[PRLive]

Amazon It's a reasonable question to ask:

Is there a way to optimize buying calls in Amazon.com Inc (NASDAQ:AMZN), beyond just hoping that the stock goes up?

Going Beyond Luck

It's just a matter of fact that if Amazon.com Inc stock doesn't go up, then owning calls is going to be a pretty bad bet. But if we want to take an aggressive bullish stance on the stock that doesn't mean that blindly buying calls will work. So, what does work?

First we look at buying the at-the-money calls in Amazon.com every week for the last 3-years. Here's what we get:

Source: CMLviz Trade Machine

Obviously, with the stock ripping over the last few years, that's going to be a winner -- perhaps 436% is a surprise, but we knew it would a good trade looking backwards. But then we come back to our original question:

Is there a way to optimize buying calls in Amazon, beyond just hoping that the stock goes up?

The answer is a resounding, yes.

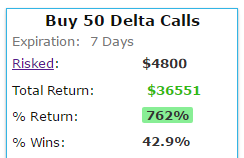

First, let's look at the exact same trading strategy in Amazon.com, that is, buying weekly at the money calls in Amazon, but this time, let's avoid the week of earnings -- literally, sit on our hands and do nothing for those four events a year. Here's what we get:

Source: CMLviz Trade Machine

We have taken a 436% winner and moved it to a 762% winner. Now, obviously that return is gigantic, but there's a bigger story. The risk of AMZN earnings has not been worth it -- and that means even if the stock rises but not as an aggressively as it has over the last three-years, we see a window into an opportunity that both reduces risk and increases returns.

But there's more we can do -- and this gets at the heart of proper option trading. It really isn't just "pick a strike price and let it rip." Or, it can be, but that's where too much risk is taken on, and worse returns are delivered.

Let's look at the last year trading these calls in AMZN:

Source: CMLviz Trade Machine

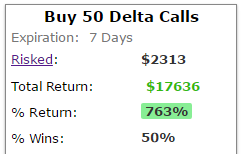

Again, yes, the returns are huge -- of course they are -- Amazon was ripping in the last year. But, let's see if we cut out earnings again -- just avoid that week:

Source: CMLviz Trade Machine

Now we see what we were hoping to -- skipping earnings -- that is avoiding that huge risk four times a year and produced a massively higher return while reducing risk. But here's the great part about options -- we can do more.

Let's take one extra step and put a stop loss on our weekly options at 70%. That means if during any week a call drops in value by 70%, we don't just let it putter out to a 100% loss, we cut it off, sell for the loss, and move on to the next week. Further yet, we do it while also avoiding AMZN earnings.

Source: CMLviz Trade Machine

Now we see the absurd returns we should expect for a stock that has climbed so quickly so fast. But more than that, we see that by avoiding earnings risk and then avoiding the risk of a huge loss, we have created remarkable returns.

So, is there a way to optimize owning calls in Amazon, beyond just hoping the stock will go up? Yeah, there really is. And we just looked it right in the eye.

If Amazon.com Inc (NASDAQ:AMZN) rises, but not as aggressively as it has recently, there's still a smart approach -- a thoughtful approach -- to this bullish bet, and now we know it.

It turns out each stock and ETF has its own specific tendencies. Sometimes a call spread is better than a call. Sometimes selling puts is better than both. Sometimes we want a really tight stop -- as far as 30%. There's only one way to test it -- and that is, of course, to test it.

THE KEY

The key here is to find edge, optimize it -- in this case by putting in a stop and avoiding earnings -- and then to see if it's been sustained through time. For AMZN it has, and that makes for a powerful result.

We've just seen an explicit demonstration of the fact that there's a lot less 'luck' and a lot more planning in successful option trading than many people realize. Here is a quick 4-minute demonstration video that will change your option trading life forever: Tap here to see the Trade Machine in action

Thanks for reading, friends.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.