Nevada is known for many things. Casino’s and gambling come to mind, but recently there’s been a surge of companies entering Nevada under the guise of Lithium Exploration. The Clayton Valley is all of a sudden a hot bed of activity, and one can’t help but think, has this taken the focus off what Nevada has already proven time and time again to have?

I’m talking about Gold. Companies like the Barrick Gold Corporation (NYSE: ABX) have been in Nevada for decades making a fortune out of the Gold sector, and many companies continue to do so today.

Let’s not forget that while Lithium is definitely on the fore-front of everyone’s mind, especially when it comes to Nevada, let’s remember what put Nevada on the Map, and the simple fact that there is an absolute abundance of Gold left in Nevada.

The simple mention of the Barrick Gold Corporation (NYSE: ABX) brings us to a point that just simply cannot be ignored. Nevada has a district called the “Bullfrog District” where a very smart company is beginning to reinvigorate one of Barrick’s old mines. The company is not coincidentally called, Bullfrog Gold Corp. (OTCQB: BFGC), and if we use history as any sort of an indicator, Bullfrog Gold Corp. (OTCQB: BFGC) may be in store for some very exciting times in the near future, along with anyone who is savvy enough to see this opportunity.

Let’s take a quick glimpse at what this small, potentially huge, company is doing, and how it’s this type of thinking that can literally discover a “Gold Mine”.

Bullfrog’s properties are located within the prolific Walker Lane Mineral Trend and only 4 miles west of the town of Beatty, Nevada, this gold mining area produced 2.3 million oz gold averaging 0.08 oz/t for Barrick Gold. Here, Barrick, et al, conducted major mining operations between 1989 and 1999.

Barrick’s mines included the major Bullfrog pit (1.1 mil.oz @ 2.5 g/t gold), the underground Bullfrog mine (690,000 oz. gold @ 7.5 g/t), and the Montgomery-Shoshone pit (M-S) which yielded 220,000 oz gold @ 2.2 g/t gold.

Bullfrog Gold Corp, began exploring this area in 2011 with the acquisition of its initial land position of 79 claims and two patents located immediately east and north of the Bullfrog and M-S open pit mines. Subsequently, the company optioned from another land owner 12 additional land patents that were previously leased by Barrick. These patents cover the NE half of the M-S pit and significant exploration areas north and south of the M-S pit. The company also leased and optioned from Barrick 28 claims and 6 more patents, two cover the SW half of the M-S pit and the balance of lands cover the northern third of the original Bullfrog deposit. Today, the company controls the entirety of the M-S, the northern third of the Bullfrog pit and all the area underground mined by Barrick, plus prospective lands to the east and north.

Gold Deposits in the Beatty Area

(M-S and Bullfrog includes Barrick + BFGC Estimates)

In all, the company now holds 2,200 acres here, including 99 federal lode claims, 20 patented claims and 8 mill site claims. Additionally, the company has identified significant additional mineralization and further exploration potential which has been based on an intensive study of Barrick’s electronic and paper data bases. This data includes 157 miles of drilling in 1,298 drill holes, as well as more than 2,500 pounds of paper documents. Today, all this data would cost more than $40 million to re-create. This study yields some surprising results in terms of showing strong potential for additional gold content throughout this area.

It is noted that Bullfrog Gold is the only one to examine the electronic and paper data bases after they were shipped offsite in 2000; and is the only entity to thoroughly evaluate the mineralization remaining around and under Barrick’s Bullfrog and M-S pits and between the Bullfrog pit and underground mine.

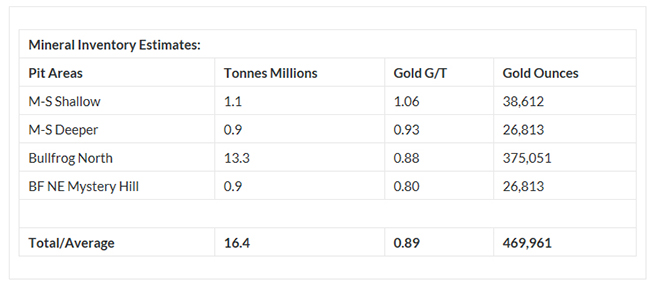

Current Gold Inventory Estimated at 470,000 oz. Gold

The Company has analyzed and estimated the remaining mineral inventories of gold around the Montgomery-Shoshone and Bullfrog mines at 470,000 oz. gold as summarized below:

The estimated mineral inventory was calculated by the company at an average of 0.89 g/t using manual cross-sectional methods and a nominal cut-off grade of 0.3 g/t. This cut-off grade is higher than most heap-leach projects now operating in the USA, suggesting that this area can be re-opened for productive, low-cost heap-leach processing. The above estimates are strongly supported by the close-spaced Barrick drill holes where 2.3 million oz gold were recovered.

The company believes the mineral inventory estimates can be readily and inexpensively upgraded with minor additional drilling to comply with US and Canadian estimation standards, as well as defining several additional exploration targets which can expand overall gold mineralization in the area.

Remember that Bullfrog Gold Corp. (OTCQB: BFGC) is just getting started here, and we have some very strong potential at much more than indicated above, but at bare minimum estimates, Bullfrog appears to be in a very sweet position.

What this means to any looking at this company, OTCQB: BFGC, from a retail point of view, is that at these entry levels ~ 0.12 – 0.13 / share, there appears to be some very strong upside potential for the savvy investor to take advantage of.

For more information on this company, spend a bit of time reviewing their website here: http://www.bullfroggoldcorp.com/