Written by Ophir Gottlieb

LEDE

With the market selling off and mega tech especially under fire, we need to examine when being short options is appropriate -- or at least has been most appropriate in the past.

Microsoft Corporation (NASDAQ:MSFT) is the long forgotten mega cap while media darlings Apple Inc, Facebook Inc, and Alphabet Inc garner all the headlines. But the lack of attention hasn't removed the opportunity in options, especially after earnings.

The difference between professional traders and non-professionals is usually access to information and mindset. We can address both with this analysis on Microsoft Corporation where we look at an option trade right after earnings that has been a winner without a loss for an entire year, and has been a loser only once in the last three-years.

The Trade After Earnings

It's a fair question to ask if trading options every month is worth it -- is it profitable -- is it worth the risk -- especially now. So, there's an action plan that measures this exactly, and the results are powerful not just for Microsoft, but for Apple Inc (NASDAQ:AAPL), Facebook Inc (NASDAQ:FB) and Alphabet Inc (NASDAQ:GOOGL) as well.

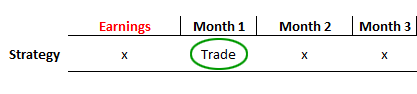

We've done this before, and we'll do it again -- because risk management is critical, and avoiding unnecessary trading is a part of risk management. Let's test the idea of selling a put spread only in the month after earnings. Here's what we mean:

Our idea here is that after earnings are reported, and after the stock does all of its gymnastics, up or down, that two-days following the earnings move and for the next month, the stock is then in a quiet period.

If it gapped down -- that gap is over. If it beat earnings, the downside move is already likely muted. Here is the set-up:

More explicitly, the rules are:

Rules

* Open short put spread 2-days after earnings.

* Close short put spread 29-days later.

* Use the option that is closest to but greater than 30-days away from expiration.

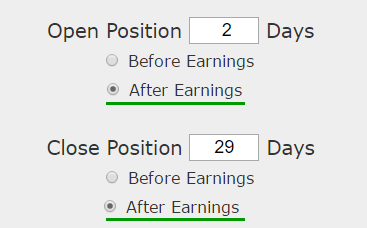

And here are the results of implementing this much finer strategy:

It's almost too good to be true -- a 71.6% return on 12 trades, where 11 were winners. We do note that the one loser came in February 2016 where the test sold a 53/50 strike put spread at $0.66 and ended up buying it back for $1.53 -- so a $0.87 loss on an original $0.66 credit.

All the other trades over the last three-years were winners.

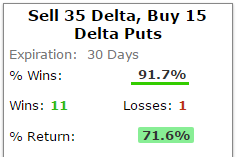

Here's what we see over the last year:

Now we see a 42.2% return over the last four earnings cycles, but the beauty of this approach has not just been superior returns, it doesn't tie up capital for months that aren't profitable. Since this was just four-months of trading, that's over 160% annualized returns.

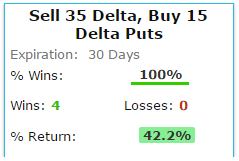

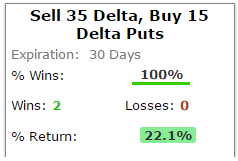

Finally, here are the last two earnings cycles (six-months):

Remarkably consistent -- with a 22.1% over six-months and 42.2% over the last year.

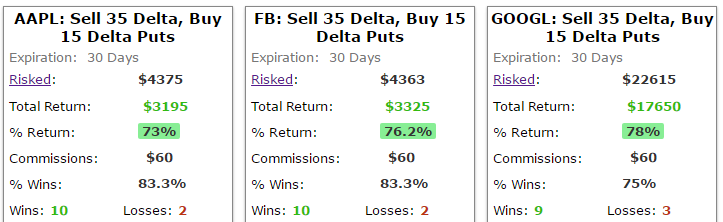

As an aside, this logic of finding the month of lowest risk to sell put spreads also worked remarkably well and remarkably similarly across the board in Apple Inc, Facebook Inc and Alphabet Inc.

WHAT HAPPENED

To see how to do this for any stock and for any strategy, including covered calls, with just the click of a few buttons, we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

The author has no position in Microsoft Corporation (NASDAQ:MSFT) as of this writing.