Galera Therapeutics has dismutase mimetics. Innovation Pharmaceuticals (OTCQB: IPIX) has defensin mimetics. The two sciences are similar in looking to mimic natural processes of the body to prevent or treat disease. Each are addressing severe oral mucositis (SOM) in head and neck cancer patients with their respective flagship drug with hopes that it will spawn a blockbuster franchise.

There are many more similarities between these two companies that portend success and lend support to the notion that IPIX is arguably undervalued. This contention is underscored by clinical data as the two strive to bring their prophylactic SOM therapies to market.

Oral mucositis is a frequent and often debilitating side effect of chemotherapy or radiation characterized by ulcerations and infection of the oral mucosa. It can become so serious that parenteral nutrition is required, sepsis can develop, and cancer therapy needs to be suspended. As such, the patient's quality of life suffers and corresponding expenses soar. According to Future Medicine, annual costs associated with treating all types of mucositis in approximately 522,000 patients annually total $13.23 billion.

Galera and IPIX are certainly looking in the right direction in targeting head and neck cancer patients receiving chemoradiation, a treatment regimen where the incidence of SOM is stunningly high at over 70 percent. Moreover, there are no FDA-approved therapies for treating SOM in solid tumors, creating a pervasive area of high unmet medical need and a market estimated in excess of $2 billion.

There are a bevy of options for "treating" SOM, including so-called "magic mouthwashes" concocted by hospitals. They are generally considered "medical devices" (not drugs) and ineffective as measured by the glaring high incidence rates of SOM seen today. There is nothing approved for "preventing" SOM, which is what Galera and IPIX are developing their drugs to do. As a pleasant collateral effect of looking to stop SOM before it begins, when it does develop, the companies' research shows that duration times are substantially reduced.

The similarities continue insomuch that both the young companies are getting help from the U.S. Food and Drug Administration via "Fast Track" designations to develop their experimental drugs: GC4419 for Galera and Brilacidin for Innovation Pharma. Fast Track makes a drug candidate eligible for more frequent meetings with the FDA and expedited approval processes. Galera has an extra designation, garnering a "Breakthrough Therapy" designation from the FDA for GC4419 too.

Both GC4419 and Brilacidin are Phase 3 assets, positioning Galera and IPIX to submit new drug applications seeking marketing approval from the FDA should Phase 3 studies meet their primary endpoints.

Leadership at Galera and Innovation Pharma comes from big pharma, including Dr. Mel Sorensen, President and CEO at Galera, previously working for Bayer and GlaxoSmithKline (as did CCO Stephen Ross) and CMO Dr. Jon Holmlund coming from Ionis Pharmaceuticals. Dr. Arthur Bertolino, President and CMO at Innovation Pharma, previously held senior positions at Novartis and Pfizer, while Jane Harness, VP of Clinical Sciences and Portfolio Management, previously held similar roles at Revance Therapeutics, Novartis and Pfizer. Also of note is Dr. Stephen Sonis, who serves as a Scientific Advisor to IPIX. Dr. Sonis is a senior surgeon at the Dana-Farber Cancer Institute and widely regarded as a foremost expert in oral mucositis toxicities.

The Divergence Begins

Galera's GC4419 is a small molecule that mimics the naturally occurring superoxide dismutase enzymes. These enzymes remove superoxide by converting it to hydrogen peroxide and molecular oxygen before it can cause the damaging effects of oxidative stress.

In the case of GC4419 for SOM, the drug is delivered intravenously.

IPIX's Brilacidin is a synthetic, non-peptidic small molecule modeled after Host Defense Proteins, the front-line of defense in the body's innate immune system. The drug has been shown to have multiple functions, including those of immunomodulatory, anti-inflammatory and anti-infective capacities.

In the case of Brilacidin for SOM, the drug is delivered as an oral rinse.

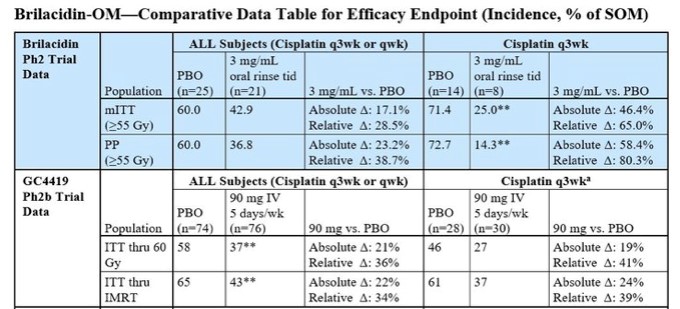

In clinical trials, both showed their worth to prevent and treat SOM in HNC patients on cisplatin therapy, as shown in the table below.

Source: Innovation Pharmaceuticals website

To be clear, it is not possible to vet a 100% apples-for-apples comparison because there are differences in trial protocols. Furthermore, Galera ran a larger study (223 patients in total) with 74 patients in the placebo group and 76 patients in the GC4419 group in what can be best used for comparisons versus 25 in the placebo group and 21 in the Brilacidin group for Innovation Pharma (trial enrolled a total of 61).

That said, a look the most aggressive chemotherapy regimen – that of cisplatin administered 80-100 mg/m2 every 21 days (q3wk) – reveals some eyebrow raising differences. This is a treatment regimen to analyze as a subset of the cohorts because, first and foremost, it is a common treatment plan for HNC patients and, second, the headline figures were relatively the same for GC4419 and Brilacidin.

In the Galera trial, treatment with GC4419 in the higher cisplatin group reduced the relative incidence of SOM by 41% compared to placebo in the Intent-to-Treat (ITT) population. In the ITT – IMRT (intensity-modulated radiation therapy) population, the relative incidence of SOM decreased by 39% versus placebo.

In the IPIX trial, treatment with Brilacidin in the modified Intent-to-Treat (mITT) population reduced the relative incidence of SOM by 65.0% compared to placebo. In the Per Protocol population, the relative incidence of SOM decreased by 80.3% compared to placebo.

To elaborate, understand that "per protocol" means that the principal investigator was certain that the patient followed Brilacidin therapy as directed. It bears repeating that, while the sample size was small for this group, treatment with Brilacidin oral rinse lowered the rate of SOM by over 80%.

An oral therapy can be a double-edged sword. One, it can have a competitive edge as oral drugs are the preferred method of administration for patients compared to laying there while the drug slowly drips through an IV. To that point, an oral drug is far more convenient, with administration available in an array of settings compared to IV. It also less expensive, likely making it the preferred method of not only insurance companies, but also doctors writing the prescriptions.

On the other hand, it can make for a more difficult trial with respect to meeting endpoints because patient compliance can be an issue. Simply, if a patient is feeling fine (no signs of OM), skipping or a treatment is a real possibility, which increases the likelihood of OM or SOM developing. That is why the per protocol results are particularly impressive.

A final dramatic difference in the two companies relates to valuation. Galera is a private company, so figuring its valuation is obviously not a simple as looking at a market cap for a public company. However, Galera has managed to raise over $250 million in the last six years, including $150 million in equity and royalty deals ($80 million which was based on future sales of CG4419) about three months ago. Galera has rallied plenty of support from venture capital, with financing partners including Clarus Ventures, Adage Capital Management, Novartis Venture Fund and more. Innovation Pharma needs to find this quality of financial partners, but the lack of them at this point by no means justifies its paltry market capitalization of $18 million.

Confirmatory Trials for Both

As for pivotal trials, Galera got the jump on IPIX, with dosing starting in its Phase 3 ROMAN trial in October. The 335-patient study, HNC patients will be evaluated for the primary endpoint of cumulative incidence of SOM. The efficacy in reducing the severity of radiation-induced OM via 60-minute IV infusions of GC4419 prior to IMRT will be compared to placebo.

In December, Innovation received the green light from the FDA to proceed with a Phase 3 trial of Brilacidin for SOM in HNC patients receiving chemoradiation. The FDA is interested in seeing the effects of Brilacidin in not only the more aggressive cisplatin group, but also at lower concentrations (30-40 mg/m2) where cisplatin is administered weekly as part of the chemoradiation regimen.

The rubber is going to meet the road with these two confirmatory trials, with there being a strong likelihood that the world will finally have some real options for meaningful prevention and treatment of SOM in HNC patients in the coming years. Fact is, that if both companies can replicate their Phase 2 studies in Phase 3, there could be two new drugs on the market in the not-too-distant future.

Remember when shares of Vivus, Inc. (NASDAQ: VVUS) and Arena Pharmaceuticals (NASDAQ: ARNA) were rifling upwards (about 400% for VVUS and 1,000% for ARNA) in 2011 and 2012 ahead of and following the FDA decisions to approve their competing obesity drugs Qsymia (VVUS) and Belviq (ARNA)? Given the market opportunity for SOM and these two at the head of the class, market participants will surely start paying attention to Galera and IPIX in 2019 for a similar type chase. For publicly-listed IPIX, whatever weight has been holding the stock down may finally be lifted so that the company can achieve a fair valuation alongside its money-raising peer so that the stock can rise from its current depressed level.

Disclaimer: This article is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this article should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Baystreet.ca assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this article and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Baystreet.ca has been compensated one thousand eight hundred dollars by a third party for

Innovation Pharmaceuticals advertising. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this article. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.