Written by Ophir Gottlieb

PREFACE

Alphabet Inc (NASDAQ:GOOGL) is making good progress into a diversified business -- but it also faces one very large risk.

STORY

First, the company revealed how serious it's getting about self-driving cars, moving it from moonshot status to full blown company status in our CML Pro dossier: It's Time to Focus on Google.

In that dossier we note that Alphabet Inc created a new company under its umbrella called Waymo. Alphabet Inc teamed up with Fiat Chrysler to put its self-driving technology in a 100 Chrysler minivans. This serves as both a test for the self-driving car technology, and the earliest part of a potential blockbuster deal. Then we got this:

"Honda Motor (HMC) said Wednesday that it is in formal discussions with Waymo, the self-driving stand-alone unit of Google parent Alphabet (GOOGL), to add its autonomous vehicle technology to Honda vehicles."

Source: BARRON'S

As we wrote in that dossier:

"It was lost in the wind of headlines, but Alphabet has already started talks with General Motors and Ford as well. Now, imagine for a moment that the self-driving revolution, which is coming much sooner than Wall Street understands, is driven by Alphabet's technology.

Yeah, Tesla will have their cars, and likely Apple as well, but Chrysler, Honda and possibly other manufacturers partnering with Alphabet Inc could mean a leader has already been established.

Let Tesla sell its 500,000 cars by 2018 if they can. Alphabet is looking to sell tens of millions within five years, with no cost of production, no assembly line, no radical new business - just the best technology in the world licensed to the largest auto makers in the world."

NEW STUFF

That was actually review, here is the new information we learned:

"Alphabet Inc. and Fiat Chrysler Automobiles NV are doubling down on their self-driving partnership, adding about 100 more Pacifica Hybrid minivans to an autonomous fleet first announced in May, according to people familiar with the decision."

Source: Bloomberg

But that was the distraction. The real news is that Alphabet is finally going after Uber. Alphabet Inc (NASDAQ:GOOGL) is going to use the semi-autonomous Chrysler Pacifica fleet as a ride-hailing service. Waymo's next move is going to be to let people "use our vehicles to do everyday things like run errands, commute to work, or get safely home after a night on the town."

That new build out with Fiat Chrysler looks like it's actually going to happen. But we got even more news from Google last week: The company has rolled out a new retail partnership with BMW and the Gap to deploy its 3-D-scanning project called 'Tango'.

"The retail deals announced at the consumer technology show CES in Las Vegas hint at Google's broader ambition to merge its mapping capabilities with its core business of facilitating commerce. "

Source: Bloomberg

The idea here is virtual shopping as a replacement or addition to 'real' shopping. The vision is pretty clear with automobiles and it's nice to see Google going further with standard retail. "A new app allows shoppers to test clothes from the Gap brand using Tango."

There are limited audiences for this technology right now, but looking to the future is always the right move for technology.

This business, the self-driving car business, along with a possible new line with the Google Pixel smartphone, which we wrote about in our dossier Wall Street is Blind to Google's Upside Potential is finally giving us an eye to Alphabet's broader diversification strategy.

RISK

But there is risk to Alphabet Inc -- one that's growing and one that is existential.

(1) Google is losing a sizable piece of its business to Amazon in one particular area: e-commerce search, according to Eugene Kim of Business Insider.

(2) Google better straighten out the 'fake news' phenomenon. As I stated ever so clearly on CBC with Peter Armstrong, if Google Search is no longer a trusted source of content, Google is dead. Of course, that's a radical take on it -- we just note that the company better make strides here, and we believe they will.

Here is that interview for convenience (link on MSN Money):

Alphabet remains a Spotlight Top Pick and we remain bullish on the company long-term. We love the new progress and praise the company for finally turning new ideas into new businesses.

OPTION TRADERS

We promised we would include more option content in our dossiers, so here is a nice piece on Alphabet Inc.

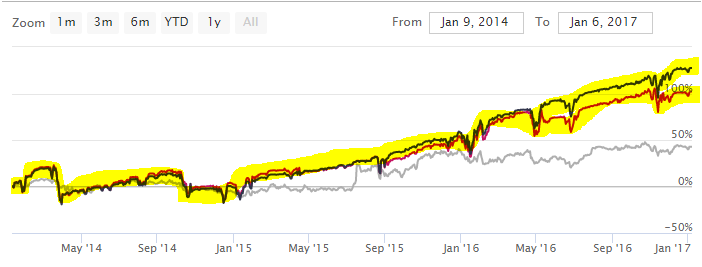

Staying bullish here, we examined selling put spreads in GOOGL over a three-year period every month. During this time frame the stock has risen 42.7%. The put spreads, well, they did a lot better:

And here is the option strategy highlighted in yellow versus the stock in gray:

We discovered this ever so easily on the CML Trade Machine option back-tester with three clicks of the mouse. For those that want to learn more you can click here (it will open a new window, this story will stay here): CML Option back-tester

WHY THIS MATTERS

If you enjoyed learning about Alphabet Inc (NASDAQ:GOOGL) but actually being ahead of the curve, this may be up your alley: Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals. Of our Top Picks, Nvidia is up 210% since we added it. Ambarella is up 50% since we added it. Relypsa was taken over for a 60% gain and we are already up on Twitter when we added it to Top Picks for $15.60.

To become a CML Pro member it's just $19 a month with no contract. It's that easy -- you cancel at any time, instantly.

Each company in our 'Top Picks' portfolio is the single winner in an exploding thematic shift like self-driving cars, health care tech, artificial intelligence, Internet of Things, drones, biotech and more. For a limited time we are offering CML Pro for $19/mo. with a lifetime guaranteed rate. Get the most advanced premium research along with access to visual tools and data that until now has only been made available to the top 1%.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.