#4: United Battery Metals (CSE:UBM, OTC: UBMCF): THE AMERICAN VANADIUM PLAY

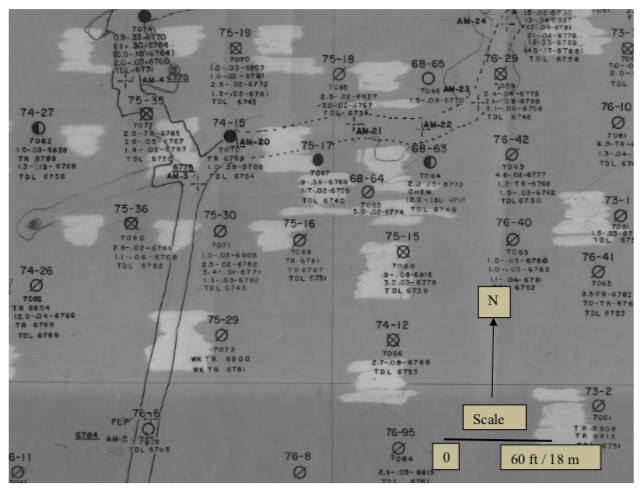

The Wray Mesa property used to be a uranium mine back in the days. When miners first came to this sleepy corner of Colorado, the United States was in desperate need of uranium, a strategic mineral that was the key to nuclear energy.

But now, the U.S. needs Vanadium. As Mining.com puts it, it’s the metal “we can’t do without and don’t produce.”

Now, UBMCF has staked a claim at Wray Mesa. But they’re not looking for uranium. Instead, they want to turn the property into the first productive vanadium mine in the Lower 48.

UBMCF’s mining team had a hunch. Where there’s uranium, there’s usually vanadium close by, as the two minerals tend to be found in close proximity.

At Wray Mesa, according to the previous 43-101 completed, there is an indicated resource of 500,000 of uranium with an estimated vanadium resource of 2,700,000 pounds.

The company is optimistic about expanding the vanadium resource estimate which, in some areas, Vanadium is being found at a ratio of 6:1 or even 14:1.

The current estimated total deposit as per the previous 43-101 report could be huge, as big as 2.7 million pounds of vanadium, with a current market price of $49.9 million.

The company plans to further explore and significantly increase production of the resource so the current 2,700,000 pounds could just be the starting point with an unlimited blue-sky potential on the Wray Mesa.

But that’s just the beginning, based on previous efforts to uncover uranium. The UBMCF team has new exploration underway that focuses JUST on vanadium.

Plus, the area is exposed sandstone and will pose no challenge to experience miners. The region around Wray Mesa has been extensively mined for uranium, with more than 700 holes drilled, and infrastructure remains in place to move product to market quickly and efficiently.

President and CEO Matthew Rhoades is an accomplished professional geologist with thirty years of extensive experience in the US, Mexico, Canada and South America. He’s experienced in battery tech and lithium mining, having served as President and CEO of United Lithium Corp. before it changed its name to United Battery Metals.

Advisor Eric Saderholm is another mining professional with three decades of experience, and a man who has added millions of ounces of gold to reserve bases in Nevada, Washington and Peru.

Mr. Saderholm worked with Newmont Mining as their exploration manager for the entire western region of the USA. His skills and access to potential new properties add tremendous value to the company’s portfolio.

UBMCF (CSE:UBM, OTC: UBMCF) has a potential major find on their hands: what could possibly be the first productive vanadium mine in the United States.

And investors who want to take advantage of this opportunity have to act fast, before the rising tide of interest in VRFBs becomes a tsunami.

#5 THE FUTURE OF ENERGY STORAGE BEGINS NOW

Both Element 23 and the “liquid electricity” battery are in the news, and they’re generating a lot of buzz. There are powerful reasons to expect the vanadium market to surge in the coming months.

But there’s no Vanadium ETF. Vanadium doesn’t trade on COMEX or LME. The only way to gain exposure to the market is to invest in miners.

China is building the world’s biggest battery using VRFB technology. These batteries will soon be everywhere: they’re better than lithium in almost every way.

But the US is lagging behind. It’ll take miners like UBMCF to close the gap.

The contest over Vanadium will only heat up as the mineral becomes more important to national security. And don’t forget that trade war with China: sooner or later, access to Vanadium could be limited. That should position UBMCF (CSE:UBM, OTC: UBMCF) perfectly to be part of the next energy revolution.

Other companies which will play a vital role in the next energy revolution:

Teck Resources (TSX:TECK): Teck Resources is a diversified miner with years of experience producing a variety of metals, including two vital ingredients in the EV revolution, copper and zinc.

In late August, Teck suffered a slight production hiccup as wildfires wreaked havoc on the British Colombia province. After a brief outage, however, the company’s lead smelting operations are back up and running.

Currently, Teck is looking to begin its ambitious $4.8 billion upgrade of the Quebrada Blanca copper mine in northern Chile, though the company has yet to set an exact start date.

Magna International (TSX:MG) is based in Aurora, Ontario. The global automotive supplier is gutsy and innovative--and definitely tuned to the obvious future--clean transportation. A great catalyst is its development of a combo electric/hydrogen vehicle--a fuel cell range-extended EV (FCREEV). It’s not going to produce them (for now, at least) but plans to use the model to show off its engineering and design prowess and produce elements of the electric drivetrain and contract manufacturing.

Though Magna has some ambitious plans in the pipeline, the ongoing tariff war has put a dent in its stock prices. While the tariffs have weighed on the auto industry as a whole, Magna was hit particularly hard. Despite this, outlook remains positive thanks to its ambitious plans to provide thermoplastic liftgates for the growing SUV/compact SUV market.

Pretium Resources (TSX:PVG): This impressive Canadian company is engaged in the acquisition, exploration and development of precious metal resource properties in the Americas.. Additionally, construction and engineering activities at its top location continue to advance, and commercial production is targeted for this year.

Pretium Resources’ efforts are clearly paying off, with another strong quarterly report surpassing analysts’ estimates. Though the strong earnings report inspired some investor confidence, Pretium also came under fire in the final week of August, with a research firm claiming the company had artificially inflated its figures.

The Descartes Systems Group Inc. (TSX: DSG) (commonly referred to as Descartes) is a Canadian multinational technology company specializing in logistics software, supply chain management software, and cloud-based services for logistics businesses. The company is making waves in the tech industry with its futuristic products and visionary leadership.

Recently, Descartes announced that it has successfully deployed its advanced capacity matching solution, Descartes MacroPoint Capacity Matching. The solution provides greater visibility and transparency within their network of carriers and brokers. This move could solidify the company as a key player in transportation logistics which is essential in the world of commerce.

Computer Modelling Group (TSX:CMG) is a software technology company producing reservoir simulation software for critical infrastructure. Computer Modeling Group LTD. Is a tempting trade for investors as it brings together two essential industries - tech and resources- which are going anywhere any time soon. Especially as the need for security grows, a tech company involved in the oil and gas industry has an incredible opportunity to offer other services.

While Computer Modelling Group focuses on the resource industry, its technology is definitely breaking ground. Founded nearly 40 years ago by Khalid Aziz, a renowned simulation developer, the company has proven that it has staying power. As the resource industry meets technology, this will be a stock to pay attention to.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This article contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this article include that prices for vanadium will retain value in future as currently expected; that UBM can fulfill all its obligations to maintain its property; that UBM’s property can achieve drilling and mining success for vanadium; that the vanadium extraction process being developed will be cost effective; that the vanadium battery process can be commercialized for large scale production; that high grades found in samples are indicative of a high grade deposit; that high-grade vanadium is in sufficient quantities to make drilling economic; that batteries and EVs will start using large amounts of vanadium; and that UBM will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the Company may not be able to finance its intended drilling programs, aspects or all of the property’s development may not be successful, mining of the vanadium may not be cost effective, UBM may not raise sufficient funds to carry out its plans, changing costs for mining and processing; increased capital costs; the timing and content of upcoming work programs; geological interpretations and technological results based on current data that may change with more detailed information or testing; potential mineral recoveries assumptions based on limited test work with further test work may not be viable; competitors may offer cheaper vanadium; more production of vanadium could reduce its price; alternatives could be found for vanadium in battery technology; the availability of labour, equipment and markets for the products produced; and despite the current expected viability of its projects, that the minerals cannot be economically mined on its properties, or that the required permits to build and operate the envisaged mines cannot be obtained. The forward-looking information contained herein is given as of the date hereof and the Company assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by UBM fifty nine thousand two hundred and eighty six US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. We have been compensated by UBM to conduct investor awareness advertising and marketing for CSE: UBM; OTC:UBMCF. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct.

SHARE OWNERSHIP. The owner of Oilprice.com may be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.