PREFACE

Selling a covered call in Amgen Inc (NASDAQ:AMGN) has been hit and miss, but for the clever investor, side-stepping risk has meant better returns.

Amgen Inc (NASDAQ:AMGN) Stock Tendencies

Doing a covered call against a long stock position can be a strong income producing strategy, but it can also be very risky when done without proper understanding of the stock dynamics. Make no mistake, a covered call can be wealth destructive.

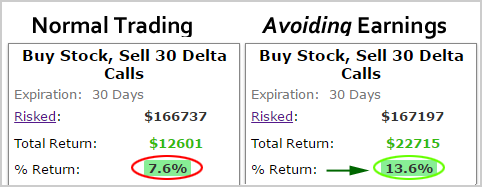

Here's what selling a covered call every month for the last two-years has returned in Amgen Inc (NASDAQ:AMGN):

That's a 7.6% return, which is not only pretty unimpressive, it's also taking on a huge amount of risk which can easily be overlooked. But there's something going on with Amgen Inc stock that is not easily seen without the right tools.

Here is how that same covered call has worked for the last 2-years, if it was held at all times, but then we simply skipped earnings -- we held no position. For ease of comparison, we have put the original strategy on the left, and the new one -- skipping earnings -- on the right.

That 7.6% return has nearly doubled to 13.6%, and even better, this strategy took far less risk than doing the covered call blindly every month.

The key to option trading is quite simple -- understanding the dynamics of the stock you're looking at allows you to adjust the option strategy to reflect those dynamics.

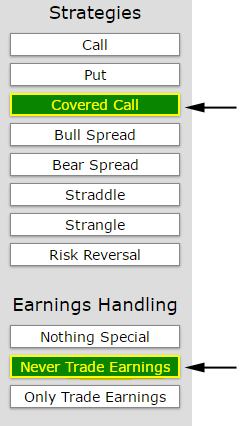

We can make this adjustment the tap of the mouse button:

IS THIS JUST LUCK?

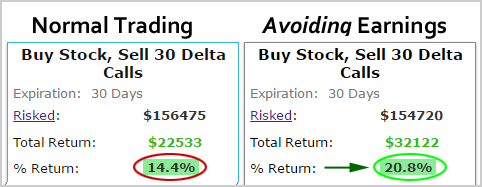

If our analysis is correct, this strategy of avoiding earnings for the covered call in Amgen Inc should have worked better than the normal strategy of just selling the covered call and holding for the near-term as well.

It turns out that this is exactly what we find. Here are the results, side-by-side, for the last year and the last six-months, respectively:

1-Year

6-Months

The left had side shows the results of holding the covered call at all times during the last year, and the right hand side shows the results of doing the same, but always avoiding earnings. It's not just the better returns we are after, it's avoiding the outsized risk of earnings -- when an option position feels like the flip of a coin rather than investment.

What Just Happened

This could have been any company -- like Apple, Gilead, Facebook or Amazon, or any ETF and any option strategy. What we're really seeing is the radical difference in applying an option strategy with analysis ahead of time, in this case understanding the impact of earnings. This is how people profit from the option market -- it's preparation, not luck.

To see how to do this for any stock, for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Tap Here to See the Tools at Work

Thanks for reading, friends.

The author has no position in Amgen Inc (NASDAQ:AMGN) at the time of this writing.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.