Preface

With the market's direction becoming tenuous, we can explore option trading opportunities in Starbucks Corporation (NASDAQ:SBUX) that do not rely on stock direction but do trade around earnings.

It turns out, over the long-run, for stocks with certain tendencies like Starbucks Corporation, there is a clever way to trade market anxiety or market optimism before earnings announcements with options.

This approach has returned 112% with a total holding period of just 84 days, or a annualized rate of 487%. Now that's worth looking into.

Starbucks earnings are expected 7-27-2017, after the market closes.

The Trade Before Earnings

What a trader wants to do is to see the results of buying an at the money straddle a few days before earnings, and then sell that straddle just before earnings. Ideally we would see a high win-rate, a high return, and small losses when the trade goes wrong, and we get all of that when examining Starbucks.

This trade is not a panacea, which is to say, we have to test it, stock by stock, to see when and why it worked. Let's start with Starbucks.

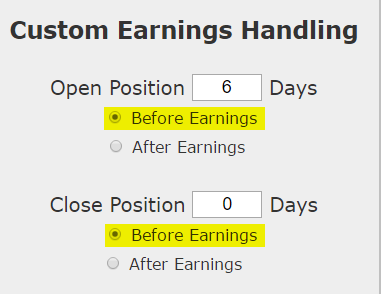

Here is the setup:

We are testing opening the position 6 calendar days before earnings and then closing the position the day of earnings. Since Starbucks reports earnings after the market closes, this is not making any earnings bet. This is not making any stock direction bet.

Once we apply that simple rule to our back-test, we run it on an at-the-money straddle:

Returns

If we did this long at-the-money (also called '50-delta') straddle in Starbucks Corporation (NASDAQ:SBUX) over the last three-years but only held it before earnings we get these results:

We see a 112% return, testing this over the last 12 earnings dates in Starbucks Corporation. That's a total of just 84 days (7 days for each earnings date, over 12 earnings dates). That's a annualized rate of 487%.

We can also see that this strategy hasn't been a winner all the time, rather it has won 10 times and lost 2 times, for am 83% win-rate and again, that 112% return in less than two-full months of trading.

Looking at Recent Results

We can do this same test but look at the last year, rather than the last 3-years. Here are those results:

This pre-earnings long volatility trade has stare to find some momentum and has won each of the last four earnings cycles after going with 2 wins and 2 losses in the year prior (2-years ago).

MORE TO IT THAN MEETS THE EYE

While this strategy is benefiting from the implied volatility rise into earnings, what it's really doing is far more intelligent.

The option prices for the at-the-money straddle will show very little time decay over this 7-day period, so what this strategy really does is buy "seven days" of potential stock movement with what is actually fairly small downside risk.

WHAT HAPPENED

This is it -- this is how people profit from the option market -- finding trading opportunities that avoid earnings risk and work equally well during a bull or bear market.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.