Written by Ophir Gottlieb

PREFACE

NVIDIA Corporation (NASDAQ:NVDA) is our number one Spotlight Top Pick and our best performer as well. The question I get rather often is whether the stock has peaked and the opportunity is over.

The answer, in my opinion, is rather simple: the opportunity for NVIDIA Corporation is far from over and we hold it as perhaps the single most innovative technology company in the world. Here are some breaking updates.

STORY

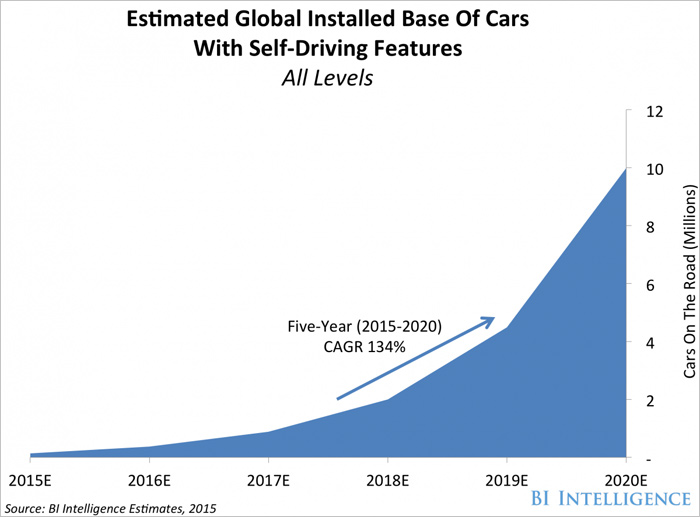

NVIDIA Corporation (NASDAQ:NVDA) spans the world of super computing, which means virtual reality, augmented reality, self-driving cars, gaming, cloud computing, biotech (yes, biotech) and artificial intelligence. Here are just a few charts of the themes NVIDIA is pursuing:

Self driving Cars

Deep learning is the secret weapon for self-driving car algorithms. NVIDIA already calls Tesla (TSLA), Aston Martin, Rolls Royce and Audi as customers with what can only be described as “the guts of the future.”

But if you dig deeper you’ll find that the company’s strategy in this segment is to become a part of the internal workings that all manufacturers depend on. NVIDIA is now partnered with more than 80 automakers working toward driver-less cars.

In a CML Pro dossier we penned on 9-1-2016, we wrote NVIDIA Strikes Deal with Chinese Giant. Here is the quick takeaway:

[NVIDIA] is partnering with Chinese search engine giant Baidu (BIDU) to use artificial intelligence to create a “cloud-to-car” mapping system for self-driving vehicles.

Baidu said, We will start testing our autonomous driving technologies on public roads very soon in California.

New: Cars

NVIDIA Corporation (NASDAQ:NVDA) won the contract to power Tesla cars.

Nvidia (NVDA) has started full production of the DRIVE PX 2, as Tesla (TSLA) may order thousands of units each month for its Model S and Model X.

The order volume may grow further when Tesla launches its Model 3 in 2017. The DRIVE PX2 model houses the most expensive Titan GPU (graphics processing unit), which carries a retail price of $1,200.

Here’s my broader take on self-driving cars in an interview with CBC’s Peter Armstrong:

And then we got more news today about data centers.

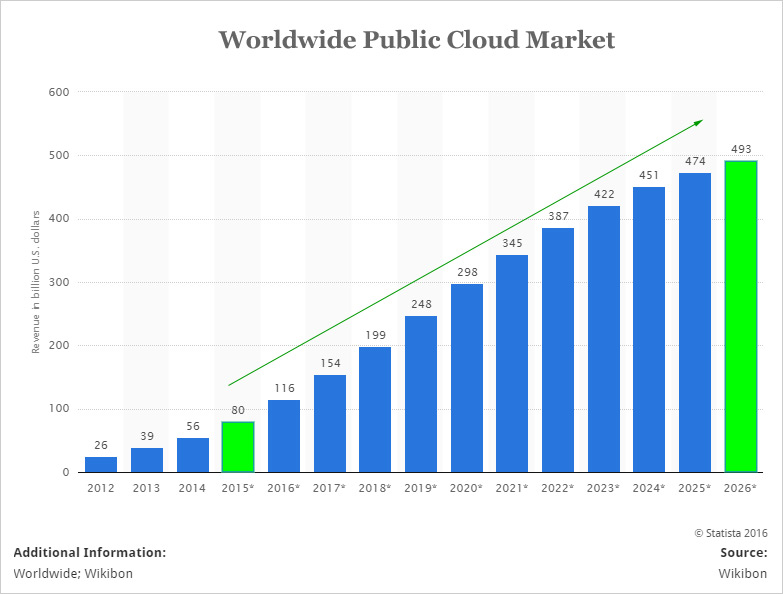

New: Data Centers

We start with the broad theme, which is rather impressive. Here is the public cloud platform revenue forecast from Statista:

Cloud

In a CML Pro dossier we penned on October 3rd, we wrote this: NVIDIA Just Got Huge News.

The takeaway was this:

Amazon.com (AMZN) announcing this morning it will rent use of Nvidia’s graphics processing unit (GPU) chips in its Amazon Web Services, as what are called “P2 Instances,” boasting, “With up to 16 NVIDIA Tesla K80 GPUs, P2 instances are the most powerful GPU instances available in the cloud.

Source: Barron’s

It’s little spoken of (other than here at CML Pro), but NVIDIA Corporation (NASDAQ:NVDA) is actually creating a monopoly in this segment. Here is a chart from Market Realist:

That Market Realist story reads:

Intel, the dominant player in the server processor market, is now eyeing deep learning and AI but is far behind Nvidia in terms of technology.

Nvidia’s deep learning and AI solutions have been well-received by a variety of cloud companies. The company is now looking to tap the government to boost its revenues from deep learning and AI.

With triple digit year-over-year revenue growth, the cloud market is yet another large opportunity for NVIDIA and as we pointed out in our CML Pro dossier, the demand for its hardware has pushed Amazon into offering NVIDIA GPUs in AWS.

More

The great thing about Nvidia is that it has several segments just like the two above that are growing quickly and further, broadly the themes will grow from “idea” phase, to full blown gigantic markets. We haven’t even touched on half of the opportunities NVIDIA Corporation (NASDAQ:NVDA) is pursuing including virtual and augmented reality, gaming and biotech.

We have yet another CML Pro dossier NVIDIA More Reach which discusses the movement into biotech. Here’s a taste:

New drugs typically take 12-14 years to make it to market, with a 2014 report from the Tufts Center for the Study of Drug Development finding that the average cost of getting a new drug to market had reached $2.59 billion.

In a study from eLIFE we learned that automation could be used to reduce the cost of drug discovery by approximately 70%.

Friends, that’s another field that is suffocating without deep learning and that means NVIDIA is coming to the rescue.

NVIDIA Wins with Microsoft

Microsoft just announced and released its new all-in-one computer, the Surface Studio. This is a high-end all-in-one system, and as such also uses stand-alone graphics rather than integrated processor graphics.

For the highest-end variants of the Surface Studio, Microsoft is including a GeForce GTX 980M. The lower-end versions will get the GeForce GTX 965M – the same chip that powers the new Surface Book.

Source: Motley Fool

This is going to keep happening, even though Apple decided against NVIDIA in its newest iMac.

CONCLUSION

Stock prices will vacillate. When we first added NVIDIA Corporation (NASDAQ:NVDA) for about $34 and it was a $17 billion company by market. Today it sits at $71 and a $38 billion market cap.

While there will be bumps in the road, perhaps some rather large ones if the market takes a dive, that market cap is nowhere near our future belief about NVIDIA Corporation if it keeps executing as well as it is.

The author is long shares of NVIDIA Corporation (NASDAQ:NVDA).

WHY THIS MATTERS

Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals. Of our Top Picks, Nvidia is up 110% since we added it. Ambarella is up 90% since we added it. Relypsa was taken over for a 60% gain and we are already up on Twitter when we added it to Top Picks for $15.60.

To become a CML Pro member it’s just $25 a month with no contract. It’s that easy – you cancel at any time, instantly.

Each company in our ‘Top Picks’ portfolio is the single winner in an exploding thematic shift like self-driving cars, health care tech, artificial intelligence, Internet of Things, drones, biotech and more. For a limited time we are offering CML Pro at a 75% discount for $25/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.