Written by Ophir Gottlieb

PREFACE

Netflix Inc (NASDAQ:NFLX) has transformed the way we consume video by introducing streaming video on demand (SVOD) as a legitimate alternative to live television. Here is the good and the bad of the company's radical expansion and growth in 8 charts.

STORY

Let's start with the rather impressive revenue growth chart.

That growth has come at a cost though. Check out the strain on cash from operations in the next chart.

And further, we can examine the debt load that Netflix Inc has taken on.

And why is this happening? Well, Netflix is pushing the envelope with original content and that is costing the company a small fortune. Here is the trend in research and development expense:

TAKING A STEP BACK

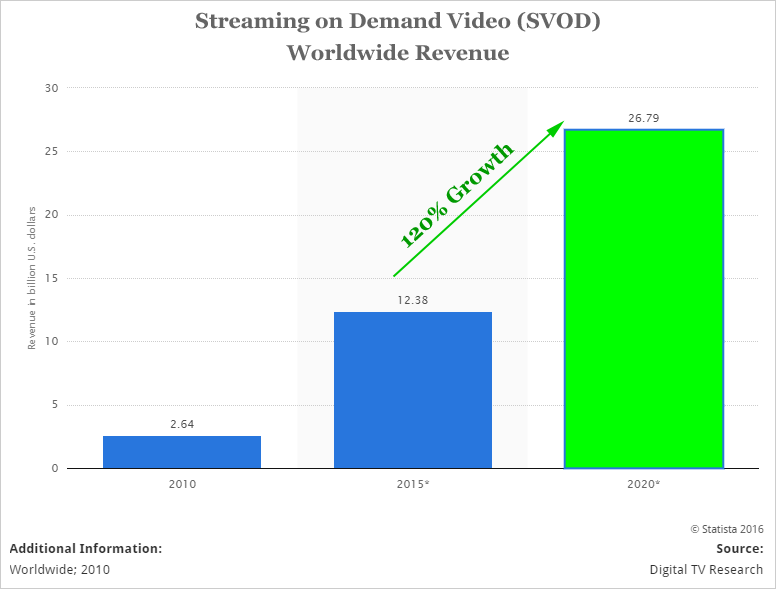

Of course all of these charts miss the critical context. First, Netflix Inc (NASDAQ:NFLX) is chasing the streaming video on demand theme in technology. Here's how that looks from our friends at Statista.

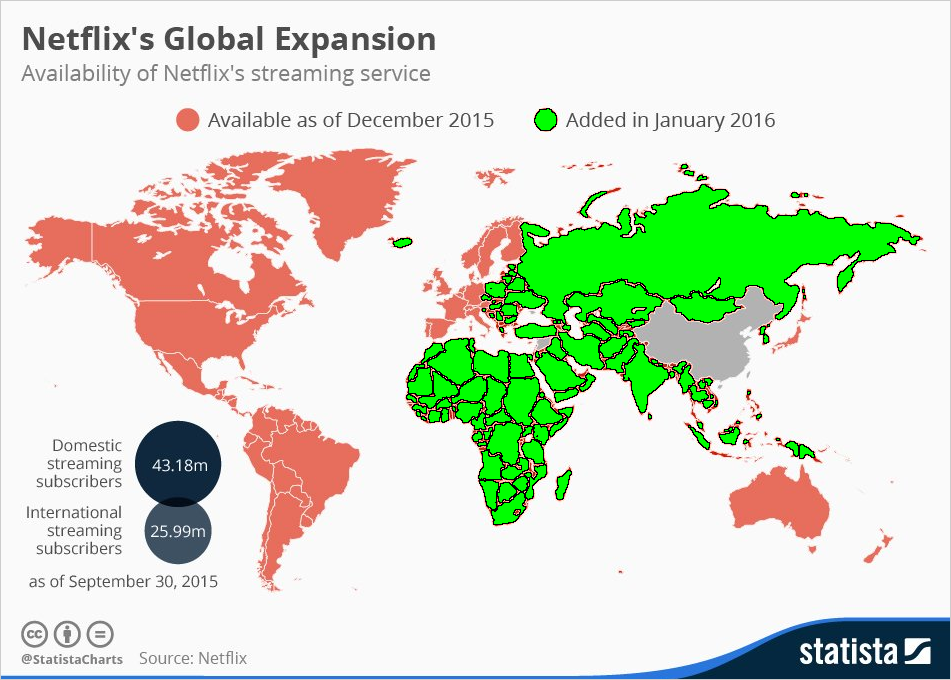

And inside that trend, Netflix is expanding internationally at a frantic rate.

But this isn't just growth for growth's sake. Netflix Inc (NASDAQ:NFLX) is winning, and that's just a matter of fact. Here are consumption patterns in a chart, to start:

And finally, market share dominance in a chart:

Believe it or not, only about 50% of U.S. households have access to SVOD, so while growth in the US will slow, there's still room, even beyond the huge international expansion.

The author has no position in Netflix Inc (NASDAQ:NFLX).

WHY THIS MATTERS

If you enjoyed learning about Netflix, this may be up your alley: Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals. Of our Top Picks, Nvidia is up 180% since we added it. Ambarella is up 80% since we added it. Relypsa was taken over for a 60% gain and we are already up on Twitter when we added it to Top Picks for $15.60.

To become a CML Pro member it's just $19 a month with no contract. It's that easy -- you cancel at any time, instantly.

Each company in our 'Top Picks' portfolio is the single winner in an exploding thematic shift like self-driving cars, health care tech, artificial intelligence, Internet of Things, drones, biotech and more. For a limited time we are offering CML Pro for $19/mo. with a lifetime guaranteed rate. Get the most advanced premium research along with access to visual tools and data that until now has only been made available to the top 1%.