Written by Ophir Gottlieb

LEDE

In a bull market, selling puts or put spreads is generally a good bet and that is the case with Tesla Inc (NASDAQ:TSLA), but using the dynamics of the stock to our favor has created an option winner with superior returns and less risk.

PREFACE

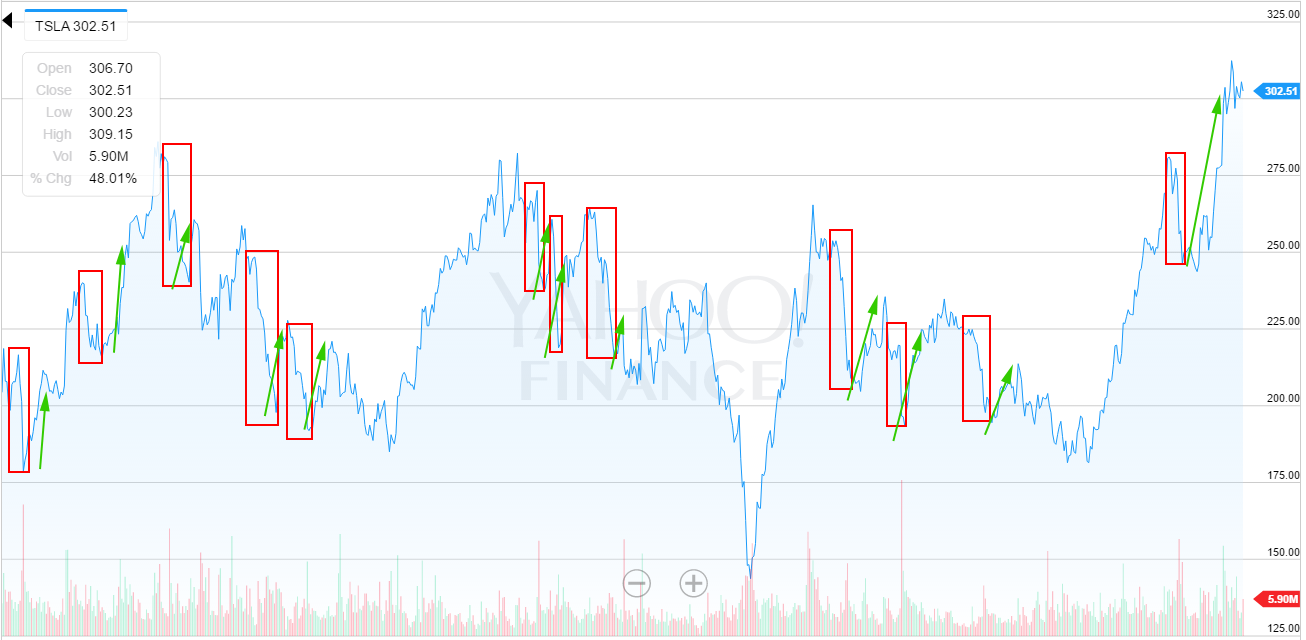

Tesla Inc (NASDAQ:TSLA) has unique stock dynamics. Here is a three year stock chart via Yahoo! Finance:

What we can see is that the stock drops abruptly quite often, but also recovers equally abruptly and equally as often. This means there are two critical elements to trading options in Tesla Inc we need to address. The first is a stop loss -- but this alone will not be good enough. Let's take step one, and see the results.

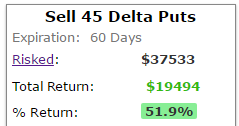

These are the results of selling an out of the money put in Tesla Inc every 60-days:

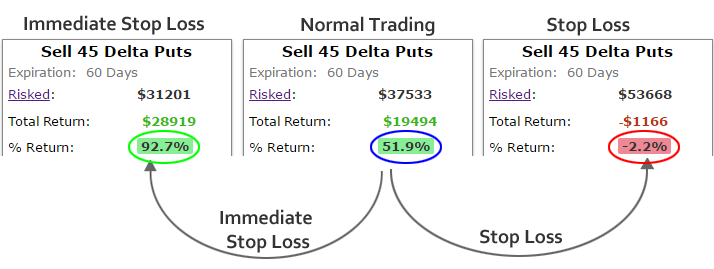

That's a 51.9% return while the stock was up 49.5%. That is a ton of risk for not very much additional return. Now, we can address the risk by putting a stop loss in, like this:

What we have done is employed a risk reduction strategy which attempts to limit the downside of a short put gone wrong. While a short put can lose several hundred percent of the actual credit received, we have limited that loss 100%. For example, if we sold a put @$1.00, if it hits $2.00, we would buy it back and end the trade.

Now here's the key: after the stop loss is triggered, in this example, we would the remaining days of that option, and only after the 60 days we would sell a put again. Here are the results:

Unfortunately, employing that stop loss has turned a 51.9% winner into a 2.2% loser. But, that stop loss has only taken into account one of the two realities surrounding Tesla Inc's (NASDAQ:TSLA) stock dynamics. We have limited the downside, but we have not addressed the abrupt recoveries. Here's how we take care of both stock dynamics:

It's subtle, but we have selected "Immediately" for our "Open Next Trade" rules. In English, in this test, when the stop loss is triggered, we buy back the losing put, but immediately sell the new near the money put at the same time. Here are the results:

The left hand side shows that this "immediate trade stop loss" returned 92.7% versus the normal short put, which returned 51.9% and the prior stop loss implementation, which waited the full 60 days to trade again, of a 2.2% loss.

We have addressed the reality that Tesla Inc can move down abruptly by using a stop loss, but we have further refined the strategy to open the next short put "immediately" to benefit from Tesla's other stock dynamic -- abrupt reversals.

OVER TIME

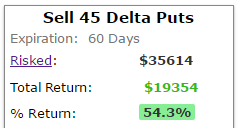

This idea has worked over time, not just over three-years. Here is the result of normal short put trading versus the stop loss with immediate re-entry over two-years:

We see a 5.4% gain, with a ton of risk, turn into a 42.2% gain with less risk due to the stop loss. That's nearly a 9-fold return with less risk. And all we have done is take what we can plainly see in the stock chart, and turn that into a trading plan.

Here is how this stop with "immediate re-open" has done over the last year:

WHAT JUST HAPPENED

Options are derivatives -- which simply means their underling price is derived from the stock price. It makes sense, then, that our option strategy accounts for the stock's dynamics.

This is how people profit from the option market - it's preparation, not luck.

To see how to do this for any stock, index or ETF and for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

The author has no position in Tesla Inc (NASDAQ:TSLA) as of this writing.