Financial transactions come in all sizes and quantities. For smart investors, being involved in the most active of transactions is extremely lucrative.

And the device that’s driving most innovation in these transactions is in most people’s pockets already: their smart phones.

The rise of digital transactions has the UN’s Better Than Cash Alliance taking notice, especially in China.

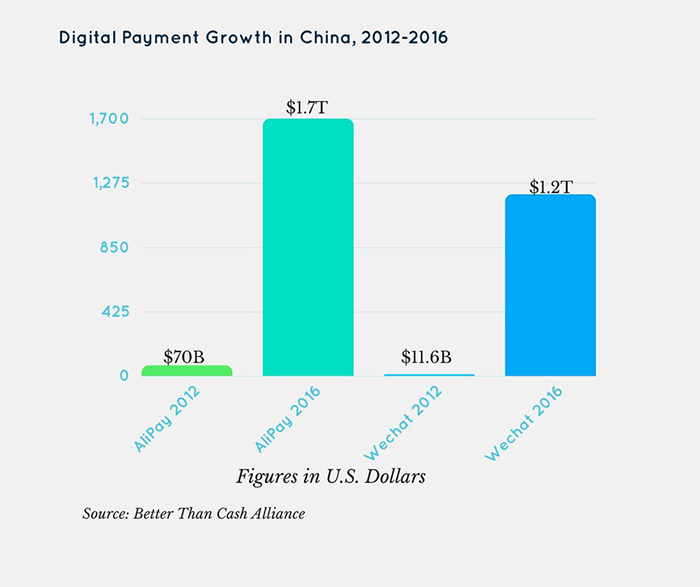

According to a report released by the aforementioned Alliance (a global partnership of governments, companies, and international organizations), Chinese customers sending cash payments digitally accounted for $3 trillion in transactions.

That’s trillion... with a big, fat T.

And that flurry of financial traffic existed on just two smartphone-app platforms: Alipay from Alibaba (NYSE: BABA), and WeChat from Tencent (OTC: TCEHY).

Alipay alone accounted for $1.7 trillion in payments sent in 2016, up a massive 2400% from $70 billion in 2012.

While China is far ahead of the pack, in terms of transitioning to a fully digital economy, the west isn’t exactly standing still either.

Over the last decade, western economies have seen a massive increase in digital transactions, as we move away from cash-driven interactions.

Banks have moved to digitize their clients’ experience, both through debit cards with easy tap transactions, and by constantly improving the online banking experience.

For many of these services, customers judge their application based on ease of use, and on time saved.

Saving time in many of life’s interactions is always to be desired for people on the go.

One Vancouver-based tech firm is aiming to shave time and add a massive convenience to an activity that many people do on a daily basis: paying the check at restaurants.

EAT, PAY, LOVE

GlancePay from Glance Technologies (CSE: GET) (OTC: GLNNF) is a mobile restaurant payment app, specifically designed to seamlessly pay for your meal in the easiest, fastest way possible.

"Allowing users to easily and quickly send payments to any merchant on our platform from anywhere opens up payment situations similar to those that have taken China by storm," says Glance CEO Desmond Griffin.

The app offers its users the ability to pay for meals without a machine, divvy up bill portions among everyone at the table, digitally track receipts, and to earn and collect restaurant rewards.

Desmond Griffin has already grown and sold another widely used payment app - PayByPhone, a parking meter payment app that was recently acquired by a Volkswagen subsidiary.

Much like PayByPhone’s rapid expansion outward into several major cities internationally, GlancePay began its journey in Griffin’s home of Vancouver, and quickly disperse far and wide.

One of Glance’s market advantages is its swift, painless setup for restauranteurs to adopt.

"Our merchants can be up and running very quickly without requiring custom costly and cumbersome hardware,” says Griffin.

“Merchants can just use their existing mobile phones or tablets, while still benefiting from of our secure proprietary anti-fraud technology."

At launch, GlancePay had a small-but-respectable stable of 46 restaurants.

However, savvy expansion and market entries has grown the app’s selection to a current number of XX restaurants, and the signing on of major chains such as Ricky’s Family Restaurants, and to be used for payment on room service bills for food orders in the Best Western Sands Hotel in downtown Vancouver.

Confidence from such major chains can become very contagious. Streamlining any transaction is advantageous, but to also reduce fraud or charge backs is downright essential in the hospitality industry.

"Our restaurants offer Glance Pay and we are very happy with the results," says Eddy Chau , Assistant GM at the Best Western Plus Sands Hotel.

"The rewards have enabled us to build more loyal customers. We've had no fraud or charge backs. We are excited to implement the anti-fraud and security features of the Glance Pay app to give our hotel guests a better experience."

Earlier this year, Glance Pay was adopted across the health-conscious Fresh restaurant chain started by Ruth Tal and Jennifer Houston. Upon adoption of the platform, Fresh issued a corporate statement saying:

“At Fresh Restaurants, we love Glance Pay because it makes dining-in even easier for our customers. Paying at your table is now as effortless as paying on your favourite food delivery app. It saves time for both our customers and our staff so it was a no brainer for us!”

MULTI-FACETED MOBILE MAGIC

Since launch, Glance Pay has incorporated multiple streams to raise value for customers, and the company as a whole.

The app’s basic function allows customers to take a picture of their bill, and then pay directly using their phone. During the payment process, customers can portion the bill among those at the table, include a tip, and also leave a review.

Glance earns a pre-determined percentage of the transaction, as well as earning revenue from bonus offers and regionally directed advertising.

But overall, the app is delivering where it promises to, by reducing the time it takes to pay your bill, and be on your way.

The app is engaged in beginning to incorporate other features such as ordering food for delivery, and branching out into other sectors, such as the service industry like salons and newsstands.

As the size of the app’s user base grows, so too will demand from the restaurant industry to establish the system industry-wide as a time-saving convenience for both the restaurant and its diners.

And as adoption grows, so too will investor value.

Legal Disclaimer/Disclosure: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Baystreet.ca assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Baystreet.ca has been compensated twenty thousand dollars from the company for Glance Technologies advertising and Baystreet.ca also holds shares in Glance Technologies. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.