Written by Ophir Gottlieb

LEDE

There has been a way to profit from Amazon.com Inc (NASDAQ:AMZN) irrespective of stock direction, but it took a deft hand and a smart investor.

PREFACE

Likely the single most important decision when trading options is whether to buy or sell the premium. It turns out that even though implied volatility (the price of options) has been very low for Amazon.com Inc (NASDAQ:AMZN), the stock's historically low realized stock volatility has made owning options a disaster -- unless we make a clever adjustment.

Owning Option Premium

Here are the results of owning naked options in Amazon over the last year. Moving from left to right we go from the at the money straddle, to slightly more out of the money strangles.

The only thing we can say with confidence is that the result are consistent across the spectrum -- about a 78% loss over the last year for owning options in Amazon.

IMPROVE

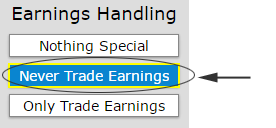

Our first step in improving the results is to eliminate the risk of earnings. Options are much more expensive during earnings periods, for good reason, and it's well worth our time to the see impact on the original strategy of removing earnings trading:

And now the results:

The losses have gone from 78% to as low as 11.6%. But now we make the really important move:

Instead of the naked buying of options, we will sell options that are further out of the money to offset the expense of the purchases. The strategy we are going to look at is called a condor (or iron condor). Here are the results of both avoiding earnings and selling out of the money options against the long options:

It's remarkable, but these are the realities of option trading. We have gone from a 78% loss, down to a 11% loss by avoiding earnings, and now to a 35% winner by selling options to offset the long options.

We can do this over the last six-months as well:

Now we see a 154% gain while the stock is up just 7% in that same time. And again, the appeal to owning options in this way is the removal of stock direction bias -- up or down, the stock direction doesn't matter.

WHAT JUST HAPPENED

This is how people profit from the option market - it's preparation, not luck. This same approach, with its own twist, has worked very well for Apple Inc (NASDAQ:AAPL), yielding 137% returns over the last year.

To see how to do this for any stock, index or ETF and for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

The author has no stock position in Amazon.com Inc (NASDAQ:AMZN) and is long Apple Inc (NASDAQ:AAPL) stock at the time of this writing.