A new oil extraction technology could unlock billions of barrels trapped in oil sands around the world with production costs as low as $23 per barrel—and without water or toxic trailing ponds.

It’s a giant claim to fame for small-cap Petroteq Energy (TSX:PQE.V; OTCQX:PQEFF) whose patented oil extraction technology is ready to generate sales.

And it’s already launched in Utah, where the company is taking advantage of the state’s massive heavy oil sands oil resource, which experts have pegged at an estimated 32 billion barrels of oil equivalent (boe).

This could be the Holy Grail of dry oil sands tech.

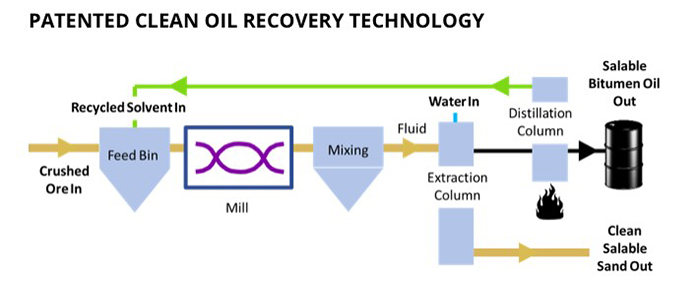

Existing oil sands extraction technologies use tons of water and leave behind toxic trailing ponds. Petroteq’s system produces oil and leaves behind nothing but clean, dry sand that can be resold as fracking sand or construction sand or simply returned to Mother Nature.

Technology today is limited only by the imagination, and Petroteq is first and foremost an energy technology company with boundless imagination and foresight: While it’s pumping out the world’s first clean oil sands and getting ready to license its proprietary tech globally, it’s also working on the first-ever energy blockchain consortium—and the heavy hitters are jumping on board.

Here are 5 reasons to keep a very close eye on Petroteq (TSX:PQE.V; OTCQX:PQEFF) right now:

#1 A $5.2-Billion Clean Oil Sands Opportunity

This is a $5.2-billion clean oil sands opportunity that will change the way we view this once-dirty resource…

In tests to date, Petroteq’s patented technology extracts over 99 percent of all hydrocarbons in the sand, generates zero greenhouse gases and doesn’t require high temperatures or pressures.

This is how it works:

The end result?

The extracted crude oil is free of sand and solvents and then pumped out of the system into a storage tank.

The only other place that has oil sands tech is Canada, and it doesn’t compete. It’s designed for wet oil sands and Petroteq is after the dry oil sands bonanza.

#2 Market-Defying Production in the low $20s/per barrel

The Utah plant is just coming online, and it’s ready to produce 1,000 bpd at a cost in the low $20s per barrel. Soon, they’ll be getting ready to ramp up to 5,000 bpd.

But the upside here just keeps coming: As soon as it ramps up in Utah and shows the world how well its technology works in a commercial setting, it will start licensing the proprietary technology to other countries that are sitting on lots of dry oil sands.

So, Petroteq (TSX:PQE.V; OTCQX:PQEFF) is sitting on estimated reserves of 87 million barrels boe that is projected to be produced at $22-$25 per barrel and sold at world oil prices, currently $60/barrel.

That’s some hefty math.

In fact, it’s a $5.2-billion opportunity in the U.S. alone. That doesn’t include the licensing opportunities (think giant oil sands potential in Canada, for instance).

#3 Global Licensing Could Disrupt Entire Oil Sands Market

Oil sands has long been sidelined because it’s dirty. So, proprietary technology that can extract oil sands without leaving behind toxic trailing ponds is highly sought after.

This is far from a simple story about another small-cap oil producer. Petroteq’s technology could generate millions in licensing fees around the world, and it is eyeing the opportunity to file patents in all countries with oil sands reserves.

This technology is aimed to be deployed to cleanly unlock oil resources representing hundreds of millions of barrels of oil around the world. Licensing is a revenue stream that can flow to Petroteq (TSX:PQE.V; OTCQX:PQEFF) with no associated capital expenditure.

Worldwide, the licensing opportunities are vast, with over 12 countries home to major oil sands deposits.

Fortunes can be built on licensing fees, and Petroteq could have a big advantage in this segment.

There’s even more upside beyond global licensing of oil sands extraction technology: Petroteq’s technology can be used for remediation, cleaning the tailing ponds created by traditional extraction methods for oil sands.

#4 It Gets Even Bigger with Blockchain

We’re talking about a blockchain consortium in an industry that is badly in need of supply chain modernization and streamlining.

Blockchain technology is fueling a technology revolution of immense proportions, and blockchain has the potential to change almost every industry.

For investors, it’s all about getting in front of this massive blockchain potential market set to see compound annual growth of 80 percent to 2022.

Smart money is moving in a virtual tsunami to blockchain, and PetroBLOQ has already earned the respect of major players like PEMEX, SOCAR, IBM and Deloitte.

Deloitte calls blockchain technology the “single source of truth” for the oil and gas industry. It’s a reference to the power of blockchain to render every transaction in the world direct (no more middlemen), transparent, and faster than the speed of light.

It’s efficiency at its purest because it has the power to:

- Transform fundamental methods of transaction processing

- Increase speed of execution and confirmation

- Save corporations and individuals significant time and money

- Secure payment and data transfers

- Increase transparency and record keeping for all parties to a transaction

- Mitigate counterparty risk for all sides

- Facilitate complex and international transactions

It’s almost impossible to put a number on the dollar value in opportunities here because blockchain will change the way every single industry does business.

For energy, it’s a mind-blowing transformation.

Deloitte sees Petroteq as an emerging player in the creation of a global consortium that will advance blockchain across the entire industry.

And Petroteq’s PetroBLOQ gives new meaning to ‘first-mover’. PetroBLOQ is developing the first blockchain-based platform exclusively for the oil and gas sector’s supply chain needs—GLOBALLY.

That means its blockchain platform could end up involved in every single transaction in the oil and gas supply chain—upstream, midstream and downstream.

The biggest change to daily human life since the steam engine could turn out to be blockchain, and small-cap Petroteq aims to harness blockchain in a big way with a novel blockchain-based oil and gas supply chain management platform that could transform the industry.

#5 Major News Right Around the Corner?

Major heavy hitters are already on board with this small-cap’s blockchain consortium. The first-ever clean oil sands production, this $65.5-million market-cap company could be poised for something far bigger than itself. And it’s all proprietary and patented.

What do we expect in the very near future?

- Petroteq’s (TSX:PQE.V; OTCQX:PQEFF) unleashing of the FIRST EVER comprehensive oil and gas blockchain supply chain platform in about 6 months

- Announcements of new blockchain consortium partners

- Licensing deals for its proprietary oil sands extraction tech

- Ramp-up of oil sands production in Utah

Deloitte is focused on the ‘single truth’ for the oil and gas industry, and PetroBLOQ could emerging as the ‘single source’ for 2 major changes in oil and gas.

At the same time, it’s bulldozing forward with a clean oil sands opportunity in Utah that is ready to ramp up and should soon be ready to start global licensing...

Other oil companies bringing tech to the oil industry:

Cenovus Energy (TSX:CVE): This is one of the most actively traded stocks on the TSX, and it’s been trending up for the second half of this year. The recent sell off represents a great opportunity for investors looking to buy the dip in a stock that climbed over $6 earlier in the year.

The potential is certainly here for this oil company, so for investors who are bullish on the return of the oil markets, this is a perfect pick in the Canadian market.

Imperial Oil (TSX:IMO): Imperial oil could be one of the best contrarian bets in the oil markets for 2018, having missed its third quarter profit estimates and currently dealing with the resultant stock decline. It still has some of the lowest cost producing oil sands in Canada and that is going to pay off as oil prices continue to rise and new tech breakthroughs bring breakeven prices even lower.

As infrastructure becomes a target for hackers, oil companies are scrambling to secure their networks and find solutions to prevent losses in their supply line, and Imperial is certainly aware of this.

The management is well known for being conservative, but that certainly shouldn’t put investors off in a time when recovery is the buzzword of the day and consistency is sure to be rewarded.

Crescent Point Energy Corp. (TSX:CPG): CPG is particularly attractive for the dividend that investors can expect back, but it is also now worth looking at for returning value in the coming months.

The recent fall in stock price provides investors with a great entry point for a company with a positive outlook in a market that is set to grow. The collapse in price over the last year appears to have stopped, with some great growth in late October and early November. This oil and gas company provides exposure in both the Canadian and U.S. markets.

MEG Energy Corp (TSX:MEG): is a Canada-based oil producer which operates primarily in Northern Alberta’s oil sands. The forward-thinking company uses steam-assisted gravity drainage to retrieve oil from the deep wells which it drills. The excess heat and electricity produced from this process is then sold to Alberta’s power grid.

The company’s large proven resources and their cutting-edge technology make MEG a promising company for investors looking to get in to the promising oil sands in Alberta.

The Descartes Systems Group Inc. (TSX: DSG) (commonly referred to as Descartes) is a Canadian multinational technology company specializing in logistics software, supply chain management software, and cloud-based services for logistics businesses. The company is making waves in the tech industry with its futuristic products and visionary leadership.

As a key stock in Canada’s tech boom, Descartes Systems is a smart choice for investors. The company has a huge market cap of $2.6-billion and the stock has grown by nearly 20% YTD.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This news release contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include that PETROTEQ will be able to produce oil as currently scheduled, at the rates of production announced and at the targeted low prices from its Utah property; that PETROTEQ will successfully develop a blockchain supply chain solution for the oil industry; that it will have customers and contracts for its supply chain technology; that oil will be as much in demand in future as currently expected; that PETROTEQ’s technology is protected by patents and that it doesn’t infringe on intellectual property rights of others; that PETROTEQ will find licensees for its technology and that it can patent its technology in many countries; that PETROTEQ’s technology will work as well as expected; that blockchain technology will help PETROTEQ create a supply chain management system which can handle all transactions; and that PETROTEQ will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the Company’s patents and other technology protection are not valid, patents may not be granted in countries where PETROTEQ wants to license its technology; production of oil may not be cost effective as expected, technology development costs may be much higher than expected, there may be construction delays and cost overruns at the production plants, PETROTEQ may not raise sufficient funds to carry out its plans, changing costs for extraction and processing; technological results based on current data that may change with more detailed information or testing; blockchain technology may not be developed to be as useful as expected and PETROTEQ may not achieve its business plans; competitors may offer better technology; and despite the current expected viability of its projects, that the oil cannot be economically produced with its technology. Currently, PETROTEQ has no revenues.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company to disseminate this communication. In this case the Company has been paid by PETROTEQ seventy thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. We have been compensated by PETROTEQ to conduct investor awareness advertising and marketing for TSXV:PQE and OTCQX:PQEFF. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases.

The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits similar to those discussed.