Blockchain can eventually affect every industry in the world--and make no mistake about it. Even if hyper-volatile cryptocurrencies are dipping and diving, the overall gains for many are thousand percentage points, and new multi-millionaires are being minted left and right.

Blockchain is its backbone—but it’s so much more than cryptocurrency. It is a technology that will up-end every single industry on the planet.

And sometimes all it takes to revive a dead dinosaur of a company right now is a whisper of blockchain involvement.

- Overstock has seen share prices jump over 300 percent in 12 months on a strategy shift to blockchain

- Kodak shares tripled in a day on the announcement of KodakCoin, and few of us even realized Kodak was still around

- MoneyGram bust through the gates by announcing a partnership with Ripple cryptocurrency to ease transactions.

It’s real. We are moving toward a cashless society. But the reality check gets even more exciting when we realize that if we think beyond the box of cryptocurrency, blockchain is reinventing the way we do EVERYTHING. From shipping and finance, to food packaging, gaming and healthcare. Absolutely everything.

But the sheer size of the potential here poses an equally sizable problem for investors: How to get in on it without losing your shirt?

It’s a complex and highly dynamic revolution and FOMO (fear of missing out) is at epidemic proportions.

Here are 5 stocks that could make it easy for investors to test the stormy blockchain sea:

#1 Overstock (NYSE:OSTK)

Overstock has been the undeniable blockchain business leader, and its stock has been climbing all year, with few setbacks.

There’s constant news flow here, and it’s being helped along by Overstock’s fintech subsidiary, tZero, which just announced the purchase of a 24 percent stake in StockCross Financial Services, Inc. tZero is on the prowl to aggregate all components of its trading, clearing and settlement platform. It’s looking to buy, build or partner, so the news flow is brilliant.

It’s a definite blockchain bull, but it’s been completely reasonable and rational. That’s what makes it one of the safest bets on blockchain. It’s investing in companies on the cutting edge of development in the blockchain space, and its stock price shows that it’s not scaring anyone away.

At this point, while everyone has always thought of Overstock as just an internet merchant, it’s time to start viewing this as a blockchain business. They’ve got their own cryptocurrency exchange, and the stock has gained 316 percent in the past 12 months. This is a strategy shift like no other. Some 80 percent of its revenue is estimated to come from the blockchain now.

#2 Global Blockchain Technologies (CSE: BLOC; OTC: BLKCF)

How about this for a small, $64-million market cap company sitting on an ethereal goldmine?

Anyone who missed the first crypto boat and is dying to get in on the most exciting market sector of our time is now wondering how, and this is easiest way:

BLOC is a publicly traded blockchain “hedge fund” and “incubator” that you can get in on through your online brokerage account.

Even better: The company is a blockchain mastermind. It’s the brainchild of the same man who co-created Ethereum, Steven Nerayoff.

Ethereum has gained over 357,000 percent since its launch, with Nerayoff as its advisor. He was also a senior advisor to the Lisk Cryptocurrency project which now has a market cap of over 3 billion dollars.

Not only are they investing in crypto projects (as one expects a hedge fund to)...

But they are also incubating hand picked blockchain companies.

The best part...

You don't need to know anything about Bitcoin... blockchain... or have your own crypto investing system...

Because you can add Global Blockchain to your portfolio with just a few clicks, and let the only publicly traded crypto investment team do the work for you.

Global Blockchain has put together a core team that aims to be “incubating” 6-12 new digital currencies every year. This means that Global Blockchain will be providing the funding for these new currencies in return for an equity stake.

BLOC’s strategy is multi-pronged and aside from giving us an easy way to get in on the biggest market ever, this is its key attraction.

It gives you exposure not only to the top trading tokens, but also early-in, exclusive access to the tokens that are expected to trade in the future. It covers large-cap, small-cap and pre-ICO/ICO tokens all at the same time.

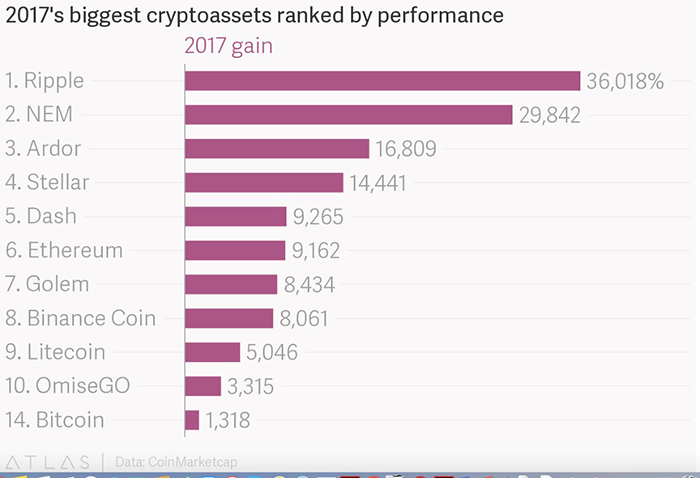

Average gains of top tokens like Bitcoin, Ethereum and Ripple (among others) is mind-blowing.

And beyond this, there is huge potential for growth.

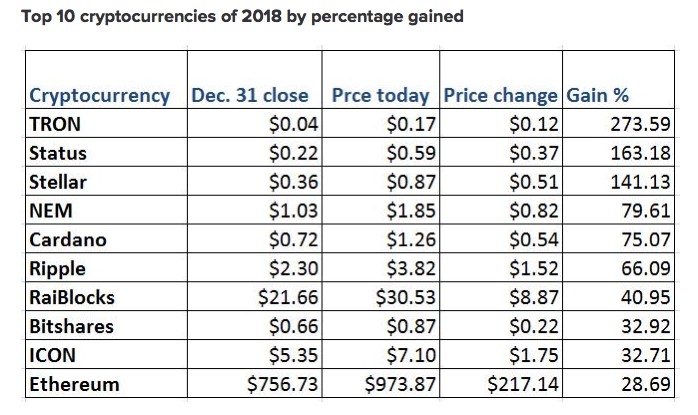

So far this year, some small-caps have been outpacing large-cap gains:

(Source: Coindesk.com)(NOTE: “Price Today” in chart above refers to an article from Coindesk.com dated January 4, 2018, after market close).

These are the precisely the types of tokens Global Blockchain is targeting, but exposure gets even better through BLOC’s access to pre-ICO (initial coin offering) and ICO tokens.

ICOs are sort of the “wild west” of the cryptocurrency world. There’s not much transparency or regulation, so many of them are illegal scams. Those that aren’t stand to be huge returners, and Global Blockchain has the experience to know the difference. After all, they are ICO masters with Ethereum and others to back them up.

There’s still more: BLOC is also building a portfolio of startups focused on blockchain-based services. That means acquiring … and tokenizing software that could further benefit blockchain. It even invested in Kodak One, and the price of Kodak jumped a whopping 321 percent after it announced a crypto-currency deal. The Kodak ICO is expected at the end of this month and with BLOC’s huge stake this is definitely one to watch.

And then there’s their partnership with Overstock.com (NASDAQ:OSTK) and its tZero subsidiary.

Blockchain—and its rewards—are only limited by the imagination, and BLOC has plenty of imagination. We expect news to flow by hard and fast as they add new, exclusive projects.

#3 Nvidia (NYSE:NVDA)

Didn’t think NVDA was a blockchain company? Well, it’s not … and it is. When you pick it apart, it’s one of the backbones: NVDA makes semiconductors to power cryptocurrency mining.

NVDA is a major climber this year, and a long-time favorite when we talk about anything from artificial intelligence to blockchain.

When stock prices go on a run for too long, the knee-jerk reaction can be a pullback out of fear that it’s just too much of a good thing. We think this is a mistake when it comes to NVDA. This company is involved heavily in everything from autonomous vehicles, graphic processing, central processing units, computer gaming and blockchain … It’s cornering tech on every level, and we think it’s only at the beginning of its run.

#5 International Business Machines (NYSE:IBM)

IBM stock isn’t doing great right now, despite a solid earnings call on 18 January. Stock is down around 4 percent over the past week.

IBM reported Q4 adjusted diluted earnings per share of $5.18 on revenues of $22.54 billion. This is up from the same period a year ago, which recorded EPS of $5.01 on revenues of $21.77 billion. Figures were also up for the full year and slightly exceeded analyst estimates.

So, IBM strengthened its position as the leading enterprise cloud provider and established itself as a blockchain leader for business.

Still, stocks are down. Why? Because no one is yet convinced about the blockchain move, and this is a mistake.

What they don’t like are IBM’s declining business signings and declining backlog, so they don’t see the profit margins improving.

But they’re stuck in the past when they should be focusing on the future, and the future is blockchain.

Right now, is a great time to buy IBM in our opinion. Buy on the dip, hold for the long term and ride the blockchain.

What we’re looking at is IBM’s deal with shipping giant Maersk to form a new company to commercialize blockchain technology. IBM would hold 49 percent in this venture, which still doesn’t have a name. It would help shippers, ports, customs offices, banks and other global supply chain stakeholders track freight and turn paperwork into digital records. This is huge, and no one’s caught on yet.

But that’s just scratching the surface. IBM is also working on a food safety blockchain with Walmart and a Chinese e-commerce company called JD.com. What will blockchain do to the food industry? Well, according to testing so far, it reduced the time to trace a package of rotten mangoes from the source farm to the store to 2 seconds (compared to the usual week).

#5 Blockchain ETFs

Another safer way to get in on blockchain is through three ETFS that seek out real ties to blockchain. What we like about this is the flexibility because they can couple small blockchain companies with something like IBM, which Wall Street would relegate only to IT, not blockchain. This gives us a wide diversity for getting in on blockchain, and something that might not have startling returns, but is safer for the cautious investor.

- Innovation Shares NextGen Protocol ETF (NYSE:KOIN) picks stocks using a quant model, tracking companies and putting them in a proprietary index (Blockchain Innovators Index). Most companies are U.S. based, but Chinese companies feature as well (11 percent). They hold Visa and Mastercard in the Top 10 because they’ve started blockchain payments. It just started trading on the NYSE.

- Reality Shares Nasdaq NextGen Economy (BLCN) ETF owns companies like HIVE Blockchain Technologies, Japanese SBI investment bank, IBM and Overstock.

- Amplify (NYSE: Arca BLOK) launched in the third week of January, and its top holdings are Citigroup, Overstock, IBM, Square and Nvidia.

Honorable Mentions:

Mogo Finance Technology Inc. (TSX:MOGO): This is a new spin on unsecured credit, which is a burgeoning sub-segment of FinTech. Mogo’s software analyzes borrowers instantly and greatly reduces the traditionally cumbersome underwriting process for loans. It’s online only, so there’s very low overhead and a ton of cash to spend on marketing.

Power Financial Corp (TSX:PWF): We like PWF because it owns 60 percent of Wealthsimple, a leading robo-advisor for investing in ETF portfolios.

D+H: D+H is a leading Canadian FinTech provider with global payments, lending and financial solutions targeting some 8,000 banks, speciality lenders, credit unions, governments and corporations.

BCE Inc. (TSX: BCE) is a Canadian telco giant. Founded in 1980, the company, formally The Bell Telephone Company of Canada is composed of three primary subsidiaries. Bell Wireless, Bell Wireline and Bell Media, however throughout its push into the position of one of Canada’s top telco groups, it has bought and sold a number of different firms.

BCE Inc has resisted takeover attempts and shown significant resilience throughout the years. The company has been so successful, that it is now a household name.

It’s paying a quarterly dividend of $0.72 per share right now. It’s had some great results, even if net income has declined a bit in the most recent quarter. It’s still blowing other telcos out of the water.

Peeks Social (TSXV:PEEK) is a Canadian company which is primarily focused on the development of social media and social commerce products. The Peeks Social app has reached over 30 million people and is growing quickly. As one of the 15th highest grossing social apps on Google platform, Peeks is adding value for both its customer and its investors.

Through strong leadership and a forward-thinking management team, the company has made waves in Canada’s mobile world. The company’s CEO, Mark Itwaru, worked with AT&T Canada for years as an engineer and designer before beginning his work with Peeks.

Peeks Social is set to continue its rise in Canada’s mobile application world, and as it continues to grow, investors are sure to profit.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable securities laws. Generally, any statements that are not historical facts may contain forward-looking information, and forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" "intends" or variations of such words or indicates that certain actions, events or results "may", "could", "would", "might" or "will be" taken, "occur" or "be achieved". Forward-looking information includes, but is not limited to the rate of cryptocurrency and blockchain technology adoption and the resultant effect on the growth of the global cryptocurrency and tokens market capitalization; Global Blockchain Technologies Corp.’s (“BLOC”) anticipated ability to reduce risk for investors and give investors exposure to a broad cross-section of the blockchain ecosystem; BLOC’s projected asset allocations, business strategy and investment criteria, including the anticipated contributions of BLOC’s incubator program; the expected strengths and contributions of BLOC’s management and advisors; and the rate of cryptocurrency adoption and the resultant effect on the growth of the global cryptocurrency market capitalization. Readers should be aware that BLOC has no assets except cash from a recently completed financing and its business plan is purely conceptual in nature: there is no assurance that it will be implemented as set out herein, or at all. Forward-looking information is based on certain factors and assumptions about BLOC believed to be reasonable at the time such statements are made, including but not limited to: statements and expectations regarding the adoption and growth of the global cryptocurrency and tokens market capitalization; BLOC’s ability to reduce risk for investors and give investors exposure to a broad cross- section of the blockchain ecosystem; BlOC’s ability to acquire a basket of cryptocurrency assets and pre-ICO and ICO financings on favorable terms or at all, successfully create or incubate its own tokens and ICO's, and execute on future investment and M&A opportunities in the cryptocurrency space; BLOC’s ability to capitalize on the skills and expertise of its management and advisors; and such other assumptions and factors as set out herein. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of BLOC to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks related to changes in cryptocurrency prices; the estimation of personnel and operating costs; that BLOC will receive required regulatory approvals; the availability of necessary financing; permitting of businesses that BLOC intends to invest in; general global markets and economic conditions; uninsurable risks; risks associated with currency fluctuations; risks associated with competition faced in securing experienced personnel with appropriate industry experience and expertise; risks associated with changes in the financial auditing and corporate governance standards applicable to cryptocurrencies and ICO's; risks related to potential conflicts of interest; the reliance on key personnel; financing, capitalization and liquidity risks including the risk that the financings necessary to fund continued development of BLOC's business plan may not be available on satisfactory terms, or at all; the risk of dilution through the issuance of additional common shares of BLOC; the risk of litigation; the risk that BLOC’s management and advisors may not contribute as much as expected to the company’s success; the risk and the risk that cyber crime may severely damage the value of any or all of BLOC’s investments. There may be many other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. We undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by law. Investors are cautioned against attributing undue certainty to forward-looking statements.

BLOC has no assets except cash from a recently closed financing and this article is based on the business plan of BLOC which at this point is purely conceptual in nature. There is no assurance that the business plan will be implemented as set out herein, or at all.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is not a recommendation to buy or sell securities. This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. In most cases we are paid by the issuer or a third party to profile the issuer. In this case, BLOC is paying to Safehaven.com eighty thousand US dollars for this article and certain banner ads. We have not investigated the background of BLOC. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur. Our emails may contain forward looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company(s), in communications, writing and/or editing.

DISCLOSURE. Safehaven.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) does not make any guarantee or warranty about what is advertised above. The Company is not affiliated with, any specific security. While the Company will not engage in front-running or trading against its own recommendations, The Company and its managers and employees reserve the right to hold possession in certain securities featured in its communications.

The opinions expressed in this article are exclusively those of the author and have in no way been approved or endorsed by BLOC. This article and the information herein are provided without warranty or liability.

SHARE OWNERSHIP. The owner of Safehaven.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Safehaven.com will not notify the market when it decides to buy more or sell shares of this issuer in the market, but will not trade on material information that has not been disclosed to the public. The owner of Oilpatch.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing the Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.