Gualcamayo. Navidad. Chinchillas. No, not a trivia question: Properties in Argentina discovered and monetized by mining veteran Joseph Grosso CEO and President of Golden Arrow Resources (TSX-V: GRG, FRA: GAC, WKN: A0B6XQ).

For those unfamiliar, these are not inconsequential deals. Case in point; Chinchillas is a 75/25 JV with Silver Standard (75%) (NASDAQ:SSRI) (TSX:SSO) a US$1.3 billion precious metals producer. SSO will be the operator.

Some salient points including from the recent Pre-Feasibility Study:

- Approximately $15 million payment to GRG on expected closing (May 30, 2017)

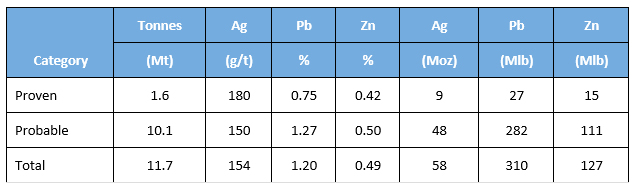

- Mineral Reserves of 11.7 million tonnes containing 58 million ounces of silver at a grade 154 g/t, 310 million pounds of lead at a grade of 1.20% and 127 million pounds of zinc at a grade of 0.49%.

- Measured and Indicated Mineral Resources (inclusive of Mineral Reserves) of 29.3 million tonnes containing 96 million ounces of silver at a grade 101 g/t, 581 million pounds of lead at a grade of 0.90% and 386 million pounds of zinc at a grade of 0.60%.

- Post-tax net present value of $178 million using a 5% discount rate and metal prices of $19.50 per ounce silver, $0.95 per pound lead and $1.00 per pound zinc.

- Attractive post-tax internal rate of return of 29%.

The above factors were responsible on Friday for increasing the GRG share price from C$0.70 to C$0.97 to close at $C$0.86; up 22% on 1.6 million shares, eight times the average daily volume. Market cap rose to C$83 million. While GRG will likely need to do another raise, it sees itself close to being self-funding.

Golden Arrow’s impressive history of discovery, identifying quality JV partners and structuring favourable royalty deals seems a simple yet compelling delivery system for consistent shareholder value. The expertise and reputation of Chairman Grosso goes a long way to getting those relationships solidified.

Extending the successful Chinchillas model, GRG is setting its sights on its 2016 optioned Antofalla gold, silver, zinc, project, which has similar geology to the Chinchillas property. A $2 million program is underway, including geochem sampling to define targets potentially resulting in a significant drill program.

GRG holds an earn-in option on the six claim 8,760-hectare property. The Company can earn a 100% ownership of the properties by making staged payments over five years totaling US$1.5 million. There is a 1% net smelter royalty (“NSR”) on the properties, which can be purchased by the Company for an additional US$1.5 million.

For the geologists among us, there is geological evidence for a High Sulphidation (HS) system with potential for the discovery of world class epithermal or porphyry deposits.

Basement rocks at the property consist of Ordivician pelites and sandstones, like the Chinchillas basement. These are intruded by Permo-Triassic granites, which are overlain by Oligocene-Miocene red beds with mudstones, sandstones and conglomerates.

The property is situated within the Miocene-age Antofalla stratavolcano complex, which was the source of intense volcanic activity, creating rhyolitic and dacitic domes with volcanoclastic tuffs and breccias, and andesites.

An extensive existing database of previous drilling exploration work, with results including:

- 18 metres @ 128 g/t silver, 0.23 g/t gold and 0.88% lead in historic drilling

- 2 metres @ 9.2 g/t gold, 52 g/t silver and 5% lead in historic trench samples

The very definition of risk can be personified as the gold/precious metals/base metals market. While luck is necessarily present in various forms, the exploration, development and eventual production is primarily a function of management.

There is much chatter about ‘Peak Gold.’ There is also ‘The Trump Factor’, central bank buying and the perpetually rising of Asian jewelry demand.

Imponderables aside, the perception of gold is more emotional than silver, which tends to be viewed as more industrial in provenance. That said, it is not a matter of whether you should have exposure to the sector, but what kind?

Perhaps unlike any other sector, risk is inherent in any gold or precious metal investment. The prudent approach, if there is one, is to carefully source opportunities that not only have a track record of finding deposits, but work just as diligently to mitigate the inherent risks for the Company and shareholders.

Golden Arrow has those unique properties. For over two decades Grosso and crew have built a portfolio of high quality Argentinian properties, developed partnerships allowing it to avoid being operator, collect NSR royalties and/or direct royalties that has allowed the Company to gain both reputation and impressive shareholder value.

As an example, the stats from Chinchillas to date:

Chinchillas Mineral Reserves (as at December 31, 2016)

While impressive, gold (et al) mining is a multi-faceted undertaking. Chinchillas will deliver 4000 tonnes per day to the Pirquitas mill, 25 miles away, likely by the second half 2018. The resultant silver/lead as well as a zinc concentrate will be exported for processing.

The 2043-hectare property is expected to have an eight-year life and an extremely competitive silver cash cost of $7.40 an ounce.

Investors aren’t buying GRG for the gold. It should be bought primarily based on Grosso and his team—a who’s who of international mining experience, all of whom have impressive experience in South America.

Management is working through monetizing its current roster of more than a half-dozen Argentine properties, including Chinchillas and Antofalla. The Company is constantly looking at properties and potential partners.

Likely more properties will be added as time progresses. Investors can still buy the shares for the unfolding of the Chinchillas deal and others to come.

Discussions of metals’ supply/demand, central banks’ rise in bullion purchases, the increased need for silver in electronics and the more than 50% of gold going to Asian markets are each a discussion on their own.

There are lots of ways to own precious metals. For investors who want a silver bias, but with all sorts of other potential growth aspects, Golden Arrow looks unique, compelling and for those patient, likely very profitable. The best part is the calculated approach to risk, which has so far done very well for the Company and shareholders.

No reason to believe that will change.

Legal Disclaimer/Disclosure: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Baystreet.ca assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.