Right now a NEW streaming war is taking place.

It’s one that’s being ignored by anyone over the age of 18.

Why? There’s a quiet revolution happening in the media world.

Now, as you know, competition for streaming market share is fierce.

Nearly every media company, from Comcast to Disney, has a stake in the “streaming war.”

Why? The network effect. Streaming services find a niche and grow their audience, quickly.

Old competitors -- like Blockbuster – couldn’t keep up.

And this new niche will likely be even bigger...

And one company is about to bust the streaming wars wide open: Torque Esports Corp. (TSXV:GAME, OTCMKTS:MLLLD)

Torque has something the many other streaming services haven’t secured yet: a huge reach into one of the hottest NEW streaming sectors, esports.

Right now, esports is just starting to come up, but many believe that it is set to grow even larger.

Its corner is sports and video games—two sectors that dwarf the video distribution market.

The NFL is worth $63 billion.

The NBA is worth at least $30 billion, the average team is worth $1.9 billion.

Premier League soccer is worth $10.2 billion.

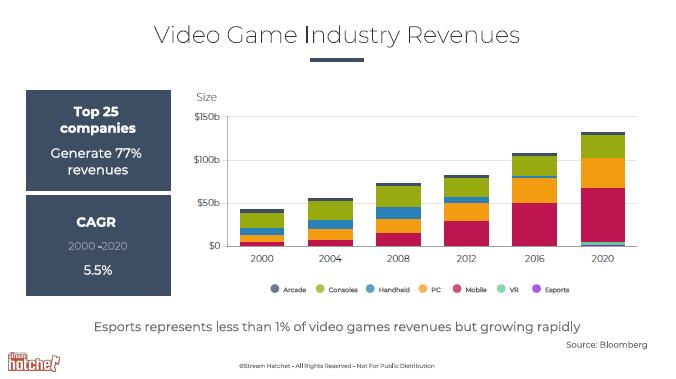

Now, compare that to video games--$135 billion in revenue in 2019, with $300 billion projected by 2025.

Torque is in a unique position to leverage video streaming expertise for esports, an up-and-coming sector that could potentially explode in size.

No other company can match its command of user data.

And no other company stands where Torque (TSXV:GAME, OTCMKTS:MLLLD) stands: at the crossroads of sports, games, and on-line streaming.

Here’s what you need to know:

#1 Scale Quickly

The secret to success in streaming is…scaling.

That was Netflix’s big move. The company bought up the rights to a ton of great content—The Office, Friends, hundreds of popular TV-shows and movies—and used the revenue generated from monthly subscriptions to grow fast.

From only 900 titles, the company used an algorithm-driven data model to expand to more than 70,000 different “microgenres.”

It leveraged user data—the viewing habits of its users, their particular tastes, as well as personal information like age and gender—to target content.

The success turned Netflix into a billion-dollar company. In 2017, the company brought in $11 billion in revenue. Netflix is now a major film and TV producer—in 2018 it published more than 80 original films.

Netflix is also international—it has 58 million subscribers in the US and 78.5 million more in international markets.

Other streaming services are trying to catch up.

Disney recently rolled out its own service, Disney+, in November 2019.

Like Netflix, it hopes to scale quickly. Disney+ will include most Disney properties—including a few it pulled from Netflix—as well as new original content.

From zero, Disney+ hopes to have 80 million subscribers by 2024.

AT&T, Comcast, Apple—they’re all diving into the streaming war with their own platforms. These big firms are throwing billions into the fight, hoping to claw away some market share from Netflix.

But there’s one big sector they’re all missing.

And that’s where Torque Esports comes (TSXV:GAME, OTCMKTS:MLLLD) in.

It’s already making key acquisitions that will strengthen its position…

But with a new mega-merger with Tom Rogers, the media legend behind CNBC, MSNBC and more, right around the corner…Torque is looking like a true competitor in the new media revolution.

#2 Get in the Game

The secret to Torque Esports (TSXV:GAME, OTCMKTS:MLLLD) is right there in the name.

Esports refers to video game sporting events—live competitions that pit gamers against one another.

Sound weird? Maybe. But take a look at the numbers.

Video games, as an industry, are already bigger than Hollywood—the sector earned $131 billion in revenue in 2018.

Thanks to mobile games and the explosive international success of titles like Fortnite and Overwatch, video games are set to reach $300 billion in revenues by 2025 according to some analysts.

Video games are popular, addictive, and hold international appeal—the biggest titles, like Call of Duty, cost $100 million to produce and can generate four times as much in revenue.

And now, video games have turned into a spectator sport.

A study from early 2019 estimated earnings from esports events will top $1 billion this year.

Audiences for these events have exploded, thanks to streaming platforms like Twitch, which broadcast the events live on-line. In 2017, some 335 million people tuned in to these events—and that number could reach 645 million by 2022.

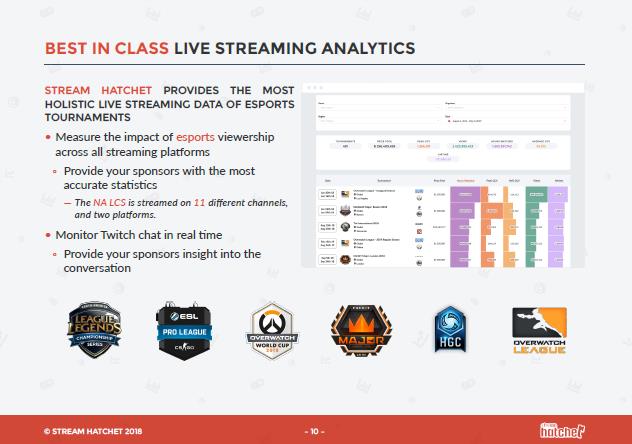

And the money is pouring in. Comcast invested $50 million into an esports arena. Twitch, the on-line game streaming platform, signed a $90 million deal to broadcast the Overwatch World Cup.

Another esports event, the Fortnite World Cup, included 40 million players, with a total prize pool of $30 million.

Look at traditional sports: across the board, numbers are down.

But esports is growing by leaps and bounds: from a niche market ten years ago, it’s on the verge of rivaling the NBA and MLB in terms of raw viewership.

Esports will attract 300 million viewers in the next few years, according to Goldman, “on par with NFL viewership.”

And Torque ( TSXV:GAME, OTCMKTS:MLLLD) has an edge on one segment of this market.

#3 User Value

What’s the most valuable commodity on earth?

Is it oil? Gold?

Nope. It’s data.

Specifically, user data—information tied to a specific individual’s online habits, from shopping patterns to viewing habits to personal information.

All of that data is precious to companies hoping to hawk their wares on-line to consumers, including the millions tuning in to esports events.

Advertising and brand investment will make up the biggest chunk of revenue from esports. This year, esports will bring in $906 million in revenue, and advertising for esports events was the centerpiece of a Advertising Week, a gathering of thousands of advertising professionals.

Everyone knows there’s money to be made in esports. The key is getting to consumers.

And who are those consumers?

Typical video gamers are young, and audiences for esports events are overwhelmingly 18-40 years of age, typically with disposable income.

According to one market research firm, esports fans tend to be well-off, professionals with purchasing power, with high levels of enthusiasm.

They’re drawn to the video game events out of strong interest, which means their likely to not click away out of boredom—it also means they won’t skip the ads, for fear of losing a moment of the e-sport excitement.

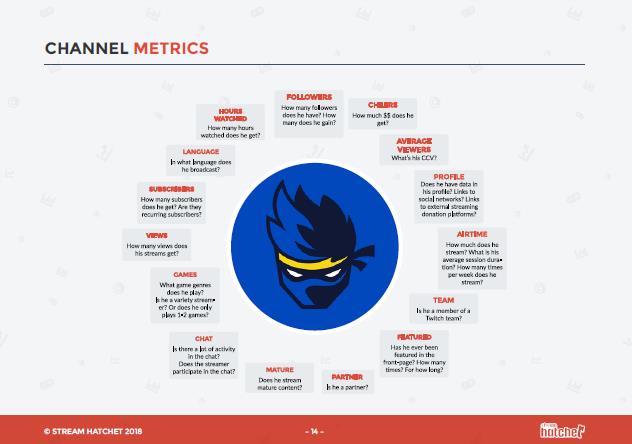

The user data for esports attendees is priceless for advertisers.

But ad buyers are in a pickle. They can’t get access to accurate data—the industry is in its infancy, and advertisers are having trouble finding the right metrics.

And Torque Esports (TSXV:GAME, OTCMKTS:MLLLD) has developed a service that makes it akin to the “Nielsen of Gaming.”

#4 The Data Edge

Torque’s secret weapon: a service that gathers and measures data relating to esports consumers.

It’s called Stream Hatchet, and here’s how it works:

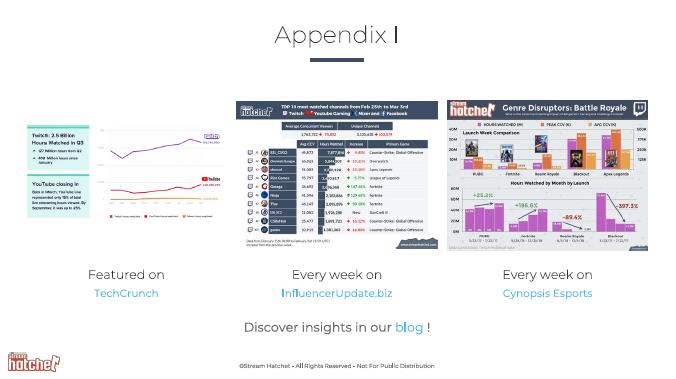

A data analytics/intelligence company under the Torque umbrella, Stream Hatchet focuses on gathering analytics on esports, allowing clients to identify influences and trends within the esports sector.

All of the biggest names in tech—Twitch, Youtube, Facebook, the gaming platform Steam—desperately need data from within the esports and streaming space in order to understand its trends and market to its customers.

And the one of the most competitive companies with access to that data is Torque, thanks to the data analytics leveraged through Stream Hatchet.

Torque has gained a major advantage in what could potentially become the most lucrative sector in esports. It is the gatekeeper to monetization and optimization in one of the world’s fastest growing industries.

And right now, there are few other companies that can offer this kind of service.

Ad-buyers are desperate to obtain useable consumer data for esports advertising.

And Stream Hatchet can provide that, and so much more.

Torque ( TSXV:GAME, OTCMKTS:MLLLD) has unique services. It’s on the cusp of breaking into the esports streaming sector, a $3 billion market that could potentially grow big, and grow fast.

#5 The Sky Is The Limit

Torque Esports is small potatoes—a tiny $5 million company, with a few assets, including Stream Hatchet, a bespoke esports competition, and a video game development company.

It’s attracting major attention however, with professional racers offering endorsements, an expanding YouTube esports channel, and key presentations at major esports conferences.

But the opportunity it’s grasping could be worth far, far more.

Consider this: esports is breaking $1 billion this year. It could potentially reach $3 billion in the next few years according to some analysts.

The video-game industry is bound to grow—it’s already bigger than Hollywood, and in a few years esports could surpass other ‘real’ sports.

And Torque (TSXV:GAME, OTCMKTS:MLLLD) has found a unique niche.

“This space is at the intersection of a $140 billion gaming industry and a $640 billion sports industry,” according to CEO Darren Cox. “From a purely financial perspective, we have barely touched 0.001% of the potential here.”

There’s a chance this little company, already like the “Nielsen for Gaming,” could become the next Netflix.

Other companies looking to ride the gaming wave:

Verizon (NYSE:VZ): When it comes to wireless network real estate, there are few bigger companies than Verizon. This giant has a market cap of $196 billion and is engaged in all aspects of communications, information and wireless services. And that matters in the new gaming boom.

The size of Verizon reduces the downside risk for investors, although after seeing a recent run and with trading volumes below average there could be a small drop in the short term. For investors with a long-term view however, Verizon has both the name and resources to make big gains in an industry that is sure to grow.

Alibaba (NYSE:BABA) is quickly becoming one of the world’s hottest companies thanks to its innovative approach to technology. It offers investors the full package; exposure to the rapidly developing fintech universe, cloud computing and AI space, e-commerce and retail, and of course, gaming.

Alibaba is even exploring the esports realm. According to Alibaba global esports director Jason Fung, "Alibaba has given us a five-year time frame to figure out what works in esports and to seek out business models that make sense. We've had that time frame to start becoming profitable and break even."

Celestica Inc. (NYSE:CLS, TSX:CLS) is a manufacturer of electrical devices used in IT, telecommunications, healthcare, defense and aerospace industries. The company has seen strong growth YoY which we expect to continue as the sales expectations are almost 3% better than last years.

While telecommunications stocks have been volatile recently, Celestica’s deals within the gaming industry, including its previous partnership with Microsoft, have helped investors see some upside.

Shaw Communications Inc. (NYSE:SJR, TSX:SJR) is another major player in the Canadian telecoms sector. It owns a ton of infrastructure throughout Canada and its cloud services and open-source projects look to address some of the biggest issues that its customers might face before the customers even face them.

Despite a couple of dips over the past few years, Shaw has rebounded nicely, proving that it can stay with the times as the industry continues to evolve.

Telus Corporation (NYSE:TU, TSX:T) is Canada’s second largest internet provider, serving over 8 million Canadians from coast to coast. Though it’s not producing its own content, it is carving out its own path in the industry thanks to its innovative approach to technology and investments across multiple sectors.

From healthcare to the Internet of Things and cloud technology, Telus is taking a stake in some of the world’s most important and fastest growing markets, making it a company worth noting.

GameHost Inc (TSX:GH) is a leading entertainment and hospitality provider based in Alberta, Canada. The company operates four primary properties in the Alberta province, each offering slot machines, table games, top-quality hospitality and more meant to appeal to both casual gamers and dedicated gamers alike.

GameHost is well-known for providing dividends to its investors, a plus for those who have stuck with the company over the years. In fact, its focus on increasing value for shareholders is made abundantly clear in its mission to reduce costs and improve offerings, creating some of the highest profit margins in the business.

The Descartes Systems Group Inc. (TSX: DSG) (commonly referred to as Descartes) is a Canadian multinational technology company specializing in logistics software, supply chain management software, and cloud-based services for logistics businesses. The company is making waves in the tech industry with its futuristic products and visionary leadership.

Recently, Descartes announced that it has successfully deployed its advanced capacity matching solution, Descartes MacroPoint Capacity Matching. The solution provides greater visibility and transparency within their network of carriers and brokers. This move could solidify the company as a key player in transportation logistics which is essential in the world of commerce.

By. Ian Jenkins

IMPORTANT NOTICE AND DISCLAIMER

PAID ADVERTISEMENT. This communication is a paid advertisement. Safehaven.com, Leacap Ltd, and their owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Torque Esports Corp. to raise public awareness about the company. Torque Esports Corp. paid the Publisher fifty thousand US dollars to produce and disseminate this and other similar articles and certain banner ads. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, insiders, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of public awareness marketing, which often ends as soon as the public awareness marketing ceases. The public awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on an interview conducted with the company’s CEO, and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The owner of Safehaven.com owns shares and/or stock options of the featured companies and therefore has an additional incentive to see the featured companies’ stock perform well. The owner of Safehaven.com has no present intention to sell any of the issuer’s securities in the near future but does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The owner of Safehaven.com will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies impacting the company’s business, the size and growth of the market for the companies’ products and services, the companies’ ability to fund its capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http:// Safehaven.com/terms-and-conditions If you do not agree to the Terms of Use http:// Safehaven.com/terms-and-conditions, please contact Safehaven.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. Safehaven.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.