Big Oil is finally going digital.

Between artificial intelligence, big data, the Internet of Things, and computer learning, the entire industry is undergoing a huge transformation.

Robots are running oil and gas rigs, drones are scouting fields, and tiny interconnected micro-sensors are transporting critical infrastructure data across the world in the blink of an eye.

But there will be winners and losers in this race to digitize the industry. This is a turning point for Big Oil. Adopt or die. And it is the companies that prioritize tech that are poised to succeed.

The industry is entering a new era, and it’s time to ditch the tried and tested methods for something brand new.

These 5 companies are at the top of the food chain, set to turn the energy industry upside down, and perhaps enjoy some of the big profits the industry has to offer.

#1 GE (NYSE: GE)

General Electric is a household name. As a leader in industrial manufacturing, but more importantly, a top contender in the energy sector, GE’s technological know-how is second to none.

While 2017 proved to be a tough year for General Electric due to some untimely bets on natural gas peaker plant tech, GE’s forward-thinking posture in the field has caught the eye of those really paying attention.

General Electric is utilizing some of the most ground-breaking tech in energy, especially in the oil and gas sector. Often overlooked, GE’s innovative use of drones has quietly reshaped oil and gas exploration and production.

In 2016, GE unveiled a helicopter drone in Fayetteville Arkansas which detects and monitors emissions of methane from oil and gas wells. These drones have the potential to unlock previously unknown stashes of crude: a game changer for the industry.

GE is also getting into the Big Data game.

In its high-profile partnership with Apple, the two have developed the Predix platform, a platform which will allow industrial companies to utilize Big Data in ways never before seen.

The Predix is able to access and analyze data from thousands of micro-sensors in refineries across the world, providing companies the opportunity to harness the true power of data in order to detect anomalies, predict maintenance, and optimize performance. This means companies adopting this platform stand to gain big. And if money is being made, it’s sure to pay off nicely for investors.

But GE’s digital push doesn’t stop there. The company is also on the forefront of the blockchain revolution.

Researchers are currently looking at ways to utilize the tech to bring renewable producers and customers together in new ways. John Carbone, a principal engineer at GE Global Research, explains: “Through blockchain, we think there’s an opportunity to create a marketplace where we can connect these participants.”

#2 Petroteq Energy Inc. (TSX:PQE.V; OTC:PQEFF)

Petroteq Energy Inc. is a special addition to this list. A small company with huge potential.

Petroteq is aiming to become a major player in the oil and gas industry thanks to its appreciation of technology.

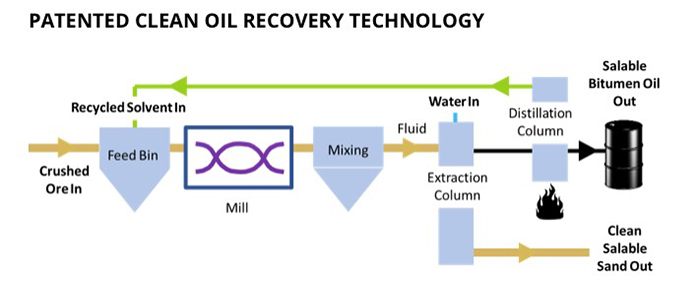

This innovator has developed a one-of-a-kind oil production technology that has the potential to unlock millions of barrels of oil: cheap and clean. And it plans to lease this technology to drillers around the world. This should be a profitable venture indeed.

Oil sands carry an incredibly dirty PR image. High emissions, toxic trailing ponds, and expensive extraction methods that have become the bane of environmental groups and the focus of disinvestment campaigns.

Using proprietary technology that employs a closed-loop system and a unique solvent that cleanly extracts heavy oil, Petroteq’s new system removes 99 percent of all hydrocarbons sand, requires no water, and generates no greenhouse gas emissions. All of this for only a projected $22 per barrel.

The often-neglected oil sands in Utah’s Unitah basin has been a nuisance to oil majors eager to tap into its estimated 32 billion barrels, but only one company has generated production from this tough terrain. Petroteq.

And this is only the tip of the iceberg.

Worldwide, there are incredible opportunities for the licensing of this breakthrough oil sands tech. Canada alone has over 170-billion barrels of oil trapped in Alberta’s oil sands. While the technology has proven to work best for dry oil sands, which is found in most of these listed countries, it may eventually be modified to be used in wet oil sands too, like those in Canada.

In addition to its revolutionary oil sands production technology, Petroteq has also joined the blockchain race.

Often referred to as “the new internet,” blockchain technology is already reshaping the world’s most important industries.

Utilizing the same blockchain technology as used by IBM, rated the world’s top blockchain company, Petroteq has formed a consortium under the name of PetroBLOQ.

With blockchain, PetroBLOQ is looking to turn the industry’s supply chain on its head. Upstream, midstream, and downstream transactions could all be completely transformed, saving the entire sector billions in costs.

As The Economist put it earlier this year, “The world’s most valuable resource is no longer oil, but data.” And Petroteq is ready to profit from both.

#3 Intel (NASDAQ: INTC)

As the world’s second largest semiconductor chip maker, Intel is a world leader in tech. As such, it is poised to see tremendous gains from the digitalization trend happening in energy.

The company’s “Intel Insider” slogan has become its claim to fame. As the creator of the world’s first microprocessor chip in 1971, Intel paved the way for the personal computer. Arguably the most disruptive piece of technology ever created.

But Intel’s genius doesn’t stop there. Now it’s set its sights on the world’s biggest industry.

Its Internet of Things platform offers unique solutions in the oil and gas industry. From optimizing resource recovery to lowering costs across the board, Intel’s highly specialized technology is sure to fill the pockets of everyone involved.

The company has also created the Intel Scalable System Framework and High Performance Computing platform which allows oil and gas companies to process data that is vital within the industry. The platform allows drillers to analyze seismic data and perform reservoir simulations that will save the industry millions.

Additionally, Intel is producing functional commercial drones for the industry. These small, unmanned units can be used to inspect rigs, capture thermal images of flare stocks, and evaluate underdeck cooling towers.

The entire oil and gas industry is racing to reduce costs, and technology is in the driver’s seat. Even oil majors are seeking the help of Intel to stay afloat, and savvy investors are taking note of this trend, getting in while the getting is still good.

#4 ExxonMobil (NYSE: XOM)

ExxonMobil is one the largest and most profitable oil companies in the world. And that’s largely thanks to their use of technology.

Over 50 years ago, Exxon pioneered a new technology that has since become ubiquitous in the industry. 3D seismic imaging. Using sound waves, Exxon was able to map geological formations, a revelation that changed the way drillers searched for and extracted oil.

But it didn’t stop there. More recently, the supermajor took it one step further. With Full Wavefield Inversion, an advanced 4D seismic surveying technology that uses supercomputing and time-lapse imaging to obtain images of the subsurface, Exxon once again positioned itself ahead of the pack.

Exxon’s drilling tech is especially noteworthy. The company is now drilling longer horizontal wells than anyone else. It’s 3-mile Bakken shale well was a landmark in the industry, and now it’s working on a 4-mile well, which, according to Barclays, will be “a game changer that could potentially allow the company to leap frog the competition in unit cost and return metrics.”

Despite Exxon’s late entry to the shale game, the company is still light years ahead of its competition in terms of profits.

Not only is Exxon held a key role in bringing the oil and gas industry into the modern era, the company is also a world leader in the development of biofuels and fuel cells.

Spending approximately $1-billion per year on the research and development in new energy technologies, Exxon is sure to continue on its path of innovation for years to come. Investors can rest assured; this research will pay off for them.

#5 Halliburton (NYSE: HAL)

Halliburton is one of the largest oilfield services companies in the world. The company has secured its place in the oil and gas industry. But it didn’t happen overnight.

The oilfield services sector is highly competitive and ripe with innovation. In order to stay ahead, companies must be on the absolute cutting edge of technology. And that’s exactly what Halliburton has done.

And recently, Halliburton increased the heat for its competition. Partnering with Microsoft, Halliburton is securing its position as a leader in the industry.

This partnership is significant. Microsoft, a leader in the tech world, is looking to bring machine learning, augmented reality, and the Industrial Internet of Things to the oil and gas industry.

The marriage between Big Oil and Big Data will usher in a new era in energy.

In a joint release, the companies announced: “The relationship will combine the expertise of a global leader in cloud and digital transformation with a global leader in exploration and production (E&P) science, software and services.”

Together, the two companies will utilize some of the most ground-breaking digital technology in existence to lower costs, reduce emissions, and access data in a brand new way.

This is the future of oil and gas. Industry heavyweights are scrambling to work with tech companies, and tech companies are opening up to the idea. The incredible advancements in tech over the past several years has opened up a new realm of possibilities in energy.

Investors can’t ignore this. These high-profile partnerships are only a glimpse of things to come. The oil and gas industry has been primed for disruption, and the cracks are beginning to form. There will soon be a turning point, where companies like Haliburton, and its focus on tech, will survive, and others, which have ignored the inevitable, will fall.

Other innovative tech companies to watch:

Inter Pipeline Ltd (TSX:IPL): Another pipeline company that holds plenty of upside for the coming year, IPL is particularly interesting for its exposure to the oil sands sector which is sure to see a boost in production as more and more companies focus on increasing output in the new high oil price environment.

The crisis in Venezuela has already seen heavy oil imports to North America drop, and as demand for the product increases and prices for oil continue to rise, companies in the space are sure to see growth.

Gibson Energy (TSX:GEI): has a long history in Canada’s oil and gas game. Established in 1953, Gibson knows the industry inside and out. The company has a diverse portfolio which includes transportation, storage, processing, marketing and distribution of oil, condensates, oilfield waste, refined products and natural gas.

With Gibson’s huge array of assets and its multi-platform sales strategies, investors look to Gibson with a confidence. And with a recent dip in the stock’s price, the company is open for business, with a modest entry point for those interested in dipping their toes into the Canadian oil market.

Computer Modelling Group (TSX:CMG) is a software technology company producing reservoir simulation software for oil and gas companies. Computer Modeling Group LTD. Is a tempting trade for investors as it brings together two essential industries - tech and resources- which are going anywhere any time soon. Especially as the need for security grows, a tech company involved in the oil and gas industry has an incredible opportunity to offer other services.

While Computer Modelling Group focuses on the resource industry, its technology is definitely breaking ground. Founded nearly 40 years ago by Khalid Aziz, a renowned simulation developer, the company has proven that it has staying power. As the resource industry meets technology, this will be a stock to pay attention to.

Pure Technologies Ltd.: Pure technologies is all about critical infrastructure including water and wastewater pipelines, oil and gas pipelines, and bridges and structures. One of Pure Tech’s biggest achievements in this space is its SoundPrint acoustic monitoring technology, which is set to revolutionize the industry.

Canadian Natural Resources Limited (TSX:CNQ): This 53 billion market cap giant is one of the biggest names in Canadian crude oil and natural gas exploration, development and production. In the second half of the year this giant has turned around its stock and has now seen consecutive months of strong gains.

It is all looking positive here as oil markets turn around and oil prices appear to have found a new price range that will only see production rise again in Canada.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This news release contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include that PETROTEQ will be able to produce oil as currently scheduled, at the rates of production announced and at the targeted low prices from its Utah property; that PETROTEQ’s technology results in much lower environmental damage; that PETROTEQ will successfully develop a blockchain supply chain solution for the oil industry; that it will have customers and contracts for its supply chain technology; that oil will be as much in demand in future as currently expected; that PETROTEQ’s technology is protected by patents and that it doesn’t infringe on intellectual property rights of others; that PETROTEQ will find licensees for its technology and that it can patent its technology in many countries; that PETROTEQ’s technology will work as well as expected; that blockchain technology will help PETROTEQ achieve its goals; and that PETROTEQ will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the Company’s patents and other technology protection are not valid, patents may not be granted in countries where PETROTEQ wants to license its technology; production of oil may not be cost effective as expected, technology development costs may be much higher than expected, there may be construction delays and cost overruns at the production plants, PETROTEQ may not raise sufficient funds to carry out its plans, changing costs for extraction and processing; technological results based on current data that may change with more detailed information or testing; blockchain technology may not be developed to be as useful as expected and PETROTEQ may not achieve its business plans; competitors may offer better technology; and despite the current expected viability of its projects, that the oil cannot be economically produced with its technology. Currently, PETROTEQ has no revenues.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company to disseminate this communication. In this case the Company has been paid by PETROTEQ seventy thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. We have been compensated by PETROTEQ to conduct investor awareness advertising and marketing for TSXV:PQE and OTCQX:PQEFF. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases.

The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. Oilprice.com is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits similar to those discussed.