There’s a new rock in town, and it’s promising to change everything we thought we knew about lithium.

It has come right at the crucial moment, when the uncertainty of production has giant electric vehicle and battery makers scrambling to secure future supply, and when even the oil and gas industry is eyeing lithium as its own lifeline in a world shifting toward lower-polluting alternatives.

The rock is pegmatite…

And some pegmatite contain abundant lithium that have already been discovered in huge quantities in Ontario, Canada.

And one little-known company called Power Metals Corp. (TSXV:PWM; OTC:PWRMF) has interests in 9 huge pegmatite-rich domes and is fast-tracking its exploration…

And it’s caught the attention of some of the biggest players in the battery metals space.

Last year, it was ranked #8 on the top 10 list of TSX:V miners. This year, it’s gunning for the top slot.

Massive drilling is now under way in Ontario, where Power Metals has managed to secure money and one of the most sought-after lithium geologists in the world: The ‘queen of pegmatite’, Dr. Julie Selway.

The world’s lithium reserves are found in three types of deposits: brines, sedimentary rocks and pegmatites. And while the North American lithium rush has been largely focused on the brine, Power Metals is going for the ultimate recovery of hard-rock lithium.

Hard rock lithium can be very high grade compared to brine, but so far, it’s only been produced in South America. Power Metals is one of few companies that have centered in on potential deposits of pegmatite large enough to turn pegmatite into a North American lithium bonanza.

Those who thought that brine was the best form of low-cost lithium production will soon need to think again. Power Metals is participating in the development on a new way of lithium extraction from hard rock, which if successful aims for a market-defying all-in cost per meter of under $100.

Right now, the public is only hearing about the brine. By summer, this could be a hard-rock story, and Power Metals will be telling it.

Here are 5 reasons to keep a very close eye on Power Metals (TSXV:PWM; OTC:PWRMF) right now:

#1 Drilling More This Year Than Anyone Else

Power Metals has already done more drilling this year than any other hard-rock lithium miner in the country.

They’ll do more than any other lithium exploration company for the rest of the year, too—and they are already fully funded for that drilling.

Now, Power Metals has three key lithium properties in Ontario:

- The Flagship Case Lake Lithium Property, with 38 mining claims covering over 7100 hectares, sits right next to established gold mining camps in the Abitibi Greenstone Belt and is surrounded by a geological lithium bonanza—the Case Batholith, a massive ovoid granitic complex. Here, multiple pegmatite outcrops have already been identified but not explored.

- The Paterson Lake Property has known multiple sources of pegmatites that remain attractively underexplored and is only 2 kilometers away from another big lithium property, Avalon’s Separation Rapids.

- The Gullwing-Tot Lake Property—another underexplored hard-rock play with two known pegmatite sources.

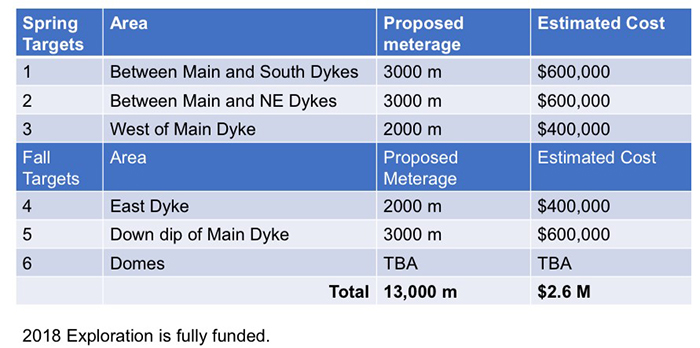

Power Metals has already done a ton of drilling, and it’s got 6 more drill targets to go for this year:

In fact, they’re budgeted and funded for an extraordinary 15,000 meters of drilling this year alone, in addition to January’s 3,000 meter program and the 5,000 meter program completed in 2017, with mouth-watering results that were disclosed in their press releases …

#2 Huge exploration upside

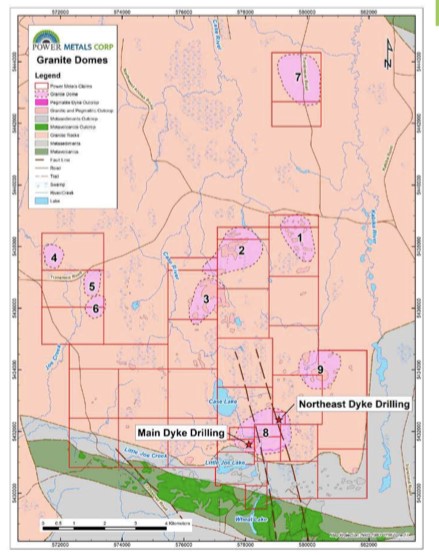

It’s all about domes.

What are domes? They are huge rock formations that contain large concentrations of lithium rich pegmatite.

When Dr. Selway started drilling at the company’s flagship property, Power Metals thought they were dealing with one big rock, with pegmatites entwined. But what Selway found was a giant “dome” of rock.

And not just one, but 9.

Exploration has only touched one of these domes, so the exploration upside potential here is a hard-rock dream. As soon as Power Metals (TSXV:PWM; OTC:PWRMF) saw what they had, they bought up all of the land, and all of the domes surrounding their first prospect.

In fact, it’s so big that Selway’s dilemma now is that there are too many drill targets.

It’s a great dilemma for a junior miner of the hottest metal on demand to have.

Now, Power Metals is being directly compared to the huge success story of Nemaska Lithium, the leader of Canadian hard rock lithium mining. And while this is a good and direct comparison, Power Metals’ average lithium grade for exploration samples is currently higher than that of Nemaska’s at Nemaska’s equivalent early stage of development.

And in this game, it’s all about grade.

The industry cut-off average grade for most world class spodumene deposits is 1 percent lithium. Power Metals currently has samples that average above that, some way higher. This incredibly high-grade zone was just drilled in January for a total of 3,000 meters and the company is currently awaiting results from the lab. Check out Power Metals’ news releases of January 22 and January 24, 2018.

At this point, the exploration upside at Case Lake is huge.

#3 Smartest Lithium Money in the World Getting in on This

Nemaska (TSX:NMX) is sitting on what many believe to the be second-richest and largest lithium deposit in the world—and despite that, some of its biggest shareholders are looking to back Power Metals.

It speaks volumes about confidence when one of the biggest North American lithium investors buys into a junior like Power Metals. They’re comparing Case Lake to Nemaska, and are seeing plenty of potential.

Institutional financing can provide companies with a major boost in confidence, and on the 15th of January, Power Metals (TSXV:PWM; OTC:PWRMF) closed its first institutional over-subscribed bought deal financing for $3.5 million.

Investors love the domes—all 9 of them. They love the drilling results so far, and the massive drill plan for this year. They love the high-grade lithium.

And they love the drilling costs. According to Power Metals, Case Lake exploration costs could positively surprise the markets.

No company that we know of this size is set up to drill this much, and for such a high grade of lithium at such a low cost.

#4 First in line for new lithium opportunities, with Queen of Pegmatites

Dr. Julie Selway is globally known as the Queen of Pegmatites. No one is more qualified or has more knowledge than her in this field, period.

Pegmatites are rare earth elements that can host several economic commodities, including lithium, tantalum, and cesium, and they are found in large deposits in Ontario.

Selway knows. She’s a rare earth expert and one of the most highly sought-after geologists in the world. She’s travelled all over Ontario and already worked on some 90 percent of all lithium pegmatites in the province—identifying the top ones.

She hitched her wagon to Power Metals (TSXV:PWM; OTC:PWRMF) because it’s sitting on the best pegmatites. When Power Metals hit substantial mineralization on its 8th hole, Selway dropped everything to work with the company on a full-time basis. She was hooked at that point, and so were investors.

Because of this, Power Metals now has a huge advantage over others looking to get in on new lithium exploration territory. They are often first in line to get a chance to option advanced lithium properties that become available, because everyone wants Selway behind it. Selway means smart, fast exploration and development.

Power Metals’ other two properties were scooped up largely because of Selway’s reputation in the space, getting the company deals that only the ‘Queen of Pegamatites’ could. Having Selway on board was the vendor’s key condition in one of the deals.

#5 Endless News Flow

The drills start drilling again in April, and once that happens, the news flow should be continuous. But it will start even before then as the market awaits results from January drilling at Case Lake.

Pretty soon, Power Metals (TSXV:PWM; OTC:PWRMF) could cease being an exploration story and start being one of the most brilliant hard-rock lithium development stories in the world.

And when investors get wind of the tax benefits of hard-rock lithium mining in Ontario, we expect the interest to spike further. Ontario offers flat 10-percent mining royalties, with no tax on the first $10 million in annual sales for three years in a new mine. The Latin American ‘lithium triangle’ can’t come close to this tax set-up.

So right now, we’re looking at a junior lithium miner that’s taking advantage of brilliant domes of high-grade, hard rock metal while everyone else is distracted by the brine.

This is a $56-million market cap company sitting on 9 domes on a single property that have enough lithium exploration potential to get some of the biggest names in new lithium on board, alongside institutional investors.

We’re looking at the company that managed to win over the most sought-after hard-rock lithium geologist in North America, and put them at the front of the line for optioning new acquisitions. We’re looking at a company that, come Spring, will be at the height of a 2018 drilling season that has the potential to be the biggest thing in hard-rock mining this year.

Other companies to watch:

Newmont Mining Corp (TSX:NMC) Founded over 100 years ago, Newmont Mining Corporation is one of the leading mining companies in the world. The company holds assets in Peru, Australia, Ghana, Indonesia, Mexico, and around the United States. Primarily focusing on gold and copper, Newmont has steadily carved out a name for itself among those in the industry.

Newmont has had an excellent start to 2018, and it is set to keep up the pace as burnt bitcoin buyers move back to gold and silver.

Agnico Eagle Mines Ltd (TSX:AEM) Canadian based miner, Agnico Eagle Mines is an especially noteworthy company for investors. Why? Between 1991-2010, the company paid out dividends every year. With operations in Quebec, Mexico, and Finland, the company also is taking place in exploration activities in Europe, Latin America, and the United States. This is certainly a company with tremendous potential that grows better by the day.

Investors have certainly taken note. In the past month, Agnico has seen its share prices climb steadily, and 2018 looks to be shaping up to be a promising year.

Alexco Resource Corp (TSX:AXR) operates on two sides of the mining spectrum. Its mining business operates in the Keno Hill Silver District in Canada’s Yukon Territory, historically one of the highest-grade silver districts in the world, having produced over 214 million ounces of silver. Alexco is a focused and driven company with proven exploration, development, and operational skills.

On the other end, Alexco also operates Alexco Environmental Group, an environmental consultation business offering remediation solutions and project management, assisting businesses with environmental permitting and compliance issues.

Alexco is tried and true company with years of experience, and an entire asset portfolio located in one country, Canada.

Wheaton Precious Metals Corp. (TSX:WPM) is Canadian precious metals streaming company, focusing primarily on gold and silver sales. The company produces a massive 26 million ounces of silver, and sells over 29 million, produced by the links of industry giants Barrick Gold and Goldcorp. The company’s agreements span across North and South America, with the majority being in Mexico. The company is relatively young, but has already made waves in the mining sector.

With a team of forward thinking industry heavyweights, investors can feel safe with Wheaton Precious Metals.

Royal Nickel Corporation (TSX:RNX): While investor attention is about to refocus on zinc, it’s possible that nickel is being overlooked, and while this stock has been a recent top decliner, if nickel demand growth is overlooked, RNC could be a good stock to hold.

RNC's principal assets are the producing Beta Hunt gold and nickel mine in Western Australia, the Dumont Nickel Project located in the established Abitibi mining camp in Quebec and a 30% stake in the producing Reed copper-gold mine in the Flin Flon-Snow Lake region of Manitoba, Canada.

RNC’s stock price has lagged since July, but a recent uptick in nickel prices could revive this stock once again.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This news release contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include that prices for lithium will retain value in future as currently expected; that PWM can fulfill all its obligations to maintain its properties; that PWM’s property can achieve drilling and mining success for lithium, that the lithium extraction process being developed will be cost effective and can work much more quickly that other extraction technologies; that the process can be commercialized for large scale production; that PWM can use the newly developed process, if successful, to reduce its costs of production; that high grades found in samples are indicative of a high grade deposit; that high-grade lithium is in sufficient quantities at surface to keep drilling costs down; that batteries and EVs will continue to use large amounts of lithium; and that PWM will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the Company may not be able to finance its intended drilling program, aspects or all of the property’s and the new process development may not be successful, mining of the lithium may not be cost effective, PWM may not raise sufficient funds to carry out its plans, changing costs for mining and processing; increased capital costs; the timing and content of upcoming work programs; geological interpretations and technological results based on current data that may change with more detailed information or testing; potential process methods and mineral recoveries assumptions based on limited test work with further test work may not be viable; competitors may offer cheaper lithium; more production of lithium could reduce its price; alternatives could be found for lithium in battery technology; the availability of labour, equipment and markets for the products produced; and despite the current expected viability of its projects, that the minerals cannot be economically mined on its properties, or that the required permits to build and operate the envisaged mines cannot be obtained. The forward-looking information contained herein is given as of the date hereof and the Company assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by PWM seventy five thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. We have been compensated by PWM to conduct investor awareness advertising and marketing for TSXV: PWM; OTC:PWRMF. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.