One hundred and seventy years ago, oil was drilled out of the ground in Western Pennsylvania for the first time. The momentous event sparked a revolution in energy production and ushered in the age of oil.

Now, a new mineral is poised to become energy’s most valuable commodity: lithium.

A critical component in modern battery technology, lithium is currently produced through a costly, time-consuming and environmentally-damaging process involving salt brine evaporation.

But now, a new company has unlocked the secret to a potentially colossal new store of lithium tucked away in the hard rock of Canada.

Through an innovative method that is expected to be far cheaper and easier than normal lithium mining, Power Metals Corp (TSXV:PWM; OTC:PWRMF) aims to unlock the high-grade lithium hidden away in hard rock formations.

With demand for lithium poised to shoot through the roof, small companies like PWM could represent big opportunities if the new method proves successful.

It’s still early days, and the big announcements will be made as development progresses.

Here are five reasons to pay attention to Power Metals Corp (TSXV:PWM; OTC:PWRMF)

#1 The Rise of Lithium

Ten years ago, nobody really cared about lithium. Now, it’s one of the fastest growing in demand minerals on earth, one that is seriously under-supplied.

Demand for lithium has shot up, thanks to advancements in battery technology and the rapid expansion of renewable energy, which uses lithium batteries to store power and improve efficiency.

Future demand for lithium will be driven by the rapid expansion in electric vehicles (EV) which depend on lithium batteries. A single Tesla Model S uses more lithium than 10,000 smartphones.

With demand for lithium picking up, concerns grew in 2017 that the mineral was in short supply. Prices exploded, rising to nearly $15,000 per ton by early 2018, before dropping off somewhat.

Observers have begun to question the under-supply thesis, but there’s no question that demand for the mineral will continue to grow dramatically.

And with new concerns over traditional mining methods coming to the fore, the time is ripe for a new approach to producing this vital material.

#2 Pulling Lithium from Pegmatite

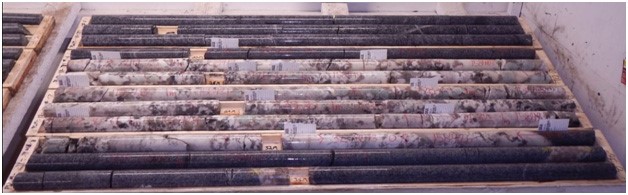

The focus and success of Power Metals (TSXV:PWM; OTC:PWRMF) has come from drilling hard rock pegmatite formations. Power Metals has drilled 8,000 meters to date and has made a high-grade discovery with lots of upside.

Found in mineral deposit “domes” scattered around the Canadian wilderness, pegmatite is made up of crystal formations that can contain a variety of different minerals. Under the right conditions, pegmatite is loaded with lithium spodumene locked away within quartz deposits within the pegmatite.

PWM searches for pegmatite “domes” or “dykes” that may hold deposits of lithium spodumene. Then, with quick and easy precision, they drill down and haul out cylinders of pegmatite rich with lithium spodumene.

Through this “hard rock” lithium mining method, Power Metals hopes to unlock some big opportunities. The exceptional grade of lithium unlocked can vary, with lithium concentrations within the pegmatite usually coming in at its Case Lake property at what are expected to be commercially viable. But at one drill location PWM discovered a lithium spodumene sample that was truly exceptional at surface!

These are preliminary findings, but they clearly indicate big discoveries could await Power Metals once drilling begins in earnest.

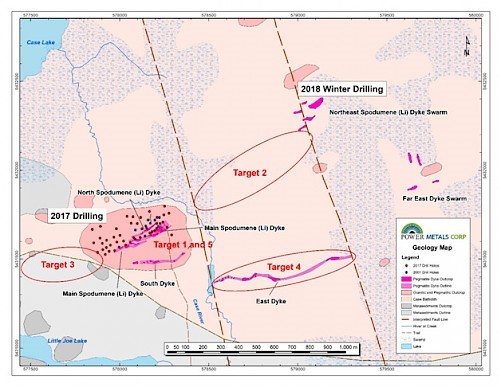

The company has made a number of impressive discoveries at Case Lake in its first 8,000 meters of drilling and they have only touched a sliver of land to be prospected and drilled. They have staked and own the entire area creating a massive opportunity to build Case Lake if it contains a world class deposit. Additionally, PWM owns and is ready to start prospecting two of its other properties in Gullwing-Tot Lake and Paterson Lake in Ontario, Canada.

After making its initial discoveries, PWM has an ambitious drilling plan prepared for 2018. It plans to drill at 5 or 6 locations, drilling more than 15,000 meters at a total cost of $2.6 million, for which it is already fully funded.

That means that any other lithium zones discovered will be added to its resource size. Based on prior discoveries, the deposits have potential to be immense.

#3 Better Than Brine

Power Metals (TSXV:PWM; OTC:PWRMF)drilling targets high-grade lithium spodumene from pegmatite deposits.

In South America, where most lithium mining is concentrated, miners will generally search for lithium deposits in subsurface brine.

Salt brines containing lithium are left to evaporate, yielding lithium which can then be collected. The whole process is slow and can take anywhere from 18 to 24 months to complete.

Producing lithium this way consumes huge amounts of water, which has become a problem in South America where access to groundwater has become a political and environmental issue, particularly in areas with indigenous populations.

Hard rock lithium mining leaves less of an environmental footprint than salt brine mining.

Hard rock mining was once thought of as the more expensive option, but it all comes down to location, location, location. Power Metals discovery at Case Lake is located at or near surface so far, is accessible via year-round roads and is high-grade which all equates to a logistical dream, and one that could become very profitable.

Power Metals deposits are located in Ontario, CA close to transportation routes. It’s much easier to move their lithium than the salt brine product pulled out of remote deserts in South America!

Plus, Canada is a highly attractive jurisdiction for lithium mining. Taxes and royalties in Chile have risen significantly; SQM, the Chilean mining giant, must pay between 20 percent and 40 percent in royalties for the lithium it extracts, and must sell a certain percentage at below market rates to satisfy Chilean demand.

Power Metals has no such restrictions on its operations; Ontario mining royalty is a flat 10 percent - with no royalty on the first $10 million CDN of sales per year for the first three years of the life of a new mine.

That means that their hard rock operation in Canada, assuming commercial production starts, should be cheaper and easier to operate than the bulky, bureaucratic operations run by most South American companies.

Plus, demand in the lithium space is shifting from lithium carbonate to lithium hydroxide, which is used in newer, more efficient battery models. And only hard rock mining can get at lithium hydroxide directly; salt brine lithium has to be converted, which takes more time, energy and money.

#4 The “Queen of Pegmatite”

Power Metals (TSXV:PWM; OTC:PWRMF) secret weapon is pegmatite drilling expert, Dr. Julie Selway.

Known as the “Queen of Pegmatite,” Selway’s doctoral research focused on pegmatite mining and she’s the world’s foremost expert on extracting lithium from pegmatite formations. She completed her Phd in 1999 and has authored or co-authored twenty-two journal articles on pegmatites.

Originally, Dr. Selway was an advisor to PWM during its initial operations, but when a substantial discovery was made on the 8th drill hole, she dropped all her other projects and joined Power Metals full-time.

Selway knows North American lithium mining better than anyone, and she’s backed up by Power Metals experienced management team.

Chairman and director Jonathan More has 20 years of experience in North American capital markets, with a focus on natural resources extraction. He’s been able to make Power Metals fully funded for all of 2018, with one drilling location up and running and two more waiting in the wings.

CEO Brent Butler has 30 years of experience in exploration, resource modeling and mining, and he’s worked for companies across nearly every global mining sector.

With such rare expertise, it’s no wonder that Power Metals has already made a number of promising discoveries, and has an ambitious drilling plan in place for 2018.

#5 Pay Attention

Power Metals (TSXV:PWM; OTC:PWRMF) is a little company with some big, big plans.

With only a $57 million market cap, they are primed to make some much bigger companies pay attention this year. And investors have already started to take notice.

They were recently ranked eighth on the TSX venture top junior miners of 2017.

One of Canada’s biggest recent success stories is the lithium miner Nemaska Lithium. After about 5 years of drilling they have found one of the largest “hard rock” lithium deposits in pegmatites in over 2 decades. The company has an average grade of 1.56 percent lithium in their main deposit, Whabouchi, and has achieved a market cap as high as $1.9 billion CDN valuation. By comparison, Power MEtals has an average grade higher than Nemaska at around 1.7 percent lithium from drill samples. This has gotten institutional investors excited.

They are poised to make an even bigger splash. In February it announced the completion of drilling at Northeast Dyke and the beginning of operations at Case Lake for Spring 2018.

In March it announced a venture with MGX Minerals Inc. to develop lithium extraction at Case Lake.

Results are still preliminary after 8,000 meters of completed drilling, but given Dr. Selway’s findings from other drill sites, there’s every reason to believe the potential at Case Lake is huge. The average grade of samples is already higher than that of Nemaska.

Investors will want to pay attention. Lithium mining will continue to expand in 2018, but questions over salt brine extraction could push the emphasis towards hard rock mining, which is expected to become faster, easier and much less environmentally damaging.

Canada has a highly-favorable atmosphere for lithium mining, and interest may soon shift from the well-worn salt brine fields of South America to the frozen fields of Ontario.

Power Metals is poised to make big things happen, and the big announcements will be made as things progress. Investors who want to take advantage of the new revolution in energy production should take careful notice.

Other players in the space:

Turquoise Hill Resources (TSX:TRQ) is a mid-cap Canadian mineral exploration and development company headquartered in Vancouver, British Columbia. Its focus is on the Pacific Rim where it is in the process of developing several large mines

The company mines a diversified set of metals/minerals including Coal, Gold, Copper, Molybdenum, Silver, Rhenium, Uranium, Lead and Zinc. One of the fortes of Turquoise hill is its good relationship with mining giant Rio Tinto.

Going forward, Turquoise’s success at the giant Oyu Tolgoi project in Mongolia will be crucial to boost its lagging share price.

Teck Resources (TSX:TECK.B): Zinc hasn’t been Teck’s best friend of late, but that looks set to change in the medium term, as supply continue to dwindle and as we hear news that the world’s top producer of the metal—Glencore—isn’t planning to bring shuttered mines back online. Supply will remain tight.

Keep in mind this, though: Teck’s Q1 earnings and revenue fell short of expectations because of weaknesses at its zinc unit, sending it shares down about 6% in late April. In particular, there’s been a 23% drop in production at its Red Dog mine due to lower grades of zinc.

Endeavor Silver (TSX:EDR) operates three silver-gold mines in Mexico, but it’s also got three attractive development projects. Production has dropped, and all-in sustaining costs have risen, leading to a negative cash flow. But the company has significantly reduced its debt, so it’s future is anything but bleak.

By 2018, with development in the pipeline, this stock might be prohibitively expensive again because there is plenty of near-term growth potential here. It’s also got further upside with zinc and should get a boost in this coming bull market. Catalysts include positive reserve estimates for its fifth mine, the Terronera silver/gold project in Mexico’s Jalisco state.

Pretium Resources (TSX:PVG): This impressive Canadian company is engaged in the acquisition, exploration and development of precious metal resource properties in the Americas.. Additionally, construction and engineering activities at its top location continue to advance, and commercial production is targeted for this year.

The company’s modest market cap and stock price make it an appealing buy for investors. Pretium has an impressive portfolio and if you can catch the stock while the price is right, there could be huge opportunity for upside.

Magna International (TSX:MG) is based in Aurora, Ontario. The global automotive supplier is gutsy and innovative--and definitely tuned to the obvious future--clean transportation. A great catalyst is its development of a combo electric/hydrogen vehicle--a fuel cell range-extended EV (FCREEV). It’s not going to produce them (for now, at least) but plans to use the model to show off its engineering and design prowess and produce elements of the electric drivetrain and contract manufacturing.

The company’s auto parts are distributed to heavyweights such as General Motors, Ford, Tesla, BMW, Toyota, Volkswagen and Chrysler. These huge deals provide a safe and steady profit stream for the company. It’s insightful, forward-thinking and smart value/low cost for shareholders.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This news release contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include that prices for lithium will retain value in future as currently expected; that PWM can fulfill all its obligations to maintain its property; that PWM’s property can achieve drilling and mining success for lithium, that the lithium extraction process being developed will be cost effective and can work much more quickly that other extraction technologies; that the process can be commercialized for large scale production; that PWM can use the newly developed process, if successful, to reduce its costs of production; that high grades found in samples are indicative of a high grade deposit; that high-grade lithium is in sufficient quantities at surface to keep drilling costs down; that batteries and EVs will continue to use large amounts of lithium; and that PWM will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the Company may not be able to finance its intended drilling program, aspects or all of the property’s and the new process development may not be successful, mining of the lithium may not be cost effective, PWM may not raise sufficient funds to carry out its plans, changing costs for mining and processing; increased capital costs; the timing and content of upcoming work programs; geological interpretations and technological results based on current data that may change with more detailed information or testing; potential process methods and mineral recoveries assumptions based on limited test work with further test work may not be viable; competitors may offer cheaper lithium; more production of lithium could reduce its price; alternatives could be found for lithium in battery technology; the availability of labour, equipment and markets for the products produced; and despite the current expected viability of its projects, that the minerals cannot be economically mined on its properties, or that the required permits to build and operate the envisaged mines cannot be obtained. The forward-looking information contained herein is given as of the date hereof and the Company assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by PWM seventy five thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. We have been compensated by PWM to conduct investor awareness advertising and marketing for TSXV: PWM; OTC:PWRMF. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.